Japan Power Market Report by Generation Source (Thermal, Hydro, Renewable, and Others), and Region 2025-2033

Japan Power Market:

Japan power market size reached 965.4 TWh in 2024. Looking forward, IMARC Group expects the market to reach 1,348.5 TWh by 2033, exhibiting a growth rate (CAGR) of 3.50% during 2025-2033. The increasing demand for green energy solutions, energy-efficient appliances, and sustainable practices in daily life is primarily driving the Japan power market growth. Renewable energy policies, international collaborations, surging awareness regarding sustainable development, technological advancements, climate change mitigation, etc., are also driving the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 965.4 TWh |

| Market Forecast in 2033 | 1,348.5 TWh |

| Market Growth Rate (2025-2033) | 3.50% |

Japan Power Market Analysis:

- Major Market Drivers: The rising digitalization along with the numerous government initiatives promoting renewable installations, providing subsidies, and setting ambitious clean energy targets are spurring both public and private sector investments in the power industry, thereby stimulating the Japan power market demand.

- Key Market Trends: The growing focus on strengthening nuclear power coupled with the ongoing refurbishment of energy storage and smart grid facilities, is further expected to escalate the market growth. Moreover, Japan has a long-standing focus on energy efficiency due to its limited domestic energy resources and high energy import dependency, thereby propelling the Japan power industry’s growth.

- Challenges and Opportunities: Energy security, grid modernization, energy transition costs, and regulatory uncertainty are some of the key challenges that the market is facing. However, modernizing the grid with smart grid technologies, sensors, and digital platforms enhances grid flexibility, optimizes asset management, and empowers consumers to participate in demand-side management programs. Digitalization presents opportunities for efficiency gains and new business models in the power sector.

Japan Power Market Trends:

Renewable Energy Growth

Renewable energy growth is a significant driver of the expansion and transformation of Japan's power market. The rising government efforts to reduce carbon emissions and alleviate the usage of fossil fuels in the power sector are driving the adoption of renewable resources. For instance, according to the article published by the U.S. Energy Information Administration, the Japanese government has established energy policies aiming at achieving carbon neutrality, or net-zero greenhouse gas (GHG) emissions, by 2050 through emissions reductions in the electric generation, industrial, and transportation sectors. In the electric power sector, government regulations set 2030 targets for expedited investment in renewable capacity, greater nuclear generation, and reduced usage of fossil fuels for electricity generation. Moreover, the expansion of renewable energy, including solar, wind, biomass, and geothermal, diversifies Japan's energy sources. This reduces reliance on imported fossil fuels, enhancing energy security and resilience against supply disruptions and price volatility in global markets. For instance, Japan's GX (Green Transformation) Decarbonization Power Supply Bill (approved in April 2023) aimed to increase the contribution of non-fossil fuel generation sources to 59% of the generation mix by 2030, up from 31% in 2022. Policies aimed to raise the share of renewable electricity sources, including solar, wind, hydropower, geothermal, and biomass, from 26% in 2022 to 36%-38% by 2030. These factors are further proliferating the power industry in Japan.

