Japan Mattress Market Size, Share, Trends and Forecast by Product, Distribution Channel, Size, Application, and Region, 2025-2033

Japan Mattress Market Size and Share:

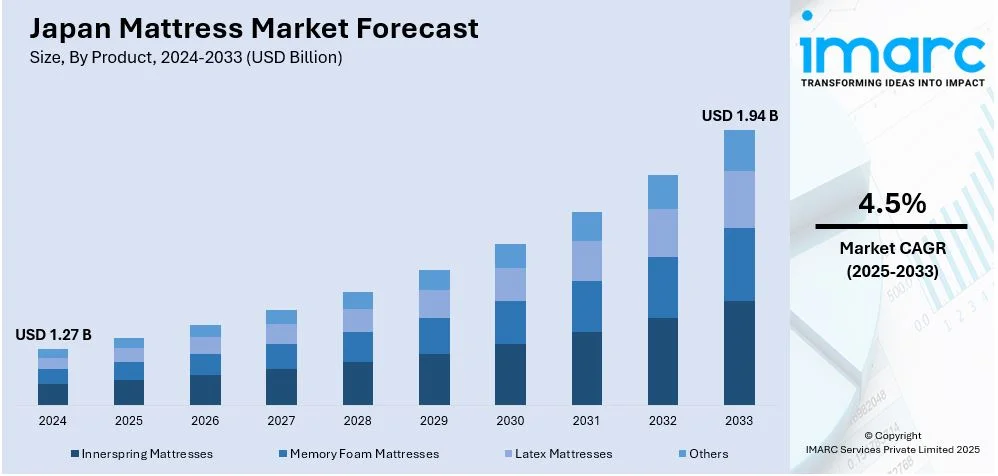

The Japan mattress market size was valued at USD 1.27 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.94 Billion by 2033, exhibiting a CAGR of 4.5% from 2025-2033. The Japan mattress market is driven by increasing consumer focus on sleep quality, rising urbanization, and demand for advanced materials like memory foam and latex. Health-conscious trends and innovations in ergonomic designs further fuel growth, while aging demographics encourage sales of orthopedic mattresses tailored to specific needs, enhancing market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.27 Billion |

| Market Forecast in 2033 | USD 1.94 Billion |

| Market Growth Rate (2025-2033) | 4.5% |

In Japan, increasing awareness of health and wellness is significantly driving the mattress market. Consumers are prioritizing high-quality sleep as a cornerstone of physical and mental well-being, prompting demand for premium mattresses with advanced technologies such as memory foam, gel-infused layers, and pressure-relief designs. Ergonomically designed mattresses addressing back, and joint health are particularly popular among an aging population. Sleep-related research and marketing efforts emphasizing its benefits also influence buying decisions. As lifestyles shift towards more health-conscious routines, brands offering innovative solutions aligned with these priorities experience higher growth, making sleep quality a critical driver in the market.

Besides this, the Japan's aging population is a significant driver for the mattress market. Older adults often face health challenges such as joint pain, arthritis, and spinal issues, creating a demand for orthopedic and therapeutic mattresses. In addition to this, the global population aged 60 years and older is projected to reach 1.4 billion by 2030 and 2.1 billion by 2050. Products designed to offer enhanced support, pressure relief, and comfort cater to these needs, with features like adjustable firmness and body-contouring materials gaining popularity. This demographic’s willingness to invest in products that improve their quality of life encourages manufacturers to innovate and cater to niche requirements. Consequently, this aging trend plays a pivotal role in shaping market demand and product development.

Japan Mattress Market Trends:

Shift towards eco-friendly and sustainable mattresses

Eco-friendly and sustainability trends are sweeping the Japan mattress market. Concerned about ecological effects, people are demanding green mattresses made of organic cotton, natural latex, and bamboo fibers. Manufacturers, too, have been adopting such practices as use of recyclable packaging and lower carbon footprints in production processes. Certifications for eco-sustainability and non-toxic materials are gaining importance, as they assure consumers of a product’s environmental compliance. This shift reflects Japan’s broader cultural emphasis on harmony with nature and sustainability. As green consumerism grows, companies integrating eco-conscious solutions into their product portfolios are positioned to capture significant market share, aligning with both regulatory and consumer expectations.

