Japan Hospitality Market Report by Type (Chain Hotels, Independent Hotels), Segment (Service Apartments, Budget and Economy Hotels, Mid and Upper Mid-Scale Hotels, Luxury Hotels), and Region 2026-2034

Japan Hospitality Market Size:

Japan hospitality market size reached USD 24.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 27.7 Billion by 2034, exhibiting a growth rate (CAGR) of 1.32% during 2026-2034. The improving living standards of individuals, coupled with the increasing popularity of weekend cultures and staycations, are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 24.6 Billion |

|

Market Forecast in 2034

|

USD 27.7 Billion |

| Market Growth Rate 2026-2034 | 1.32% |

The hospitality industry is a multifaceted and dynamic sector, playing a crucial role in economies globally. It encompasses a spectrum of services, including accommodation, food and beverage, travel, tourism, and recreational activities, each focused on delivering superior customer experiences. This industry stands distinct due to its relentless commitment to customer satisfaction and its capacity to create memorable experiences. It operates in an environment marked by constant evolution, driven by shifts in consumer preferences, technological innovations, and global trends. Today, the significance of technology and sustainable practices is profoundly impacting the sector, paving the way for enhanced service delivery and responsible operations. The integration of digital solutions and green initiatives is shaping the industry's future, responding to the modern consumer's desire for convenience and eco-consciousness. Overall, the hospitality industry is a vibrant realm, harmonizing traditional values of service with contemporary advancements to meet evolving demands.

Japan Hospitality Market Trends:

Increase in Domestic Tourism

Domestic tourism has become a critical driver of the Japan hospitality industry, majorly fueled by beneficial government initiatives and the magnifying popularity of local cultural experiences. Travelers are increasingly exploring rural destinations, resulting in an elevated demand for regional accommodations, such as local resorts and traditional ryokan inns. Moreover, this trend gained traction during the pandemic as international travel restrictions stimulated an inclination towards domestic vacations. As a result, occupancy rates have substantially risen in domestic tourist spots, with customers continuing to focus on convenience, safety, and culturally immersive experiences when choosing their travel destinations. As per industry reports, the estimated number of Japanese domestic travelers is anticipated to reach 273 million in the year 2024.

Sustainability and Eco-Friendly Accommodations

The Japanese hospitality market is witnessing an escalating demand for eco-friendly and sustainable accommodations, with both global brands and local hotels adopting green practices. Hotels are increasingly deploying energy-saving technologies, minimizing plastic usage, and providing organic, locally sourced food options. Moreover, stringent government regulatory policies and heightening environmental awareness among travelers have further bolstered this trend, as customers are currently preferring accommodations with a smaller carbon footprint. In addition, this intensified emphasis on sustainability is transforming how hospitality businesses operate, making eco-conscious tactics a prime component of their competitive positioning. As per industry reports, 56% of Japanese travelers indicated a strong preference for adopting more sustainable travel practices, while 22% expressed their willingness to pay extra for certified sustainable travel experiences.

Technological Advancements in Hospitality

Technological integration in hospitality market in Japan is rapidly becoming essential, with the utilization of AI-based services, digital concierge systems, and contactless check-ins. Hotels are increasingly investing in smart technologies to enhance their customer service, upgrade operations, and improve safety post-pandemic. Moreover, customized digital experiences, virtual tours, and robot assistants are rapidly gaining momentum, especially among tech-savvy and younger travelers. For instance, in March 2024, SeRogai, a Japan-based virtual travel platform developer, launched the Tama City VR360 virtual tour event, with 95% of participants expressing heightened interest in Tama City and an increased intent to visit after experiencing the tour. In addition, this trend is supporting businesses in not only enhancing operational efficacy but also in differentiating themselves in a competitive market where innovation and convenience play a crucial role in customer decision-making.

Japan Hospitality Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on type and segment.

Breakup by Type:

- Chain Hotels

- Independent Hotels

The report has provided a detailed breakup and analysis of the market by type. This includes chain hotels and independent hotels.

Breakup by Segment:

- Service Apartments

- Budget and Economy Hotels

- Mid and Upper Mid-scale Hotels

- Luxury Hotels

A detailed breakup and analysis of the market based on the segment have also been provided in the report. This includes service apartments, budget and economy hotels, mid and upper mid-scale hotels, and luxury hotels.

