Japan Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End Use Industry, and Region, 2025-2033

Japan Drones Market Size and Share:

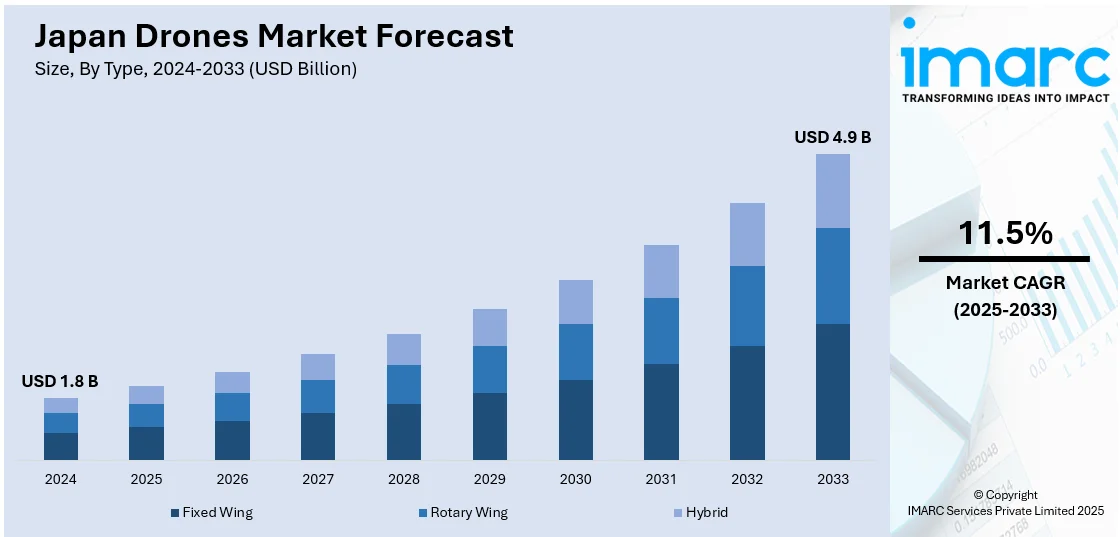

The Japan drones market size was valued at USD 1.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.9 Billion by 2033, exhibiting a CAGR of 11.5% from 2025-2033. The escalating advancements in AI and automation, coupled with expanding industrial applications, are majorly driving the market growth. Moreover, key sectors, such as agriculture, logistics, and infrastructure, contribute significantly to Japan drones market share, with government support and regulatory reforms fostering innovation and accelerating adoption across diverse industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Market Growth Rate (2025-2033) | 11.5% |

The drones market in Japan is driven by rapid technological advancements in artificial intelligence, imaging systems, and autonomous navigation. These advancements enable drones to carry out complex operations like precision farming, infrastructure monitoring, and emergency management with greater effectiveness and precision. Drones equipped with real-time data analysis and machine learning capabilities are increasingly preferred across industries for their ability to optimize operations and reduce costs. For instance, in November 2024, Japan Airlines, NEDO, and KDDI successfully demonstrated a single pilot managing five drones across four sites, utilizing advanced systems for real-time monitoring, intervention, and safe multi-drone operations under diverse conditions. Furthermore, as technology evolves, businesses in Japan are adopting drones to enhance productivity and sustainability, positioning the technology as a cornerstone of industrial modernization.

Government initiatives and regulatory support significantly contribute to Japan drones market growth. Favorable policies, including airspace reforms and subsidies for agricultural drone adoption, encourage integration across various industries. Dedicated testing zones and funding for research and development further bolster the ecosystem. For instance, in December 2024, ITOCHU Corporation and Wingcopter tested drone-based blood transport in Okinawa, covering 53 km in 32 minutes. The project aims to improve delivery efficiency and disaster preparedness across remote islands. These measures not only ensure operational safety but also stimulate innovation and collaboration between public and private sectors. By fostering a supportive framework, the Japanese government addresses key challenges such as labor shortages and accessibility, enabling widespread adoption and sustaining the upward trajectory of the drone’s market.