Adoption of Hydrogen Power Energy

Japan has developed a comprehensive vision for a "hydrogen society" as part of its efforts to decarbonize the economy and reduce reliance on fossil fuels. The government has set ambitious targets to become a global leader in hydrogen technology and aims to establish a supply chain for producing, transporting, and utilizing hydrogen across various sectors, including power generation, transportation, industry, and residential applications. For instance, in June 2023, the Japanese government amended its "Hydrogen Basic Strategy" launched in 2017. The updated Hydrogen Basic Strategy outlines Japan's hydrogen strategy over the next five years. The basic strategy set new goals that include increasing the supply of hydrogen and ammonia in Japan, to 3 million tons by 2030, to 12 million tons by 2040 and to 20 million tons by 2050. It also aimed to expand the number of water electrolysis equipment with Japan-made parts to roughly 15GW globally by 2030. In addition to this, in terms of power generation, Japan would promote the development of high-hydrogen-mixed combustion systems, as well as 30%- and 100%-hydrogen combustion systems. These factors are further contributing to the Japan power market share. Moreover, establishing a hydrogen infrastructure is critical for the widespread adoption of hydrogen energy in Japan. The government and private companies are investing in infrastructure development, including hydrogen production facilities, storage tanks, transportation networks, and refueling stations for hydrogen-powered vehicles and fuel cell buses. For instance, in April 2024, Mitsui O.S.K. Lines (MOL) started Hanaria, a hydrogen and biofuel hybrid passenger ship in Kitakyushu. Also, in September 2023, Mitsubishi Power, a power solution brand of Mitsubishi Heavy Industries, Ltd. (MHI), launched Takasago Hydrogen Park, the world's first complete hydrogen validation facility, which is located in west central Japan.

Rapid Technological Advancements

Japan is investing in smart grid technologies to modernize its power grid infrastructures. Smart meters, energy storage, sensors, communication systems, and advanced analytics enable real-time monitoring, control, and optimization of electricity distribution, improving grid reliability, efficiency, and resilience. For instance, in October 2023, JERA Co., Inc. (JERA) and Toyota Motor Corporation (Toyota) launched the Sweep Energy Storage System in Japan. Moreover, innovations in energy storage technologies, such as lithium-ion batteries, flow batteries, and pumped hydro storage, support the integration of intermittent renewable energy sources and enhance grid stability. For instance, in May 2024, Stonepeak, an infrastructure investment firm, collaborated with CHC, a Singapore-based battery energy storage system BESS developer, to progress BESS projects across Japan. In addition to this, Japan invested in EV infrastructure, including charging stations, smart charging solutions, and vehicle-to-grid (V2G) technologies. In addition, innovations in EV batteries, charging protocols, and grid integration support the electrification of transportation and facilitate the transition towards a low-carbon transportation sector. For instance, in April 2024, the Audi charging hub was launched in Tokyo. Situated in the Kioichō business sector, this facility has four fast-charging outlets that can provide up to 150 kW of power each. These factors are positively influencing the Japan power market forecast.

Japan Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on generation source.

Breakup by Generation Source:

- Thermal

- Hydro

- Renewable

- Others

The report has provided a detailed breakup and analysis of the market based on the generation source. This includes thermal, hydro, renewable, and others.

Thermal power plants, primarily fueled by liquefied natural gas (LNG), coal, and oil, have traditionally been a major source of electricity generation in Japan. These plants use combustion or steam turbines to convert the energy released from burning fossil fuels into electricity. Moreover, hydropower has been a significant source of renewable energy in Japan, contributing to electricity generation through the use of flowing water to drive turbines and generate electricity. Japan's mountainous terrain and numerous rivers provide ample opportunities for hydropower development. Besides this, Japan has been actively promoting the expansion of renewable energy sources, including solar, wind, biomass, and geothermal power. Solar energy, in particular, has experienced rapid growth, with millions of rooftop solar installations and utility-scale solar farms across the country. Wind power capacity is also increasing, especially offshore wind projects along Japan's coastlines. While nuclear power has historically been a significant source of electricity generation in Japan. Before the Fukushima Daiichi nuclear disaster in 2011, nuclear reactors provided around 30% of Japan's electricity.

