Japan Food Flavor and Enhancer Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Japan Food Flavor and Enhancer Market Summary:

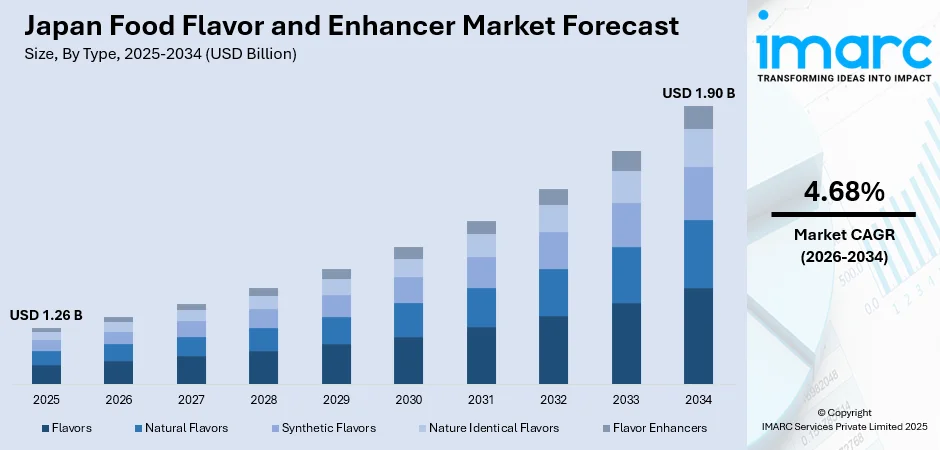

The Japan food flavor and enhancer market size was valued at USD 1.26 Billion in 2025 and is projected to reach USD 1.90 Billion by 2034, growing at a compound annual growth rate of 4.68% from 2026-2034.

The desire for convenient food products, growing health consciousness, and changing customer tastes for a variety of taste experiences are driving the Japanese food flavor and enhancer market. Stable market growth is supported by the growing demand for natural and clean-label components as well as technological developments in taste development. Japan's food flavor and market share are still being shaped by the country's traditional culinary heritage and international flavor influences.

Key Takeaways and Insights:

-

By Type: Flavors dominate the market with a share of 68% in 2025, owing to strong umami flavor preferences in Japanese cuisine, growing demand for unique and exotic taste experiences, and continuous product innovations in natural and clean-label flavor solutions meeting evolving consumer preferences.

-

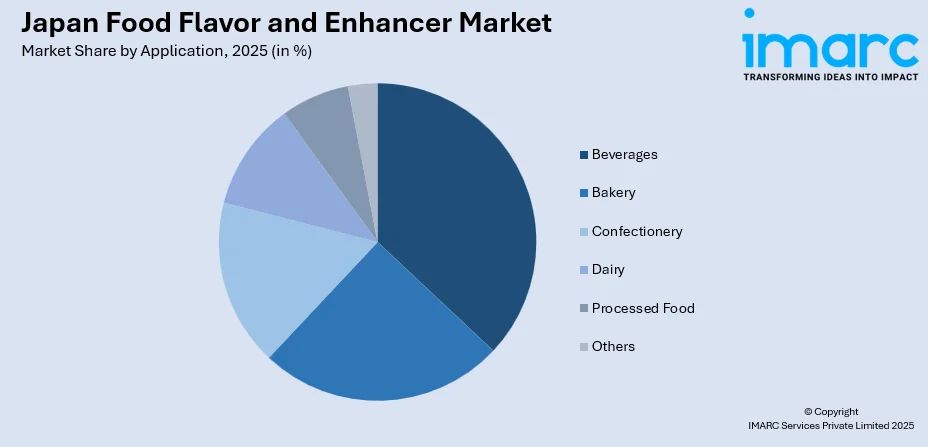

By Application: Beverages lead the market with a share of 25% in 2025. This dominance is driven by Japan's deeply ingrained beverage culture, extensive vending machine infrastructure, and consistent demand for innovative flavor profiles in soft drinks, teas, coffees, and functional beverages across diverse consumer segments.

-

By Region: Kanto Region represents the largest segment with 35% share in 2025, driven by the concentration of food and beverage manufacturing facilities, high population density in metropolitan Tokyo, presence of major corporate headquarters, and robust consumer demand for diverse flavor innovations.

