Japan Pet Food Market Size, Share, Trends and Forecast by Pet Type, Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2025-2033

Japan Pet Food Market Size and Share:

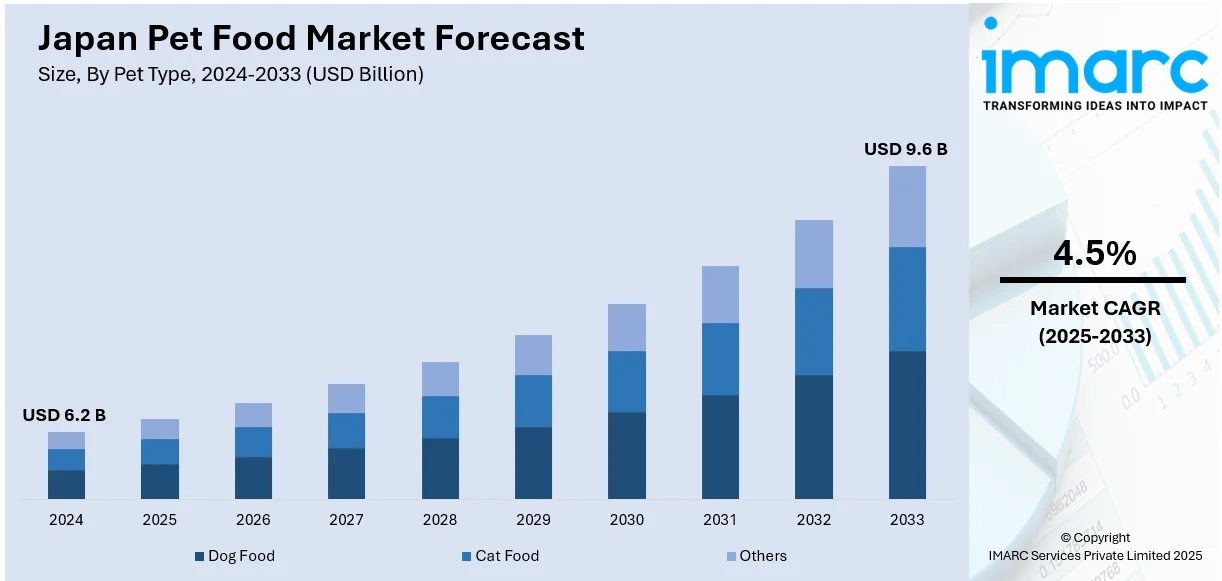

The Japan pet food market size was valued at USD 6.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.6 Billion by 2033, exhibiting a CAGR of 4.5% from 2025-2033. Rising pet ownership and increasing focus on pet health, demand for premium, functional, and sustainable products, and innovation in individualized diets, are propelling the Japan pet food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.2 Billion |

|

Market Forecast in 2033

|

USD 9.6 Billion |

| Market Growth Rate (2025-2033) | 4.5% |

The Japanese pet food market is driven by the growing pet population and pet ownership trend, particularly among urban households. According to Agriculture Canada, the cat and dog populations are expected to reach 8.6 million and 6.2 million, respectively, by 2028 in Japan. This growth stems from shifting societal attitudes where pets are increasingly treated as integral family members, driving higher spending on pet care and premium food products. Key drivers are urbanization and demographic change, especially an aging population. More seniors keep pets for companionship; thus, demand for pet food that caters to their special dietary needs as well as to age is on the rise. Young urban professionals with smaller spaces are turning toward smaller pets like cats, thus increasing the market for specific food products.

Manufacturers are responding with breed-specific, life-stage-appropriate, and functional formulations to meet the diverse nutritional demands of pets and their increasingly informed owners. Consumer trends toward health and wellness have extended to the pet food segment, fueling demand for organic, grain-free, and additive-free options. Japanese pet owners prioritize high-quality, safe products that reflect the country's strict quality standards, leading to the introduction of premium and innovative offerings. The other is functional pet foods focused on addressing health issues, like joint support and weight management as well as digestive health. There is growing pressure on sustainability from the environmental awareness about companies toward environmentally friendly sources and packaging methods. The expansion of online stores and subscription services for home delivery further improves accessibility and availability to premium and specialty pet products.

