Japan Major Home Appliances Market Report by Product (Refrigerators, Freezers, Dishwashers, Washing Machines, Cookers and Ovens, and Others), Distribution Channel (Multi-brand Stores, Exclusive Stores, Online, and Others), and Region 2026-2034

Japan Major Home Appliances Market Size:

Japan major home appliances market size reached USD 29,343.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 34,099.4 Million by 2034, exhibiting a growth rate (CAGR) of 1.68% during 2026-2034. The market is driven by technological innovations, rising popularity of energy-efficient products, high demand for smart home devices, growing aging population that escalates the need for user-friendly appliances, and environmental regulations that encourage the adoption of eco-friendly and sustainable solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 29,343.5 Million |

| Market Forecast in 2034 | USD 34,099.4 Million |

| Market Growth Rate (2026-2034) | 1.68% |

Japan Major Home Appliances Market Analysis:

- Major Market Drivers: Japan major home appliances market recent developments include advanced technological innovations and a strong consumer preference for high-quality, durable products. The country's emphasis on energy efficiency and sustainability encourages the adoption of appliances that reduce electricity consumption and environmental impact. Additionally, Japan's aging population drives demand for user-friendly, automated, and smart home appliances that enhance convenience and improve quality of life. Government incentives and policies promoting eco-friendly products also support market growth, as do rising disposable incomes and an increasing trend toward urbanization and modern living standards.

- Key Market Trends: The major trend in Japan major home appliances market includes the increasing integration of smart technology and Internet of Things (IoT) capabilities. Consumers are showing a growing preference for connected appliances that can be controlled remotely via smartphones and voice-activated assistants. Energy efficiency remains a significant trend, with manufacturers focusing on developing appliances that consume less power and adhere to stringent environmental standards. Another trend is the rise of compact and multifunctional appliances tailored to Japan's urban living spaces. Additionally, there is a noticeable shift toward premium, aesthetically pleasing appliances that complement modern interior designs are further escalating Japan major home appliances demand.

- Competitive Landscape: The competitive landscape of Japan's major home appliances market features prominent players such as Panasonic Corporation, Hitachi, Ltd., Mitsubishi Electric Corporation, Toshiba Corporation, Sharp Corporation, and Sony Corporation, among many others. These companies are renowned for their innovative product offerings, strong brand presence, and extensive distribution networks. They continuously invest in research and development to introduce cutting-edge technologies and maintain a competitive edge. Partnerships, mergers, and acquisitions are common strategies employed by these players to expand their market share and cater to the evolving consumer demands for advanced and efficient home appliances.

- Challenges and Opportunities: The Japan major home appliances market recent opportunities face challenges such as intense competition among leading brands and fluctuating raw material prices, which can impact production costs and pricing strategies. Additionally, the high cost of implementing advanced technologies poses a barrier for some manufacturers. However, these challenges also present opportunities. Companies can capitalize on the growing demand for eco-friendly and energy-efficient appliances by investing in green technologies and sustainable practices. The increasing adoption of smart home ecosystems offers vast potential for growth, as consumers seek integrated solutions for enhanced convenience and connectivity. Furthermore, expanding into emerging markets and developing innovative, cost-effective products can help companies tap into new customer segments and drive future growth.

Japan Major Home Appliances Market Trends:

Increasing Adoption of Smart Home Appliances

The adoption of smart home appliances is a significant trend in Japan's major home appliances market. Consumers are increasingly integrating Internet of Things (IoT) technologies into their homes, seeking convenience, energy efficiency, and enhanced functionality. Smart refrigerators, washing machines, and air conditioners that can be controlled remotely via smartphones are becoming popular. According to the Ministry of Internal Affairs and Communications, the penetration rate of smart home devices in Japan is projected to reach 25.8% by 2025. The tech-savvy population and the rising awareness of energy conservation drive this trend. Companies are responding by launching products with advanced features such as voice control, predictive maintenance, and energy usage monitoring, further driving the market.

Emphasis on Energy Efficiency and Eco-friendly Appliances

Energy efficiency and eco-friendly appliances are increasingly in demand in Japan, driven by stringent government regulations and consumer awareness of environmental issues. The Japanese government has set ambitious targets for reducing greenhouse gas emissions, encouraging the adoption of energy-efficient home appliances. The Ministry of Economy, Trade, and Industry (METI) reports that energy-efficient appliances have seen a significant increase in market share, with energy-efficient air conditioners accounting for 64% of total sales in 2022. Manufacturers are focusing on developing appliances that meet or exceed energy efficiency standards, incorporating features such as inverter technology and eco-friendly refrigerants. This trend aligns with environmental goals and helps consumers reduce electricity bills, making energy-efficient appliances a preferred choice. The Japan major home appliances market forecast highlights this growing preference for energy-efficient products, reflecting the positive impact of regulatory measures and consumer demand on market dynamics.

