Japan Sneaker Market Size, Share, Trends and Forecast by Product Type, Category, Price Point, Distribution Channel, and Region, 2026-2034

Japan Sneaker Market Size and Share:

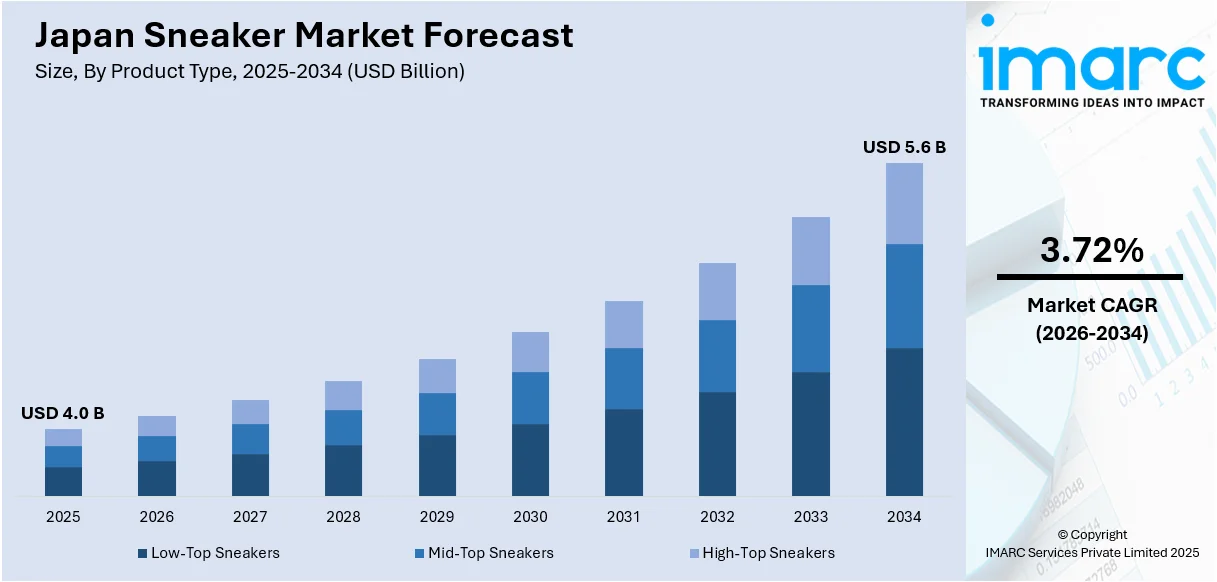

The Japan sneaker market size was valued at USD 4.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 5.6 Billion by 2034, exhibiting a CAGR of 3.72% from 2026-2034. The Japan sneaker market share is primarily propelled by the rising demand for athleisure and casual footwear, the influence of streetwear culture and celebrity collaborations, increasing interest in sneaker customization, growth in e-commerce and online retail, and strong presence of global sneaker brands and local manufacturers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.0 Billion |

| Market Forecast in 2034 | USD 5.6 Billion |

| Market Growth Rate (2026-2034) | 3.72% |

The Japan sneaker market growth is driven by the rising demand for fashion and comfort, particularly among young generations. Japanese consumers are seeking fashionable and multi-purpose shoes. As a result, global sneaker brands such as Nike, Adidas, and New Balance have risen in popularity. The expansion of e-commerce in Japan has also improved sneaker accessibility through easy online shopping, exclusive releases, and greater choices of products. According to the IMARC Group, the Japan e-commerce market is projected to grow at a CAGR of 11.60% during 2024-2032. Additionally, a strong country culture for collecting and appreciation for unique and limited editions further fuels market growth. Collaborations between sneaker brands and other popular designers and celebrities also add to the market appeal, generating buzz and driving sales.

To get more information on this market Request Sample

Other than this, the growing focus on health and wellness also contributes to the Japan sneaker market demand. As more individuals prioritize active lifestyles, sneakers are becoming essential for fitness and daily wear. Rising demand for performance-oriented footwear for sports activities such as running, hiking, and casual workouts has further added to the trend. The high urbanization in Japan, which promotes walking and public transportation, also supports comfortable, durable sneakers for daily wear. As per industry reports, 93.1% of the total population in Japan lives in urban areas. Besides this, continuous innovation in sneaker technology, such as improved cushioning and lightweight designs, also contributes to consumer interest and market growth.

Japan Sneaker Market Trends:

Sports and streetwear culture

The Japan sneaker market trends indicate that the most significant growth drivers for the industry have been sports and streetwear culture. What was once limited to athletic purposes is now identified with urban fashion. Streetwear has played a great role in changing this, with young consumers in Japan becoming more influenced by global sports and street culture that promote sneakers as both performance footwear and also as style and status symbols. This fusion of sports and fashion has made sneakers a part of everyday wear, with the shoe being worn for fashion as much as for performance. The influence of Japanese urban subcultures has further fueled this trend as individuals use sneakers to make a fashion statement.