Japan Pet Food Market Trends:

Organic and natural pet foods on the rise

The increasing health-conscious mindset of Japanese consumers created a surge in demand for organic and natural pet food products. This shift is increasingly motivated by awareness about the environmental impact of conventional pet food, with research from Elsevier having shown that dog food constitutes 90% of the average dog's contribution to climate change. As a result, pet owners are opting for grain-free, additive-free, and preservative-free formulations that minimize artificial substances while aligning with sustainable practices. Many consumers are looking for sustainably sourced ingredients to reduce their pets' environmental footprints, reflecting broader concerns about climate change. Pet food manufacturers are responding by developing products with clean labels, ethical production practices, and eco-friendly packaging. Organic pet food, devoid of synthetic fertilizers and pesticides, is most desirable for pet owners who are committed to their animal's good-quality nutrition without environmental damage. With this movement came an increase in demand for vegetarian and vegan-based pet food; it aligns with an environmentally responsible individual. As awareness about health and sustainability grows, the organic and natural segment is well poised to shape the future of Japan's pet food market.

Premium and functional pet foods

Premium and functional pet foods are gaining traction in Japan as pet owners pay more attention to tailored nutrition and the growing importance of pets' health and wellness. In response, functional pet foods that promote overall health or assist with issues specific to certain types of digestive health, joint mobility, and weight are experiencing heightened demand. Aligning with an overall increase in demand for higher protein sources across humans and animals within Japan's animal protein market, growth is expected to exhibit a CAGR of 1.89% from 2025-2033, as per the IMARC Group. In response to these evolving needs, pet food brands are innovating formulations with probiotics, omega-3 fatty acids, and other health-enhancing ingredients. Beyond the ingredients, the premiumization extends to manufacturing processes and safety standards, which greatly resonate with the expectations of quality from Japanese consumers. Breed-specific and age-specific diets are becoming popular, which reflects the diverse profile of pets.

E-commerce and subscription models expansion

E-commerce platforms and subscription-based services are revolutionizing the way pet food is bought in Japan. Online retail provides pet owners with a vast range of brands, from premium to niche products that are not available in local stores. Convenience is another reason, as busy consumers can order products at any time and have them delivered directly to their homes. Subscription models enhance this convenience, ensuring regular delivery of pet food tailored to the needs of individual pets. These services often include personalized recommendations based on a pet's age, breed, and dietary requirements, enhancing the customer experience. In addition, e-commerce platforms enable brands to interact directly with consumers, offering promotions, loyalty programs, and detailed product information to build trust. This digital transformation is increasing Japan pet food market demand and fostering stronger connections between brands and consumers in the pet food market.

Japan Pet Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan pet food market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on pet type, product type, pricing type, ingredient type, and distribution channel.

Analysis by Pet Type:

- Dog Food

- Cat Food

- Others

Dog food represents a significant segment, spurred by the rising humanization trend among pets. Increasing numbers of pet owners in Japan prefer premium and special dog food, which can target specific dietary requirements, such as age-specific nutrition, joint health, and weight management. This trend has further been boosted by the rise of single-person households and the aging population in Japan, as it has led to an increase in the adoption of dogs as pets, which requires high-quality food products. Cat food is another major segment driven by the increased preference for domestic cats among consumers in metropolitan regions with restricted land space. Moist and semi-soft cat food varieties are particularly attractive, considering feline animals do not need more water due to their biological physiology, and palatability is higher than with dry food. However, preference for natural and organic raw materials used to prepare cat foods is one area that encourages such health-conscious consumers.