-

Key Players: Key players drive the Japan food flavor and enhancer market by investing in research and development, expanding natural flavor portfolios, leveraging artificial intelligence for flavor creation, and strengthening distribution networks to meet diverse consumer preferences across food and beverage applications.

To get more information on this market Request Sample

Because of the country's sophisticated culinary traditions and changing customer preferences, the food flavor and enhancer business in Japan is still growing steadily. Manufacturers are being forced to create natural and clean-label flavor solutions as Japanese customers place a greater emphasis on health and wellness when making food decisions. The convenience food industry continues to be a major growth engine, and in order to satisfy customer demands, processed meals and ready-to-drink beverages need to have improved taste profiles. Flavor innovation in commercial applications is further supported by the growing foodservice industry and the growing demand for upscale dining experiences. Manufacturers may now provide more stable and adaptable flavor solutions because to technological developments including encapsulation techniques and artificial intelligence-powered flavor development. The market benefits from strong collaborations between domestic and international players, combining traditional Japanese flavor expertise with global innovation capabilities to address diverse consumer demands across multiple application categories. Seasonal product launches and limited-edition offerings continue driving consumer engagement throughout the year.

Japan Food Flavor and Enhancer Market Trends:

Rising Demand for Clean-Label and Natural Flavor Ingredients

Japanese consumers increasingly prioritize transparency in ingredient sourcing, driving manufacturers toward natural and clean-label flavor solutions. Health-conscious buyers seek products free from artificial additives while maintaining authentic taste experiences. This shift has accelerated innovation in plant-based flavor compounds, botanical extracts, and fermentation-derived ingredients. Major manufacturers are reformulating product lines to incorporate naturally sourced flavor enhancers, responding to consumer demand for recognizable ingredients without compromising sensory quality or product performance.

Integration of Artificial Intelligence in Flavor Development

Artificial intelligence technologies are transforming flavor creation processes across Japan's food industry. Manufacturers leverage machine learning algorithms to analyze consumer preferences, identify emerging flavor combinations, and accelerate product development cycles. These systems process vast amounts of sensory data to predict successful ingredient pairings and optimize formulations for specific target demographics. Integration of digital tools throughout the innovation pipeline enables more efficient experimentation while reducing development costs and time-to-market for new flavor formulations, strengthening competitive positioning for forward-thinking manufacturers.

Expansion of Functional Flavors for Health-Oriented Products

Functional flavors combining sensory appeal with health benefits are gaining prominence in Japan's food and beverage sector. To fulfill customer wellness priorities, manufacturers create taste systems that include probiotics, adaptogens, and immune-supporting substances. Traditional Japanese flavors like matcha, sakura, and fermented ingredients are being reimagined with functional properties. This trend aligns with Japan's aging population demographics and growing preventive health consciousness, creating opportunities for flavors that deliver both taste satisfaction and nutritional value.

Market Outlook 2026-2034:

The Japan food flavor and enhancer market outlook remains positive through the forecast period, supported by continuous innovation and evolving consumer preferences. The market generated a revenue of USD 1.26 Billion in 2025 and is projected to reach a revenue of USD 1.90 Billion by 2034, growing at a compound annual growth rate of 4.68% from 2026-2034. Growth drivers include expanding convenience food consumption, functional beverage innovation, and technological advancements in flavor encapsulation and delivery systems. Manufacturers continue investing in natural ingredient portfolios and sustainable sourcing practices to meet regulatory requirements and consumer expectations.

Japan Food Flavor and Enhancer Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Flavors | 68% |

| Application | Beverages | 25% |

| Region | Kanto Region | 35% |

Type Insights:

- Flavors

- Natural Flavors

- Synthetic Flavors

- Nature Identical Flavors

- Flavor Enhancers

Flavors dominate with a share of 68% of the total Japan food flavor and enhancer market in 2025.

The flavors segment maintains its leading position driven by Japan's rich culinary heritage and consumer demand for authentic taste experiences. Strong umami preferences deeply rooted in Japanese cuisine fuel continuous innovation in flavor formulations. Growing consumer preference for clean-label products accelerates development of natural alternatives across food and beverage applications. In order to satisfy consumer needs for transparency while maintaining conventional flavor profiles that appeal to domestic consumers looking for well-known but novel taste solutions, manufacturers are increasingly using plant-based and botanical extracts.