Japan Drones Market Trends:

Advancements in Precision Agriculture

Drones are transforming Japan’s agriculture sector, enabling precision farming techniques. Equipped with AI and advanced imaging sensors, they optimize crop monitoring, irrigation, and pesticide application, enhancing productivity while reducing costs. For instance, according to industry reports, NTT E-Drone Technology will launch the "AC101 Connect" agricultural drone in spring 2024, featuring advanced precision spraying, enhanced navigation, and crop-specific fertilization integration with BASF Digital Farming's platform. These innovations address labor shortages due to the aging workforce and declining farm populations. Moreover, government support, including subsidies for drone adoption, accelerates this trend, ensuring modern, sustainable farming practices. As the demand for efficient agricultural methods grows, drones are becoming indispensable tools in Japan’s efforts to maintain food security and boost the sector’s overall efficiency.

Infrastructure and Construction Applications

The adoption of drones in infrastructure and construction is growing steadily across Japan. Drones streamline inspections for bridges, tunnels, and roads, offering precise data collection and minimizing human risk in hazardous areas. They also support construction site surveys and progress monitoring, significantly reducing project costs and timelines. As Japan's infrastructure continues to age and demands regular upkeep, drones are becoming indispensable for enhancing both safety and operational efficiency. For instance, in October 2024, Yokogawa Electric partnered with Sensyn Robotics to integrate Sensyn Core and OpreX Robot Management Core, providing advanced drone and robot solutions for safer, autonomous inspections of industrial facilities and infrastructure. In addition, their integration aligns with the country’s push toward innovative technologies, making infrastructure management more effective and aligned with modern sustainability goals.

Expansion of Drone Delivery Services

Drone delivery services are gaining traction in Japan, particularly in remote and underserved regions. Drones facilitate quicker and more efficient delivery of essential items, such as groceries and medical supplies, to the destination. Supported by favorable government policies and advancements in autonomous flight technology, these services aim to address logistics challenges in mountainous areas. For instance, in December 2024, the Tokyo Metropolitan Government announced and conducted BVLOS medical delivery tests using ACSL drones, showcasing autonomous technology to address traffic challenges and enhance critical medical supply delivery across the prefecture. Moreover, companies are increasingly piloting delivery networks to improve accessibility and reduce environmental impact. As Japan continues to develop smart city initiatives, drone delivery is set to play a key role in building sustainable, technology-driven logistics systems nationwide.

Japan Drones Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan drones market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, component, payload, point of sale, and end use industry.

Analysis by Type:

- Fixed Wing

- Rotary Wing

- Hybrid

Fixed-wing drones are designed like traditional airplanes, with wings providing lift, enabling them to achieve longer flight durations and cover larger distances. In Japan, these drones are widely used for applications such as surveying, agriculture, and disaster management, particularly in remote or expansive areas. Their ability to maintain efficient cruising speeds makes them ideal for mapping and monitoring operations. Nevertheless, their operation depends on runways or launch catapults for both takeoff and landing, restricting their use in densely populated or constrained areas.

Rotary-wing drones, including quadcopters and multi-rotor models, are popular in Japan's drone market due to their versatility and ease of use. These drones can hover, perform vertical takeoffs, and navigate tight spaces, making them ideal for infrastructure inspection, delivery services, and real-time surveillance. Their stability and precision in flight are particularly advantageous for urban environments and close-range operations. Despite shorter flight times and limited range compared to fixed-wing drones, their adaptability and lower cost make them a preferred choice across industries.

Hybrid drones like the fixed-wing and rotary-wing variants allow taking off and landing vertically, and at the same time, they enable long-lasting flights. This growing segment has significantly picked up momentum in Japan for purposes of enhancing various factors like logistics, emergency responses, and environmental monitoring. Hybrid drones are especially valued in scenarios requiring both range and precision, such as delivering goods to remote areas or conducting detailed inspections over vast terrains. Their advanced functionality, though often accompanied by higher costs, positions them as a promising option for specialized and evolving use cases.

