Japan Electric Car Market Size, Share, Trends and Forecast by Type, Vehicle Class, Vehicle Drive Type, and Region, 2025-2033

Japan Electric Car Market Size and Share:

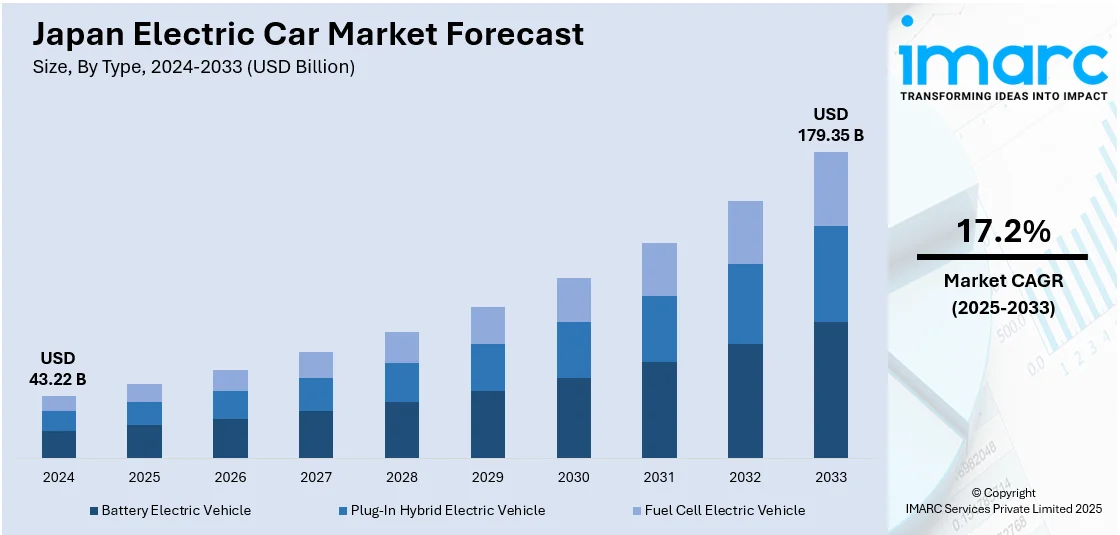

The Japan electric car market size was valued at USD 43.22 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 179.35 Billion by 2033, exhibiting a CAGR of 17.2% from 2025-2033. Government incentives, environmental awareness, and urbanization drive the market. Supportive policies like subsidies and tax breaks encourage EV adoption. The growing demand for eco-friendly transportation, along with advancements in battery technology and expanding charging infrastructure, further enhances the Japan electric car market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 43.22 Billion |

| Market Forecast in 2033 | USD 179.35 Billion |

| Market Growth Rate (2025-2033) | 17.2% |

policies play a pivotal role in driving market expansion. Japan’s government has set ambitious targets for reducing carbon emissions and promoting green technologies. Financial incentives such as subsidies, tax exemptions, and rebates for electric vehicle (EV) purchases have made electric cars more affordable for consumers. Additionally, Japan’s carbon neutrality goal by 2050 and the government’s plans to electrify the country’s transportation sector further fuel the market. According to industry reports, by 2035, the Japanese government wants all new light-duty vehicle (LDV) sales to be electric (EVs), and by FY 2030, CO2 emissions must be 46% lower than in FY2013. Moreover, urbanization and lifestyle changes, especially in metropolitan areas like Tokyo, have made electric cars more appealing. With dense populations and heavy traffic, EVs offer reduced operating costs, such as lower fuel and maintenance costs, making them ideal for city dwellers.

The increasing environmental awareness among Japanese consumers represent one of the key Japan electric car market trends. The public’s growing concern over air pollution, greenhouse gas emissions, and climate change has led to a shift toward more sustainable transportation options. Being eco-friendly with zero tailpipe emissions, electric vehicles are an attractive alternative to traditional internal combustion engine (ICE) vehicles. For instance, in October 2024, Nissan declared that in 2026, it will introduce reasonably priced bi-directional charging for a limited number of electric cars. The project advances Nissan's dedication to The Arc, its business plan, which calls for delivering unique ideas that facilitate the transition to electric vehicles while opening new revenue streams. Additionally, it advances Ambition 2030, the company's long-term goal to make the world safer, cleaner, and more inclusive. Furthermore, technological advancements in battery technology and energy efficiency are also key contributors to the Japan electric car market growth.