Natural and nature-identical flavors gain momentum as health-conscious consumers seek products with recognizable ingredients. Synthetic flavors retain significant share due to their consistency, cost-effectiveness, and ability to replicate complex taste profiles. The global appeal of Japanese flavor innovations, particularly matcha, yuzu, and sakura, supports export opportunities for domestic manufacturers expanding into international markets. Collaborations between Japanese flavor houses and global food companies continue strengthening the segment's competitive position while introducing authentic Japanese taste experiences worldwide.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bakery

- Confectionery

- Dairy

- Beverages

- Processed Food

- Others

Beverages lead with a share of 25% of the total Japan food flavor and enhancer market in 2025.

The beverages segment commands the largest application share, driven by Japan's extensive drink culture and continuous product innovation. Soft drinks, ready-to-drink teas, coffees, and functional beverages require diverse flavor profiles to meet consumer expectations. Tea-based beverages remain particularly popular among Japanese consumers seeking refreshing and health-oriented options throughout the day. Manufacturers leverage seasonal flavor launches and limited-edition releases to maintain consumer engagement and drive repeat purchases across retail and vending channels, while the widespread vending machine infrastructure supports convenient access to innovative beverage formulations nationwide.

Functional beverages represent a rapidly growing subsegment, incorporating flavors that complement health-oriented formulations. Traditional Japanese flavors including matcha, sakura, and barley tea remain popular while fusion combinations attract younger demographics seeking unique experiences. In 2024, Kirin Beverage introduced the Japan Blend and Craft Grape Tea, blending domestic tea leaves with Nagano Purple grapes using traditional artisanal techniques. Such innovations demonstrate the industry's commitment to combining heritage flavors with contemporary consumer preferences.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 35% share of the total Japan food flavor and enhancer market in 2025.

The Kanto Region maintains market leadership due to its concentration of food and beverage manufacturing facilities, corporate headquarters, and consumer demand centers. Tokyo alone hosts over 680,000 business establishments, with food and beverage processing representing a significant industrial segment. The region's dense population and high disposable income levels support premium product adoption and innovative flavor experimentation. Major convenience store chains headquartered in Kanto drive continuous flavor innovation for ready-to-eat products across nationwide distribution networks.

The presence of leading flavor manufacturers, research institutions, and food technology companies creates a robust ecosystem for ingredient development and commercialization. Kanto Region’s well-established logistics infrastructure enables efficient distribution of flavor ingredients to food processors throughout Japan, reinforcing the region's central role in supply chain operations. Additionally, the concentration of international food companies and foreign business operations in the greater Tokyo metropolitan area facilitates cross-cultural flavor development and accelerates adoption of global taste trends adapted for Japanese consumer preferences.

Market Dynamics:

Growth Drivers:

Why is the Japan Food Flavor and Enhancer Market Growing?

Expanding Convenience Food and Ready-to-Eat Product Consumption

Japan's evolving lifestyle patterns drive sustained demand for convenience foods requiring enhanced flavor profiles. Urbanization and busy work schedules increase reliance on ready-to-eat meals, packaged snacks, and grab-and-go beverages that depend on flavor technologies for consumer appeal. The convenience store sector continues expanding its prepared food offerings, requiring diverse flavor solutions to differentiate products. In 2024, sales from seven major Japanese convenience store chains reached a record high of JPY 11.8 Trillion (USD 75.5 Billion), reflecting strong consumer demand for convenient food options. Manufacturers respond by developing stable flavor systems that maintain quality through processing, storage, and reheating, ensuring consistent taste experiences across distribution channels.

Growing Health Consciousness and Demand for Natural Ingredients

Japanese consumers increasingly prioritize health and wellness in food choices, creating demand for natural and clean-label flavor ingredients. Health-conscious buyers seek products with recognizable ingredients while maintaining authentic taste experiences. This preference drives innovation in plant-based flavors, botanical extracts, and fermentation-derived ingredients that deliver both sensory satisfaction and perceived health benefits. Manufacturers invest in reformulating products with reduced artificial additives and increased natural flavor components. The functional foods sector particularly benefits from this trend, as flavor companies develop solutions that complement health-oriented formulations while ensuring palatability and consumer acceptance across diverse product categories.

