Japan Insurance Analytics Market Report by Component (Solution, Service), Deployment Mode (On-premises, Cloud-based), Enterprise Size (Small and Medium-sized Enterprises, Large Enterprises), Application (Claims Management, Risk Management, Customer Management, Sales and Marketing, and Others), End User (Insurance Companies, Government Agencies, Third-Party Administrators, Brokers and Consultancies), and Region 2026-2034

Market Overview:

Japan insurance analytics market size reached USD 948.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,241.6 Million by 2034, exhibiting a growth rate (CAGR) of 14.63% during 2026-2034. The increasing availability of advanced analytics tools, machine learning, artificial intelligence (AI), and big data technologies, which have empowered insurers to perform more sophisticated analyses, is primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 948.6 Million |

| Market Forecast in 2034 | USD 3,241.6 Million |

| Market Growth Rate (2026-2034) | 14.63% |

Insurance analytics refers to the systematic analysis of data within the insurance industry to make informed decisions and optimize various aspects of the insurance business. It involves the use of data science, statistical modeling, and advanced technology to extract valuable insights from vast amounts of data. Insurance companies use analytics to assess risk more accurately, price policies competitively, and detect fraudulent claims. They can also improve customer experiences by personalizing offerings and enhancing claims processing efficiency. Key applications of insurance analytics include predictive modeling to forecast future losses, underwriting automation to assess policyholder risk, customer segmentation for targeted marketing, and claims analytics to streamline the claims settlement process. Additionally, analytics can aid in regulatory compliance, helping insurers adhere to industry standards and requirements. Ultimately, insurance analytics empowers insurers to make data-driven decisions that enhance profitability, customer satisfaction, and overall operational efficiency, making it a crucial tool in the modern insurance landscape.

Japan Insurance Analytics Market Trends:

The insurance analytics market in Japan is being propelled by several key drivers, which together are reshaping the industry landscape. Firstly, the growing adoption of advanced technologies such as artificial intelligence and machine learning is revolutionizing the way insurers operate. These technologies enable insurers to analyze vast datasets with precision, helping them make more informed underwriting decisions and effectively manage risks. Additionally, the rising complexity of insurance products and customer expectations for personalized services are pushing insurers to invest in analytics solutions. By leveraging data-driven insights, insurance companies can tailor their offerings to individual customer needs, improving customer satisfaction and loyalty. Moreover, regulatory compliance and risk management requirements are becoming increasingly stringent, necessitating robust analytics tools. Insurers are turning to analytics to ensure compliance and proactively identify potential risks in their operations. Furthermore, the need to combat fraudulent claims is another driving force behind the growth of insurance analytics. Advanced analytics can detect anomalies and patterns indicative of fraud, helping insurers minimize losses and maintain profitability. Lastly, the growing importance of agility and resilience in the insurance sector, which prompts a surge in interest in analytics solutions that can enhance business continuity planning and response strategies, is expected to drive the insurance analytics market in Japan.

Japan Insurance Analytics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, deployment mode, enterprise size, application, and end user.

Component Insights:

- Solution

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and service.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises.

Application Insights:

- Claims Management

- Risk Management

- Customer Management

- Sales and Marketing

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes claims management, risk management, customer management, sales and marketing, and others.

End User Insights:

- Insurance Companies

- Government Agencies

- Third-Party Administrators, Brokers and Consultancies

The report has provided a detailed breakup and analysis of the market based on end user. This includes insurance companies, government agencies, third-party administrators, brokers and consultancies.

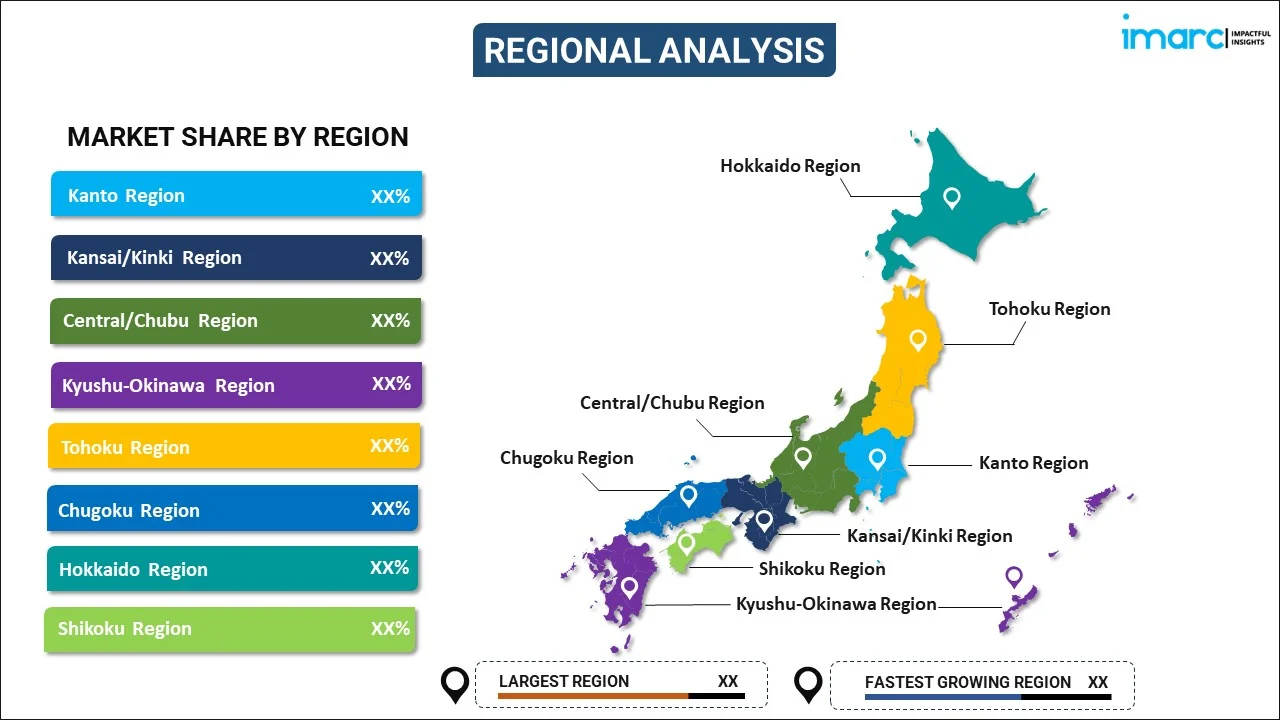

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Insurance Analytics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Service |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Claims Management, Risk Management, Customer Management, Sales and Marketing, Others |

| End Users Covered | Insurance Companies, Government Agencies, Third-Party Administrators, Brokers and Consultancies |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan insurance analytics market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan insurance analytics market?

- What is the breakup of the Japan insurance analytics market on the basis of component?

- What is the breakup of the Japan insurance analytics market on the basis of deployment mode?

- What is the breakup of the Japan insurance analytics market on the basis of enterprise size?

- What is the breakup of the Japan insurance analytics market on the basis of application?

- What is the breakup of the Japan insurance analytics market on the basis of end user?

- What are the various stages in the value chain of the Japan insurance analytics market?

- What are the key driving factors and challenges in the Japan insurance analytics?

- What is the structure of the Japan insurance analytics market and who are the key players?

- What is the degree of competition in the Japan insurance analytics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan insurance analytics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan insurance analytics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan insurance analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)