Japan Personal Cloud Market Size, Share, Trends and Forecast by Revenue type, Hosting Type, End User, and Region, 2026-2034

Japan Personal Cloud Market Size and Share:

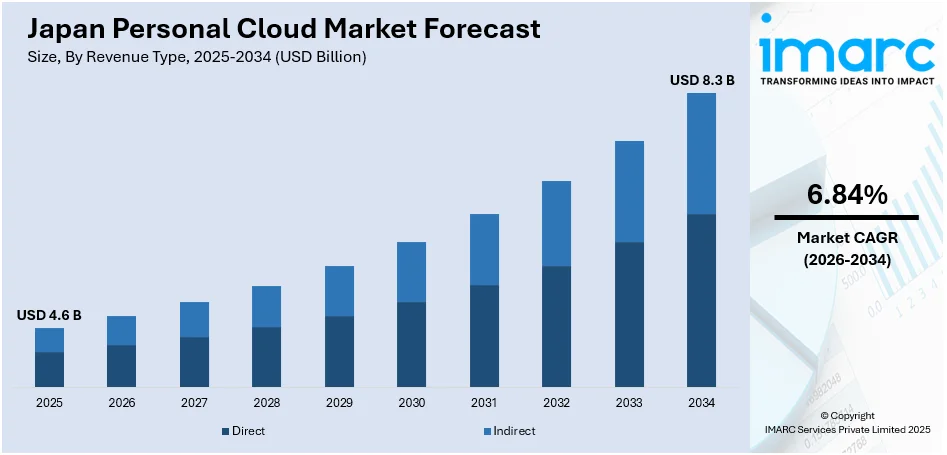

The Japan personal cloud market size was valued at USD 4.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 8.3 Billion by 2034, exhibiting a CAGR of 6.84% from 2026-2034. The elevating need for personal storage systems to store data that can be accessed across several devices, increasing concerns about data breaches among the masses, and rising digitization of businesses are some of the factors supporting the Japan personal cloud market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.6 Billion |

|

Market Forecast in 2034

|

USD 8.3 Billion |

| Market Growth Rate (2026-2034) | 6.84% |

Businesses are focusing on digitization to increase their operational efficiency. As personal data becomes increasingly digitized and mobile devices become ubiquitous, the demand for convenient, secure, and scalable cloud devices is growing across Japan. Japan has also been a leader in technological innovation, with major players taking the lead in hardware development. These innovations with 5G networks as well as advancement in artificial intelligence (AI), machine learning (ML), and edge computing bring a speed to cloud services more reliable and more personalized towards end users. Cloud providers also benefited by high-performance storage solutions in proper management of their data. Users can now store and access huge amounts of data, including photos, videos, documents, and media files, without having to worry about running out of space.

To get more information on this market Request Sample

Another important trend contributing to the increase in personal cloud usage in Japan is the rising adoption of mobile devices. Smartphones and tablets have become part of daily life, with a large majority of the Japanese population using these devices for work, entertainment, communication, and personal storage. With increasing complexity and power in camera and storage facilities, there is also a significant requirement for cloud-based solutions for the management of personal data. Mobile culture in Japan has increased dependency on cloud storage, so photos, videos, and other important data can be backed up through mobile applications that are now part of personal cloud services; with this setup, users are automatically syncing data from all of their devices to make sure files are always available wherever they go.

Japan Personal Cloud Market Trends:

Increased Mobile Device Usage and Digital Lifestyle

Rapid transformation towards mobile-first lifestyles is occurring in Japan, as phones and portable devices become more of an integral element in daily lives. These mobile phones are now used not just for communication purposes but also to manage personal data, entertainment, and work tasks. This has meant that the need for personal cloud services has become more pronounced since users require reliable, accessible, and secure ways to store and manage their data. The personal cloud services provide flexible automatic syncing across multiple devices of pictures, videos, and documents that can be used at any point in time or from anywhere. High mobile internet penetration in Japan made cloud storage a perfect solution to manage large daily data generated from smartphones and connected devices. An article from Freedom House stated that in 2024, Japan had 188.9 million mobile connections.

Growing Concerns Over Data Security and Privacy

While the adoption of personal cloud services has grown, concerns around data security and privacy remain significant in Japan. The Japanese population is known for its strong sense of privacy, which has led to a heightened knowledge of the risks associated with storing sensitive data online. As a result, there is an increase in the demand for cloud services that offer robust security features like multi-factor authentication and end-to-end encryption. Moreover, the Japanese government has implemented strict data protection laws to ensure that personal data is safeguarded against cyber threats and misuse. These regulations are fostering trust in domestic cloud providers that comply with local privacy standards, encouraging people to store their data with services that prioritize privacy. The growing demand for secure personal cloud solutions that comply with local data laws has become a key factor driving the market, as users look for options that balance convenience with security. In 2024, Wiz partnered with Rescana and Aspiration Japan to create a novel cloud security for Japanese businesses.

