Japan Security Market Size, Share, Trends and Forecast by System, Service, End User, and Region, 2025-2033

Japan Security Market Size and Share:

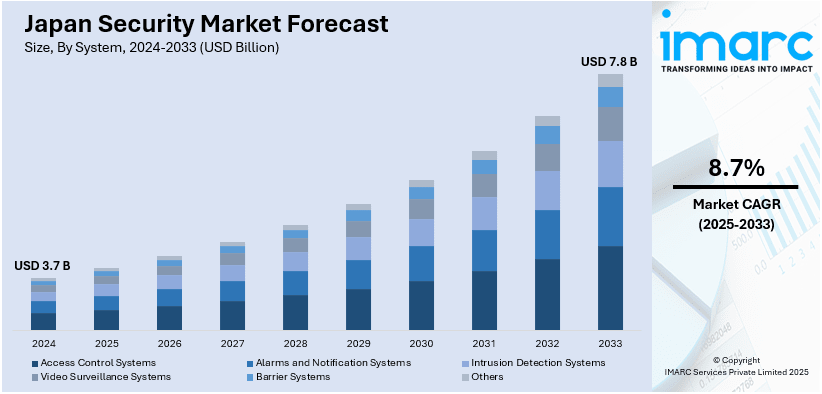

The Japan security market size was valued at USD 3.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.8 Billion by 2033, exhibiting a CAGR of 8.7% from 2025-2033. The market is experiencing significant growth in revenue, mainly driven by the increase in cyber threats, strict government regulations and increase in digital transformation across various industries. Expanding awareness of data protection, technological advancements and rising investments in cybersecurity infrastructure also contributes positively to the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.7 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Market Growth Rate (2025-2033) | 8.7% |

The market is experiencing significant growth mainly driven by the escalating sophistication and frequency of cyber threats. As businesses and government nowadays increasingly rely on digital infrastructure, the vulnerability to cyber-attacks, such as phishing, data breaches and ransomware, is on the rise. According to industry reports in 2024, Japanese organizations experience an average of 1,003 cyberattacks each week. Notable incidents include data breaches involving University of Tokyo and CASIO as well as attacks on Nissan and JAXA.This growing threat landscape compels the organization to invest in advanced cybersecurity solutions including artificial intelligence and machine learning based defenses.

The market is also driven by the strict governmental regulations and policies aimed at enhancing national cybersecurity. The Japanese government has implemented comprehensive frameworks and standards in order to protect critical infrastructure and sensitive data mandating compliance across various industries. For example, in April 2024, the International Labour Organization (ILO), DICT and Japan launched their first Digital Transformation Center in Pampanga. This center aims to enhance digitalization for micro, small and medium sized enterprises in Central Luzon. Growing investments in smart city initiatives and rise of remote work culture also contribute significantly to the rising need for integrated and scalable security fostering sustained growth in the market.

Japan Security Market Trends:

AI and Machine Learning Integration

In the Japanese security market, machine learning (ML) and artificial intelligence (AI) are transforming threat detection and response. These technologies analyze large data sets in real-time to identify patterns and anomalies indicating potential cyber threats, such as unusual network activity or suspicious user behavior. ML algorithms improve over time enhancing predictive capabilities while AI-driven automation accelerates incident response reducing mitigation time and minimizing potential damage from attacks. For instance, in November 2024, Kyndryl launched a dedicated AI private cloud in Japan powered by Dell's AI Factory and NVIDIA to facilitate AI innovation for businesses and academia. This secure environment enables organizations to develop, test, and deploy AI solutions efficiently enhancing their competitive edge while meeting security and data residency requirements. This integration enhances overall cybersecurity resilience for businesses and government entities in Japan.

