Japan Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

Japan Meat Market Size and Share:

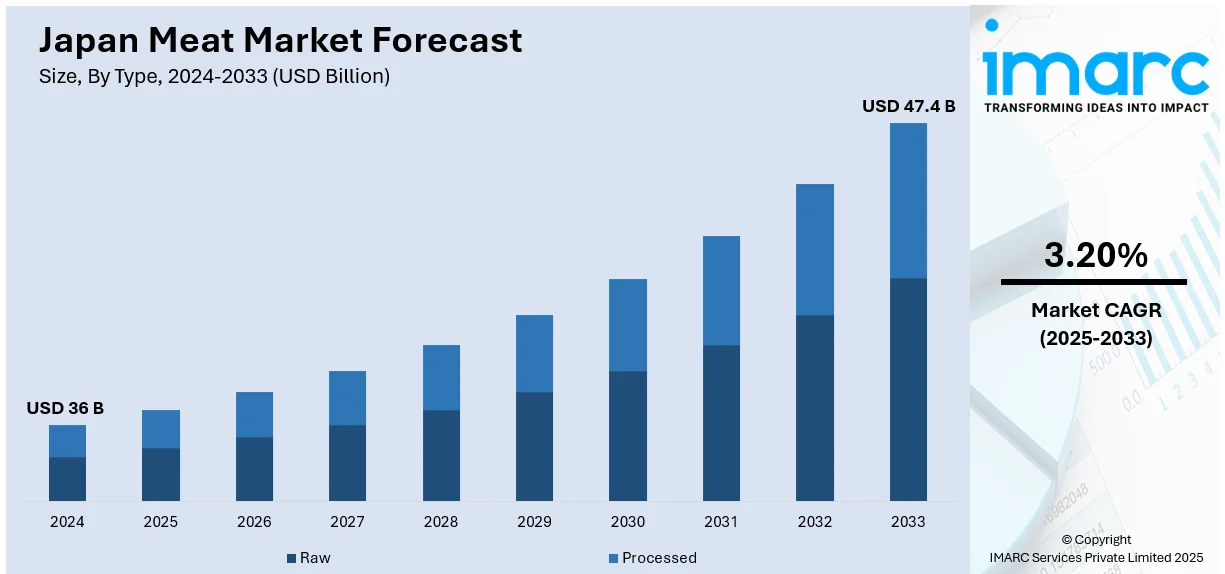

The Japan meat market size was valued at USD 36 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 47.4 Billion by 2033, exhibiting a CAGR of 3.20% from 2025-2033. The rapidly changing consumer preferences, rising income levels and urbanization, growing health consciousness and dietary trends, increasing influence of international cuisines, and recent developments in meat production are some vital factors supporting the Japan meat market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 36 Billion |

| Market Forecast in 2033 | USD 47.4 Billion |

| Market Growth Rate (2025-2033) | 3.20% |

In recent years, meat consumption per person in Japan has risen significantly, reflecting changing consumer tastes and preferences. In the year 2022, the per capita meat consumption reached 31.4 kilograms. This growing trend is projected to persist, with per capita meat consumption anticipated to reach 34.7 kg by 2027. Various factors are driving this increase, such as the younger demographic in Japan is increasingly seeking diverse and convenient food options, leading to a higher demand for various meat products. Additionally, the growing popularity of international cuisines has introduced new meat-based dishes to the Japanese palate, further diversifying consumption patterns and driving the Japan meat market demand.

Japan meat market growth is significantly influenced by rising disposable incomes and urbanization, leading to increased household expenditure on meat products. In 2023, Japanese households spent an average of ¥72,800 on meat, with projections indicating a steady annual increase of approximately 0.7% from 2024 to 2028. The rise in meat consumption is closely tied to the country's economic growth and performance. The International Monetary Fund (IMF) remains optimistic about consumption prospects, attributing potential growth to significant pay raises from the year's spring wage negotiations, which are expected to boost household incomes and, consequently, meat consumption. Additionally, urbanization contributes to the demand for diverse and convenient meat products.

Japan Meat Market Trends:

Rising Health Consciousness and Dietary Trends

In recent years, Japan has experienced notable shifts in meat consumption patterns, influenced by health consciousness and dietary trends. Pork and poultry have traditionally been staples in the Japanese diet, valued for their protein content and versatility. In 2023, the per capita consumption of poultry meat was estimated at approximately 14.4 kilograms, indicating a strong preference for chicken. Despite the overall growth in meat consumption, beef intake has stayed relatively unchanged. In 2023, the per capita consumption of beef and veal stood at 10.08 kilograms, with forecasts indicating marginal increases in the coming years. These consumption trends are influenced by various factors, including health considerations, dietary preferences, and economic conditions. The growing interest in lean meats like poultry aligns with health-conscious dietary choices, while the stability in beef consumption suggests a consistent demand for this protein source.

