Japan Digital Transformation Market Size, Share, Trends and Forecast by Type, Deployment Mode, Enterprise Size, End Use Industry, and Region, 2025-2033

Japan Digital Transformation Market Size and Share:

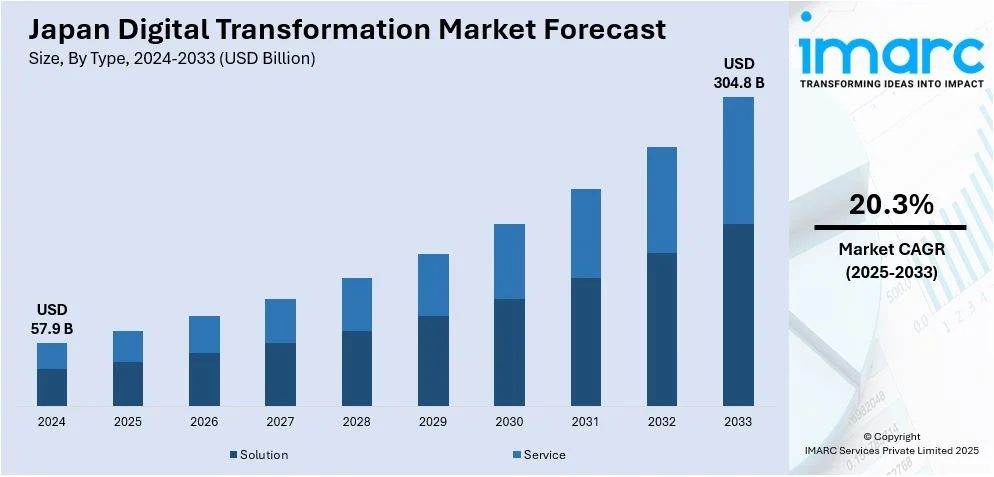

The Japan digital transformation market size was valued at USD 57.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 304.8 Billion by 2033, exhibiting a CAGR of 20.3% from 2025-2033. The market is experiencing significant growth, driven by advancements in AI, IoT, and cloud computing solutions. Government initiatives, such as promoting smart cities and 5G adoption, are further accelerating innovation. Moreover, increasing demand for automation, secure digital platforms, and data-driven solutions is boosting Japan digital transformation market share and positioning the country as a leader in technological modernization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 57.9 Billion |

| Market Forecast in 2033 | USD 304.8 Billion |

| Market Growth Rate (2025-2033) | 20.3% |

Prolific assimilation of advanced technologies, including artificial intelligence (AI), the Internet of Things (IoT), and cloud computing, is a key active contributor to the Japan digital transformation market growth. These technologies are useful in improving organizational flow, helping customers, and improving functions within different fields. Moreover, the government entails various measures that foster this transition more due to its ongoing drive for experimenting to find solutions to emerging pertinent issues like aging populations and lack of workforce. For instance, in November 2024, Japan announced a USD 65 Billion plan to strengthen its chip and AI industries by 2030, providing subsidies and financial incentives to enhance supply chains, support innovation, and boost economic growth. Besides this, the growing demand for automating and data-driven decision-making leads organizations to adopt technology-driven solutions to remain consistent in a global economy.

Another significant driver is the expansion of 5G networks and the growing demand for remote work solutions. For instance, in July 2024, DOCOMO announced the launch of New Radio-Dual Connectivity (NR-DC) across three frequency bands Sub-6 (3.7GHz and 4.5GHz) and millimeter-wave (28GHz) for enhanced 5G connectivity. The technology will provide download speeds of up to 6.6Gbps in select areas of Tokyo and Kanagawa starting 1 August 2024, further highlighting the critical need for state-of-the-art data centers to accommodate these emerging technologies. The implementation of high-speed connectivity infrastructure propels the development and use of new generation applications such as smart manufacturing, telemedicine, and intelligent transportation systems. While company employees shift towards new hybrid work arrangements, market need for cloud solutions, virtual cooperation platforms, and digital services further expands. Additionally, increasing consumer expectations for personalized and seamless digital experiences encourage companies to prioritize digital transformation strategies, fostering innovation and growth in Japan’s evolving technological landscape.