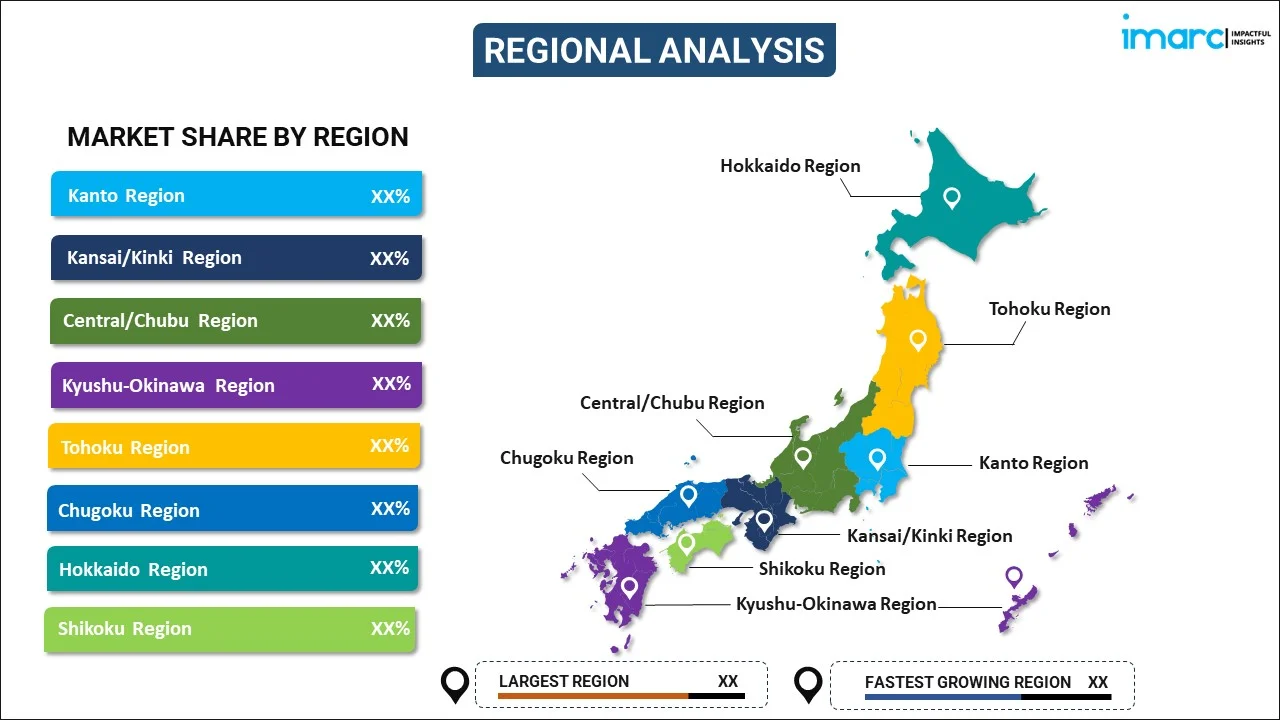

Breakup by Region:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of the Japan hospitality market by region, including Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- APA Hotels & Resorts

- JR Hotel Group

- Marriott International Inc.

- MYSTAYS Hotel Group

- Okura Nikko Hotel Management Co. Ltd.

- Prince Hotels & Resorts

- Route Inn Japan Co. Ltd.

- Super Hotel Co. Ltd.

- Tokyu Hotels & Resorts Co. Ltd.

- Toyoko Inn Co. Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Japan Hospitality Market News:

- In August 2024, NOT A HOTEL, a Japanese hospitality startup, announced a strategic expansion in the country, encompassing four new flagship properties in Rusutsu, Setouchi, Miura, and Tokyo.

- In April 2024, Six Senses, a prominent resort and hotel company, announced its launch in Kyoto, Japan, and a significant addition to its proliferating urban portfolio. This luxury Kyoto hotel includes 81 suites and guest rooms, providing sustainable practices, holistic wellness, and unique experiences to its guests.

Japan Hospitality Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chain Hotels, Independent Hotels |

| Segments Covered | Service Apartments, Budget and Economy Hotels, Mid and Upper Mid-Scale Hotels, Luxury Hotels |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | APA Hotels & Resorts, JR Hotel Group, Marriott International Inc., MYSTAYS Hotel Group, Okura Nikko Hotel Management Co. Ltd., Prince Hotels & Resorts, Route Inn Japan Co. Ltd., Super Hotel Co. Ltd., Tokyu Hotels & Resorts Co. Ltd., Toyoko Inn Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan hospitality market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan hospitality market?

- What is the breakup of the Japan hospitality market on the basis of type?

- What is the breakup of the Japan hospitality market on the basis of segment?

- What are the various stages in the value chain of the Japan hospitality market?

- What are the key driving factors and challenges in the Japan hospitality market?

- What is the structure of the Japan hospitality market and who are the key players?

- What is the degree of competition in the Japan hospitality market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan hospitality market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan hospitality market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan hospitality industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)