Integration of smart mattress technologies

Smart mattresses equipped with advanced technologies are rapidly transforming the Japanese mattress market. Features such as sleep tracking, temperature regulation, and automatic firmness adjustment are gaining traction among tech-savvy consumers seeking personalized comfort and health monitoring. Many smart mattresses now connect with mobile applications, offering detailed analytics on sleep patterns and suggesting improvements. These innovations align with Japan’s strong affinity for cutting-edge technology, fostering consumer interest in high-tech sleep solutions. As lifestyles become busier, these smart mattresses appeal to individuals prioritizing efficient and high-quality rest. This trend not only enhances market growth but also encourages manufacturers to invest in R&D for developing AI-driven and IoT-enabled sleep systems.

Growing popularity of customized mattresses

Customization is emerging as a key trend in the Japanese mattress market, driven by diverse consumer preferences and a focus on individual comfort. Customizable features such as size, firmness levels, and material composition are increasingly sought after, especially among consumers with specific health or lifestyle needs. Retailers and online platforms offer tools for personalization, allowing buyers to design mattresses tailored to their requirements. This trend also aligns with Japan’s cultural emphasis on attention to detail and high-quality craftsmanship. By catering to unique demands, brands can enhance customer satisfaction and loyalty. The growing emphasis on personalized solutions highlights a shift toward consumer-centric approaches, boosting the appeal of customizable options.

Japan Mattress Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan mattress market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, distribution channel, size, and application.

Analysis by Product:

- Innerspring Mattresses

- Memory Foam Mattresses

- Latex Mattresses

- Others

Innerspring mattresses dominate the Japan mattress market due to their widespread availability, affordability, and balanced comfort and support. These mattresses utilize a network of steel coils, offering durability and excellent weight distribution, making them a popular choice among various consumer groups. Their breathability ensures better air circulation, appealing to Japan’s humid climate. Furthermore, continuous innovations, such as pocketed coils for motion isolation and hybrid designs combining foam layers, enhance their appeal. Innerspring mattresses are also preferred for their firmness options, which cater to the needs of individuals seeking spinal support, including elderly users. The blend of cost-effectiveness, durability, and evolving features has cemented their position as a leading product category in Japan's dynamic mattress market.

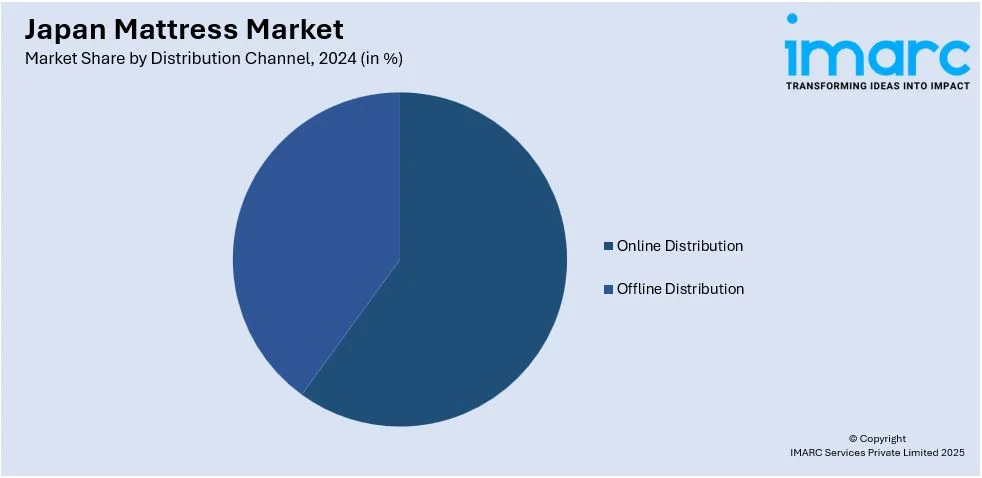

Analysis by Distribution Channel:

- Online Distribution

- Offline Distribution

Offline distribution channels dominate the Japan mattress market, primarily through physical retail stores such as specialty mattress shops, department stores, and large home goods retailers. These outlets allow consumers to test mattresses in person, offering an experiential advantage that online channels cannot replicate. Consumers in Japan value the tactile experience of testing firmness, comfort, and quality before purchasing, making offline channels essential. Additionally, sales staff provide personalized recommendations, further enhancing the customer experience. High-end mattress brands also often rely on showrooms and partnerships with furniture stores to build brand recognition and trust. Despite the growth of e-commerce, offline distribution remains dominant due to Japan's traditional shopping habits, the need for product trial, and strong in-store customer service offerings.