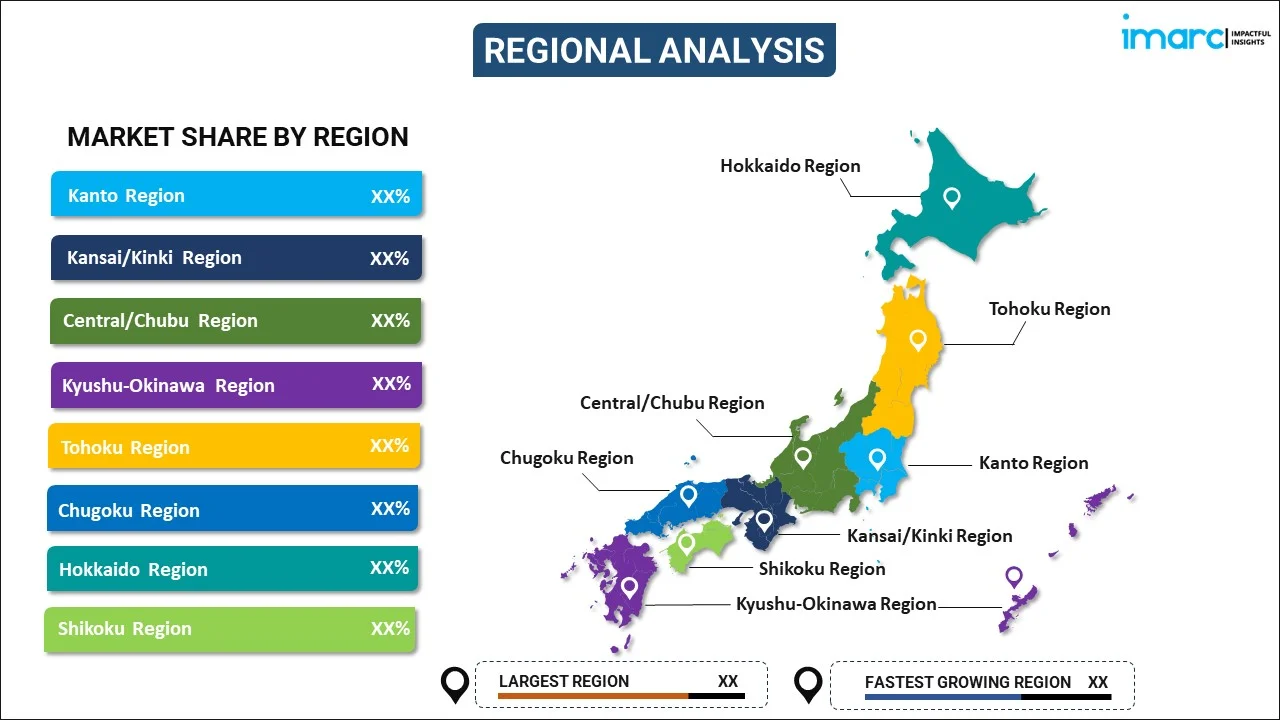

Breakup by Region:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

As per the Japan power market overview, the Kanto region, which includes Tokyo and its surrounding prefectures, is Japan's most populous and economically significant region. The power market in the Kanto region is characterized by high electricity demand, diverse energy infrastructure, and a mix of thermal, nuclear, and renewable energy sources. While the power market in the Kansai region is illustrated by a mix of thermal, nuclear, and renewable energy sources, with a significant contribution from hydropower. Moreover, the Chubu region hosts several large power plants and industrial facilities. Okinawa, in particular, has been focusing on renewable energy and energy self-sufficiency due to its geographical isolation. The Tohoku region has a diverse energy infrastructure, including large-scale power plants and transmission networks.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Power Market News:

- May 2024: Stonepeak, an infrastructure investment firm, collaborated with CHC, a Singapore-based battery energy storage system BESS developer, to progress BESS projects across Japan.

- May 2024: PAG announced the launch of PAG REN I to support Japan in achieving its solar energy targets, which include adding 108GW of solar power by 2030.

- April 2024: Mitsui O.S.K. Lines (MOL) started Hanaria, a hydrogen and biofuel hybrid passenger ship in Kitakyushu.

Japan Power Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | TWh |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Generation Sources Covered | Thermal, Hydro, Renewable, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan power market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan power market?

- What is the breakup of the Japan power market on the basis of generation source?

- What are the various stages in the value chain of the Japan power market?

- What are the key driving factors and challenges in the Japan power?

- What is the structure of the Japan power market and who are the key players?

- What is the degree of competition in the Japan power market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan power market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)