Japan Heavy Construction Equipment Market Report by Equipment Type (Earthmoving Equipment, Material Handling Equipment, Heavy Construction Vehicles, and Others), End User (Infrastructure, Construction, Mining, Oil and Gas, Manufacturing, and Others), and Region 2026-2034

Market Overview:

Japan heavy construction equipment market size reached USD 5.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.4 Billion by 2034, exhibiting a growth rate (CAGR) of 3.70% during 2026-2034. The market is experiencing growth due to the rise in private sector investments and the rapid expansion of the real estate sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.3 Billion |

| Market Forecast in 2034 | USD 7.4 Billion |

| Market Growth Rate (2026-2034) | 3.70% |

Access the full market insights report Request Sample

Heavy construction equipment encompasses large-scale machinery utilized for various demanding tasks and operations, including but not limited to material handling, tunnel excavation, recycling processes, waste management, and heavy lifting activities. This category of machinery comprises commonly used equipment like tippers, dumpers, motor graders, bulldozers, loaders, and excavators. These substantial machines play a pivotal role in augmenting productivity rates, minimizing the dependency on manual labor, improving overall efficiency, enhancing work speed and safety measures on a significant scale, and ultimately reducing project durations and construction expenditures. Consequently, heavy construction equipment finds widespread application in diverse industries such as mining, manufacturing, infrastructure development, construction projects, and the oil and gas sector.

Japan Heavy Construction Equipment Market Trends:

In Japan, the utilization of heavy construction equipment has seen significant growth, primarily driven by its multifaceted applications, including heavy lifting, demolition, river dredging, tree removal, and material handling tasks like asphalt, debris, dirt, and snow management. The adoption of cranes, renowned for their power, precision, and safety features in lifting heavy loads with accuracy, has emerged as a major growth driver in the Japanese market. Furthermore, technological advancements, notably the integration of machine learning (ML) and the Internet of Things (IoT), have enabled equipment optimization and enhanced operational efficiency, further fueling market growth. In addition, the implementation of driver assistance systems and real-time data tracking has streamlined processes, providing precise insights into machinery location, fuel consumption, operating hours, and maintenance needs, thereby positively influencing the market growth. These advancements are positively influencing the market landscape in Japan. In addition to this, various technological advancements, including the incorporation of machine learning (ML) and the Internet of Things (IoT) to improve equipment utilization and boost operational efficiency, are propelling market expansion. The growing demand for state-of-the-art construction equipment and government initiatives aimed at promoting residential, commercial, and infrastructural development projects are expected to continue driving market expansion in the region.

Japan Heavy Construction Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on equipment type and end user.

Equipment Type Insights:

To get detailed segment analysis of this market Request Sample

- Earthmoving Equipment

- Material Handling Equipment

- Heavy Construction Vehicles

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes earthmoving equipment, material handling equipment, heavy construction vehicles, and others.

End User Insights:

- Infrastructure

- Construction

- Mining

- Oil and Gas

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes infrastructure, construction, mining, oil and gas, manufacturing, and others.

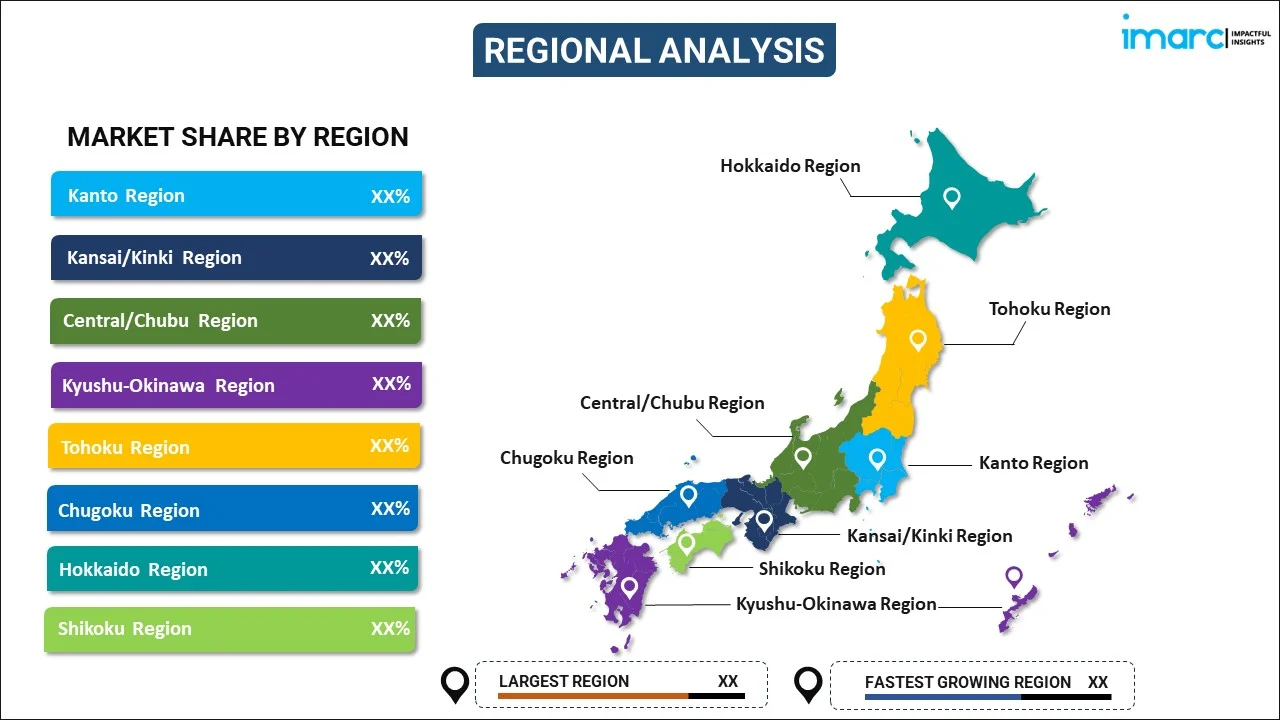

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Caterpillar Inc.

- Hitachi Construction Machinery Co. Ltd. (Hitachi Ltd.)

- Komatsu Ltd.

- Liebherr

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Japan Heavy Construction Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Equipment Types Covered | Earthmoving Equipment, Material Handling Equipment, Heavy Construction Vehicles, Others |

| End Users Covered | Infrastructure, Construction, Mining, Oil and Gas, Manufacturing, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | Caterpillar Inc., Hitachi Construction Machinery Co. Ltd. (Hitachi Ltd.), Komatsu Ltd., Liebherr, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan heavy construction equipment market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan heavy construction equipment market?

- What is the breakup of the Japan heavy construction equipment market on the basis of equipment type?

- What is the breakup of the Japan heavy construction equipment market on the basis of end user?

- What are the various stages in the value chain of the Japan heavy construction equipment market?

- What are the key driving factors and challenges in the Japan heavy construction equipment?

- What is the structure of the Japan heavy construction equipment market and who are the key players?

- What is the degree of competition in the Japan heavy construction equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan heavy construction equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan heavy construction equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan heavy construction equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)