Japan Payment Gateways Market Size, Share, Trends and Forecast by Application, Mode of Interaction, and Region, 2026-2034

Japan Payment Gateways Market Overview:

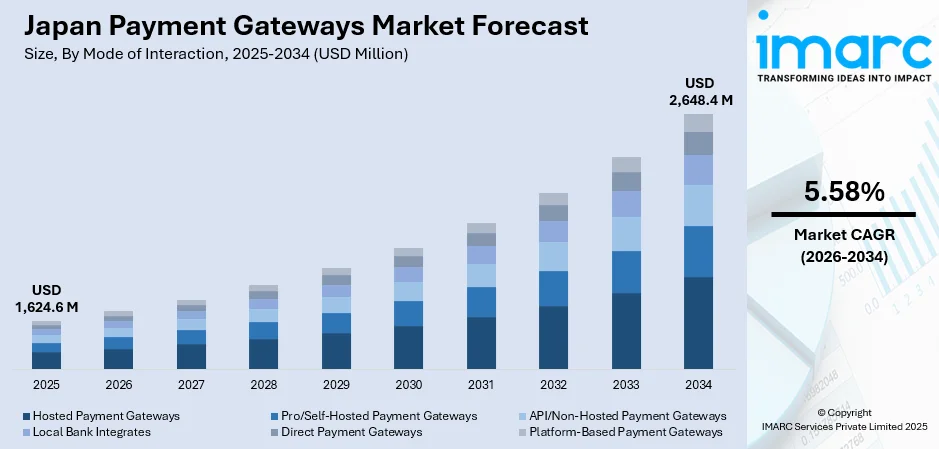

The Japan payment gateways market size reached USD 1,624.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,648.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.58% during 2026-2034. Cashless adoption, contactless retail demand, government-backed digital incentives, loyalty and wallet integrations, fintech expansion, API-driven gateway innovation, open banking standards, APPI-compliant data handling, embedded finance solutions, and rising platform interoperability across Rakuten Pay, PayPay, and Line Pay are some of the factors positively impacting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,624.6 Million |

| Market Forecast in 2034 | USD 2,648.4 Million |

| Market Growth Rate 2026-2034 | 5.58% |

Japan Payment Gateways Market Trends:

Digital Retail Transformation and Shift Toward Cashless Transactions

Japan’s retail landscape is undergoing a digital transition, driven by rising consumer preference for contactless and online payments across various sectors including convenience stores, department chains, and travel services. As this shift unfolds, payment gateways have become essential for ensuring seamless transaction flows between customers, merchants, and financial institutions. Retailers are increasingly integrating gateway solutions that support real-time settlement, compatibility with domestic e-wallets, and loyalty program integration. The competitive edge now lies in the ability to facilitate transactions across multiple platforms with minimal friction. This has redefined the Japan payment gateways market share, especially among providers who can effectively support interoperability with local platforms such as Rakuten Pay, PayPay, and Line Pay. The trend is further reinforced by government support for cashless payment infrastructure through programs like the Cashless Rebate Scheme and the Digital Garden City initiative. These efforts have accelerated merchant adoption of electronic payment systems, particularly in small to mid-sized enterprises that were previously cash-dependent. According to a survey conducted in Japan between February and March 2025, credit cards emerged as the most commonly used cashless payment method, with 73% of respondents indicating regular usage. In contrast, only 7.2% reported relying exclusively on cash for their daily transactions. Gateways that offer bundled services—such as inventory management, analytics, and CRM tools—are gaining preference in retail digital transformation strategies. As these systems are scaled, attention to cybersecurity, system uptime, and data localization requirements under Japan’s Act on the Protection of Personal Information (APPI) remains a key priority for vendors.

To get more information on this market Request Sample

Integration of Fintech Solutions and Open Banking Standards

Japan’s payment ecosystem is increasingly shaped by the emergence of fintech platforms that offer faster, cheaper, and more customizable transaction services. Fintech firms are actively leveraging APIs to integrate payment gateways with services such as peer-to-peer lending, digital wallets, and subscription billing. This has led to increased adoption of gateway solutions that prioritize flexibility, automation, and developer-friendly interfaces. The demand for frictionless integration into enterprise systems—especially among SaaS platforms, online education providers, and mobile applications—has significantly contributed to Japan payment gateways market growth, as businesses aim to modernize customer experiences while reducing operational bottlenecks. Simultaneously, Japan’s move toward open banking—underpinned by regulatory amendments to the Banking Act—has enhanced access to financial APIs, allowing licensed entities to collaborate with gateway providers in delivering personalized, real-time payment services. On March 5, 2024, Stripe launched “Tour Tokyo 2024,” a strategic initiative to deepen its presence in Japan by supporting digital-first businesses and modernizing local payment infrastructure. The campaign highlights Stripe’s partnerships with Japanese enterprises and its expanding suite of payment tools tailored for domestic and cross-border commerce. Institutions are prioritizing partnerships that enable data sharing and instant authorization while maintaining strict compliance with APPI and FSA (Financial Services Agency) requirements. This landscape favors gateways capable of supporting multi-channel orchestration, tokenization, and seamless reconciliation. The broader Japan payment gateways market outlook is shaped by this convergence of regulatory support, digital innovation, and rising demand for scalable infrastructure that accommodates embedded finance across diverse service sectors.

