Japan Insulin Drugs Delivery Devices Market Report by Type (Drug, Device), and Region 2025-2033

Market Overview:

Japan insulin drugs delivery devices market size reached USD 2.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.75% during 2025-2033. The increasing incidences of diabetes in Japan coupled with the development of new insulin formulations and drugs that require specialized delivery devices are primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.0 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Market Growth Rate (2025-2033) | 6.75% |

Insulin drugs delivery devices are essential tools for individuals suffering from diabetes, a chronic condition characterized by impaired insulin production or utilization. These devices enable precise and convenient administration of insulin, a hormone crucial for regulating blood sugar levels. One of the most notable advancements in insulin delivery is the insulin pen, which resembles a regular pen and allows for accurate dosing with a simple push of a button. Its discreet design and portability have made it a popular choice for type 1 and type 2 diabetics. Additionally, insulin pumps offer continuous subcutaneous insulin infusion, mimicking the natural insulin release in the body. These devices provide precise control over insulin dosage and can be programmed to match an individual's unique needs. Furthermore, the development of smart insulin delivery systems, which integrate with mobile apps and continuous glucose monitors, has further improved diabetes management. These devices enable real-time tracking of blood sugar levels and automated insulin adjustments, reducing the burden of constant monitoring and decision-making for patients.

Japan Insulin Drugs Delivery Devices Market Trends:

The insulin drugs delivery devices market in Japan is poised for significant growth, primarily due to several compelling drivers. Firstly, the rising prevalence of diabetes is a pivotal factor propelling market expansion. Moreover, the increasing awareness about diabetes management and the importance of timely insulin administration among patients and healthcare providers is contributing to the market's upward trajectory. Additionally, technological advancements in insulin delivery devices, such as the development of smart insulin pens and wearable insulin pumps, are driving patient convenience and adherence. Furthermore, the growing geriatric population, who are more susceptible to diabetes, is augmenting the demand for these devices. Apart from this, the escalating obesity rates and sedentary lifestyles in Japan are fueling the incidence of type 2 diabetes, further bolstering the insulin drugs delivery devices market. Additionally, the pursuit of personalized medicine and tailored insulin therapies is fostering innovation in device design and functionality. Moreover, favorable reimbursement policies for diabetes management products, which incentivize patients to adopt advanced insulin drugs delivery devices, are expected to drive the market in Japan during the forecast period.

Japan Insulin Drugs Delivery Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Drug

- Basal or Long-Acting Insulins

- Lantus (Insulin Glargine)

- Levemir (Insulin Detemir)

- Toujeo (Insulin Glargine)

- Tresiba (Insulin Degludec)

- Basaglar (Insulin Glargine)

- Bolus or Fast-Acting Insulins

- NovoRapid/Novolog (Insulin aspart)

- Humalog (Insulin lispro)

- Apidra (Insulin glulisine)

- FIASP (Insulin aspart)

- Admelog (Insulin lispro Sanofi)

- Traditional Human Insulins

- Novolin/Mixtard/Actrapid/Insulatard

- Humulin

- Insuman

- Combination Insulins

- NovoMix (Biphasic Insulin aspart)

- Ryzodeg (Insulin degludec and Insulin aspart)

- Xultophy (Insulin degludec and Liraglutide)

- Soliqua/Suliqua (Insulin glargine and Lixisenatide)

- Biosimilar Insulins

- Insulin Glargine Biosimilars

- Human Insulin Biosimilars

- Basal or Long-Acting Insulins

- Device

- Insulin Pumps

- Insulin Pump Devices

- Insulin Pump Reservoirs

- Insulin Infusion sets

- Insulin Pens

- Cartridges in reusable pens

- Disposable insulin pens

- Insulin Syringes

- Insulin Jet Injectors

- Insulin Pumps

The report has provided a detailed breakup and analysis of the market based on the type. This includes drug [basal or long-acting insulins (lantus (insulin glargine), levemir (insulin detemir), toujeo (insulin glargine), tresiba (insulin degludec), and basaglar (insulin glargine)), bolus or fast-acting insulins (novorapid/novolog (insulin aspart), humalog (insulin lispro), apidra (insulin glulisine), fiasp (insulin aspart), and admelog (insulin lispro sanofi)), traditional human insulins (novolin/mixtard/actrapid/insulatard, humulin, and insuman), combination insulins (novomix (biphasic insulin aspart), ryzodeg (insulin degludec and insulin aspart), xultophy (insulin degludec and liraglutide), and soliqua/suliqua (insulin glargine and lixisenatide)), and biosimilar insulins (insulin glargine biosimilars and human insulin biosimilars)] and device [insulin pumps (insulin pump devices, insulin pump reservoirs, and insulin infusion sets), insulin pens (cartridges in reusable pens and disposable insulin pens), insulin syringes, and insulin jet injectors].

