Japan Recycled Plastics Market Size, Share, Trends and Forecast by Plastic Type, Raw Material, Application, and Region, 2025-2033

Japan Recycled Plastics Market Size and Share:

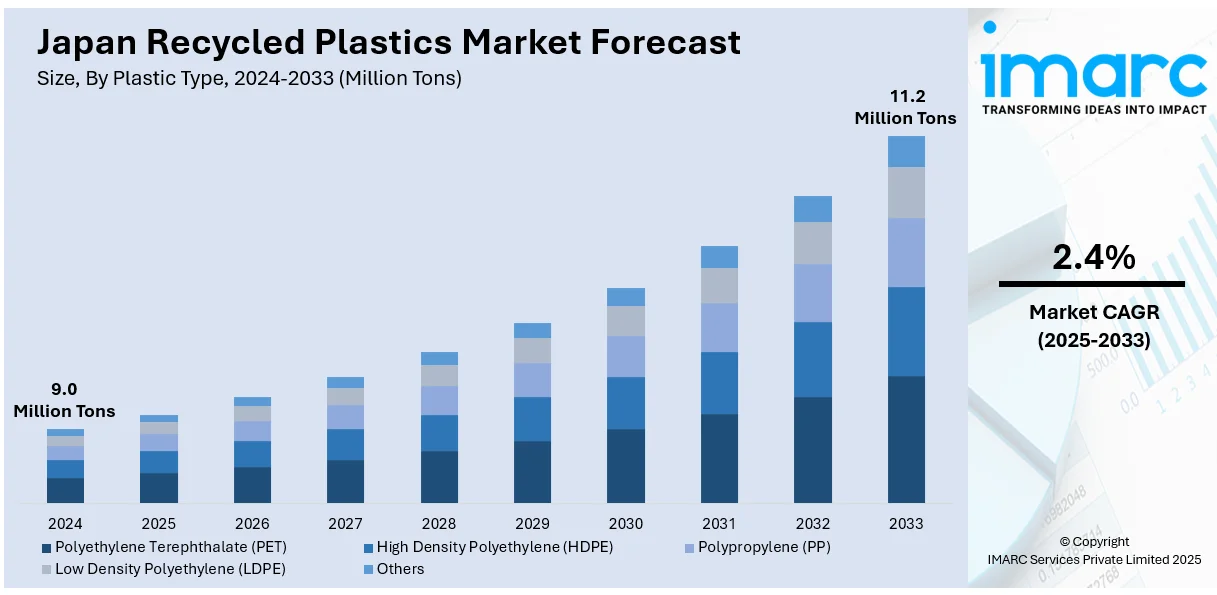

The Japan recycled plastics market size was valued at 9.0 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 11.2 Million Tons by 2033, exhibiting a CAGR of 2.4% from 2025-2033. The market is majorly driven by growing sustainability awareness, government regulations for recycled content, advancements in recycling technologies, increased demand for eco-friendly products, strategic public-private sector collaborations, automation and AI integration in recycling processes, and rising consumer preference for green certifications and circular economy initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

9.0 Million Tons |

|

Market Forecast in 2033

|

11.2 Million Tons |

| Market Growth Rate (2025-2033) | 2.4% |

The market in Japan is majorly driven by an enhanced emphasis on sustainability among companies and consumers in relation to the usage of eco-friendly plastic options, rather than the original plastic. Additionally, new regulation imposed by governments increases interest in the use of recycling to minimize the adverse effect of these materials on nature. For instance, Japan is instituting mandates for recycled plastic content as part of the measures to enhance the circular economy and reduce environmental impacts. The Ministry of Economy, Trade, and Industry has proposed amendments to the Resource Effective Utilisation Promotion Act, making it mandatory to use recycled plastic in industries like packaging, automotive, and building materials. This initiative will be supplemented by reporting requirements, incentives for green procurement, and a certification system for ensuring quality and supply stability. The policy aims at dealing with the plastic waste issue in Japan, whereby only 25% of plastic waste is recycled. Moreover, ongoing advancements in recycling techniques is increasing the quality and portfolio of recycled plastics and the usability of such types across industries. Besides this, escalating demand for lightweight and more durable materials in the automotive as well as electronic sectors is influencing the market's growth positively. In addition to this, strategic collaboration between public and private sectors are bolstering recycling capacities and thereby promoting market expansion.

