Japan Green Hydrogen Market Size, Share, Trends and Forecast by Technology, Application, Distribution Channel, and Region, 2026-2034

Japan Green Hydrogen Market Size and Share:

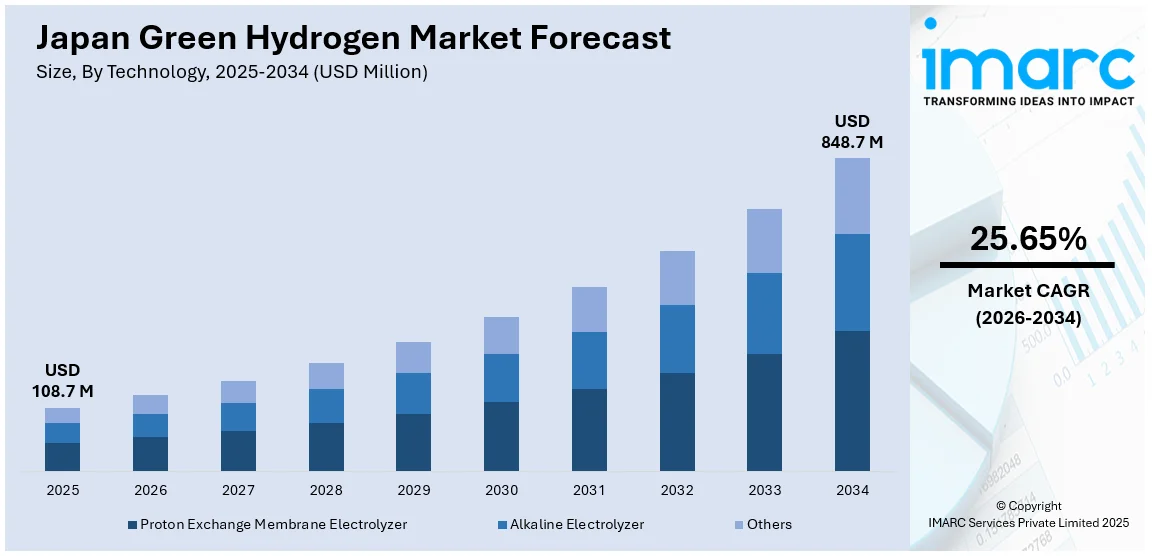

The Japan green hydrogen market size was valued at USD 108.7 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 848.7 Million by 2034, exhibiting a CAGR of 25.65% from 2026-2034. Government policies and investments in renewable energy infrastructure, technological leadership in hydrogen solutions, international collaborations, and rapid product utilization in transportation and industrial sectors supported by consumer awareness and supportive initiatives, are some of the factors propelling the Japan green hydrogen market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 108.7 Million |

| Market Forecast in 2034 | USD 848.7 Million |

| Market Growth Rate (2026-2034) |

Japan's green hydrogen market is propelled by the nation's commitment to achieving carbon neutrality by 2050. The government's policies and incentives, such as the Basic Hydrogen Strategy, have created a favorable regulatory environment for hydrogen production and utilization. Along with this, growing investments in renewable energy infrastructure, particularly solar and wind, are bolstering the availability of clean electricity required for green hydrogen generation. On 21st November 2024, ACWA Power and ITOCHU Corporation of Japan signed an MoU at COP29 in Azerbaijan with the aim of furthering renewable energy and environmental infrastructure investments globally. The partnership looks toward achieving improvements in the energy quadrilemma, especially through initiatives related to water desalination and green hydrogen. Additionally, Japan's focus on energy security drives efforts to diversify its energy mix and reduce dependency on imported fossil fuels. These factors collectively position green hydrogen as a key pillar in Japan’s transition toward a sustainable energy future.