Analysis by Size:

- Twin or Single Size

- Twin XL Size

- Full or Double Size

- Queen Size

- King Size Mattress

- Others

Queen-size mattresses dominate the size segment of the Japan mattress market due to their balanced dimensions, providing ample space for individuals and couples while still fitting comfortably in most Japanese bedrooms. This size offers a perfect middle ground between comfort and space efficiency, catering to a wide range of consumer preferences. As Japan's living spaces are typically smaller compared to other countries, the queen-size mattress strikes a practical balance, offering a spacious sleep area without overwhelming limited room sizes. Moreover, queen-size mattresses are versatile, appealing to both single sleepers who prefer more space and couples looking for comfort. Their popularity is further reinforced by their availability across various mattress types, from innerspring to memory foam, making them the top choice for most consumers in Japan.

Analysis by Application:

- Domestic

- Commercial

The domestic application segment dominates the Japan mattress market due to the high demand for comfort and quality sleep in residential settings. Sleep has been considered a most vital part of health and wellness among the Japanese, making high-quality mattresses for home usage increasingly important. Therefore, it can be seen that sales for the domestic segment- households and families- represent a vast proportion of mattress sales. Home is also one area where the demand for personal comfort like adjustable firmness and ergonomic support is at the peak because home buyers can easily select on the basis of individual comfort. Additionally, with an aging population, many Japanese households seek orthopedic and supportive mattresses for seniors, further driving the demand. The domestic application segment remains the largest due to its emphasis on comfort, customization, and health.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region is dominating the Japan mattress market due to its large population and economic importance. Being the most populous region, which contains Tokyo, Yokohama, and Chiba, it is a major consumer base for mattress sales. The high standard of living, along with increasing demand for comfort and good sleep quality, drives the premium mattress preference in this region. Further, Kanto is an area which has many companies of home and international brands of mattress, with retail outlets and showrooms located in numerous places. The region's affluent population is also more inclined to invest in high-tech and luxury mattresses, further boosting market growth. As Japan’s economic center, the Kanto region remains a key driver for mattress sales and innovations.

Competitive Landscape:

The Japan mattress market is highly competitive, featuring a mix of domestic and international players. Prominent local brands dominate with their deep market understanding and focus on traditional as well as modern designs. International brands are emerging as leaders in the market, offering premium, technology-based mattresses. Companies are increasingly relying on innovation, such as materials that are eco-friendly and smart technologies, to be different from others. Expansion of e-commerce platforms increased market accessibility, thus upping the competition. Moreover, agreements with hotels and healthcare facilities increase brand presence. With the increasing demand for ergonomic and customized solutions, players have been investing in R&D and marketing strategies to solidify their position in the market.

The report provides a comprehensive analysis of the competitive landscape in the Japan mattress market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2023, Paramount Bed Co., Ltd., Mitsui Chemicals, Inc., and Rever Corporation announced that their initiative for chemical recycling of polyurethane in mattresses has been selected by Japan’s Ministry of the Environment (MOE) for the FY2023 Project to Encourage Decarbonized Circular Economy Systems. The project, part of a call for submissions, will focus on developing plastic recycling processes and reducing CO2 emissions through sustainable mattress recycling practices.

- In June 2024, Koala Sleep Japan KK won the Retail Product of the Year - Japan category at the Retail Asia Awards 2024 for its MIRAIKUSTOM Bed Frame. Known for its FSC-certified wood and three adjustable leg heights, it has become the highest-rated product in the company’s lineup. The innovative design allows seamless installation of two bed frames and storage of unused components within the frame, making it a popular choice on its e-commerce platform.

Japan Mattress Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Others |

| Distribution Channels Covered | Online Distribution, Offline Distribution |

| Sizes Covered | Twin or Single Size, Twin XL Size, Full or Double Size, Queen Size, King Size Mattress, Others |

| Applications Covered | Domestic, Commercial |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan mattress market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan mattress market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan mattress industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A mattress is a rectangular, cushioned structure designed to support the body during sleep. Typically placed on a bed frame, it comprises materials like foam, springs, latex, or fibers, offering comfort and spinal alignment. Mattresses vary in firmness, size, and features, catering to diverse health, comfort, and lifestyle preferences.

The Japan mattress market was valued at USD 1.27 Billion in 2024.

IMARC estimates the Japan mattress market to exhibit a CAGR of 4.5% during 2025-2033.

Key factors driving the Japan mattress market include rising health awareness, increasing demand for quality sleep solutions, and a growing aging population requiring orthopedic support. Technological advancements like smart mattresses and customization trends also fuel growth, alongside consumer preferences for eco-friendly and sustainable materials, aligning with Japan's focus on wellness and innovation.

In 2024, innerspring mattresses represented the largest segment by product, driven by their affordability, durability, comfort, and widespread availability, appealing to a broad consumer base.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)