Japan Fintech Market Report by Deployment Mode (On-premises, Cloud-based), Technology (Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, and Others), Application (Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, and Others), End User (Banking, Insurance, Securities, and Others), and Region 2025-2033

Market Overview:

The Japan fintech market size reached USD 9.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 30.2 Billion by 2033, exhibiting a growth rate (CAGR) of 14.1% during 2025-2033. The introduction of regulations that facilitate the growth of fintech companies while maintaining financial stability, the consumer's increasing demand for convenient and efficient financial services, and continuous technological advancements represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.2 Billion |

| Market Forecast in 2033 | USD 30.2 Billion |

| Market Growth Rate (2025-2033) | 14.1% |

Fintech, short for financial technology, involves the use of modern technology to improve and innovate traditional financial services. By leveraging software and algorithms, fintech enables companies and consumers to manage financial operations more efficiently and at a lower cost. This sector has experienced significant growth and encompasses various services, including mobile banking, online investing, peer-to-peer lending, and digital payments. Through fintech, consumers can easily access financial information, execute transactions, and monitor their investments, all through digital platforms. Businesses benefit from streamlined processes and enhanced data analytics, leading to better decision-making. Regulatory technology, or RegTech, is also essential to fintech, ensuring compliance with financial laws and regulations. It has democratized financial services by making them more accessible to a broader audience and has also driven competition in the industry, leading to better products and services. Its continued evolution is expected to shape the future of the financial industry, making it more responsive, transparent, and user-friendly. While the rise of fintech has brought about several advantages, it poses challenges, such as cybersecurity concerns and regulatory issues. Nevertheless, fintech remains a transformative force in the global financial landscape, fostering innovation and facilitating financial inclusion.

Japan Fintech Market Trends:

The Japan fintech industry has witnessed robust growth, driven by the supportive regulatory framework. The Japanese government has actively embraced financial innovation, introducing regulations that facilitate the growth of fintech companies while maintaining financial stability. This encourages collaboration between traditional banks and fintech startups. Along with this, the consumer's increasing demand for convenient and efficient financial services has significantly contributed to the industry's expansion. The emergence of mobile payments, digital wallets, and online banking platforms reflects this trend, meeting the evolving needs of the tech-savvy population. In addition, investments and partnerships play an essential role in shaping the industry as well. Many financial institutions in Japan invest in or collaborate with fintech startups to enhance their technology capabilities. This cooperation promotes innovation and leads to the development of new products and services, accelerating the growth of the fintech ecosystem in the country. Moreover, technology advancements are another vital driver, with developments in artificial intelligence (AI), machine learning, blockchain, and data analytics paving the way for cutting-edge financial solutions. These technologies enable the creation of personalized services, enhance security measures, and improve efficiency, thus appealing to both consumers and businesses. Apart from this, the Japanese government's push towards a cashless society, particularly in preparation for global events like the Olympics, has fueled the adoption of digital payments. Initiatives such as offering tax incentives for cashless transactions have helped in promoting this transition. In confluence with this, the globalization of the Japanese economy has also necessitated more sophisticated cross-border financial solutions, creating opportunities for fintech companies specializing in international payments and remittances.

Japan Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan fintech market report, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes banking, insurance, securities, and others.