Technological advancements and international collaborations further fuel the Japan green hydrogen market growth. Japan is a global leader in hydrogen technologies, including fuel cells and hydrogen storage systems, which facilitates the adoption of hydrogen-based solutions across industries. Partnerships with nations rich in renewable resources, such as Australia and the Middle East, ensure a stable supply of green hydrogen imports, complementing domestic production. Meanwhile, the industrial and transportation sectors are increasingly adopting hydrogen-powered solutions, influenced by growing consumer awareness and supportive government initiatives. This convergence of innovation, policy, and demand reinforces the upward trajectory of Japan's green hydrogen industry. On 16th September 2024, the Japan Hydrogen Fund launched with over USD 400 million in committed capital to establish a low-carbon hydrogen supply chain in Japan and globally. Supported by major firms such as Toyota, Iwatani, and TotalEnergies, the fund will invest in hydrogen production, storage, transport, and usage projects. This initiative aligns with Japan's Hydrogen Society Promotion Act and aims to accelerate the transition to a hydrogen-based economy.

Japan Green Hydrogen Market Trends:

Expansion of Hydrogen Refueling Infrastructure

Japan is witnessing rapid growth in its hydrogen refueling infrastructure, aligning with its vision to mainstream hydrogen-powered vehicles. Small as well as large-scale companies and government bodies are investing heavily in building hydrogen stations, aiming to make refueling convenient and accessible. This trend is supported by advances in station technology that reduce costs and improve efficiency. On 10th April 2024, the Japanese government announced that they will effectively double its hydrogen budget to ¥20.3 billion (USD133 million) in 2024, which focuses on commercial fuel cell vehicles, including heavy goods vehicles (HGVs). ¥4.2 billion (USD 27.6 Million) will be specifically reserved for subsidies to buy hydrogen-powered trucks while bridging the cost difference with diesel trucks. The additional funding will be used for the enhancement of hydrogen refueling stations for large vehicles. As the adoption of fuel cell electric vehicles (FCEVs) rises, the development of refueling networks is becoming a critical enabler, driving the transition to cleaner transportation.

To get more information on this market Request Sample

Integration of Hydrogen in Power Generation

Hydrogen’s role in power generation is emerging as one of the significant Japan green hydrogen market trends, with utilities exploring its use in grid-scale applications. Hydrogen-blended fuels in thermal power plants and hydrogen-powered turbines are being tested to replace natural gas. This trend reflects Japan's ambition to decarbonize its power sector while ensuring energy stability. On 8th August 2024, Hygenco Green Energies and Mitsubishi Power entered an MoU, which would entail collaboration in terms of green hydrogen- and ammonia-fired gas turbine combined cycle power plants in India and around the world. Hygenco develops and supplies green hydrogen and ammonia, whereas Mitsubishi Power seeks to decarbonize GTCC plants by making a shift from natural gas to green fuels. The collaboration will be facilitated and supported by the Japan International Cooperation Agency (JICA) in making sustainable energy solutions. In addition, pilot projects and demonstration plants are paving the way for commercial adoption, highlighting hydrogen's potential to complement renewable energy sources and provide reliable, low-carbon energy solutions.

Adoption of Hydrogen in Industrial Decarbonization

The industrial sector in Japan is increasingly adopting green hydrogen as a solution to reduce carbon emissions. Industries such as steel, chemicals, and cement are integrating hydrogen into their processes to replace traditional fossil fuel-based inputs. This trend is driven by both regulatory pressures to meet emissions targets and the global push for sustainable manufacturing practices. Moreover, projects focusing on hydrogen-based steel production and ammonia synthesis demonstrate the potential for large-scale industrial transformation through green hydrogen integration. Therefore, this is creating a positive Japan green hydrogen market outlook. On 14th February 2024, Nippon Steel successfully reduced CO2 emissions from its blast furnaces by 33% through hydrogen injection technology, marking a historic milestone in the quest for sustainable steel production. With ¥193.5 billion from NEDO's Green Innovation Fund, the company will be able to cut emissions by half by 2050 using advanced processes such as the Super COURSE50 technology. This achievement falls in line with Nippon Steel's Carbon Neutral Vision 2050, which focuses on achieving carbon neutrality through innovative hydrogen-based methods.