Analysis by Component:

- Hardware

- Software

- Accessories

The hardware segment forms the backbone of Japan's drone market, encompassing physical components such as frames, motors, sensors, and cameras. Japanese manufacturers emphasize high-quality and reliable hardware to ensure precision and durability for various applications, including agriculture, logistics, and disaster management. Advancements in this field are being propelled by breakthroughs in lightweight materials and the adoption of energy-efficient design solutions. With the rising demand for specialized drones, hardware customization has become a critical factor, enabling drones to meet specific industry needs like payload capacity and environmental resilience.

The software segment plays a pivotal role in enhancing the functionality and efficiency of drones in Japan. It includes navigation systems, flight control algorithms, and data analysis platforms tailored for diverse applications. Japanese developers focus on integrating advanced technologies such as artificial intelligence and machine learning to enable autonomous operations, obstacle avoidance, and real-time data processing. The demand for sophisticated software solutions is growing in sectors like logistics, infrastructure inspection, and agriculture, where precise data collection and analysis are critical for decision-making.

Accessories encompass a wide range of add-ons that enhance drone performance and usability, including propellers, batteries, gimbals, and payload attachments. In Japan, the accessories segment is expanding as users seek to customize drones for specific tasks, such as thermal imaging for inspections or extended battery life for logistics. High-quality accessories are essential for ensuring operational efficiency and safety. With increasing applications in industries like delivery and surveillance, the demand for reliable and innovative accessories continues to rise, supporting the overall growth of the drone market.

Analysis by Payload:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

Drones with payloads under 25 kilograms are widely used in Japan for applications requiring agility and precision, such as aerial photography, surveying, and small-scale deliveries. These lightweight drones are favored for their ease of deployment, affordability, and compliance with Japan's strict aviation regulations. Their growing adoption in sectors like agriculture and construction reflects the increasing Japan drones market demand for versatile and efficient solutions. With advancements in miniaturized technologies, these drones continue to expand their capabilities while maintaining operational simplicity and cost-effectiveness.

Payload capacities of 25-170 kilograms cater to medium-duty operations, balancing efficiency with expanded payload needs. In Japan, these drones are commonly deployed for industrial inspections, environmental monitoring, and medium-scale logistics. Their ability to carry specialized equipment, such as LiDAR sensors or larger delivery packages, makes them ideal for a range of applications. With the government supporting drone use in infrastructure and disaster management, this segment is expected to grow as industries seek robust and reliable drone solutions for intermediate payload requirements.

Drones exceeding 170 kilograms are emerging as a key segment for heavy-duty applications in Japan, including large-scale cargo transport and infrastructure projects. These drones are designed for longer flight durations and higher payload capacities, making them suitable for delivering medical supplies to remote islands or carrying equipment for large-scale inspections. While still in the early stages of adoption, the potential for heavy-lift drones is significant, especially as advancements in battery technology and regulatory support evolve to accommodate their operational needs.

Analysis by Point of Sale:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The OEM segment represents a primary channel in the market, where manufacturers supply complete, ready-to-use drones and integrated systems. These products cater to various industries such as agriculture, logistics, surveillance, and disaster management. OEMs prioritize innovation and quality, delivering drones equipped with advanced features like autonomous navigation and high-precision sensors. By addressing specific industry needs and offering customized solutions, OEMs play a significant role in advancing drone adoption and meeting the diverse requirements of businesses and government agencies in Japan.

The aftermarket segment supports the market by providing essential services like parts replacement, system upgrades, and maintenance solutions. As drone adoption grows across industries, the need for accessories such as batteries, sensors, and enhanced cameras has increased significantly. This segment allows businesses to maintain and optimize their drone fleets, ensuring long-term performance and cost-efficiency. The aftermarket also enables users to adapt their drones for new applications, driving flexibility and continued innovation in various sectors, including infrastructure inspection, logistics, and environmental monitoring.