Globalization and Influence of International Cuisine

The globalization of food culture is substantially proving as a significant factor behind Japan meat market growth. As Japan continues to integrate with modern culinary phenomena, it has witnessed a considerable rise in the demand for various meat products and new ways of preparing them. For instance, American barbecue, fast foods, and steaks introduced larger portions and other cuts of meat to consumers. The influence of Korean BBQ, grilling meat in front of consumers, is also building up more interest in the increased consumption of beef and pork. The incoming foreigners in cities like Tokyo also attract the changes in food preferences. Furthermore, global food's exposure to the younger generation has been expanded by travel and media influence. This is what encourages young people to have no obligation over food exploration with nontraditional dishes, thus enhancing the types of meat intakes.

Recent Innovation and Development of Meat Substitutes

Another important point to boost the Japan meat market share is the innovation and introduction of meat substitutes, mostly concerning plant-based or lab-grown meat. With rising global concerns of health, sustainability, and animal welfare, Japanese consumers are already turning to various replacements other than the common animals. This is evident in plant-based meat products that are quickly taking market space as consumers enjoy meaty 'feel and taste,' but without the baggage of livestock farming. Production companies are racing against time to innovate further and create more convincing and different plant-based types, from sandwiches to sausage, to catch the vegetarian and vegan populace elite. Another innovation gaining traction in the Japanese market is laboratory-cultured or lab-grown meat through cellular agriculture. These alternatives are not on a consumer scale but have great promises to disrupt an otherwise too-moldy agriculture industry by meeting increased protein demand sustainably and ethically.

Japan Meat Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the keyword market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, product, and distribution channel.

Analysis by Type:

- Raw

- Processed

Raw meat cuts are fresh or raw cuts of beef, pork, chicken, etc. that come directly to customers for home and commercial preparation for cooking. Fresh meat is, in fact one of the components of traditional diets in Japan for yakiniku, shabu-shabu, or tonkatsu.

Processed meat, though, has started to gain in popularity over time due to easy convenience and increasing consumer demands in recent years. Processed meat products, for example, sausages, bacon, ham, and ready-to-eat meals, have gained popularity mainly because of the longer shelf life of these products and their ease in preparation and diverse flavor. In a busy city, convenience rules food choices.

Analysis by Product:

- Chicken

- Beef

- Pork

- Mutton

- Others

As per the recent Japan meat market forecast, chicken is one of the most commonly consumed meats in Japan, prepared for yakitori, karaage, and ramen because it is affordable and flexible to use.

Beef, however, is expensive but highly sought after in Japan due to its mouthwatering taste and tender meat, especially its premium cut: Kobe beef, which stands for luxury and fine dining.

Pork is a staple, found in traditional dishes like tonkotsu ramen, tonkatsu and almost every variety of hot pots. It's such an accessible and affordable meat.

Mutton is the least popular of the four cuts, but it is consumed, particularly in Hokkaido, in which the locals enjoy jingisukan, grilled mutton. Consumer preferences are constantly changing, but the market remains predominantly beef and pork, with an increased interest in chicken, particularly in urban regions, and a slow but sure demand for mutton in regional markets. Diverse product segmentation is possible by suppliers to various tastes and price points, thereby increasing the growth of Japan's meat market.