Japan Green Hydrogen Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan green hydrogen market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on technology, application, and distribution channel.

Analysis by Technology:

- Proton Exchange Membrane Electrolyzer

- Alkaline Electrolyzer

- Others

The Proton Exchange Membrane (PEM) electrolyzer segment is gaining traction in Japan's green hydrogen market due to its high efficiency and ability to operate under fluctuating renewable energy conditions. PEM electrolyzers use solid polymer electrolytes, allowing compact designs and rapid response times, ideal for applications integrated with solar and wind power. Their lower energy consumption and suitability for small- to medium-scale production make them a preferred choice in distributed hydrogen production systems, supporting Japan's push for decentralized clean energy solutions.

The alkaline electrolyzer segment is a significant contributor to the green hydrogen market in Japan, known for its established technology and cost-effectiveness. Alkaline electrolyzers use liquid alkaline solutions as electrolytes, offering robust performance and scalability for large-scale hydrogen production. These systems are well-suited for industrial applications, such as steelmaking and chemical manufacturing, which require consistent hydrogen supply. Their lower operational costs and compatibility with industrial operations make them a vital component of Japan's efforts to achieve a sustainable hydrogen economy.

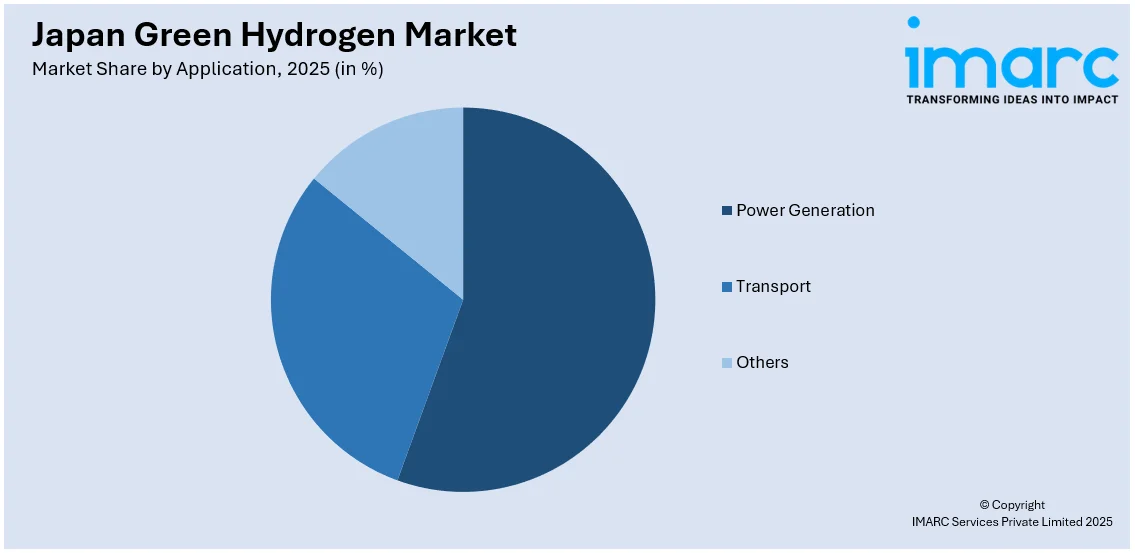

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Power Generation

- Transport

- Others

The power generation segment is a key application in Japan's green hydrogen market, driven by the country's push for a decarbonized energy system. Green hydrogen is increasingly utilized in gas turbines, fuel cells, and hydrogen-blended fuels to produce low-carbon electricity. Pilot projects for hydrogen-based power plants are paving the way for widespread adoption, ensuring grid stability and reducing dependence on fossil fuels. This segment is crucial to meeting Japan's renewable energy goals while addressing fluctuating energy demands efficiently.