Cloud Security Expansion

With the shift of Japanese companies to the cloud sector, the integration of the cloud-based security solutions has increased to safeguard against data and application security issues. For instance, in November 2024, Wiz, a leader in cloud-native application protection received strategic funding from SoftBank Vision Fund 2 to strengthen its presence in the Asia-Pacific region. This investment will support the company's expansion efforts including the doubling of its workforce and an increase in market operations. By implementing these solutions, organizations can achieve the desired scalability of cloud security with encryption, advanced threat detection, and identity management, which enhances the Japan security market outlook. They also provide comprehensive measures and real-time monitoring for addressing vulnerabilities from data breaches and cyberattacks and automated response actions to enhance resilience to continually changing threats.

Escalating Cyber Threats

Japan faces a significant rise in cyber threats with businesses and government institutions increasingly targeted by sophisticated attacks such as ransomware, phishing, and advanced persistent threats (APTs). The growing reliance on digital infrastructure and the Internet of Things (IoT) expands potential vulnerabilities making systems more susceptible to breaches. For instance, in October 2024, Japan's ruling Liberal Democratic Party reported a cyberattack during the general election campaign wherein it was alleged that a distributed denial-of-service attack targeted the party's website and other state entities. Cybercriminals nowadays are using AI and ML to overcome traditional security measures. This is facilitating the need for more efficient solutions, which, in turn, is contributing to the market growth.

Japan Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan security market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on system, service, and end user.

Analysis by System:

- Access Control Systems

- Alarms and Notification Systems

- Intrusion Detection Systems

- Video Surveillance Systems

- Barrier Systems

- Others

Access control systems are essential for protecting both physical and digital assets across various sectors in Japan. The growing emphasis on workplace safety and the protection of sensitive information is catalyzing the adoption of advanced access control technologies. Enhanced integration with IoT and cloud-based solutions also allows for real time monitoring and management with significantly boosts the overall security effectiveness. The growing shift toward mobile access and contactless options showcases Japan’s commitment to innovation and development of user-friendly security solutions for business and residential users alike.

Notification systems and alarms are a crucial component of Japan's extensive security network, ensuring quick alerts in case of security breaches or emergencies. The increase in urbanization and the rising need for enhanced public safety has resulted in the implementation of advanced alarm systems in commercial buildings, public spaces, and residential complexes. Technological progress makes it easy to connect with mobile devices for quick alerts and remote control, leading to faster responses and better security incident management, ultimately improving safety.

Intrusion detection systems (IDS) are pivotal in Japan’s security landscape as they work to detect and counteract unauthorized access attempts to secured environments. The rise in cyber-physical attacks and the necessity for strong perimeter defenses drive the adoption of advanced IDS solutions. By integrating artificial intelligence and machine learning technologies, these systems improve threat detection accuracy and efficiency thereby minimizing false alarms and allowing for proactive defense strategies. Protecting critical infrastructure and valuable assets further highlights the significance of advanced IDS technologies in the region.

Video surveillance systems are foundational to Japan's security strategy delivering continuous observation and visual validation of activities in various environments. High-definition cameras paired with intelligent video analytics enable real-time monitoring, incident documentation and evidence collection. The incorporation of AI and machine learning enhances features like automated threat detection, facial recognition and behavioral analysis significantly improving surveillance effectiveness. The demand for comprehensive video surveillance solutions stretches across commercial establishments, public infrastructure, transportation hubs and residential neighborhoods reflecting the evolving security needs of Japanese society.

Barrier systems are crucial to Japan’s security paradigm offering physical deterrents and controlled access to sensitive locations. These systems consist of bollards, gates, turnstiles and automated barriers designed to prevent unauthorized entry while managing vehicular access. The heightened focus on safeguarding critical infrastructure, government sites and high-security areas has escalated the demand for robust barrier solutions. Contemporary barrier systems integrate smart technologies for automated control in combination with access management systems ensuring smooth operation while enhancing security with designs also considering aesthetics and urban planning.