To get more information on this market, Request Sample

The market is also expanding due to inflating consumer awareness about waste management and the importance of circular economies, which is growing demand for recycled plastics in packaging and textiles. Also, the increasing incorporation of automation and AI in recycling processes is making operations streamlined and more efficient, hence driving the market. For instance, as per an article by Plastic Collective, Artificial Intelligence (AI) has a transformative role in addressing the global plastic crisis through advanced recycling technologies. AI has improved the effectiveness of sorting systems by being able to sort different kinds of plastics more accurately and enhance recycling rates. In addition, AI predictive analytics have facilitated optimum resource use and the invention of new solutions for recycling. Furthermore, exports of recycled plastics to areas of high demand are also providing new opportunities for market players. Also, the acceptance of green certifications and eco-labelling is also aligned with consumer preferences for sustainable products, which further supports the market outlook.

Japan Recycled Plastics Market Trends:

Adoption of Advanced Recycling Technologies

Japan is increasingly utilizing advanced chemical recycling technologies that can process mixed and contaminated plastics. Innovations such as pyrolysis and depolymerization break up plastic waste into monomers, hence making it possible for the manufacturing of high-quality recycled material. For instance, Technip Energies and Anellotech have signed an agreement to advance and license the Plas-TCat™ process, transforming mixed plastic waste into basic chemicals for virgin plastics. The partnership includes performance trials at Anellotech's Texas demonstration plant in support of CO2 reduction and the circular economy. Technip Energies will act as global licensor, building on its capabilities in energy transition, while Anellotech concentrates on renewable technologies. These technologies have gained even more popularity, especially given the stringent quality standards put on the recycled plastics in manufacture. Furthermore, government incentives for industrial collaborations in R&D are accelerating the development of efficient, scalable recycling methods, contributing to Japan’s efforts toward a circular economy while reducing dependency on virgin plastic imports.

Rising Integration of Recycled Plastics in Manufacturing

Japanese manufacturers are adding recycled plastics to various products, such as car parts, packaging, and construction materials. This is a move toward corporate sustainability and increasing demand for green products from consumers. Global companies in Japan are investing in formulations of recycled plastics that retain the same performance but minimize the overall environmental impact. Multinational companies based in Japan are also promoting the use of post-consumer recycled plastics as part of their commitment to comply with global environmental directives. For instance, Murata Manufacturing is investing in R PLUS JAPAN for advancing plastic recycling as part of its sustainability goals, under its Vision 2030 and Mid-term Direction 2024. The partnership develops chemical recycling technology efficiently to develop a systematic recycling plan. Such technology development specifically targets PET bottles. As such, the move complements Murata's quest to realize a sustainable society and the company's solution to plastic waste challenges that have beset the globe. This integration supports both waste management initiatives and carbon reduction targets, making recycled plastics a key material in sustainable industrial practices.

Emergence of Circular Business Models

A new wave of circular business models in Japan's recycled plastics market is characterized by companies taking an active role in reclaiming and recycling used plastic from their supply chains. Take-back programs launched by retailers and packaging companies allow for direct collection and recycling of plastic waste with support through digital tracking systems, which add greater transparency and traceability in the recycling process. Moreover, collaborations by municipalities with private enterprises establish robust infrastructure for closed-loop recycling systems. This trend in turn minimizes waste as well as fosters innovation in product design to be recyclable to reinforce the nation's commitment to sustainable development.

Japan Recycled Plastics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan recycled plastics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on plastic type, raw material and application.

