Japan Single-Use Bioprocessing Market Report by Product Type (Media Bags and Containers, Filtration Assemblies, Single-Use Bioreactors, Disposable Mixers, and Others), Application (Filtration, Storage, Cell Culture, Mixing, Purification), Workflow (Upstream, Fermentation, Downstream), End User (Biopharmaceutical Manufacturers, Life Science R and D, and Others), and Region 2026-2034

Market Overview:

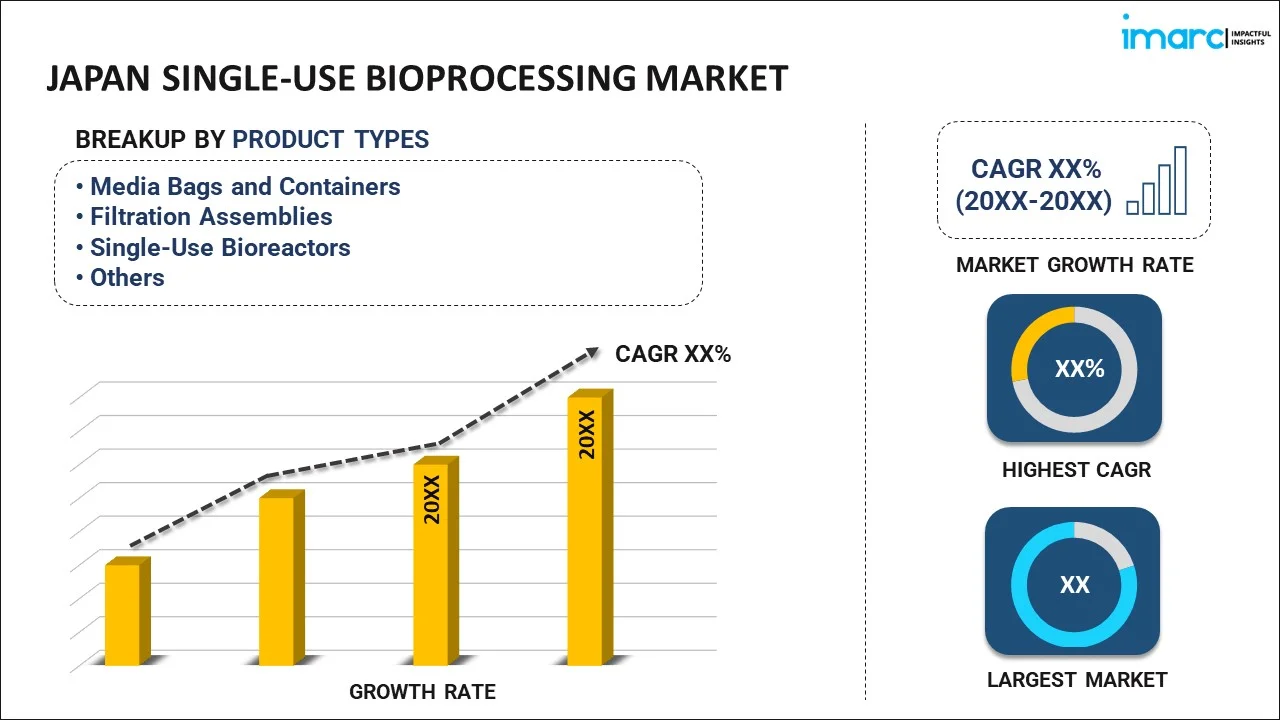

Japan single-use bioprocessing market size reached USD 1,448.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,829.2 Million by 2034, exhibiting a growth rate (CAGR) of 16.73% during 2026-2034. The increasing development of innovative materials, such as biocompatible plastics and polymers, which has improved the performance and reliability of single-use bioprocessing systems, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,448.7 Million |

| Market Forecast in 2034 | USD 5,829.2 Million |

| Market Growth Rate (2026-2034) | 16.73% |

Single-use bioprocessing is a cutting-edge approach in the field of biotechnology and pharmaceutical manufacturing that utilizes disposable components and equipment for the production of biopharmaceuticals. Unlike traditional stainless steel systems, which require extensive cleaning and validation between batches, single-use systems are designed for one-time use, reducing the risk of cross-contamination and speeding up production. Single-use bioprocessing offers several advantages, including increased flexibility, cost-efficiency, and reduced setup times. It allows for rapid scale-up or scale-down of production, making it suitable for both small-scale research and large-scale commercial production. These systems typically consist of single-use bioreactors, filtration units, and tubing assemblies, which are easy to install and replace. Furthermore, single-use bioprocessing aligns with current trends in biomanufacturing, promoting sustainability by reducing water and energy consumption and minimizing waste generation. Overall, it has revolutionized the biopharmaceutical industry by streamlining processes, improving product quality, and accelerating the development and production of life-saving drugs and therapies.

Japan Single-Use Bioprocessing Market Trends:

The single-use bioprocessing market in Japan is being propelled forward by several key drivers. First and foremost, the growing demand for biopharmaceuticals is a significant driver. As the pharmaceutical industry shifts its focus from traditional small-molecule drugs to biologics, there is an increased need for efficient and flexible bioprocessing solutions. Single-use bioprocessing technologies offer rapid deployment, reduced contamination risk, and cost-effective scalability, making them a preferred choice for many biopharmaceutical companies. Another driver is the increasing emphasis on cost savings and sustainability. Single-use systems reduce the need for complex cleaning and sterilization processes, leading to lower operational costs and a smaller environmental footprint. This aligns with the broader trend towards more sustainable and environmentally friendly practices in the healthcare and biopharmaceutical industries. Additionally, the agility provided by single-use bioprocessing systems is crucial in responding to rapidly changing market demands and shorter development timelines. They enable manufacturers to quickly adapt to different production scales and accommodate diverse product portfolios. In summary, the single-use bioprocessing market in Japan is thriving due to increased demand for biopharmaceuticals, cost savings, sustainability concerns, flexibility, and regulatory support.