Analysis by Service:

- System Integration and Consulting

- Risk Assessment and Analysis

- Managed Services

- Maintenance and Support

In Japan’s security market system integration and consulting services are vital for creating customized security solutions that meet client needs. These services integrate various security systems such as access control, video surveillance and intrusion detection forming a cohesive security network. Consulting expertise aids organizations in assessing security requirements, developing strategic plans and implementing best practices. By utilizing cutting-edge technologies and industry insights these services provide robust protection, enhance operational efficiency, and ensure compliance with Japan’s strict security regulations.

Risk assessment and analysis services play a key role in Japan's security landscape by offering organizations crucial insights into potential vulnerabilities and threats. These services involve the systematic identification and evaluation of risks helping prioritize them based on their impact on business operations. Security experts employ advanced tools and methodologies to assess both physical and cyber environments pinpointing weaknesses and suggesting mitigation strategies. This tailored approach enables businesses across various industries to adopt effective security measures bolstering resilience and safeguarding critical assets.

Managed services in Japan’s security market provide organizations with comprehensive solutions for ongoing security management and monitoring. These offerings include continuous surveillance, threat detection, incident response and regular system updates allowing businesses to maintain strong security without requiring in-house expertise. Managed security providers utilize advanced technologies like AI and cloud platforms to deliver scalable and efficient security operations. By managing the complexities of security, these services empower businesses to concentrate on core activities while ensuring consistent protection and compliance with regulations.

Maintenance and support services are crucial for maintaining the reliability and effectiveness of security systems in Japan. These services encompass regular inspections, troubleshooting, software updates and hardware repairs ensuring that security infrastructure remains operational and current. Proactive maintenance helps avert system failures and reduce downtime providing continuous protection against threats. Support services offer technical assistance and user training enhancing their capability to manage security systems effectively. This ongoing maintenance and responsive support help organizations uphold high security standards while adapting to evolving needs.

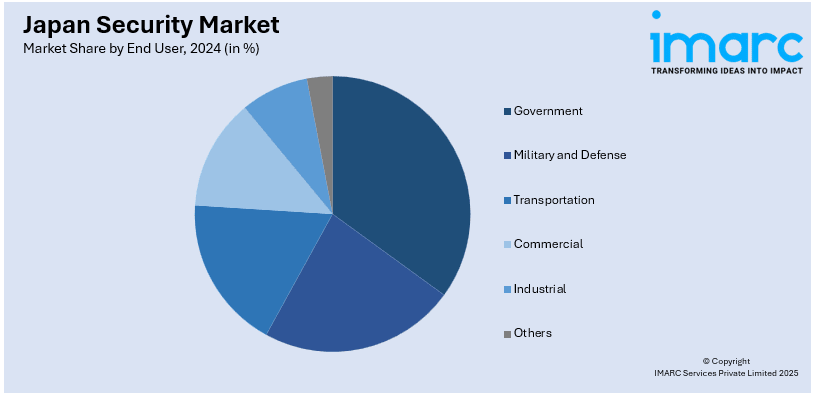

Analysis by End User:

- Government

- Military and Defense

- Transportation

- Commercial

- Industrial

- Others

In Japan's security market the government sector is a prominent end user driving demand for sophisticated security solutions tailored to protect national infrastructure and public services. Various government facilities such as administrative buildings, data centers and public institutions necessitate robust access control, surveillance and intrusion detection systems to safeguard sensitive information and ensure public safety. Furthermore, initiatives focused on smart cities and digital transformation require integrated security frameworks capable of addressing large-scale deployments and complex security challenges.

Japan's military and defense sector is vital to the security market emphasizing the protection of national security assets and sensitive military information. This sector demands highly specialized security solutions, including advanced surveillance systems, secure communication networks and sophisticated access control measures to prevent unauthorized access and potential espionage. The integration of cyber defense technologies is crucial to shield against cyber threats targeting defense infrastructure. The push for enhanced capabilities through cutting-edge technologies fuels the adoption of innovative security measures.

