Japan Dropshipping Market Size, Share, Trends and Forecast by Product, Type, Application, and Region, 2026-2034

Japan Dropshipping Market Overview:

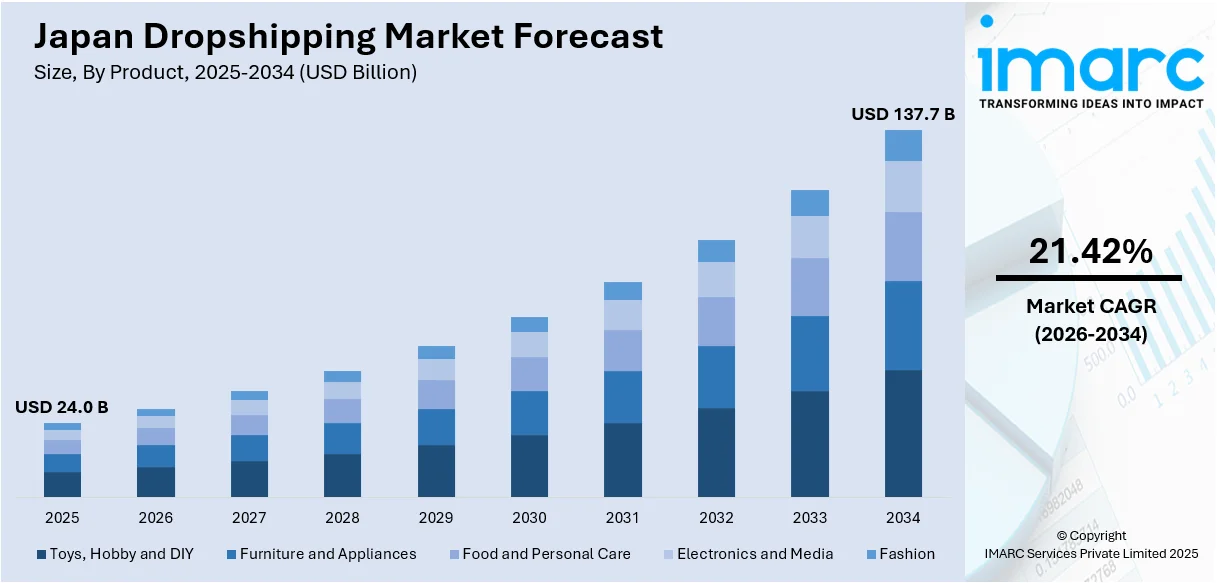

The Japan dropshipping market size reached USD 24.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 137.7 Billion by 2034, exhibiting a growth rate (CAGR) of 21.42% during 2026-2034. Rising e-commerce adoption, demand for low-capital business models, increasing smartphone usage, efficient logistics infrastructure, and growing interest in niche products are some of the factors propelling the growth of the market. Social media marketing and integration with global platforms like Shopify also support market expansion and entrepreneurial growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 24.0 Billion |

| Market Forecast in 2034 | USD 137.7 Billion |

| Market Growth Rate 2026-2034 | 21.42% |

Japan Dropshipping Market Trends:

Accelerating E-Commerce Logistics Integration

In Japan, online selling is becoming more streamlined through backend delivery integration. The recent collaboration between logistics and digital commerce players highlights a growing push to simplify shipping workflows for sellers using established platforms. By linking storefronts directly with major delivery service providers, merchants can manage inventory, orders, and shipping within a unified system. This shift is enhancing efficiency, reducing manual errors, and enabling faster delivery times. Small and mid-sized dropshipping businesses, in particular, benefit from the automated coordination between sales and logistics, helping them scale without needing extensive infrastructure. As backend systems become more connected, operational friction decreases, setting the stage for broader adoption of cross-platform selling and delivery models tailored to Japan’s domestic and international shipping requirements. For example, in April 2024, Mitsui & Co., Ltd. partnered with Shopify Japan and Yamato Transport Co., Ltd. to support the digital transformation of logistics for online stores built with Shopify, integrating data with Japan's major delivery companies.

To get more information on this market Request Sample

Shift toward In-House Distribution Models

Dropshipping activity in Japan is seeing a shift as global sellers reassess third-party dependencies. By setting up direct distribution channels and local offices, businesses are aiming to improve control over supply chains, customer experience, and market responsiveness. The move reflects a preference for localized operations to navigate Japan’s complex retail and logistics environment more effectively. This setup enables greater flexibility in managing inventory, pricing, and brand positioning, which is particularly valuable for dropshipping models looking to offer premium or niche products. The increased focus on self-managed distribution also aligns with growing demand for transparency and delivery reliability. As more sellers explore direct entry strategies, the support infrastructure for dropshipping in Japan is expected to become more competitive and service-focused. For instance, in April 2024, Brown-Forman Corporation launched its own distribution business in Japan, bringing distribution in-house for the first time since entering the market in the 1970s, with a new office in Tokyo.