Technological advancements in footwear

Technological innovation in sneaker design is having a very positive influence on the Japan sneaker market outlook. Advancements in materials and manufacturing are enhancing the comfort, performance, and durability of sneakers. Moreover, since public transportation systems dominate the urban landscapes of the country and because walking is widely practiced, Japanese customers are attracted to sneakers with a high comfort experience while walking. These technological advancements develop sneakers with greater performance and also help in addressing the increasing need for sustainable footwear. As sneaker companies use eco-friendly materials and manufacturing processes, they increase their appeal to Japan's environmentally conscious consumer base, which is further expanding the market size.

Collaborations and limited-edition releases

In Japan, partnerships between sneaker manufacturers, celebrities, designers, and other brands have significantly driven the demand for limited-edition and exclusive products. Japanese consumers are fond of unique and rare products, and limited releases give them a chance to own something different. High-profile collaborations add exclusivity to sneakers and increase their appeal as collectibles. These limited releases sell out rapidly, which often creates a feeling of urgency for the buyer, and in the resale market, prices skyrocket. The buzz created by such collaborations fuels sales of sneakers and also helps in positioning sneakers as status symbols, making them even more desirable in the fashion-conscious Japanese sneaker market industry.

Japan Sneaker Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan sneaker market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, category, price point, and distribution channel.

Analysis by Product Type:

- Low-Top Sneakers

- Mid-Top Sneakers

- High-Top Sneakers

Due to versatility and comfort, the low-top sneaker remains to be on top in Japan. These are preferred for daily wear, particularly for casual outings. They are popular among both men and women and ideal for hot weather or during any casual occasions of everyday life, aligning with the consumer preference for stylish and functional footwear.

In Japan, mid-top sneakers are also gaining attention. These sneakers provide a great balance between fashion and support. Such shoes give better ankle protection compared to low-top but do not sacrifice the fashionable and casual aspects. As a result, these types of sneakers attract consumers who are seeking increased stability and security in more intense applications such as sports or other outdoor games. Streetwear fans also find these as their favorites when seeking versatile comfort.

High-top sneakers are a leading segment in the Japan sneaker market, particularly in basketball and fashion. They are popular for their ankle support and bold style, which athletes and sneaker collectors love. The iconic design of high-top sneakers has also made them a significant element in Japan's streetwear culture, where they symbolize status and individuality.

Analysis by Category:

- Branded

- Private Label

Branded sneakers hold a majority market share in Japan due to consumer confidence in global giants such as Nike, Adidas, and New Balance. These global giants offer quality and fashionable designs, along with advanced technology and exclusive collaborations. Japanese consumers are known for their appreciation of quality and design, and thus branded sneakers continue to be a consistent demand.

Private label sneakers are gaining popularity in Japan, mainly among budget-sensitive consumers. Retailers and local brands sell such products as cheap alternatives to expensive ones, which still have good quality and style. As the need for value-for-money products increases, private label sneakers attract customers who need affordable yet stylish footwear. The segment is increasingly growing because of its accessibility.

Analysis by Price Point:

- Luxury

- Economic

Luxury sneakers are the main portion of Japan's sneaker market, as the Japanese have an affinity toward high-end fashion and exclusivity. Their market includes Balenciaga, Gucci, Louis Vuitton, and other luxury brands that cater to the wealthy customer base in pursuit of precision craftsmanship, unique designs, and status symbols. They often come with luxurious materials, limited editions, and collaborations and are highly pursued by fashion enthusiasts and collectors.

Economic sneakers cater to price-sensitive consumers in Japan, as they are sold at affordable prices without compromising on style and comfort. They are usually produced by private labels or budget-friendly brands. With a focus on value, economic sneakers continue to be popular among younger consumers, students, and individuals seeking practical, everyday footwear at a lower price point.