Japan Single-Use Bioprocessing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, application, workflow, and end user.

Product Type Insights:

- Media Bags and Containers

- Filtration Assemblies

- Single-Use Bioreactors

- Disposable Mixers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes media bags and containers, filtration assemblies, single-use bioreactors, disposable mixers, and others.

Application Insights:

- Filtration

- Storage

- Cell Culture

- Mixing

- Purification

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes filtration, storage, cell culture, mixing, and purification.

Workflow Insights:

- Upstream

- Fermentation

- Downstream

The report has provided a detailed breakup and analysis of the market based on the workflow. This includes upstream, fermentation, and downstream.

End User Insights:

- Biopharmaceutical Manufacturers

- Life Science R and D

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes biopharmaceutical manufacturers, life science R and D, and others.

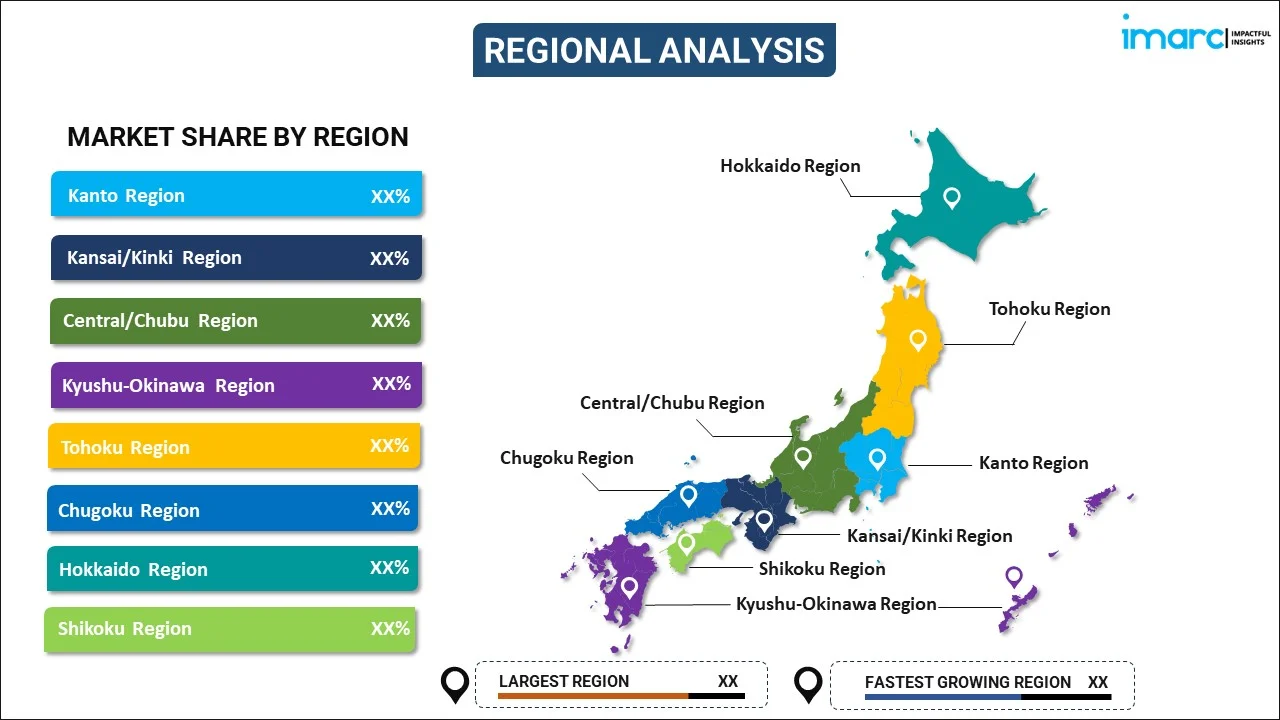

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Single-Use Bioprocessing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Media Bags and Containers, Filtration Assemblies, Single-Use Bioreactors, Disposable Mixers, Others |

| Applications Covered | Filtration, Storage, Cell Culture, Mixing, Purification |

| Workflows Covered | Upstream, Fermentation, Downstream |

| End Users Covered | Biopharmaceutical Manufacturers, Life Science R and D, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan single-use bioprocessing market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan single-use bioprocessing market?

- What is the breakup of the Japan single-use bioprocessing market on the basis of product type?

- What is the breakup of the Japan single-use bioprocessing market on the basis of application?

- What is the breakup of the Japan single-use bioprocessing market on the basis of workflow?

- What is the breakup of the Japan single-use bioprocessing market on the basis of end user?

- What are the various stages in the value chain of the Japan single-use bioprocessing market?

- What are the key driving factors and challenges in the Japan single-use bioprocessing?

- What is the structure of the Japan single-use bioprocessing market and who are the key players?

- What is the degree of competition in the Japan single-use bioprocessing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan single-use bioprocessing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan single-use bioprocessing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan single-use bioprocessing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)