Advancements in Cloud Infrastructure and AI Integration

Advancements in cloud technology and AI are pivotal in Japan personal cloud market growth. Improvements in cloud infrastructure, such as more efficient storage solutions and faster internet speeds, have made cloud services more reliable and accessible. With the expansion of 5G networks and the integration of edge computing, it has been possible to store and access the data on the cloud faster, more efficiently, and in a more seamless way than ever before. Furthermore, personal cloud platforms are improving user experience with AI integration. For instance, AI-powered features such as automated organization of photos, intelligent search, and personalized recommendations assist users in managing data easily. In a country like Japan, known for its technological prowess, these innovations are appealing to individuals who demand advanced functionalities from their cloud services. The ongoing developments in cloud infrastructure and AI are therefore key drivers of the expanding personal cloud market in Japan. Moreover, the Japan AI market is expected to reach USD 35.2 billion by 2033, as per the predictions made by the IMARC Group.

Japan Personal Cloud Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan personal cloud market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on revenue type, hosting type, and end user.

Analysis by Revenue Type:

- Direct

- Indirect

The direct revenue model refers to income generated through direct transactions between cloud service providers and individuals. This model typically involves subscription fees, where customers pay for access to cloud storage and associated services on a recurrent basis like annually or monthly. People who opt for direct payment models are generally individual users, small businesses, or even larger enterprises looking to secure, store, and access their data efficiently. This model also includes premium services, where customers pay for added benefits like additional storage, advanced security features, or enhanced support.

The indirect revenue model in the personal cloud market involves third-party partnerships or integrations that help generate revenue through affiliate sales, advertising, or reselling services. In this model, cloud service providers collaborate with businesses, device manufacturers, and application developers, where their cloud services are bundled with other products or marketed through different channels. For instance, a smartphone manufacturer might offer cloud storage as part of the device package, generating income indirectly by selling devices and services together.

Analysis by Hosting Type:

- Service Providers

- Consumers

The service providers segment holds a major portion of the Japan personal cloud market share. Service providers in the personal cloud market refers to businesses or organizations that offer cloud-based storage and computing services to end-users. These service providers typically include large cloud computing companies, such as Google, Apple, Microsoft, and local Japanese providers like Rakuten and Fujitsu, who offer cloud solutions to individuals and businesses. Service providers manage the infrastructure, data storage, and security for their customers, often offering a range of plans and services based on storage capacity, features, and security levels.

The consumers segment in the personal cloud market refers to individual users who directly utilize cloud storage services to store, manage, and access their personal data. This segment includes a broad range of people, from tech-savvy individuals to those who use personal cloud services for basic file storage, photo backup, or document sharing. Consumers typically choose from a variety of cloud services based on their specific needs, including free or freemium services for basic storage, and paid plans for expanded storage or advanced features.

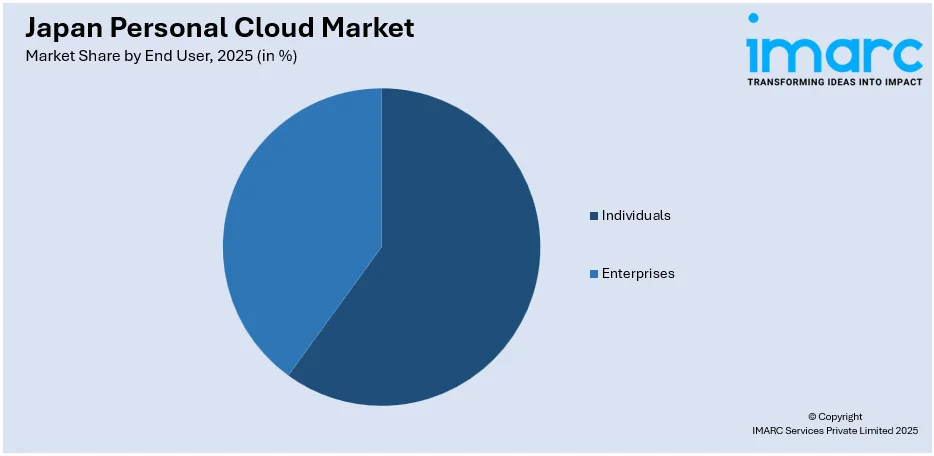

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Individuals

- Enterprises

The individuals segment in the personal cloud market consists of private users who seek cloud storage solutions primarily for personal data management. This includes storing photos, videos, documents, music, and other personal files that individuals want to keep accessible and secure across multiple devices. Individuals typically opt for cloud storage services based on convenience, ease of use, and the ability to access their data from anywhere, whether on smartphones, tablets, or computers.

The enterprises segment in the personal cloud market includes businesses, ranging from small and medium-sized enterprises (SMEs) to large corporations, that adopt cloud services to store and manage corporate data. For enterprises, cloud storage offers a scalable, flexible, and cost-effective efficient option to traditional on-premises data storage solutions. Businesses use personal cloud services for various purposes, including file storage, data backup, collaboration, and disaster recovery, all of which help improve operational efficiency.

