Japan Insurtech Market Report by Type (Auto, Business, Health, Home, Specialty, Travel, and Others), Service (Consulting, Support and Maintenance, Managed Services), Technology (Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory, and Others), and Region 2026-2034

Market Overview:

Japan insurtech market size reached USD 573.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 7,057.4 Million by 2034, exhibiting a growth rate (CAGR) of 32.18% during 2026-2034. The widespread adoption of cybersecurity measures and consumer behavior, along with the growing inclination among individuals towards digital platforms, is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 573.2 Million |

|

Market Forecast in 2034

|

USD 7,057.4 Million |

| Market Growth Rate 2026-2034 | 32.18% |

An insurtech, short for insurance technology, constitutes a subset within the insurance sector that employs technology to revolutionize and enhance the conventional insurance paradigm. It harnesses technological breakthroughs like artificial intelligence, data analysis, and cloud computing to optimize operational efficiency, individualize insurance products, and simplify customer interactions. These companies operate by deploying digital interfaces, automation, and advanced algorithms to offer swifter insurance quotes, more precise risk evaluations, and a seamless claims handling procedure. Insurtech is dedicated to various dimensions of the insurance realm, encompassing underwriting, the management of claims, and customer engagement, thus crafting tailor-made solutions that align with specific requirements.

Japan Insurtech Market Trends:

The insurtech market in Japan is undergoing significant transformation, blending the country's rich insurance industry heritage with cutting-edge technological advancements. Japan's insurance sector, one of the world's largest, is embracing insurtech to optimize operations and enhance customer experiences. This market is characterized by innovative startups and established insurers that are leveraging technology to disrupt and improve traditional insurance practices. Several factors are driving the growth of insurtech in Japan. Firstly, the country's aging population and changing demographics necessitate innovative insurance solutions to cater to evolving healthcare and retirement needs. Insurtech companies are stepping in to fill these gaps with personalized and tech-driven insurance products. Secondly, Japan's robust regulatory environment encourages the integration of insurtech, ensuring data security and consumer protection while promoting innovation. Furthermore, the nation's high internet and smartphone penetration rates make it conducive for insurtech firms to reach and engage with customers digitally. Moreover, insurtech is optimizing various aspects of the insurance process in Japan, from underwriting and policy issuance to claims management and customer service. This, in turn, is expected to fuel the regional market in the coming years.

Japan Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This auto, business, health, home, specialty, travel, and others.

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes blockchain, cloud computing, IoT, machine learning, robo advisory, and others.

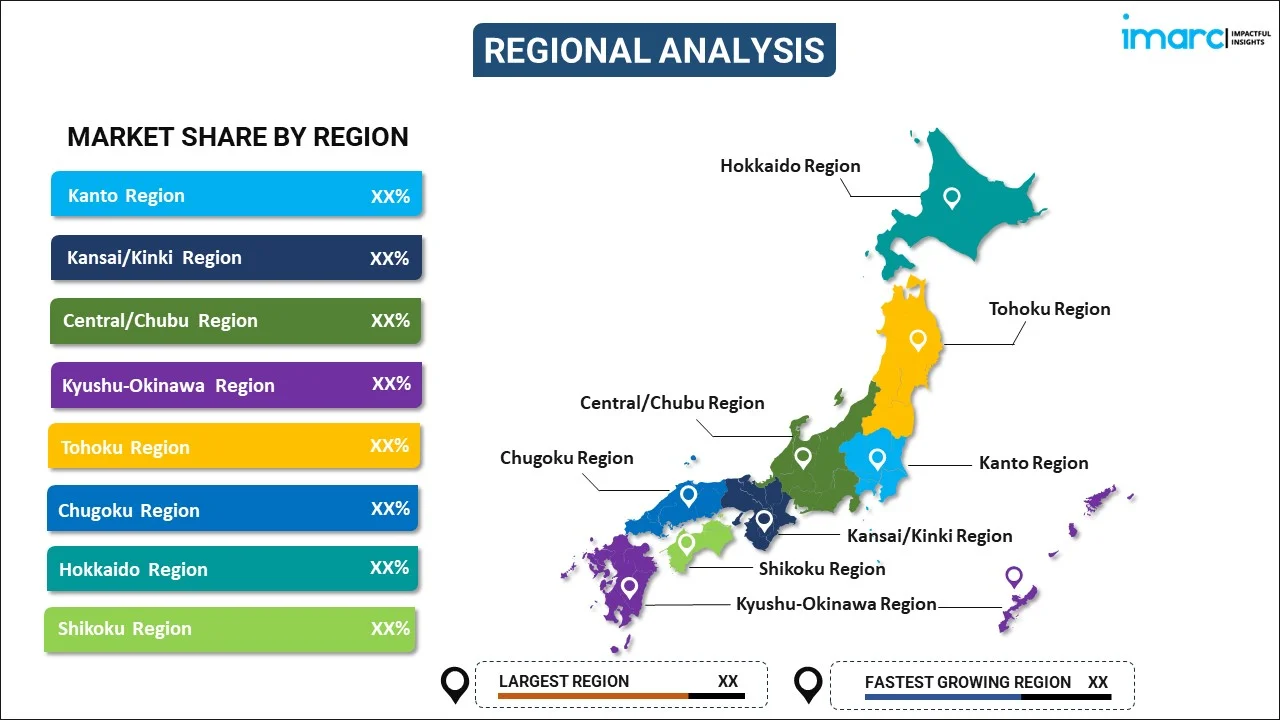

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan insurtech market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan insurtech market?

- What is the breakup of the Japan insurtech market on the basis of type?

- What is the breakup of the Japan insurtech market on the basis of service?

- What is the breakup of the Japan insurtech market on the basis of technology?

- What are the various stages in the value chain of the Japan insurtech market?

- What are the key driving factors and challenges in the Japan insurtech?

- What is the structure of the Japan insurtech market and who are the key players?

- What is the degree of competition in the Japan insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan insurtech market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)