Analysis by Plastic Type:

- Polyethylene Terephthalate (PET)

- High Density Polyethylene (HDPE)

- Polypropylene (PP)

- Low Density Polyethylene (LDPE)

- Others

Polyethylene Terephthalate (PET) is crucial in Japan's recycled plastics market as it is used largely in packaging, especially bottles and food containers. Its recyclability and high-value applications make it a critical material in the pursuit of a circular economy. PET's recyclability does not reduce its performance after recycling, making it a material with great appeal in sustainable packaging solutions, hence increasing demand across industries.

High-Density Polyethylene is a key material in Japan's recycling activities due to its strength, versatility, and the fact that it is used in almost all bottles, pipes, and household items. Its robust nature enables it to be recycled several times without losing much quality, ensuring its importance in sustainable infrastructure and consumer products. It is well in line with Japan's sustainability goals and eco-conscious manufacturing trends.

Polypropylene (PP) is a very important product in the recycled plastics market in Japan due to its versatility and lightweight properties. It is used extensively in automotive, packaging, and consumer goods applications. The recycling of PP reduces waste and meets environmental regulations. It is very durable and adaptable to high-demand applications, which makes it indispensable for the advancement of innovative recycling practices in Japan and long-term sustainability efforts.

Analysis by Raw Material:

- Plastic Bottles

- Plastic Films

- Rigid Plastic and Foam

- Fibres

- Others

Plastic bottles play a crucial role in the recycled plastics market in Japan because they account for a large proportion of post-consumer waste and can be easily collected and recycled. Their recycling contributes to the production of PET resins used in a number of industries, such as packaging and textiles. Recycling plastic bottles is in line with national sustainability goals and promotes resource efficiency.

Plastic films play an important role in the market as it is extensively applied in food packaging and for industrial purposes. Innovations of recycling technologies are making easier the processing and reprocessing plastic films, which are formerly difficult to recycle. Plastics recycling helps to bring down plastic waste, accelerates the development of the circular business model, and calls for eco-friendly alternatives.

Rigid Plastics and foams also play a vital role in the market as they can be used as durable goods, automotive components, and packaging materials which have a massive influence on Japan's recycled plastics market. Recycling these substances helps save resources and cut carbon emissions from virgin plastic production. Improved recycling infrastructure and advanced technologies ensure efficient recovery of rigid plastics and foam; this is essential for sustaining this economy as more consumers want more recycled material in their end uses.