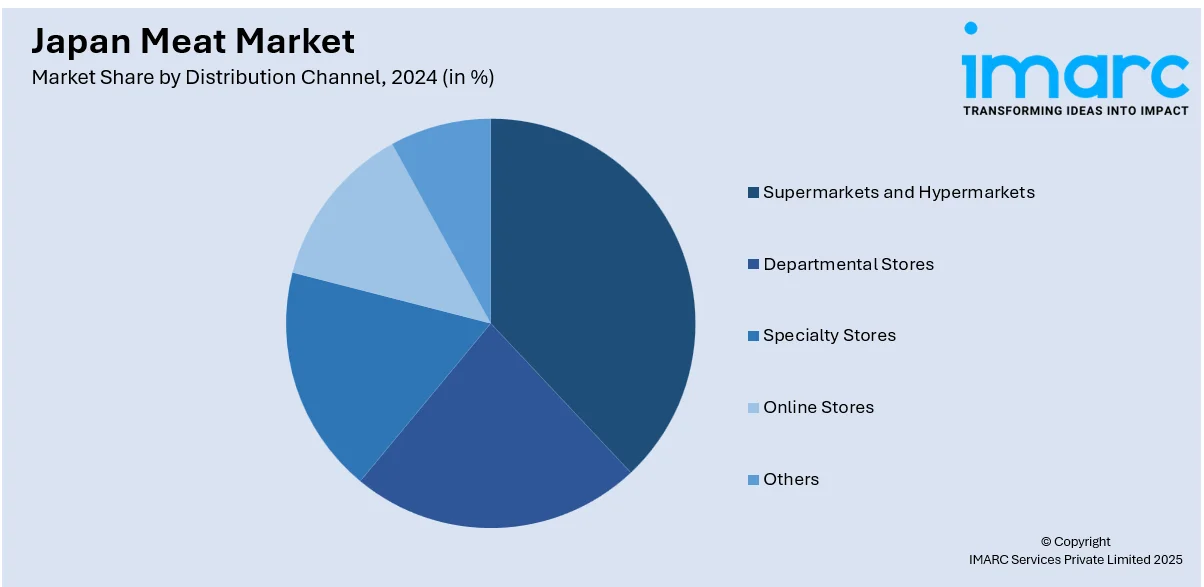

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Based on the latest Japan meat market outlook, supermarkets and hypermarkets lead as the primary distribution channels, supplying a diverse range of raw and processed meat products to meet the needs of a wide customer base. These outlets capitalize on their convenience and high foot traffic, offering a one-stop shopping solution for everyday buyers.

Departmental stores, particularly in urban areas, often target high-income consumers and provide premium cuts of meat, especially luxury beef, such as Kobe beef, alongside other high-quality food products.

Specialty stores, including butcher shops and stores focused on organic or niche meats, serve a more specific clientele looking for specialized or artisanal products. These establishments are recognized for their specialized service and expertise in recommending and selecting quality cuts of meat.

Finally, online stores are rapidly growing in importance as e-commerce trends rise across Japan. Consumers appreciate the convenience of ordering meat online, with some platforms offering home delivery of fresh, frozen, or premium meat products.

As convenience and digitalization become increasingly central to the Japanese shopping experience, online stores are expected to continue expanding their share of the market, particularly in urban regions.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region, home to Tokyo, is the largest and most lucrative market due to its urban population and high disposable income, driving both demand for premium meats and convenience-driven processed products.

The Kinki Region, which includes Osaka and Kyoto, is known for a robust food culture that embraces a variety of meats, particularly pork and beef, reflecting a balanced demand for both fresh and processed meat.

The Central/Chubu Region, including cities like Nagoya, has a strong affinity for pork and poultry, with a growing trend toward ready-to-eat and processed meat products.

Kyushu/Okinawa Region stands out for its preference for chicken and pork, with regional specialties like tonkotsu ramen and yakitori influencing local consumption.

The Tohoku Region, known for its colder climate, has a smaller, yet steady, demand for beef and mutton, with certain areas specializing in high-quality regional meats.

The Chugoku Region in western Japan has a strong presence of both beef and chicken, while Hokkaido Region, with its large agricultural base, is known for producing premium meats, including lamb and beef.

Lastly, the Shikoku Region exhibits a preference for high-quality beef and pork, influenced by the region's agricultural practices. Regional preferences and unique culinary traditions contribute to the overall diversity and segmentation of Japan’s meat market.

Competitive Landscape:

As per the latest Japan meat market trends, leading players are actively adapting to changing consumer preferences, innovations, and market dynamics. Leading companies are broadening their product ranges to include both conventional meat cuts and processed meat products, aiming to appeal to a wider audience. These companies are increasingly investing in premium products, such as Wagyu beef and high-quality pork, to appeal to the growing demand for luxury meat items. Additionally, these companies are prioritizing sustainability and ethical sourcing practices, responding to the growing consumer awareness of the environmental effects of meat production. In line with global trends, many leading players are incorporating plant-based and lab-grown meat options into their portfolios, responding to the rise of health-conscious and environmentally aware consumers. Collaborations with innovative food tech companies are helping them introduce alternative protein products to meet the growing demand for meat substitutes.

The report provides a comprehensive analysis of the competitive landscape in the Japan meat market with detailed profiles of all major companies.

Latest News and Developments:

- In June 2024, Starzen, a Japanese meat trading company bought the Macquarie Downs specialized Wagyu Feedlot for A$ 55.9 million. This move is part of the company’s strategy to strengthen its operations, especially the supply and production of Wagyu beef.

- In September 2024, Yoshinoy Holdings, a Japanese fast-food chain operator, announced its intention to introduce ostrich meat to overcome the shortages of its popular beef bowl.

- In January 2024, An award of $27.7 million was given by the Japanese government to Umami United and IntegriCulture to support the development of plant-based eggs and cultivated meat.

- In May 2023, PIK VRBOVEC became the first Croatian meat firm to export beef to Japan. The company was given HVI 21-2 veterinary certificate, allowing to it sell high-quality baby beef in Japan.

Japan Meat Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu/Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan meat market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan meat market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Japan meat market was valued at USD 36 Billion in 2024

The rapidly changing consumer preferences, rising income levels and urbanization, growing health consciousness and dietary trends, increasing influence of international cuisines, and recent developments in meat production are some vital factors supporting the market growth.

IMARC estimates the Japan meat market to exhibit a CAGR of 3.20% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)