The transport segment is experiencing rapid growth in Japan’s green hydrogen market, fueled by the rising adoption of fuel cell electric vehicles (FCEVs). Hydrogen-powered buses, trucks, and passenger vehicles offer zero-emission solutions, supported by expanding hydrogen refueling infrastructure. This segment aligns with Japan's strategy to decarbonize its transportation sector and reduce reliance on petroleum-based fuels. Additionally, green hydrogen is increasingly used in maritime applications and trains, solidifying its role as a versatile and sustainable energy carrier in transportation.

Analysis by Distribution Channel:

- Pipeline

- Cargo

The pipeline distribution segment plays a critical role in Japan’s green hydrogen market, providing an efficient method for transporting hydrogen from production facilities to end-users. Pipelines offer a cost-effective and reliable solution for large-scale hydrogen distribution, particularly for industrial applications and power plants. Japan is investing in dedicated hydrogen pipeline networks and retrofitting existing infrastructure to accommodate hydrogen transport. This segment supports the seamless integration of hydrogen into the energy system, reducing logistical challenges and fostering widespread adoption.

The cargo distribution segment is essential for transporting green hydrogen across regions and international markets, particularly for imports. Japan's collaborations with countries such as Australia and the Middle East rely on liquid hydrogen and ammonia transported via specialized cargo vessels. Advanced cryogenic storage technologies enable long-distance hydrogen transport, ensuring stability and efficiency. This segment addresses Japan's domestic production limitations, facilitating a steady supply for various applications, including industrial use and refueling stations, while supporting its ambition to lead the global hydrogen economy.

Regional Analysis:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region is a significant contributor to Japan's green hydrogen market, driven by its high population density and industrial activity. As the economic hub of Japan, it hosts substantial investments in renewable energy projects and hydrogen infrastructure, including refueling stations and research facilities. The region's focus on decarbonizing transportation and energy systems positions it as a leader in hydrogen adoption, further supported by government-backed initiatives and public-private partnerships.

The Kansai/Kinki region is a region that has emerged as one of the strong players in the green hydrogen market, considering the industrial base and renewable energy capabilities. It has advanced manufacturing industries and is leveraging hydrogen for industrial decarbonization and energy storage solutions. The region is also a hub for hydrogen-related innovation, with universities and companies collaborating on pilot projects. This proactive approach strengthens Kansai's position as a key driver of Japan's green hydrogen transition.

The Central/Chubu region is playing a crucial role in Japan's green hydrogen market, with its strong industrial presence and renewable energy potential. Centered around core industries such as automotive and aerospace, the region is actively bringing hydrogen into its manufacturing and energy systems. Chubu's strategic position and investment in hydrogen infrastructure - such as pipelines and production facilities - enhance the contribution of this region to the hydrogen economy in Japan. Collaboration among local governments, businesses, and researchers accelerates progress in this dynamic market segment.

The Kyushu-Okinawa region plays a critical role in Japan's green hydrogen market due to its abundant renewable energy resources, especially solar and wind. The region's commitment to decarbonization supports the development of hydrogen infrastructure, focusing on energy storage and transportation systems. Its geographical advantage also enables the establishment of export hubs for green hydrogen to neighboring countries.

The Tohoku region leverages its significant wind energy potential to contribute to Japan's green hydrogen development. It is known for ongoing investments in hydrogen production plants and focuses on creating sustainable energy solutions for industrial and residential applications. Its renewable energy projects are aligned with Japan's broader carbon-neutral goals, making it a vital player in the market.

The Chugoku region is emerging as a hub for green hydrogen innovation, driven by its focus on hydrogen production from biomass and renewable energy. With strong industrial backing, the region is advancing hydrogen storage and fuel-cell technologies. These developments aim to power local industries, reduce emissions, and support the transition to cleaner energy systems.