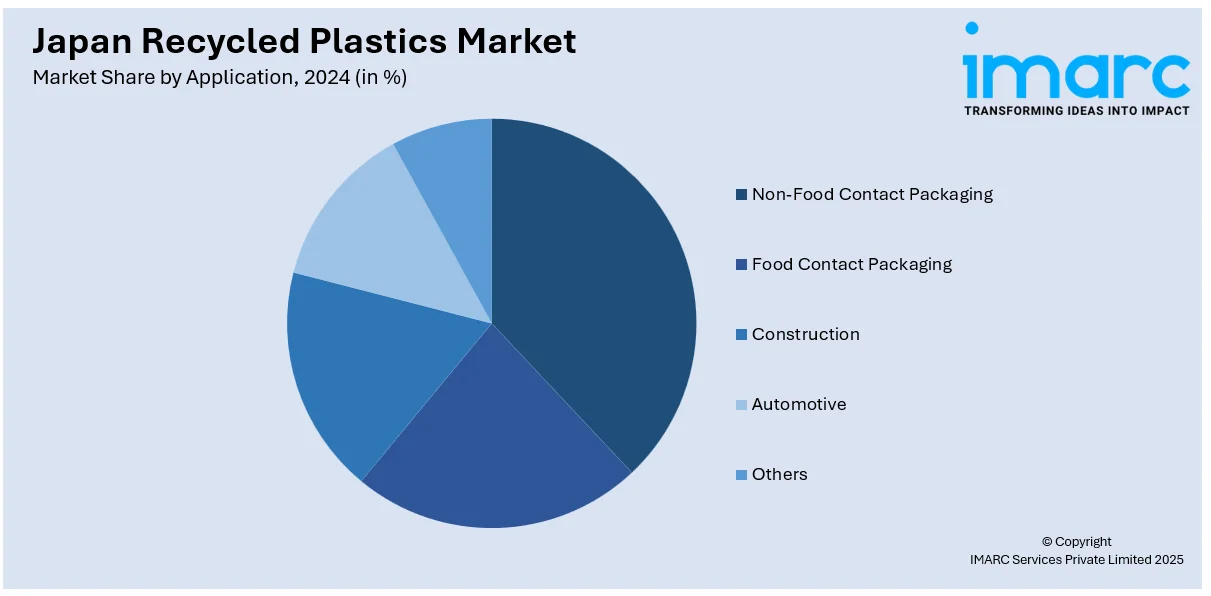

Analysis by Application:

- Non-Food Contact Packaging

- Food Contact Packaging

- Construction

- Automotive

- Others

Non-food contact packaging is an important part of Japan's recycled plastics market, considering the demand for durable, cost-effective, and eco-friendly solutions in industries such as logistics and retail. The use of recycled plastics in the manufacturing of crates, pallets, and protective coverings reduces plastic waste and helps align with Japan's sustainability goals. Improved recycling processes also ensure compliance with environmental standards.

Food contact packaging is important for safety and hygiene and supports sustainability initiatives in Japan. Recycled plastics are used in food-grade packaging, processed with the highest standards to ensure safety, as consumers prefer sustainable products. This segment expands the scope of the market by integrating advanced recycling technologies that ensure material integrity for reuse in food-related applications.

The construction industry in Japan uses recycled plastics for insulation, pipes, and composite materials, which reflects the industry's commitment to sustainable development. Recycled plastics are durable, lightweight, and resistant to environmental factors, making them suitable for various construction needs. In this regard, the inclusion of recycled materials in the construction industry in Japan not only helps reduce waste but also supports the nation's broader goals of environmental responsibility and resource efficiency.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region is a crucial region for the Japan's recycled plastic markets as it is a high industrialized area coupled with great consumer demand with top infrastructure. It is a high-end driving force in innovations involving the waste management aspect that requires more focus on recycling issues while at the same time functioning as a hub for such circular economy technological innovations.

The Kinki Region, including Osaka and Kyoto, is important for Japan's recycled plastics market due to its robust industrial base, with a focus on manufacturing sectors like packaging and textiles. The region is known for its initiatives in promoting sustainability and advanced recycling technologies, driven by both government and private sector investments, reinforcing its leadership in the market.

The Central or Chubu Region, with Nagoya as a key industrial center, contributes significantly to the recycled plastics market by hosting numerous automotive and manufacturing industries. This region is pivotal for creating circular supply chains, with a growing emphasis on adopting recycling solutions in the production of materials like plastics used in the automotive sector.

Thus, the Kyushu-Okinawa Region is very relevant to the recycled plastics industry due to its focus on environmental sustainability. Industrial output is concentrated in the energy and chemicals business in Kyushu but is slowly adopting the intake of recycled plastics into production and Okinawa benefits on growth in the region for such sensibility and increasing demand for these kinds of products.

The Tohoku Region emphasizes innovation and technology. Improvement processes in the manufacturing industries in terms of recycling contribute to the increased demand for recycled plastics in its market. Preservation of environment and growth in agricultural and textiles sectors increase demand for recycled plastics thus supporting the circular economy processes.

The Chugoku Region, including Hiroshima and Okayama, is now getting more involved in recycling plastic waste as the region grows interest in sustainable waste management practices. This region has a very strong industrial base that incorporates recycled plastics into production. It is helping increase investments in green solutions, thereby expanding the local market for recycling and sustainable materials.

The Hokkaido Region focuses on environmental sustainability. The agricultural and forestry sectors contribute to the demand for recycled plastics. With initiatives for waste reduction and recycling, the region becomes more important in Japan's circular economy, driving local innovations and supporting plastic recycling efforts in different industries.

The Shikoku Region has an importance to the plastics recycled market due to the growth in eco-friendly thinking within the people and a high agriculture industry. Shikoku promotes initiatives at the local level of encouraging increased plastic recycling. The collaborative efforts between regional municipalities and industries also encourage sustainable practices and recycle more within the region.