Japan Electric Car Market Trends:

Government Policies and Incentives

The Japanese government is actively promoting the adoption of electric cars (EVs) through subsidies, tax benefits, and environmental regulations. Policies like phasing out gas-powered vehicles by 2035 and offering incentives for EV purchases encourage consumer adoption. These measures align with Japan’s carbon neutrality goals and the international push for greener transportation solutions. Additionally, the government supports infrastructure development, including charging stations, to address range anxiety and increase convenience for EV users. Such initiatives create a favorable environment for manufacturers and consumers, driving the overall growth of the EV market in Japan. For instance, in September 2024, the Japanese government announced JPY 55.7 billion (USD 391.36 million) to fund Nissan Motor Co. Ltd.'s electric vehicle (EV) battery research strategy. Financial grants will be the form of state assistance.

Significant Technological Advancements

Technological innovation plays a significant role in the growth of the Japan electric car market. Advances in battery efficiency, charging technologies, and vehicle-to-grid (V2G) systems are making EVs more practical and appealing. Japanese automakers, such as Nissan and Toyota, are pioneers in hybrid and electric vehicle technology, continually launching innovative and affordable models. Bi-directional charging and energy-efficient designs further enhance the appeal of EVs. These advancements also lower operational costs and improve vehicle range, addressing consumer concerns and creating a positive Japan electric car market outlook. For instance, in November 2024, Honda Motor Co., Ltd. introduced the all-solid-state battery demonstration manufacturing line, which is being developed separately by Honda in preparation for mass production. The line was built in Sakura City, Tochigi Prefecture, Japan, on the grounds of Honda R&D Co., Ltd. (Sakura).

Rising Environmental Awareness

Consumers in Japan are increasingly conscious of environmental sustainability. Concerns about air pollution and global warming are driving a preference for zero-emission vehicles. Electric cars, which produce significantly less pollution than traditional internal combustion engines, are considered an eco-friendly alternative. Public awareness campaigns and corporate responsibility initiatives also highlight the environmental benefits of EVs, fostering their acceptance. This cultural shift supports the growing demand for electric vehicles in urban and rural regions. According to industry reports, In Japan, the automotive industry is responsible for approximately sixteen percent of all CO2 emissions. Achieving the target of net-zero GHG emissions by 2050 requires the promotion and widespread use of clean energy vehicles. By 2035, all new passenger car sales in Japan are expected to be electric. The nation has been providing CEV subsidies to encourage the new purchase of clean energy vehicles to reach this aim.

Japan Electric Car Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan electric car market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, vehicle class, and vehicle drive type.

Analysis by Type:

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle

Battery electric vehicles (BEVs) hold the biggest market share for electric cars in Japan because they emit no pollutants and help support Japan’s environmental goals to become a carbon-neutral country by 2050. The general efficiency of batteries has increased drive range and shortened charging time for BEVs, thus making them more reasonable. The government eagerly provides subsidies and tax preferences for BEV to stimulate auto industry sales. They also have a wide charging infrastructure and consumer awareness regarding the environment is also growing at an unprecedented rate. Nissan and Toyota act as the two leading companies in Japan’s electric car industry as they work to develop their BEV line-ups to meet consumer demand.

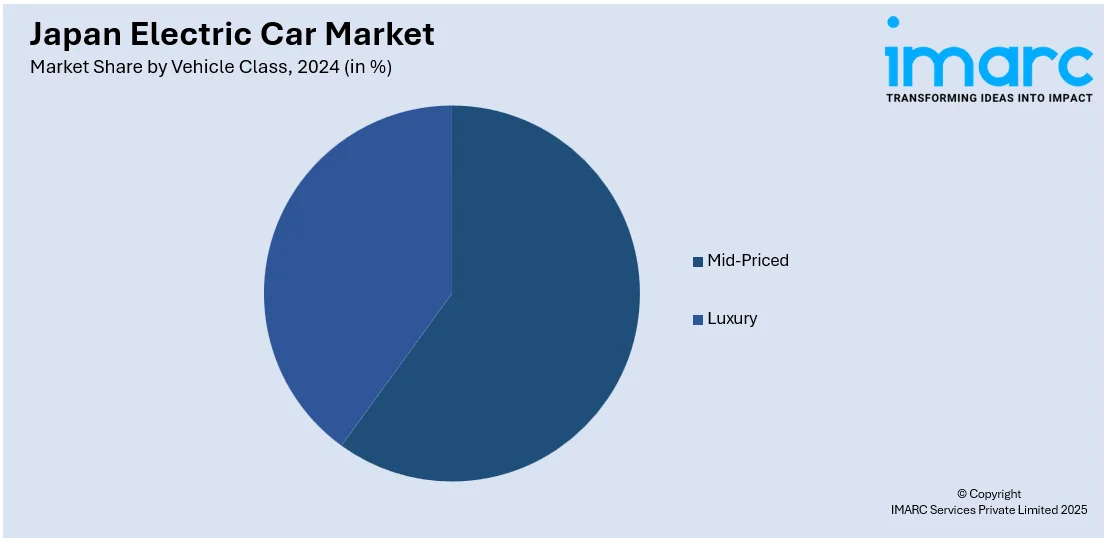

Analysis by Vehicle Class:

- Mid-Priced

- Luxury

The mid-price range of electric vehicles represents the highest market share of electric cars in Japan due to their relative cost, available power, and technological advancement. These vehicles are suited to a broad cross-section of consumers who want a green alternative to regular cars but are not ready to buy premium cars. The need for cost-effective electric vehicles (EVs) has been prompted by incentives from governments across the world in terms of subsidies. Furthermore, rising innovations in battery technology, the vehicle driving range, and charging infrastructure make proper high-performing mid-priced electric cars offer competitiveness with luxurious models but with low initial cost rates.

Analysis by Vehicle Drive Type:

- Front Wheel Drive

- Rear Wheel Drive

- All-Wheel Drive

Front-wheel drive (FWD) represents the biggest market share because of several aspects. FWD systems are relatively inexpensive to manufacture and require minimal upkeep cost, which is a major concern for producers and consumers. Moreover, FWD vehicles are generally more fuel-efficient, which is important to the Japanese due to their specific orientation toward small and efficient vehicles. FWD also has a better grip on slippery surfaces, making it suitable for Japan’s volatile climate. Furthermore, the design flexibility of FWD allows for more interior space, enhancing comfort in compact EVs.

Regional Analysis:

- Kanto

- Kinki

- Central/Chubu

- Kyushu-Okinawa

- Tohoku

- Chugoku

- Hokkaido

- Shikoku

The Kanto region holds the highest market share because of its favoring government policies such as subsidies and tax rebates for EV adoption. A high number of people in the region use electric vehicles and due to environmental-friendly policies, people embrace electric cars. Regarding convenience for EVs, Kanto has a well-established charging infrastructure. Moreover, raising awareness regarding air pollution and Japan’s promise to minimize carbon emissions is another factor that stimulates the demand for electric cars. The availability of mid-priced electric vehicles and advances in battery technology also creates a positive Japan electric car market outlook.

Competitive Landscape:

The Japan electric car market is gradually growing and competitive due to impactful manufacturers such as Toyota, Nissan and Honda that offer advanced electric technologies and models. There is still strong demand for Nissan’s LEAF which is an early entrant into the segment as Toyota concentrates on hybrid and electric choices. Honda is also diversifying its EV portfolio to fit emerging market demands. Local companies are competing with foreign players such as Tesla and BYD. Innovations take place as an effort to maximize battery energy, distance per charge, and charging time. The push for hydrogen fuel cell vehicles, supported by government initiatives, adds another competitive layer to the market.

Latest News and Developments:

- In March 2024, Nissan debuted the Ariya NISMO at the 2024 Tokyo Auto Salon. Nissan scheduled the launch of its premium EV model, NISMO, in Japan in June.

- In June 2024, China's BYD debuted its third electric car in Japan, a sedan that will be the company's priciest model to date in a country where local brands have traditionally been preferred by consumers.

- In November 2024, Suzuki Motor Corp. and Toyota Motor Co. announced their partnership to develop a new electric SUV for international distribution. The two OEMs are working together on electric vehicles for the first time.

- In March 2024, Nissan and Honda, two Japanese automakers, declared that they will investigate a joint venture in the electric vehicle market to rival Chinese competitors. As the industry seeks collaborative development to spur innovation, the emphasis moves from hybrids to electric vehicles.

Japan Electric Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle, Fuel Cell Electric Vehicle |

| Vehicle Classes Covered | Mid-Priced, Luxury |

| Vehicle Drive Types Covered | Front Wheel Drive, Rear Wheel Drive, All-Wheel Drive |

| Regions Covered | Kanto, Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, Shikoku |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan electric car market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan electric car market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan electric car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric car market in the Japan was valued at USD 43.22 Billion in 2024.

The Japan electric car market is driven by government incentives, stringent emission regulations, and advancements in battery technology. Increasing consumer awareness of environmental sustainability, growing charging infrastructure, and the presence of major automotive manufacturers further boost market growth. Additionally, a strong focus on innovation and energy efficiency fuels electric car adoption.

The Japan electric car market is projected to exhibit a CAGR of 17.2% during 2025-2033, reaching a value of USD 179.35 Billion by 2033.

Mid-priced electric vehicles leads the market by vehicle class due to affordability, government incentives, improved technology, and a balance of performance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)