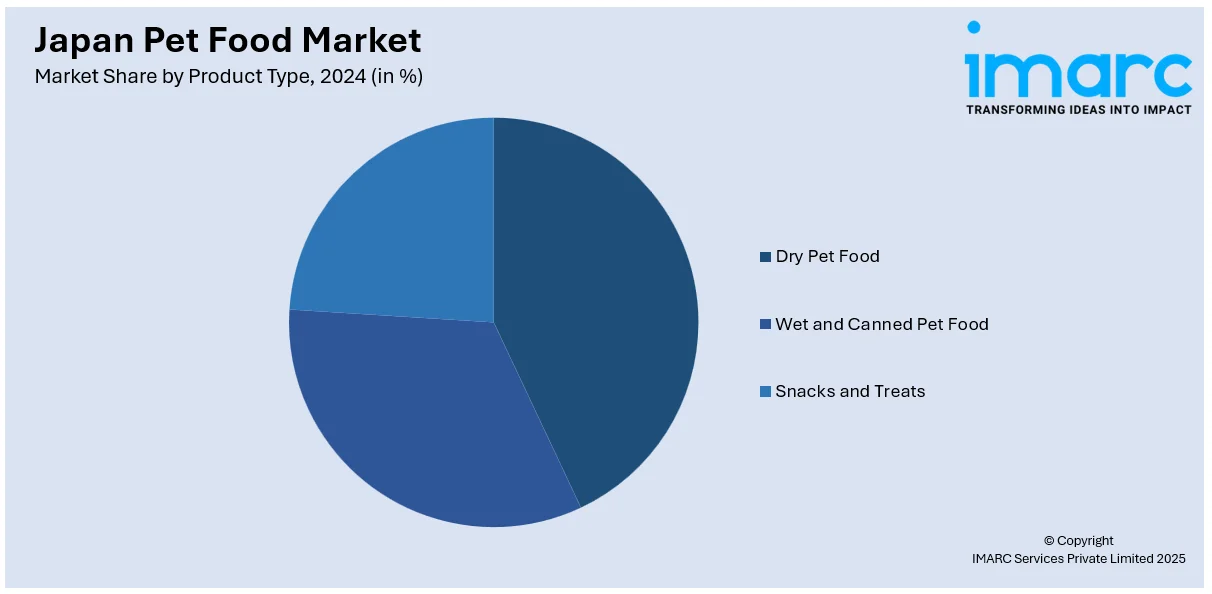

Analysis by Product Type:

- Dry Pet Food

- Wet and Canned Pet Food

- Snacks and Treats

Dry pet food holds a significant share due to its convenience, long shelf life, and value for money. According to the Statistics Bureau of Japan, the average monthly household income in Japan was 580,675 yen in 2024, which reflected a 3.7% nominal and 1.1% real growth from 2023, contributing to higher discretionary spending on pet care. With rising incomes, pet owners are increasingly opting for premium dry food products that offer a balanced blend of nutrition and affordability. Wet and canned food has become increasingly popular due to its improved flavor and suitability for pets with certain dietary requirements, like hydration. Snacks and treats are a developing category, where the product line is driven by training, positive reinforcement, and functional health applications, such as dental care and digestive health. This product diversification demonstrates changing consumer demands for pet nutrition.

Analysis by Pricing Type:

- Mass products

- Premium products

Premium products are seeing accelerated growth, driven by heightened awareness about pet health issues and the willingness of owners to invest in their pets' well-being. As per the VCA Animal Hospital, more than 80% of dogs of three years or more in Japan suffer from active dental disease, which is increasing demand for premium formulations for oral health, such as dental sticks and fortified kibble. Premium formulations often tout organic ingredients, advanced formulations targeting age- or breed-specific requirements, and the marketing of products as hypoallergenic. Mass still leads to more affordable solutions for households. These products are mainly catering to the basic needs of diet and keeping it affordable. However, the growing humanization of pets and individualized care are changing consumer preferences toward premium categories, especially in urban areas, where disposable income and awareness about pet health are higher.

Analysis by Ingredient Type:

- Animal Derived

- Plant Derived

Animal-based pet food is the market leader as it contains a high percentage of protein and is more likely to appeal to a pet's natural diet. Meat-based kibble and canned foods are still used as a standard source of necessary nutrients and muscle development. However, plant-based formulations are gaining popularity very fast, supported by health-conscious pet owners and sustainability. As per the industry reports, 25.2% of Japanese pet owners said that their pets have pollen allergy symptoms, leading to increased demand for hypoallergenic and plant-based products. These products will include lentils, chickpeas, and quinoa in their formulation. These will help with balanced nutrition without any potential allergens. Overall, this change toward plant-based pet food matches the trend that consumers are currently adopting to seek more environmentally friendly and ethically sourced products. This dual focus on health and sustainability places plant-based pet food as a rising category in the Japanese market.