Technological Advancements in Flavor Creation and Delivery Systems

Continuous technological innovation enhances flavor development capabilities and product applications across Japan's food industry. Advanced encapsulation techniques improve flavor stability, controlled release, and shelf life while protecting volatile compounds during processing. Artificial intelligence and machine learning algorithms accelerate flavor discovery by analyzing consumer preferences and identifying promising ingredient combinations. These emerging technologies enable faster prototyping and more precise flavor matching to meet specific consumer taste expectations. Spray drying, extrusion, and fluidized bed processes allow manufacturers to develop specialized delivery systems for various food and beverage applications. These technological capabilities enable manufacturers to create more sophisticated flavor profiles, reduce development timelines, and respond rapidly to emerging consumer trends while maintaining cost efficiency and production scalability. Investment in research and development facilities continues strengthening Japan's competitive position in advanced flavor technologies, supporting both domestic market growth and international export opportunities for innovative flavor solutions.

Market Restraints:

What Challenges the Japan Food Flavor and Enhancer Market is Facing?

Stringent Food Safety Regulations and Compliance Requirements

Japan's Ministry of Health, Labour and Welfare enforces rigorous food safety standards that require extensive testing and approval processes for new flavor ingredients. Compliance demands significant investment in documentation, quality assurance, and regulatory expertise. These requirements create barriers for new market entrants and can delay product launches, particularly for innovative natural ingredients requiring novel approvals.

Fluctuating Raw Material Costs and Supply Chain Vulnerabilities

Volatility in raw material prices impacts production costs and profit margins across the flavor industry. Global supply chain disruptions affect availability and pricing of key natural ingredients including botanical extracts, essential oils, and specialty compounds. Manufacturers face challenges balancing cost management with quality maintenance while meeting consumer expectations for affordable yet premium-quality flavor products.

Growing Consumer Preference for Minimally Processed Alternatives

Increasing consumer interest in whole foods and minimally processed products creates competitive pressure on flavor additives and enhancers. Health-conscious buyers question the necessity of flavor modifications in natural food products. This trend requires manufacturers to demonstrate clear value propositions and safety profiles while developing solutions that align with clean-label expectations and transparency demands.

Competitive Landscape:

The Japan food flavor and enhancer market features a competitive landscape comprising global multinational corporations and established domestic players. Major companies invest heavily in research and development to expand natural flavor portfolios and leverage advanced technologies for product innovation. Strategic partnerships between international flavor houses and local manufacturers combine global expertise with regional market knowledge. Companies differentiate through clean-label solutions, sustainable sourcing practices, and customized formulations addressing specific application requirements. The competitive environment encourages continuous innovation in flavor technologies, delivery systems, and functional ingredients to capture evolving consumer preferences.

Recent Developments:

-

In March 2025, Otsuka Pharmaceutical launched the SOYJOY Black Sesame bar, expanding its SOYJOY brand with a low-glycemic, gluten-free nutrition bar combining plant protein from soy and aromatic black sesame flavor. The product aligns with growing demand for health-conscious, convenient foods while preserving natural flavors and delivering essential nutrients.

Japan Food Flavor and Enhancer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Applications Covered | Bakery, Confectionery, Dairy, Beverages, Processed Food, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan food flavor and enhancer market size was valued at USD 1.26 Billion in 2025.

The Japan food flavor and enhancer market is expected to grow at a compound annual growth rate of 4.68% from 2026-2034 to reach USD 1.90 Billion by 2034.

Flavors dominated the market with a share of 68%, driven by strong umami preferences in Japanese cuisine, continuous innovation in natural flavor solutions, and growing consumer demand for authentic taste experiences.

Key factors driving the Japan food flavor and enhancer market include expanding convenience food consumption, growing health consciousness driving demand for natural ingredients, technological advancements in flavor creation and delivery systems, and continuous innovation in functional beverages.

Major challenges include stringent food safety regulations requiring extensive testing and approval processes, fluctuating raw material costs and supply chain vulnerabilities, growing consumer preference for minimally processed alternatives, and intense competition among established domestic and international players.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)