Japan Payments Market Report by Mode of Payment (Point of Sale, Online Sale), End Use Industry (Retail, Entertainment, Healthcare, Hospitality, and Others), and Region 2025-2033

Market Overview:

Japan payments market size reached USD 264.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2,288.6 Billion by 2033, exhibiting a growth rate (CAGR) of 26.40% during 2025-2033. The growing use of ATMs and the cultural inclination towards tangible money gifts during occasions represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 264.2 Billion |

| Market Forecast in 2033 | USD 2,288.6 Billion |

| Market Growth Rate (2025-2033) | 26.40% |

Payments refers to an integral aspect of trade and commerce. These transactions, whether in the form of currency exchange, barter, or digital transfers, facilitate the movement of value for goods and services. From ancient civilizations using coins and promissory notes to today's digital era, where electronic and virtual currencies are the norm, the evolution of payments has been monumental. In the recent times, the payment landscape is characterized by its technological advancements and the convergence of multiple channels, offering consumers and businesses a plethora of options. Whether it's tapping a credit card on a point-of-sale device, transferring money internationally via mobile apps, or using cryptocurrencies for online purchases, the realm of payments has expanded dramatically.

Japan Payments Market Trends:

The Japan payments market, deeply rooted in a rich economic history and simultaneously poised at the cutting edge of technology, offers a dynamic blend of traditional and modern transaction methods. One of the major trend is the growing acceptance and utilization of cashless transactions. Mobile wallets, contactless cards, and QR code payments have become increasingly popular among consumers. Furthermore, the rise of fintech companies in Japan has spurred innovation in the payments sector. These startups, often collaborating with established banks and financial institutions, are introducing new payment platforms, ensuring faster, more secure, and seamless transactions. Another driving factor is the integration of advanced technologies like AI and blockchain into payment systems, enhancing security and offering personalized payment experiences for users. Additionally, with Japan's penchant for technological integration, the Internet of Things (IoT) is also playing a role, with innovations like connected cars and smart appliances facilitating automated payments. Lastly, regulatory support and policies have been crucial in fostering a conducive environment for the growth of digital payment solutions. In essence, backed by technological advancements, strategic collaborations, and regulatory support, the Japan payments market is expected to bolster over the forecasted period.

Japan Payments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on mode of payment and end use industry.

Mode of Payment Insights:

- Point of Sale

- Card Payments (includes Debit Cards, Credit Cards, and Bank Financing Prepaid Cards)

- Digital Wallet (includes Mobile Wallets)

- Cash

- Others

- Online Sale

- Card Payments (includes Debit Cards, Credit Cards, Bank Financing Prepaid Cards)

- Digital Wallet (includes Mobile Wallets)

- Others

The report has provided a detailed breakup and analysis of the market based on the mode of payment. This includes point of sale (card payments (includes debit cards, credit cards, and bank financing prepaid cards), digital wallet (includes mobile wallets), cash, and others) and online sale (card payments (includes debit cards, credit cards, bank financing prepaid cards), digital wallet (includes mobile wallets), and others.

End Use Industry Insights:

- Retail

- Entertainment

- Healthcare

- Hospitality

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes retail, entertainment, healthcare, hospitality, and others.

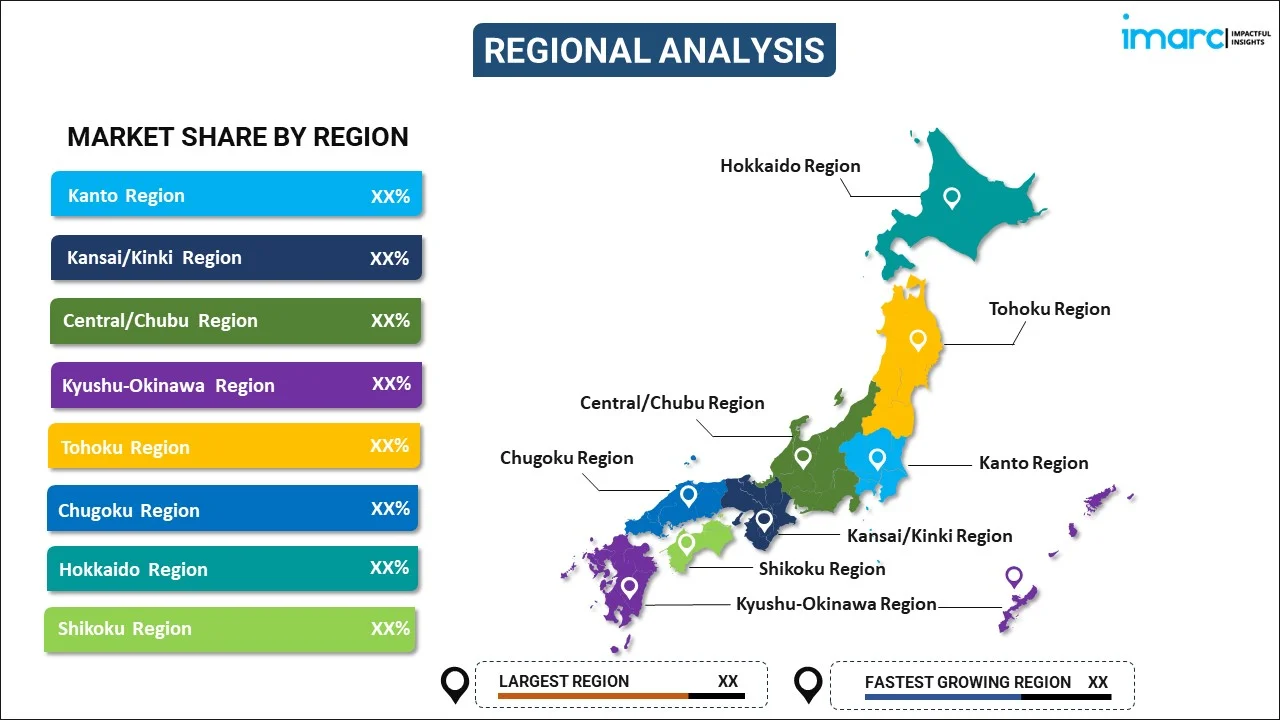

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Japan Post Bank Co. Ltd.

- LINE Pay Corporation (Line Corporation)

- Mizuho Financial Group Inc.

- PayPay Corporation

- Rakuten Group Inc.

- Resona Holdings Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Japan Payments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Payments Covered |

|

| End Use Industries Covered | Retail, Entertainment, Healthcare, Hospitality, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | Japan Post Bank Co. Ltd., LINE Pay Corporation (Line Corporation), Mizuho Financial Group Inc., PayPay Corporation, Rakuten Group Inc., Resona Holdings Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan payments market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan payments market?

- What is the breakup of the Japan payments market on the basis of mode of payment?

- What is the breakup of the Japan payments market on the basis of end use industry?

- What are the various stages in the value chain of the Japan payments market?

- What are the key driving factors and challenges in the Japan payments?

- What is the structure of the Japan payments market and who are the key players?

- What is the degree of competition in the Japan payments market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan payments market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan payments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan payments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)