Regional Analysis:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, which includes Tokyo, Yokohama, and surrounding areas, is the economic and technological hub of Japan and thus the largest and most developed market for personal cloud services. Home to many of Japan’s largest companies, tech startups, and a dense population of tech-savvy individuals, the demand for cloud services in this region is particularly high.

The Kansai or Kinki region, encompassing major cities such as Osaka, Kyoto, and Kobe, is a key economic zone in Japan, known for its industries in manufacturing, retail, and technology. The region has a large population and a high concentration of both individuals and business markets.

The Chubu or Central region, which includes cities like Nagoya and the Aichi Prefecture, is home to major manufacturing and industrial players, including automotive giants like Toyota. While the region is historically known for its manufacturing dominance, there is a growing trend toward digital transformation, with more businesses in the region investing in cloud technologies.

The Kyushu-Okinawa region, which includes cities like Fukuoka, Kumamoto, and Okinawa, is one of the less saturated areas for personal cloud services in Japan but has experienced steady growth in recent years.

The Tohoku region, comprising areas such as Sendai, is located in the northeastern part of Japan and is known for its beautiful landscapes and relatively low population density. However, the region is seeing an increasing uptake of cloud services due to rising smartphone usage, internet penetration, and demand for digital services.

The Chugoku region, which includes cities such as Hiroshima and Okayama, is another area where personal cloud adoption is gradually increasing. This region is home to a mix of urban and rural areas, with larger cities like Hiroshima witnessing greater demand for cloud services among both individuals and businesses.

The Hokkaido region, the northernmost part of Japan, is characterized by its vast natural landscapes and relatively low population density in comparison with other regions. Despite this, Hokkaido is seeing a steady rise in the use of personal cloud services, particularly in urban centers like Sapporo.

he Shikoku region, consisting of four prefectures—Ehime, Kagawa, Kochi, and Tokushima—is known for its rural landscapes and smaller urban centers. However, personal cloud adoption in Shikoku is on the rise, particularly as the region's population becomes more digitally connected.

Competitive Landscape:

Key players in the Japanese personal cloud market are adopting a variety of strategies to improve their business and strengthen their competitive position. One of the main approaches is improving the overall user experience by integrating advanced technologies such as AI, ML, and automation into their cloud platforms. For instance, in April 2024, Oracle Corporation Japan announced its plans to invest more than USD 8 billion over the next 10 years in order to fulfill the growing requirement for cloud computing and AI infrastructure in Japan. Additionally, cloud providers are focusing on improving security measures to address privacy concerns, which remain a significant issue for Japanese individuals. Many companies are investing in end-to-end encryption, multi-factor authentication, and other advanced security features to ensure user data is protected from potential breaches. This builds trust with users and ensures compliance with Japan’s strict data protection regulations. Finally, partnerships and collaborations with other tech firms, mobile providers, and hardware manufacturers are enabling cloud service providers to integrate their solutions into broader ecosystems, further embedding their services into the daily lives of Japanese users. These initiatives collectively help key players strengthen their presence and drive growth in the competitive personal cloud market.

The report provides a comprehensive analysis of the competitive landscape in the Japan personal cloud market with detailed profiles of all major companies.

Latest News and Developments:

- October 2023: Synchronoss Technologies, Inc. announced that SoftBank Corp., which is one of Japan’s major telecommunication carriers, deployed Synchronoss Personal Cloud to improve the efficiency of Anshin Data Box service.

- November 2024: Kyndryl launched a dedicated AI private cloud created to allow AI innovation in Japan. This collaboration with Dell Technologies using the Dell AI Factory with NVIDIA has allowed Kyndryl to create a secure, sovereign and control-rich cloud for organizations that develop, test, and deploy AI services capable of extending the capabilities of business organizations to improve performance.

- February 2024: Rakuten Symphony, Inc. stated its initiative to commercially launch Rakuten Drive, a file storage cloud service, in Japan. Rakuten Drive is a cloud-based file storage service for both personal and enterprise users that enables rapid sending of large files, and it provides safe, easy file storage and sharing on the cloud.

- April 2024: Microsoft launched its plan of financing $2.9 billion over two years to expand its cloud and AI infrastructure in Japan.

Japan Personal Cloud Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Revenue Types Covered | Direct, Indirect |

| Hosting Types Covered | Service Providers, Consumers |

| End Users Covered | Individuals, Enterprises |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan personal cloud market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan personal cloud market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan personal cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Japan personal cloud market was valued at USD 4.6 Billion in 2025.

The Japan personal cloud market outlook is favored by factors such as increased smartphone and mobile device usage, rising demand for secure and scalable storage solutions, advancements in cloud infrastructure and AI integration, strong data privacy regulations, and the growing trend of digitalization in both consumer and business sectors.

IMARC estimates the Japan personal cloud market to exhibit a CAGR of 6.84% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)