The transportation sector in Japan which includes airports, railway systems, ports and highways serves as a significant end user in the security market. Ensuring the safety and security of passengers, cargo and infrastructure is of utmost importance propelling the adoption of comprehensive security solutions. Measures such as video surveillance, access control, intrusion detection and perimeter security protect transportation hubs from threats. The increasing use of advanced technologies like facial recognition, biometric authentication and automated threat detection enhances overall security measures and operational efficiency.

In Japan's security market the commercial sector including retail, hospitality and office buildings represents a key end user. Businesses within this sector prioritize the protection of assets, employees and customers driving demand for advanced security solutions such as video surveillance access control and alarm systems. Retailers deploy sophisticated surveillance and theft prevention technologies while office buildings focus on secure access control. The hospitality industry implements comprehensive security measures to ensure guest safety. The rise of smart buildings facilitates centralized management of security operations thereby enhancing efficiency.

The industrial sector in Japan encompassing manufacturing, energy and utilities constitutes a significant end user in the security market. Protecting critical infrastructure, intellectual property and maintaining operational continuity are essential leading to the adoption of robust security solutions. Industrial facilities employ advanced access control, surveillance and intrusion detection systems to guard against unauthorized access and sabotage. Integrating cybersecurity measures is crucial to combat cyber threats targeting industrial control systems. Emphasizing automation and smart manufacturing further necessitates IoT-enabled security solutions for real-time monitoring and threat detection.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region encompassing Tokyo and its metropolitan area is one of the largest and most dynamic market for security solutions in Japan. Home to major financial institutions, corporate headquarters and government bodies Kanto demands advanced security systems including access control, video surveillance, and cybersecurity measures. The region’s rapid urbanization and smart city initiatives drive the adoption of integrated and innovative security technologies. High population density and significant infrastructure projects in Kanto necessitate robust security frameworks to ensure public safety and protect critical assets.

The Kinki region includes major cities like Osaka, Kyoto and Kobe plays an indispensable role in Japan’s security market. As a commercial and industrial hub Kinki requires comprehensive security solutions to protect diverse sectors such as manufacturing, finance and tourism. The presence of historical sites and cultural landmarks also drives the need for specialized surveillance and access control systems. The region’s vibrant economy and significant transportation networks including major ports and airports enhance the demand for advanced security technologies to safeguard people, property and critical infrastructure.

Central/Chubu covers areas like Nagoya and the surrounding prefectures is a key region for Japan’s security market due to its strong industrial base and manufacturing prowess. The presence of automotive giants and high-tech industries necessitates robust security measures including intrusion detection, cybersecurity and comprehensive surveillance systems. Central/Chubu’s strategic location as a transportation and logistics hub drives the demand for advanced security solutions to protect supply chains and critical infrastructure. The region’s focus on innovation and smart manufacturing further supports the adoption of cutting-edge security technologies.

Kyushu-Okinawa is an essential region for Japan’s security market mainly driven by its strategic maritime location and significant military presence. The region requires advanced security solutions to protect naval bases, ports and critical infrastructure from potential threats. Kyushu-Okinawa’s growing tourism industry and urban centers like Fukuoka demand comprehensive security systems including video surveillance and access control. The region’s emphasis on disaster resilience and smart city projects also promotes the integration of innovative security technologies to enhance public safety and infrastructure protection.

Tohoku, encompassing prefectures such as Sendai and Aomori, is increasingly important in Japan’s security market, especially after the 2011 earthquake and tsunami. The region focuses on enhancing disaster preparedness and resilient security systems to protect against natural and man-made threats. Key security solutions include robust surveillance, emergency response systems, and cybersecurity measures for recovering and rebuilding infrastructure. Tohoku’s industrial sectors, including manufacturing and agriculture, drive the need for comprehensive security frameworks to safeguard assets and ensure operational continuity amidst ongoing regional development.