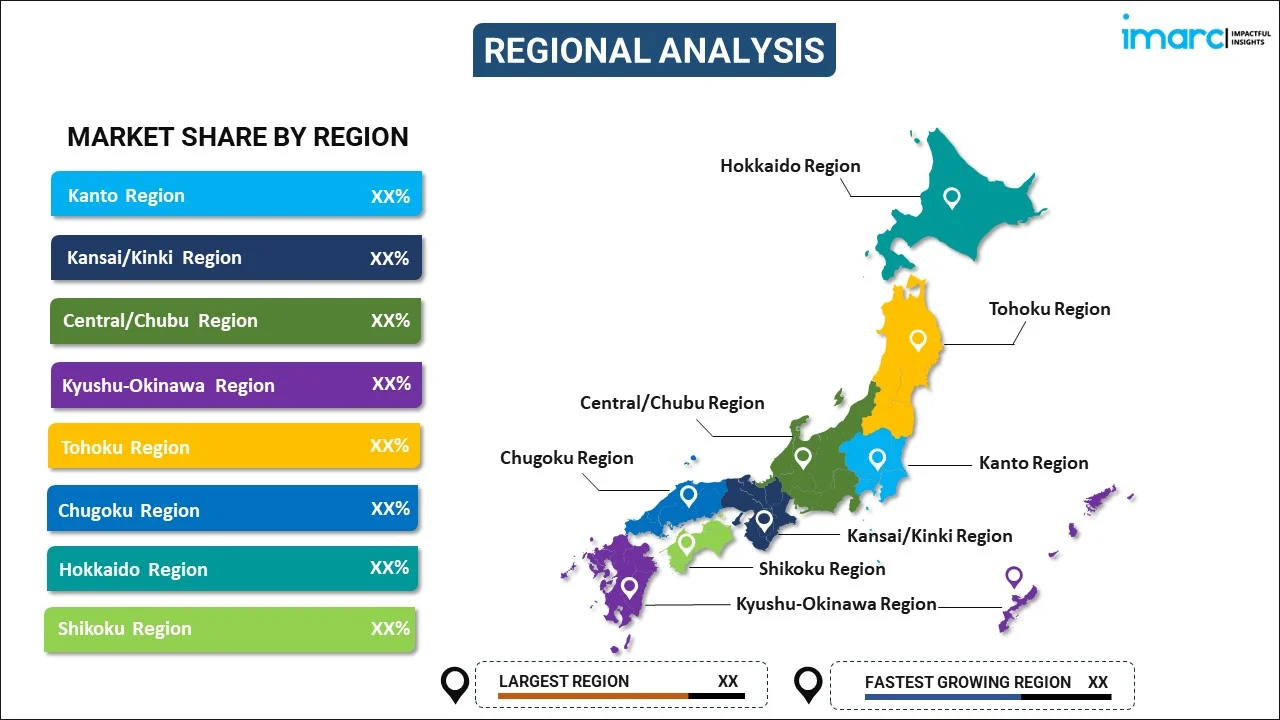

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Insulin Drugs Delivery Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan insulin drugs delivery devices market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan insulin drugs delivery devices market?

- What is the breakup of the Japan insulin drugs delivery devices market on the basis of type?

- What are the various stages in the value chain of the Japan insulin drugs delivery devices market?

- What are the key driving factors and challenges in the Japan insulin drugs delivery devices?

- What is the structure of the Japan insulin drugs delivery devices market and who are the key players?

- What is the degree of competition in the Japan insulin drugs delivery devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan insulin drugs delivery devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan insulin drugs delivery devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan insulin drugs delivery devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)