Japan Payment Gateways Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on application and mode of interaction.

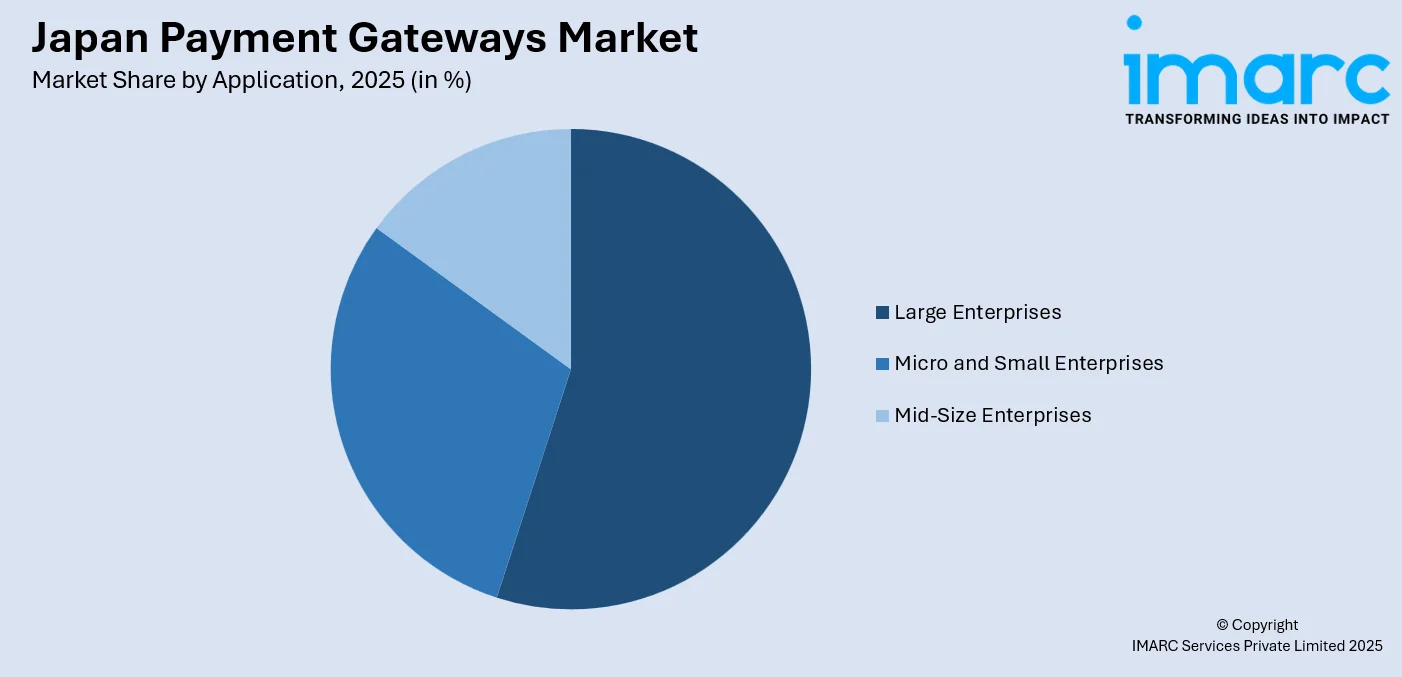

Application Insights:

Access the comprehensive market breakdown Request Sample

- Large Enterprises

- Micro and Small Enterprises

- Mid-Size Enterprises

The report has provided a detailed breakup and analysis of the market based on the application. This includes large enterprises, micro and small enterprises, and mid-size enterprises.

Mode of Interaction Insights:

- Hosted Payment Gateways

- Pro/Self-Hosted Payment Gateways

- API/Non-Hosted Payment Gateways

- Local Bank Integrates

- Direct Payment Gateways

- Platform-Based Payment Gateways

The report has provided a detailed breakup and analysis of the market based on the mode of interaction. This includes hosted payment gateways, pro/self-hosted payment gateways, API/non-hosted payment gateways, local bank integrates, direct payment gateways, and platform-based payment gateways.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Payment Gateways Market News:

- On March 28, 2024, Wise received regulatory approval to directly join Zengin, Japan’s domestic payment clearing system, becoming the first non-Japanese fintech granted such access. This integration enables Wise to process domestic transfers in Japan more efficiently, reducing costs and settlement times for users. The move marks a significant milestone for Japan’s payment gateways market by opening its core infrastructure to international payment platforms and enhancing competition in cross-border and local digital transactions.

Japan Payment Gateways Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Large Enterprises, Micro and Small Enterprises, Mid-Size Enterprises |

| Modes of Interaction Covered | Hosted Payment Gateways, Pro/Self-Hosted Payment Gateways, API/Non-Hosted Payment Gateways, Local Bank Integrates, Direct Payment Gateways, Platform-Based Payment Gateways |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan payment gateways market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan payment gateways market on the basis of application?

- What is the breakup of the Japan payment gateways market on the basis of mode of interaction?

- What is the breakup of the Japan payment gateways market on the basis of region?

- What are the various stages in the value chain of the Japan payment gateways market?

- What are the key driving factors and challenges in the Japan payment gateways?

- What is the structure of the Japan payment gateways market and who are the key players?

- What is the degree of competition in the Japan payment gateways market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan payment gateways market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan payment gateways market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan payment gateways industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)