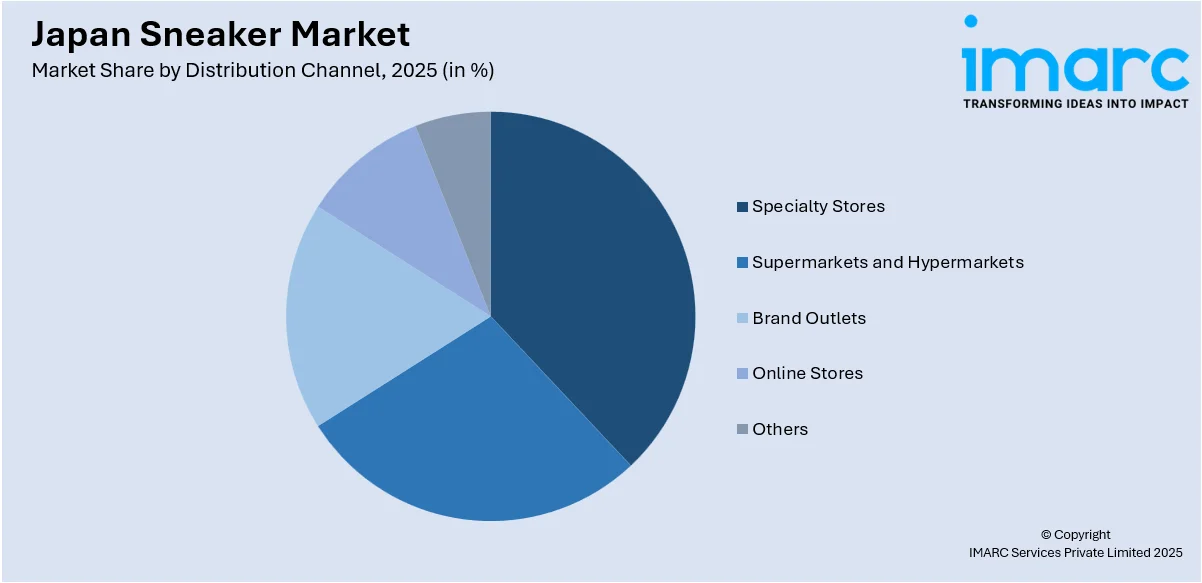

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Specialty Stores

- Supermarkets and Hypermarkets

- Brand Outlets

- Online Stores

- Others

Specialty stores are a leading distribution channel in the Japan sneaker market, where most popular and high-end brands can be found. Specialty stores present an extensive experience of shopping for different styles, technologies, and fits. Such stores are recognized for personalized services and expert opinion, and for sneaker fanatics and collectors seeking limited-release and new trendy designs, the stores are particularly preferred.

In Japan, supermarkets and hypermarkets represent accessible distribution outlets for sneakers, particularly among budget shoppers. These stores stock several affordable shoes every day that individuals can get along with their groceries or any other daily commodities. Compared to specialized retailers, their collections may not be as extensive. However, due to their wide appeal as being practical and convenient, many consumers prefer to shop for footwear in these stores.

Brand outlets are becoming very important in the Japan sneaker market, offering direct access to branded footwear at discounted prices. These stores, operated by global and local sneaker brands, allow customers to purchase high-quality sneakers at lower rates, often through seasonal sales or outlet-exclusive products. With a focus on brand loyalty and customer experience, brand outlets are favored by consumers seeking both savings and authenticity.

Regional Analysis:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, which includes Tokyo and Yokohama, is the largest market for sneakers in Japan due to its high population density and fashion-forward consumer base. As the economic and cultural hub, it hosts numerous global sneaker brands, specialty stores, and fashion-forward retailers. The vibrant urban lifestyles in Kanto drive demand for stylish, premium, and limited-edition sneakers, making it a key market.

The Kansai/Kinki region, which houses Osaka, Kyoto, and Kobe, has an enormous sneaker market because of its diverse urban culture and the fashion-conscious crowd. This area is known for its rich history and its modern appeal. As a result, the consumers here have an enormous demand for high-end as well as casual sneakers. The young population and the trendy shopping districts also give a boost to the sales of sneakers in this region.

The Central/Chubu region, including cities such as Nagoya, is still growing its sneaker market. This can be attributed to both urban and industrial groups. Not nearly as fashion-based as Kanto or Kansai, it still has a more middle-income demographic that wants its shoes to be both practical and fashionable. Thus, the development of the region's retail market and high-tech businesses is contributing to steady growth in sneaker sales.

Competitive Landscape:

Major players in the Japanese sneaker market are driving growth through strategic collaborations, innovative designs, and unique product launches. Brands are tying up with popular streetwear influencers and celebrities for limited-edition sneakers, generating excitement among consumers. Moreover, companies are focusing on technological improvements, such as improved cushioning, breathability, and durability features in the products. These improvements meet the increasing consumer interest in performance as well as style. In addition, brands are expanding their reach through e-commerce platforms and exclusive retail stores, making the latest collections accessible to consumers easily. These initiatives, along with targeted marketing campaigns, are further strengthening brand loyalty and driving market expansion.

The report provides a comprehensive analysis of the competitive landscape in the Japan sneaker market with detailed profiles of all major companies.

Latest News and Developments:

- 27 January 2025: Toyoda Gosei Co. Ltd., a leading international automotive components manufacturer, has entered into a partnership project with athletic goods giant ASICS Corporation to jointly create the SKYHAND OG sneakers. The production process will involve the usage of leather waste from the production of steering wheels to create a more ethical product.

- 9 January 2025: ASICS has launched the GEL-RESOLUTION X, the newest edition to the company’s tennis shoes line. Compared to the previous editions, this novel product will provide greater stability, ease of use, and enhanced comfort to consumers.

Japan Sneaker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Low-Top Sneakers, Mid-Top Sneakers, High-Top Sneakers |

| Categories Covered | Branded, Private Label |

| Price Points Covered | Luxury, Economic |

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Brand Outlets, Online Stores, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan sneaker market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan sneaker market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan sneaker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Japan sneaker market was valued at USD 4.0 Billion in 2025.

The growing focus on fitness and sports activities, increasing disposable income and consumer spending, popularity of limited-edition and collectible sneakers, rising trend of sneaker culture among youth, and enhancements in sneaker technology and comfort features are the primary factors driving the growth of the Japan sneaker market.

IMARC estimates the Japan sneaker market to exhibit a CAGR of 3.72% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)