Analysis by Distribution Type:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets still rule the roost due to their ubiquity and ability to support bulk purchases. Specialty stores focus on offering niche and premium products, often accompanied by expert advice, making them appealing to owners seeking tailored solutions for their pets. Online stores are the fastest-growing segment, driven by the extensive product variety, convenience of doorstep delivery, and features like subscription models for recurring orders. The rise of e-commerce platforms, coupled with promotional discounts and personalized recommendations, has significantly enhanced the popularity of online shopping in the pet food market.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Japanese pet food market is divided into the Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region. The Kanto Region, where the Tokyo-Yokohama metropolitan area is located, drives demand for premium pet food and specialized care products, with pet owners prioritizing convenience and health-focused options driven by its dense urban population. The Kinki Region, which includes Osaka and Kyoto, is ranked second, with high demand for functional and convenient products driven by its urbanized population. The Central/Chubu Region caters to a blend of urban and rural consumers, balancing affordability with interest in premium offerings. The Kyushu-Okinawa Region reflects regional climatic influences, with a growing preference for wet food and allergy-specific solutions. The Tohoku Region is essentially rural and demands cost-effective, bulk pet food options. The Chugoku Region has a relatively stable demand for natural and locally sourced products. The Hokkaido Region, which is colder, demands energy-dense formulations. The Shikoku Region is coming up with niche demands, led by growing awareness about pet nutrition and smaller populations of pets.

Competitive Landscape:

Key players are focusing on innovation, sustainability, and consumer-specific solutions. The most important area of activity has been in developing breed-specific and size-focused formulations that address the varying nutritional needs of pets. For instance, PetKonnect points out, small breeds, weighing less than 20 pounds, require energy-dense meals and smaller kibbles to keep pace with their high metabolic rates. Medium breeds (20-50 lbs) benefit from balanced diets that support overall health and sustained energy levels, while large and giant breeds (over 50 lbs) need specialized diets that promote controlled growth and joint health, critical for preventing skeletal issues. A strategy that is target-oriented reflects on the market concern of catering to the specific demands of Japan's pet population as smaller breeds are more popular among the urban citizenries. For instance, added to these innovative developments are environmentally friendly packaging methods and plant-based products, which are complemented by technological enhancements such as personalized dietary recommendations and mobile applications.

The report provides a comprehensive analysis of the competitive landscape in the Japan pet food market with detailed profiles of all major companies, including:

- Hill's Pet Nutrition Inc.

- INABA-PETFOOD Co. Ltd.

- Mars Incorporated

- Nestlé

- Unicharm Corporation

- Wellness Pet LLC

- General Mills Inc.

- ADM

- Petline Co. Ltd.

- DoggyMan H. A. Co. Ltd.

Latest News and Developments:

- In March 2024, Hills Colgate Japan K.K. launched the first new pet food brand that has developed in 20 years, Science Diet Vet Essential, which will go on sale. The brand is sold only in veterinary clinics and specialty stores, offering multi-care nutritional food based on science with ingredients that can help pets achieve good health and well-being.

- On September 2024, nationwide delivery of Pizza-La's Wanko, or the "Doggy" Pizza, was launched. As created by Comif Deli, the pizza will have a chicken crust, teriyaki chicken, corn, mushrooms, and seaweed. According to Pizza-La, the product is specially prepared with ingredients that are safe for dogs to eat.

- In October 2024, FamilyMart Co. Ltd announced that Shibanban-themed products will be offered at about 16,300 FamilyMart outlets countrywide from October 29, 2024, to commemorate "Dog Day" on November 1. To celebrate, FamilyMart will sell exceptional, limited-edition Shibanban goods with charming packaging and delectable flavors. This year's Dog Day offerings include baked snacks, chocolates, candies, potato chips, and eco-friendly bags, with each item adding visual and flavor appeal for a unique experience.

Japan Pet Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered | Dog Food, Cat Food, Others |

| Product Types Covered | Dry Pet Food, Wet and Canned Pet Food, Snacks and Treats |

| Pricing Types Covered | Mass Products, Premium Products |

| Ingredient Types Covered | Animal Derived, Plant Derived |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan pet food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan pet food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan pet food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Japan pet food market was valued at USD 6.2 Billion in 2024.

IMARC estimates the Japan pet food market to exhibit a CAGR of 4.5% during 2025-2033.

Rising pet ownership and increasing focus on pet health, demand for premium, functional, and sustainable products and innovation in individualized diets, are shaping the growth and evolution of the market.

Some of the major players in the Japan pet food market include Hill's Pet Nutrition Inc., INABA-PETFOOD Co. Ltd., Mars Incorporated, Nestlé, Unicharm Corporation, Wellness Pet LLC, General Mills Inc., ADM, Petline Co. Ltd., and DoggyMan H. A. Co. Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)