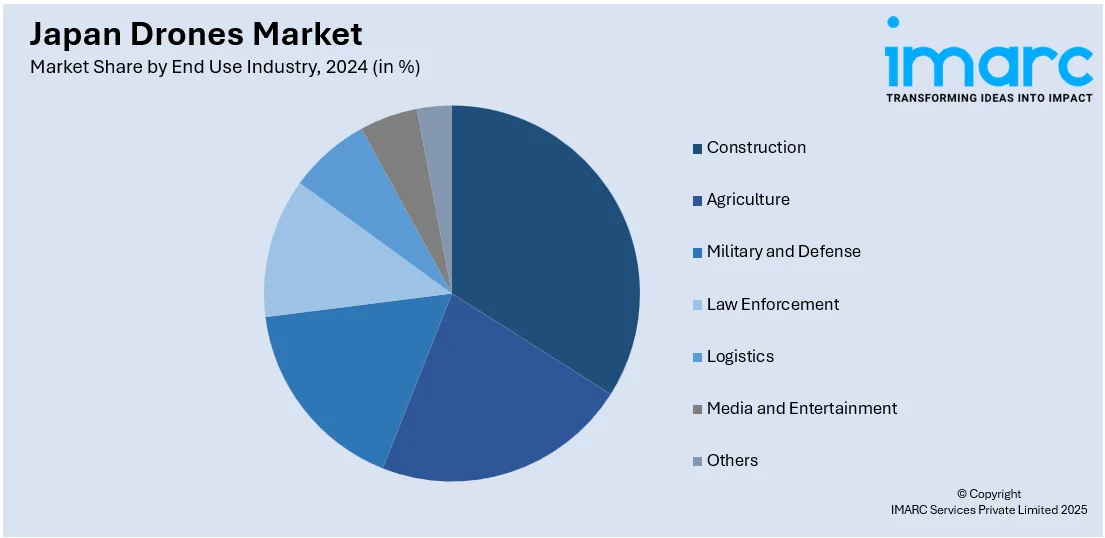

Analysis by End Use Industry:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

In Japan, drones are increasingly used in the construction industry for tasks such as surveying, mapping, and site inspections. They enable real-time data collection and provide high-resolution images, improving project accuracy and reducing time and labor costs. Drones also assist in monitoring work progress, ensuring safety, and inspecting difficult-to-reach areas, such as rooftops and high-rise structures. With the construction sector focusing on enhancing efficiency and reducing risks, drones are becoming an essential tool for streamlining workflows, improving decision-making, and ensuring compliance with regulations in the evolving construction landscape.

Drones are transforming Japan’s agricultural industry by offering precise and efficient solutions for crop monitoring, pest control, and irrigation management. Using sophisticated sensors and cutting-edge imaging systems, drones can gather detailed, high-resolution information about crop health, soil quality, and yield predictions. They help farmers reduce pesticide use, optimize water usage, and increase crop yields. Drones also facilitate precise planting and crop spraying, minimizing waste and improving sustainability. As Japan faces challenges like labor shortages and aging farming populations, drone technology is playing a crucial role in ensuring long-term productivity and efficiency in agriculture.

Drones play a significant role in Japan’s military and defense sector, supporting surveillance, reconnaissance, and tactical operations. Unmanned aerial systems (UAS) provide real-time intelligence and surveillance over vast areas, helping military forces monitor borders, detect potential threats, and gather critical information. Drones are also used for training, logistics, and potentially combat scenarios, offering enhanced situational awareness while minimizing risks to personnel. As Japan continues to invest in autonomous systems, drones are becoming an integral part of defense strategies, supporting national security while adapting to evolving technological demands in modern warfare.