Growth in Online Retailing of Home Appliances

Online retailing of home appliances is a growing trend in Japan, driven by the convenience and extensive product range offered by e-commerce platforms. The coronavirus (COVID-19) pandemic accelerated the shift toward online shopping, with consumers preferring to purchase appliances from the comfort of their homes. According to the Ministry of Economy, Trade, and Industry (METI), the e-commerce market for household appliances grew by 15.1% in 2021. Major online retailers such as Amazon Japan and Rakuten are enhancing their product offerings and providing detailed product descriptions, customer reviews, and competitive pricing. This trend is further supported by the increasing penetration of smartphones and the internet, making online shopping more accessible. Manufacturers are also partnering with e-commerce platforms to reach a broader audience, offering exclusive online deals and promotions to attract customers.

Japan Major Home Appliances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and distribution channel.

Breakup by Product:

- Refrigerators

- Freezers

- Dishwashers

- Washing Machines

- Cookers and Ovens

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes refrigerators, freezers, dishwashers, washing machines, cookers and ovens, others.

Japan major home appliances market share is significantly driven by product categories such as refrigerators, freezers, dishwashers, washing machines, cookers and ovens, and other appliances. Refrigerators and freezers are essential in nearly every household, driven by the need for food preservation and storage efficiency. Dishwashers are gaining popularity due to their convenience and water-saving benefits, especially in urban areas with busy lifestyles. Washing machines, known for their technological advancements and energy efficiency, are staple appliances in Japanese homes. Cookers and ovens see steady demand owing to the growing interest in home cooking and baking. Additionally, other appliances, including air purifiers and vacuum cleaners, contribute to the market growth as consumers prioritize health and cleanliness. Thus, continuous innovation, energy efficiency, and rising consumer expectations for convenience is positively impacting Japan major home appliances market revenue.

Breakup by Distribution Channel:

- Multi-brand Stores

- Exclusive Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes multi-brand stores, exclusive stores, online, and others.

As per the Japan major home appliances market overview, the distribution channels, including multi-brand stores, exclusive stores, online platforms, and others, play a crucial role in driving the market. Multi-brand stores attract a wide customer base by offering a variety of brands and products under one roof, providing consumers with diverse options and competitive pricing. Exclusive stores, often representing leading brands such as Panasonic and Hitachi, draw loyal customers seeking brand-specific features and after-sales services. The growing popularity of online platforms, such as Amazon and Rakuten, offers convenience, detailed product comparisons, and attractive discounts, significantly boosting sales. Other channels, including department stores and specialty electronics shops, cater to niche markets and provide personalized customer service. Together, these distribution channels are positively driving Japan major home appliances market growth.