Competitive Landscape:

The market is highly competitive, with numerous players actively working to enhance recycling processes and develop innovative solutions. Companies are focusing on improving recycling efficiency through advanced technologies such as AI and automation. Furthermore, strategic collaborations between public and private sectors are helping to improve infrastructure and strengthen the recycling ecosystem. Additionally, the increasing demand for sustainable products, driven by both consumer preferences and regulatory pressures, is pushing firms to adopt green certifications and eco-friendly labeling to remain competitive. The market is also characterized by a growing emphasis on circular business models, with many businesses incorporating take-back programs and closed-loop systems.

The report provides a comprehensive analysis of the competitive landscape in the Japan recycled plastics market with detailed profiles of all major companies.

Japan Recycled Plastics Market News:

- July 2025: Mitsubishi Chemical Corporation (MCC) and ENEOS, both oil and petrochemical firms, opened a facility in Kamisu, Japan that employed Mura Technology’s water-based recycling method to transform end-of-life plastic into oil for creating new chemicals and plastic items. MCC and ENEOS would utilize the recycled oil in their refinery and naphtha cracker to manufacture products like food and pharmaceutical packaging, as well as various organic and inorganic chemicals.

- May 2025: Toyoda Gosei Co., Ltd., based in Japan, created a novel technology to reclaim high-quality plastic from end-of-life vehicles (ELV) to satisfy the increasing need for recycled plastic in the automotive sector due to stringent environmental regulations. This technology would aid in a decarbonized, circular economy by being implemented in multiple vehicle models, beginning with the Toyota Camry.

- March 2025: Scientists headed by Takuzo Aida at the RIKEN Center for Emergent Matter Science (CEMS) in Japan created a robust and recyclable plastic that could completely dissolve in ocean water. It did not result in microplastic pollution in the oceans since it decomposed in the water gradually. The scientists utilized supramolecular plastics, characterized by structures maintained through reversible interactions.

- February 2025: Kashima City, REFINVERSE, Inc., Mitsubishi Chemical Corporation, Toyo Seikan Group Holdings, Ltd., Kewpie Corporation, and KASUMI CO., LTD. established a comprehensive partnership agreement aimed at enhancing closed-loop recycling of plastic packaging in Ibaraki Prefecture. Known as the ‘Pla-relay Project,’ this initiative represented Japan's inaugural closed-loop recycling project for packaging, utilizing the distinctive capabilities of a local government, a chemical producer, a waste management firm, a packaging producer, and a food processor.

Japan Recycled Plastics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Plastic Types Covered | Polyethylene Terephthalate (PET), High Density Polyethylene (HDPE), Polypropylene (PP), Low Density Polyethylene (LDPE), Others |

| Raw Materials Covered | Plastic Bottles, Plastic Films, Rigid Plastic and Foam, Fibres, Others |

| Applications Covered | Non-Food Contact Packaging, Food Contact Packaging, Construction, Automotive, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan recycled plastics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan recycled plastics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan recycled plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Recycled plastics refer to plastics that have been processed and repurposed from used plastic materials, such as bottles, films, and foams, into new products. Common applications include packaging, automotive parts, construction materials, and textiles, contributing to sustainable development and a circular economy.

The recycled plastics market in Japan reached a volume of 9.0 Million Tons in 2024.

The Japan recycled plastics market is projected to exhibit a CAGR of 2.4% during 2025-2033, reaching a volume of 11.2 Million Tons by 2033.

Japan’s commitment to circular economy practices and waste management policies is encouraging businesses to adopt recycled plastics as a cost-effective and eco-friendly alternative. Moreover, advancements in recycling technologies are enhancing the quality and applications of recycled plastics, making them more competitive with virgin materials. The growth of e-commerce and packaging industries is further accelerating the need for sustainable plastic solutions.

Plastic bottles account for the largest share in the Japan recycled plastics market because of their high utilization, easy collection, established recycling systems, and wide reuse in packaging applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)