In Japan, drones are gaining traction in law enforcement for enhancing monitoring, crowd control, and emergency response operations. Equipped with high-resolution cameras and sensors, drones offer real-time aerial views of crime scenes, accidents, or large public gatherings, aiding police in decision-making and rapid response. They are also used for monitoring traffic, conducting border patrols, and supporting investigations by collecting evidence from otherwise inaccessible areas. The use of drones in law enforcement improves safety, reduces risks to officers, and ensures faster, more accurate responses to incidents, making them valuable assets in maintaining public order.

Drones are transforming Japan’s logistics industry by enabling fast, cost-effective, and efficient delivery solutions. They provide last-mile delivery services, especially in urban areas and remote locations where traditional delivery methods face challenges. Drones reduce delivery times, lower operational costs, and reduce the reliance on ground transportation, helping businesses streamline their supply chains. In addition, drones are used in warehouses for inventory management and surveillance. With the growing demand for quick deliveries and the country’s advanced technological infrastructure, drones are becoming essential for optimizing Japan’s logistics and e-commerce sectors.

Drones are revolutionizing the media and entertainment industry in Japan by enabling breathtaking aerial cinematography and live broadcasting. They are used in film production, sports events, concerts, and news coverage to capture unique perspectives and deliver high-quality footage from previously difficult-to-reach locations. Drones equipped with high-definition cameras provide dynamic shots that enhance storytelling, while their mobility allows for creative flexibility in capturing live events. As demand for immersive and high-quality content continues to rise, drones offer cost-effective solutions for production companies, enabling new possibilities for both creative and broadcast industries.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto area, which includes Tokyo and its neighboring prefectures, stands out as a pivotal hub for the drone industry in Japan. The region's highly developed infrastructure, advanced technology sectors, and dense population drive demand for drones across various industries, including logistics, construction, and media. As Japan’s economic and technological hub, the Kanto Region leads the adoption of unmanned aerial systems, particularly in urban environments. The growing demand for drone-based services such as aerial surveys, deliveries, and surveillance reflects the region’s strategic importance in shaping the future of drone technology in Japan.

The Kinki region, home to major cities like Osaka and Kyoto, is a significant market for drones in Japan, driven by its diverse industrial base, including manufacturing, tourism, and agriculture. Drones are increasingly used for infrastructure inspections, disaster management, and agriculture, particularly in rural areas. The region's emphasis on fostering innovation and advancing technology drives the integration of drone services, particularly in industries where precision and operational efficiency are paramount. As the second-largest economic area in Japan, Kinki plays a vital role in expanding the use of drones across various sectors and applications.

The Chubu region, which includes cities like Nagoya and major industrial zones, is an important market for drones, particularly in the automotive, manufacturing, and agriculture sectors. The region's emphasis on technological advancements in robotics and automation aligns well with the integration of drones for industrial inspections, logistics, and crop monitoring. Drones are also becoming increasingly popular in surveying and construction, helping to streamline operations and improve efficiency. As Chubu is home to Japan’s key aerospace and automotive companies, its market for drones is poised for significant growth, driven by demand for advanced technologies.

The Kyushu-Okinawa region is a growing market for drones, driven by its unique geography and industries, such as agriculture, logistics, and tourism. Drones are particularly beneficial in the region's vast rural and mountainous areas, where they are used for crop monitoring, forest management, and delivery services. Additionally, the region’s strategic location as a gateway to international trade and its role in disaster response and recovery drive further demand for unmanned aerial systems. With its expanding infrastructure and focus on innovation, Kyushu-Okinawa is expected to see an increase in drone adoption for both commercial and governmental applications.

The Tohoku region, located in northeastern Japan, is increasingly adopting drones for agricultural, environmental, and disaster relief applications. Following the 2011 earthquake and tsunami, drones have played a crucial role in disaster recovery, offering real-time surveillance and delivering essential supplies to hard-to-reach areas. The region's vast rural areas benefit from drones in monitoring crop health and managing forests. As the Tohoku Region continues to rebuild and modernize its infrastructure, drones are becoming an integral tool in improving efficiency, enhancing safety, and supporting recovery and growth in various industries. This trend aligns with the positive Japan drones market outlook, which predicts continued growth in the region’s drone adoption.