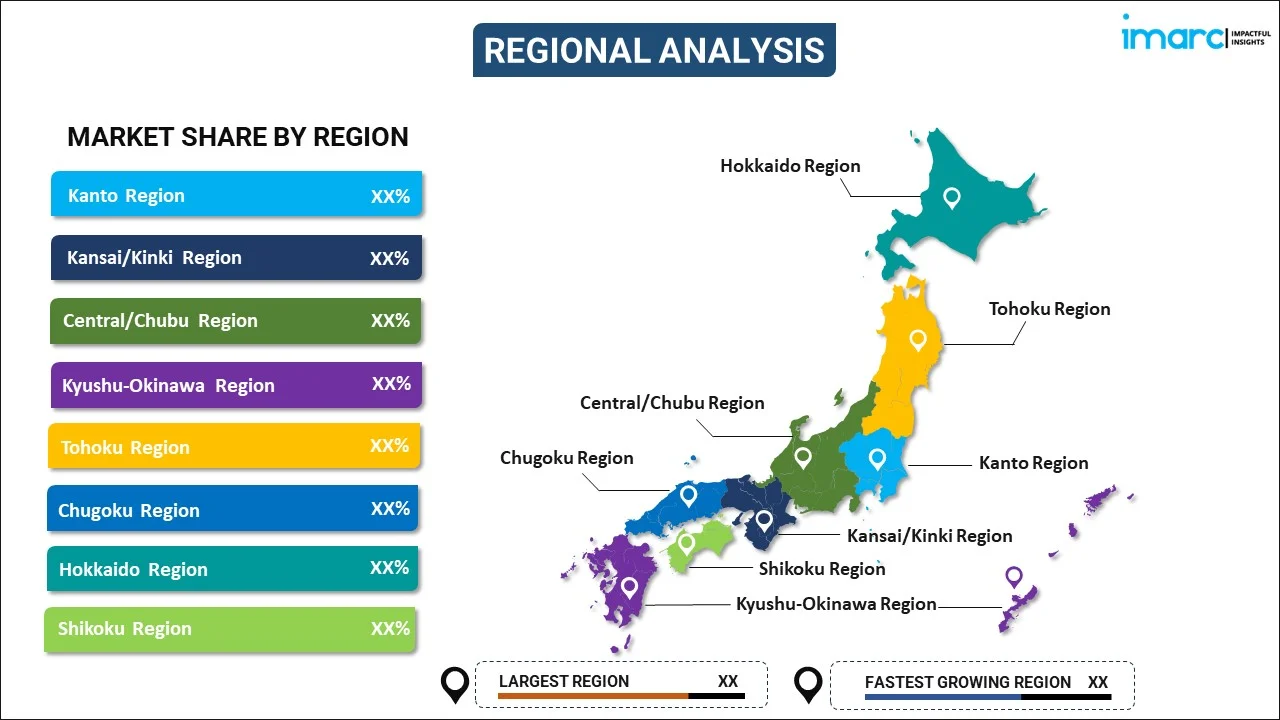

Breakup by Region:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major markets in the country, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

The regional dynamics in Japan significantly drive the major home appliances market, with each area contributing uniquely. The Kanto Region, encompassing Tokyo, leads due to its dense population and high demand for advanced, space-saving appliances. The Kansai/Kinki Region, including Osaka, also shows strong demand driven by urbanization and disposable income. Central/Chubu Region, with its industrial hubs, supports growth through robust retail networks and consumer spending. Kyushu-Okinawa Region benefits from tourism, boosting sales in accommodations and homes. Tohoku Region sees steady demand due to reconstruction efforts and modernization post-disaster. Chugoku Region's economic activities support regional growth. Hokkaido Region, with its colder climate, drives demand for heating appliances, while Shikoku Region, with a smaller population, focuses on niche markets. These regional contributions collectively enhance the diversity and resilience of the market and is creating a favorable Japan major home appliances market outlook.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- The competitive landscape of the market is dominated by Japan major home appliances companies such as Panasonic Corporation, Hitachi, Ltd., Mitsubishi Electric Corporation, Toshiba Corporation, Sharp Corporation, and Sony Corporation. These firms are known for their advanced technological innovations, strong brand loyalty, and extensive distribution networks. For instance, on April 9, 2024, Japanese electronics giant Sharp is planning a $3-4 Billion investment in setting up a Gen 10 display fab for TVs in India. Moreover, several companies continually invest in research and development to introduce cutting-edge, energy-efficient, and smart home appliances, while leveraging strategic partnerships and mergers to strengthen their market positions and meet evolving consumer demands.

Japan Major Home Appliances Market News:

- On July 16, 2024, The new head of Japanese electronics maker Sharp announces that the firm is going to put a bigger focus on major home appliances in a bid to reverse its fortunes. Okitsu plans to expand Sharp's operations in parts of Asia and elsewhere where consumers will potentially start to spend more on household appliances, and to promote products with extra value in Japan, the US and Europe.

- On April 21, 2024, Nissan Motor Co. and Panasonic Corp. launched a service in which information, such as the charging status and location of private cars, is sent to home appliances, using the internet of things (IoT), which connects various devices online. The companies aim to deepen the linkage between cars and home appliances to enhance the convenience for both companies’ products.

Japan Major Home Appliances Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Refrigerators, Freezers, Dishwashers, Washing Machines, Cookers and Ovens, Others |

| Distribution Channels Covered | Multi-brand Stores, Exclusive Stores, Online, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan major home appliances market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan major home appliances market?

- What is the breakup of the Japan major home appliances market on the basis of product?

- What is the breakup of the Japan major home appliances market on the basis of distribution channel?

- What are the various stages in the value chain of the Japan major home appliances market?

- What are the key driving factors and challenges in the Japan major home appliances market?

- What is the structure of the Japan major home appliances market, and who are the key players?

- What is the degree of competition in the Japan major home appliances market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan major home appliances market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan major home appliances market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan major home appliances industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)