Hokkaido stands out in Japan's green hydrogen market due to its expansive land and significant renewable energy capacity, particularly wind power. The region is focused on producing hydrogen on a large scale to support both domestic needs and international exports. Its remote location fosters investment in advanced hydrogen storage and transportation infrastructure to overcome logistical challenges.

The Shikoku region, known for its progressive stance on renewable energy, is expanding its green hydrogen market through solar and wind energy projects. The development of hydrogen production facilities in Shikoku is enhancing local energy security and sustainability. This region also promotes hydrogen-based technologies in transportation and industry to reduce carbon footprints.

Competitive Landscape:

The competitive landscape of Japan’s green hydrogen market is characterized by active investments in technology development, strategic partnerships, and infrastructure expansion. Key players are focusing on advancing electrolyzer efficiency and scaling production facilities to meet growing Japan green hydrogen market demand. Companies are also collaborating with international suppliers to secure stable green hydrogen imports while diversifying their supply chains. Some of the other notable efforts involve expanding hydrogen refueling networks and deploying fuel cell technologies in transportation and industry. In addition, companies are innovating in the storage of hydrogen and participating in pilot projects in the large-scale applications of hydrogen in power generation and industrial decarbonization. All these strategic steps are in place to ensure market leaders emerge as pioneers for Japan's journey into a hydrogen-based, low-carbon economy.

The report provides a comprehensive analysis of the competitive landscape in the Japan green hydrogen market with detailed profiles of all major companies.

Latest News and Developments:

- September 27, 2024: ITOCHU, HIF, JFE Steel, and MOL entered into a MoU for considering the creation of a green hydrogen supply chain to produce synthetic fuel and transport CO2. The study will examine the feasibility of capturing CO2 in Japan; shipping it to Australia; and producing, storing, and exporting e-fuels from Australia. The project focuses on developing sustainable energy and reducing carbon emissions.

- June 07, 2024: The Japan Hydrogen Association (JH2A) and H2Global Stiftung signed an MOU at the Japan-EU Roundtable to strengthen financial cooperation on hydrogen initiatives. This partnership will provide affordable hydrogen to Japan, with Germany's strategic expertise being used in this regard. This is an important step toward furthering Japan-EU cooperation on clean energy.

- April 02, 2024: JGC Corporation, in collaboration with ENEOS, Sumitomo, and SEDC Energy, was granted the FEED contract for a green hydrogen and MCH production plant in Sarawak, Malaysia. The facility will produce 90,000 tons of CO2-free hydrogen annually, with renewable hydroelectric power, where MCH is used to make efficient marine transport to Japan. This initiative helps to support the transition to a decarbonized society and strengthens sustainable energy solutions.

- September 13, 2024: Mitsubishi Corporation and ExxonMobil recently signed a Project Framework Agreement with the goal of collaborating on a Baytown, Texas facility, touted to be the world's largest low-carbon hydrogen and ammonia project. Scheduled to start up in 2029, it will produce between 1 billion cubic feet per day of low-carbon hydrogen and over 1 million tons of ammonia every year, at 98% CO2 removal. Mitsubishi will employ this ammonia industrially in power generation and chemical applications for Japan.

Japan Green Hydrogen Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Proton Exchange Membrane Electrolyzer, Alkaline Electrolyzer, Others |

| Applications Covered | Power Generation, Transport, Others |

| Distribution Channels Covered | Pipeline, Cargo |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan green hydrogen market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan green hydrogen market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan green hydrogen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Japan green hydrogen market was valued at USD 108.7 Million in 2025.

The market is driven by the nation's commitment to achieving carbon neutrality by 2050, government policies supporting renewable energy, advancements in hydrogen technologies, increasing adoption in transportation and industrial sectors, and international collaborations ensuring a stable hydrogen supply.

IMARC estimates the Japan green hydrogen market to exhibit a CAGR of 25.65% during 2026-2034, reaching USD 848.7 Million by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)