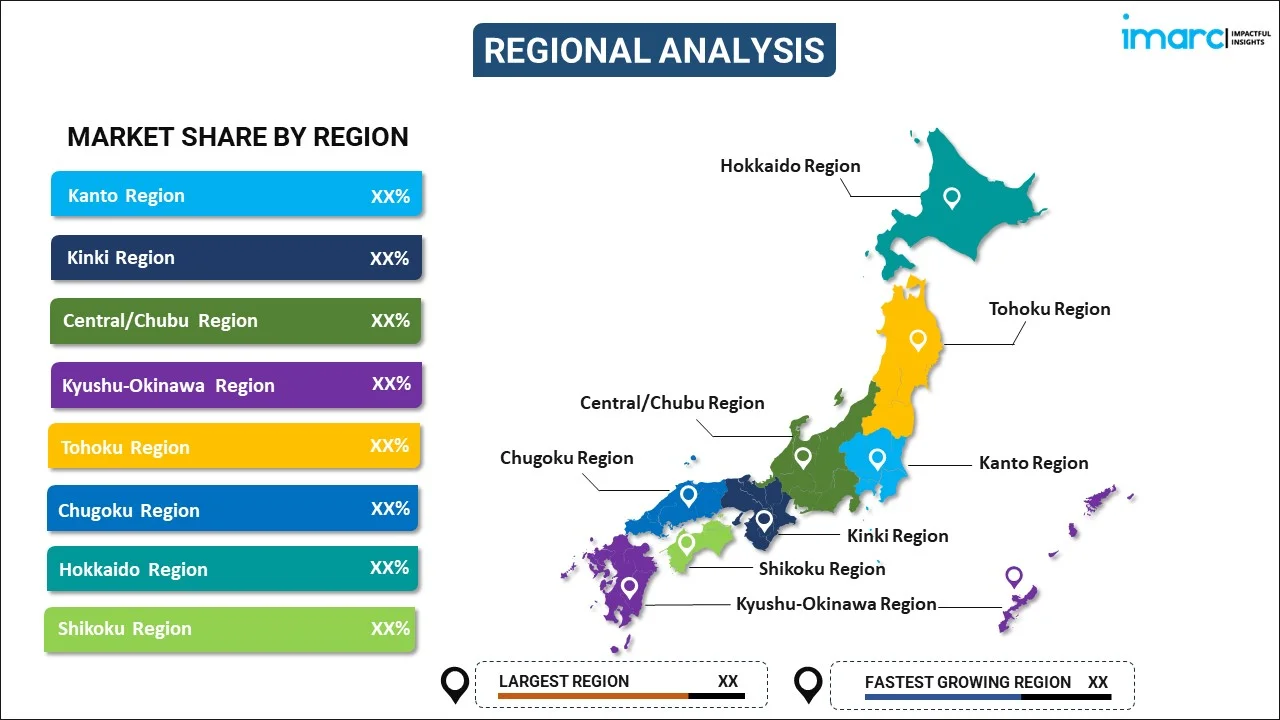

Regional Insights:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Fintech Market News:

- June 2025: Nomupay, the prominent Irish Fintech startup, secured €35 Million to grow and penetrate the Japanese market. It sought to address the challenge of payment fragmentation by consolidating numerous local payment options, including bank transfers and wallets, into one cohesive API. Nomupay delivered centralized management for payment transactions, whether conducted online or offline, and directly or via partners, while maintaining the local experiences that customers anticipated.

- April 2025: The Japan Fintech Festival's website was announced to be running live, providing a preview of the agenda, first speakers, and the start of registration. Renowned professionals from various sectors, including government representatives, industry veterans, scholars, and influential thinkers, were expected to take part in the festival, offering perspectives that would influence the future of Fintech.

- March 2025: Fin Capital, the well-known asset management firm focused on B2B Fintech, revealed that it would create a formal presence in Asia by opening an office in Tokyo, which would serve as its Asia headquarters. The firm intended to recruit a team in Tokyo that would interact with corporate partners and assist in market entry for Fin’s worldwide collection of Fintech firms.

- February 2025: The Tokyo Metropolitan Government and the Financial Services Agency (FSA) announced that they would co-host the ‘Japan Fintech Week 2025 Opening Party.’ The main events spanned from March 3 to March 7. The event would include the Tokyo Financial Award 2024 ceremony, honoring exceptional achievements in financial innovation and sustainability. Japan Fintech Week 2025 aimed to highlight Japan’s fintech sector internationally, encouraging business ventures for enhanced industry expansion.

- January 2025: Nuvei, a Canadian fintech firm, expanded its presence in the Asia-Pacific area by purchasing Paywiser Japan Limited and obtaining an acquiring license from Japan's Ministry of Economy, Trade and Industry. This strategic initiative allowed Nuvei to introduce direct acquiring functions in Japan, enabling it to handle payments directly through all major card networks and link with significant alternative payment options in the region.

- November 2024: Checkout.com, the leading fintech firm, revealed its growth into the Japanese market. This tactical initiative involved introducing direct acquiring features and setting up a new office in Tokyo, strengthening Checkout.com’s footprint in Asia. Sasaki would spearhead the company's initiatives to provide localized payment solutions customized for the requirements of both domestic and international companies functioning within the nation.

Japan Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan fintech market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fintech market in Japan was valued at USD 9.2 Billion in 2024.

The Japan fintech market is projected to exhibit a CAGR of 14.1% during 2025-2033, reaching a value of USD 30.2 Billion by 2033.

As cashless transactions are becoming more common, fintech solutions, such as mobile wallets, digital payments, and online banking, are gaining popularity among both individuals and businesses. Japan's aging population and younger tech-savvy generation is driving the demand for accessible, convenient, and user-friendly financial services. Traditional banks are also partnering with fintech startups to modernize their offerings and improve customer experience through blockchain and data analytics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)