The Chugoku region, including Hiroshima and Okayama, plays a significant role in Japan’s security market with its blend of industrial, commercial, and historical sites. The presence of major manufacturing industries and ports necessitates advanced security solutions such as access control, surveillance, and cybersecurity to protect critical infrastructure and supply chains. Chugoku’s historical landmarks and urban centers require specialized security systems to ensure the safety of cultural assets and public spaces. The region’s focus on economic growth and smart city initiatives further drives the adoption of integrated and innovative security technologies.

Hokkaido, Japan’s northernmost region, is a growing market for security solutions driven by its expanding tourism industry and significant industrial activities. The region requires comprehensive security systems to protect popular tourist destinations, ski resorts, and urban centers like Sapporo. Hokkaido’s agricultural and manufacturing sectors necessitate robust security measures, including surveillance, access control, and cybersecurity solutions to safeguard assets and ensure operational integrity. The region’s emphasis on smart infrastructure and sustainable development also supports the integration of advanced and eco-friendly security technologies.

Shikoku, the smallest of Japan’s main islands, is an emerging market for security solutions, driven by its mix of industrial, agricultural, and tourism sectors. The region requires effective security systems to protect manufacturing facilities, agricultural operations, and popular tourist sites. Key security technologies include video surveillance, access control, and cybersecurity measures tailored to the specific needs of Shikoku’s diverse industries. The region’s focus on regional development and smart community initiatives promotes the adoption of integrated and scalable security solutions to enhance public safety and support economic growth.

Competitive Landscape:

The Japan security market is highly competitive characterized by a blend of global and local vendors attempting to innovate and distinguish their offerings. Japan security market statistics indicate a rise in demand for integrated security platforms, driving company innovation in AI, IoT, and cloud-based solutions. Strategic partnerships, collaborations, and mergers and acquisitions are common strategies to expand market reach and technological capabilities. For instance, In June 2024, Cisco announced the establishment of a Cybersecurity Center of Excellence in Tokyo to enhance Japan's digital resilience. This initiative includes appointing a National Cybersecurity Advisor, deploying the Cisco Talos Intelligence team, and expanding training programs with a goal to educate 100,000 IT and cybersecurity professionals over the next five years, addressing the growing cybersecurity challenges in the country. Emphasis on developing biometric systems and integrated security platforms drives competitive advantage. Additionally, extensive distribution networks and a strong brand reputation bolster market position. Opportunities emerge from smart city initiatives and rising cybersecurity investments, while regulatory changes and high research and development costs pose potential risks.

The report provides a comprehensive analysis of the competitive landscape in the Japan security market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, DerSecur and TOYO Corporation announced a strategic partnership to launch the DerScanner application security solution in Japan. This collaboration aims to enhance cybersecurity in key industries amid rising digital threats. The platform will be showcased at EdgeTech+ 2024, underscoring its importance in the evolving digital landscape.

-

In May 2024, Japan announced its plans to establish a consultative body to implement an active cyber defense system aimed at enhancing protections for critical infrastructure against cyberattacks. The initiative involves collaboration with key sectors like railways, electricity, and telecommunications to share cyber risk information. Modeled after the U.S. Joint Cyber Defense Collaborative, this new strategy will mandate infrastructure operators to report cyber incidents and may include real-time network monitoring to bolster national cybersecurity efforts.

Japan Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Systems Covered | Access Control Systems, Alarms and Notification Systems, Intrusion Detection Systems, Video Surveillance Systems, Barrier Systems, Others |

| Services Covered | System Integration and Consulting, Risk Assessment and Analysis, Managed Services, Maintenance and Support |

| End Users Covered | Government, Military and Defense, Transportation, Commercial, Industrial, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan security market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan security market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Japan security market was valued at USD 3.7 Billion in 2024.

The key factors driving the Japan security market include escalating cyber threats, stringent government regulations, and the increasing digital transformation across industries. Additionally, growing awareness of data protection, advancements in technologies like AI and IoT, and rising investments in cybersecurity infrastructure significantly propel market growth.

MARC estimates the Japan security market to exhibit a CAGR of 8.7% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)