The Chugoku region, which includes cities like Hiroshima and Okayama, is an emerging market for drones, particularly in the fields of agriculture, construction, and environmental monitoring. Drones are used for precision farming, providing farmers with detailed data on crop health and soil conditions, while their role in construction includes surveying and site inspection. The region's focus on revitalizing rural areas and improving logistics networks also boosts the adoption of drone technology. As Chugoku seeks to modernize its infrastructure and improve operational efficiency, drones are poised to play an increasingly significant role in driving regional development.

The Hokkaido region, Japan’s northernmost area, presents unique opportunities for drone adoption due to its vast landscapes, low population density, and industries such as agriculture, tourism, and forestry. Drones are widely used for crop monitoring, forest management, and environmental conservation, providing valuable data in areas where traditional methods are less effective. The region’s harsh climate and remote locations also make drones ideal for search and rescue operations, particularly in winter months. As the demand for innovative solutions to manage Hokkaido’s unique geography grows, drones are expected to become increasingly integral in various sectors.

Shikoku, Japan's smallest main island, is a developing market for drones, driven by its rural and agricultural landscape. Drones are used extensively in the region for crop monitoring, pest control, and environmental management. The island’s focus on rural revitalization and disaster management further supports the growth of drone services. Drones are also beneficial for infrastructure inspections and surveying, particularly in hard-to-reach areas. With Shikoku’s emphasis on sustainability and innovation, drones are becoming increasingly important for improving operational efficiency in agriculture, disaster recovery, and environmental monitoring across the region.

Competitive Landscape:

The Japan drone market is highly competitive, driven by rapid technological advancements and expanding applications across industries. Companies focus on innovation in navigation, AI, and automation to meet diverse industry demands, including agriculture, logistics, and infrastructure management. Strategic collaborations with government and research institutions enhance development, fostering a dynamic market environment. For instance, in August 2024, the Japan Coast Guard signed a procurement contract with General Atomics for two SeaGuardian drones, to be delivered in 2025, after successfully using them for maritime surveillance, search and rescue, and disaster response since 2022. Moreover, competitors prioritize offering tailored solutions to address specific sector needs, emphasizing efficiency and precision. As the market evolves, differentiation through cutting-edge technology and compliance with regulatory frameworks becomes critical for maintaining a competitive edge in Japan’s expanding drone industry.

The report provides a comprehensive analysis of the competitive landscape in the Japan drones market with detailed profiles of all major companies.

Latest News and Developments:

- In February 2024, Japan Airlines and Setouchi Town launched Amami Island Drones, providing drone-based services for disaster relief, medical supplies, and daily logistics, ensuring sustainable community support and development.

- In August 2024, Tokyo-based JDrone announced the launch of its cargo services, utilizing Yamaha FAZER R G2 and DJI Flycart 30 drones to deliver supplies to remote sites and disaster areas in Japan.

- In September 2024, Nippon Express Holdings invested in Spiral Inc. to support its autonomous indoor drone technology, enhance logistics operations, expand in Europe, and strengthen ties with the construction industry.

- In October 2024, Mitsui Fudosan and Nippon Steel Kowa Real Estate announced the opening of Itabashi Drone Field in Tokyo, supporting drone R&D, logistics, disaster response, and industry collaboration to address social challenges.

Japan Drones Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Point of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan drones market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan drones market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Japan drones market was valued at USD 1.8 Billion in 2024.

The market is driven by advancements in drone technology, government support for integration in logistics and disaster management, and growing demand across industries such as agriculture, infrastructure inspection, and surveillance. Moreover, labor shortages, aging infrastructure, and the need for efficient solutions further fuel adoption, highlighting drones as essential tools for innovation and productivity.

IMARC estimates the Japan drones market to reach USD 4.9 Billion by 2033, exhibiting a CAGR of 11.5% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)