Japan Dropshipping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product, type, and application.

Product Insights:

- Toys, Hobby and DIY

- Furniture and Appliances

- Food and Personal Care

- Electronics and Media

- Fashion

The report has provided a detailed breakup and analysis of the market based on the product. This includes toys, hobby and DIY, furniture and appliances, food and personal care, electronics and media, and fashion.

Type Insights:

- Same-Day Delivery

- Regional Parcel Carriers

- Heavy Goods Delivery

The report has provided a detailed breakup and analysis of the market based on the type. This includes one same-day delivery, regional parcel carriers, and heavy goods delivery.

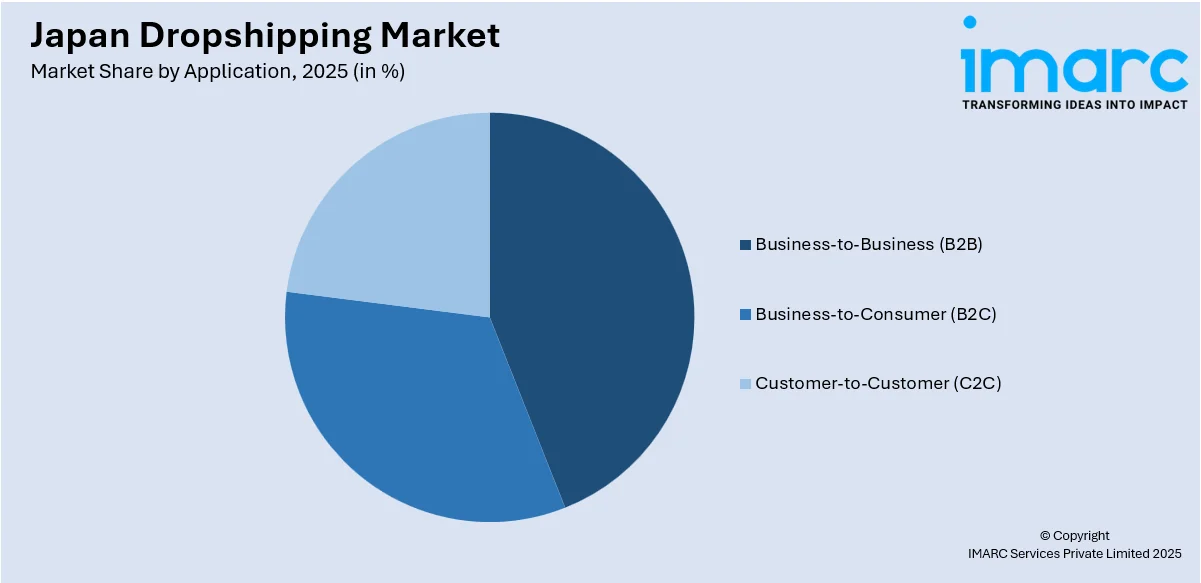

Application Insights:

Access the comprehensive market breakdown Request Sample

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Customer-to-Customer (C2C)

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes business-to-business (B2B), business-to-consumer (B2C), and customer-to-customer (C2C).

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Dropshipping Market News:

- In November 2024, Printful and Printify, both originating from Latvia, announced their merger to enhance global e-commerce services. While both companies have their roots in Latvia, Printful has expanded its operations internationally, including establishing partner facilities in Amakusa, Japan. This strategic move aims to leverage their combined strengths to offer improved services worldwide.

Japan Dropshipping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Toys, Hobby and DIY, Furniture and Appliances, Food and Personal Care, Electronics and Media, Fashion |

| Types Covered | Same-Day Delivery, Regional Parcel Carriers, Heavy Goods Delivery |

| Applications Covered | Business-to-Business (B2B), Business-to-Consumer (B2C), Customer-to-Customer (C2C) |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan dropshipping market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan dropshipping market on the basis of product?

- What is the breakup of the Japan dropshipping market on the basis of type?

- What is the breakup of the Japan dropshipping market on the basis of application?

- What are the various stages in the value chain of the Japan dropshipping market?

- What are the key driving factors and challenges in the Japan dropshipping market?

- What is the structure of the Japan dropshipping market and who are the key players?

- What is the degree of competition in the Japan dropshipping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan dropshipping market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan dropshipping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan dropshipping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)