Japan Fraud Detection and Prevention Market Report by Component (Solutions, Services), Application (Identity Theft, Money Laundering, Payment Fraud, and Others), Organization Size (Small and Medium Enterprises, Large Enterprises), Vertical (BFSI, Government and Defense, Healthcare, IT and Telecom, Manufacturing, Retail and E-Commerce, and Others), and Region 2026-2034

Market Overview:

Japan fraud detection and prevention market size reached USD 1.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 11.0 Billion by 2034, exhibiting a growth rate (CAGR) of 21.35% during 2026-2034. The market is being driven by several significant factors, including the growing preference among individuals for online banking services, the increasing number of e-commerce platforms, and the rising adoption of measures in educational institutions to reduce the occurrence of malware attacks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.9 Billion |

| Market Forecast in 2034 | USD 11.0 Billion |

| Market Growth Rate (2026-2034) | 21.35% |

Fraud detection entails a structured procedure for recognizing fraudulent actions, such as unauthorized financial transactions, identity theft, or deceptive practices. This method utilizes a blend of rules, analytics, and algorithms to scrutinize extensive data for irregular patterns or disparities. Conversely, fraud prevention centers on the implementation of measures aimed at halting fraudulent activities before they take place. This encompasses the deployment of security protocols, procedures, and technologies geared towards protecting sensitive information and financial resources. Combining fraud detection and prevention constitutes a formidable defense against unauthorized and potentially harmful activities.

Japan Fraud Detection and Prevention Market Trends:

The fraud detection and prevention market in Japan is experiencing remarkable growth, in line with global trends, as there is a growing recognition of the need to combat fraudulent activities across various sectors. This heightened awareness has prompted a significant number of businesses and organizations in Japan to adopt robust strategies for detecting and preventing fraud effectively. Government regulations aimed at curtailing fraudulent practices have also contributed to the expansion of this market. One of the driving forces behind this market's growth is the integration of advanced technology into fraud prevention measures. Innovations such as machine learning algorithms, artificial intelligence, and real-time data analytics have become integral tools in identifying and mitigating fraudulent activities. These technologies allow businesses to detect anomalies, unusual patterns, and suspicious transactions swiftly, enabling a proactive response to potential threats. Additionally, the Japanese market's growth is influenced by the country's evolving financial landscape and the increasing adoption of digital payment systems. With more financial transactions occurring online, the need for robust fraud detection and prevention measures has become paramount to safeguard sensitive financial information and protect against cyber threats. Overall, the growing emphasis on fraud detection and prevention in Japan signifies a commitment to financial integrity, consumer trust, and adherence to stringent regulatory standards.

Japan Fraud Detection and Prevention Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, application, organization size, and vertical.

Component Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions and services.

Application Insights:

- Identity Theft

- Money Laundering

- Payment Fraud

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes identity theft, money laundering, payment fraud, and others.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

Vertical Insights:

- BFSI

- Government and Defense

- Healthcare

- IT and Telecom

- Manufacturing

- Retail and E-Commerce

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, government and defense, healthcare, IT and telecom, manufacturing, retail and e-commerce, and others.

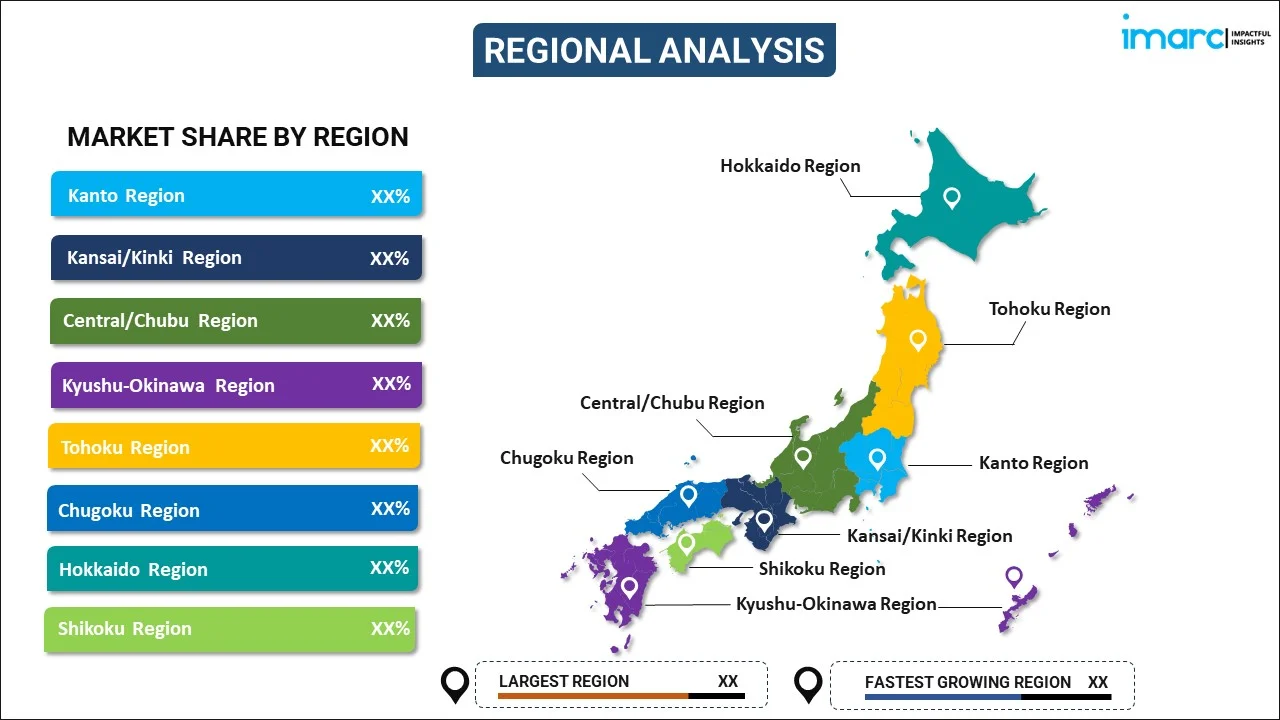

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Fraud Detection and Prevention Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Applications Covered | Identity Theft, Money Laundering, Payment Fraud, Others |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Government and Defense, Healthcare, IT and Telecom, Manufacturing, Retail and E-Commerce, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan fraud detection and prevention market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan fraud detection and prevention market?

- What is the breakup of the Japan fraud detection and prevention market on the basis of component?

- What is the breakup of the Japan fraud detection and prevention market on the basis of application?

- What is the breakup of the Japan fraud detection and prevention market on the basis of organization size?

- What is the breakup of the Japan fraud detection and prevention market on the basis of vertical?

- What are the various stages in the value chain of the Japan fraud detection and prevention market?

- What are the key driving factors and challenges in the Japan fraud detection and prevention?

- What is the structure of the Japan fraud detection and prevention market and who are the key players?

- What is the degree of competition in the Japan fraud detection and prevention market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan fraud detection and prevention market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan fraud detection and prevention market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan fraud detection and prevention industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)