Japan Digital Transformation Market Trends:

Increasing Adoption of AI and Automation

The Japan digital transformation market demand is fast growing with increasing utilization of AI and automation technologies in different sectors. Businesses are adopting AI-based applications in managing their operations, interacting with customers, and in their management decisions. For instance, in November 2024, Tapway and Asteria launched the AIoT Suite in Japan, integrating Vision AI and no-code IoT technologies. This platform automates manufacturing tasks like quality inspections and safety monitoring, with its Japanese version debuting in Tokyo. Furthermore, the advancement in manufacturing, especially through robotics and smart factories, has been identified as another need, which forms the core of Japanese robotics innovation. AI is also being applied in Japan by firms for predictive analysis, personalized marketing, and autonomous systems, showing its significance in the country’s transformation to a digitally enabled economy.

Expansion of Cloud Computing and Data Analytics

Cloud computing and data analytics are pivotal to the Japan digital transformation market, enabling businesses to store, process, and analyze vast amounts of data efficiently. With increasing demand for remote work solutions and scalable IT infrastructure, enterprises are migrating to cloud platforms to ensure flexibility and cost efficiency. Organizations are leveraging data analysis solutions to extract meaningful insights, refine operational strategies, and enhance the quality of customer interactions. Furthermore, this trend is supported by investments from global and domestic tech firms, as well as government initiatives encouraging the adoption of cloud-based solutions to strengthen Japan’s digital infrastructure and drive innovation across sectors. For instance, in April 2024, Microsoft announced a USD 2.9 Billion investment to enhance its cloud capabilities, AI infrastructure, and digital skilling initiatives in Japan. The initiative aims to support Japan's digital transformation, enhance cybersecurity, and address economic challenges.

Growth in IoT and Smart Cities

The integration of the Internet of Things (IoT) and smart city solutions is transforming the Japan digital transformation market trends. IoT applications in transportation, healthcare, and energy management are enhancing connectivity and operational efficiency. For instance, in June 2024, Yuko-Keiso Co., Kyushu University, Kogakuin University, and Internet Initiative Japan Inc. developed an energy-saving shrimp aquaculture system. It reduces CO2 emissions, uses biogas for energy, and improves farming efficiency with IoT technologies. Moreover, smart city projects, supported by the government, aim to create sustainable urban environments with intelligent infrastructure, autonomous vehicles, and efficient resource utilization. Businesses are investing in IoT-enabled devices and networks to streamline processes and improve service delivery. Furthermore, the focus on digital ecosystems and sustainable technologies aligns with Japan’s vision of fostering innovation and addressing societal challenges through connected data-driven solutions.

Japan Digital Transformation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan digital transformation market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, deployment mode, enterprise size, and end use industry.

Analysis by Type:

- Solution

- Analytics

- Cloud Computing

- Mobility

- Social Media

- Others

- Service

- Professional Services

- Integration and Implementation

Solutions such as analytics, cloud computing, mobility, and social media play a critical role in the Japan digital transformation market. Analytics enables organizations to derive actionable insights, improving decision-making and operational efficiency. Additionally, cloud computing provides scalable and secure infrastructure, ensuring flexibility and real-time access to resources. Mobility enhances connectivity, empowering employees and customers with seamless, on-the-go access to services. Meanwhile, social media drives engagement, improves brand visibility, and offers a platform for gathering customer insights.

Professional services and integration and implementation are pivotal in boosting the Japan digital transformation market share. Professional services provide expert consulting, strategic planning, and customized solutions, enabling businesses to navigate their digital transformation effectively while aligning with evolving technology trends. Meanwhile, integration and implementation services ensure the seamless adoption of advanced systems by optimizing workflows and minimizing disruptions. These services enhance compatibility and scalability, accelerating deployment and operational efficiency.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

Cloud-based deployment is a driving force in the Japan digital transformation market outlook, offering scalable, flexible, and cost-efficient solutions. It allows organizations to leverage live data, enhance teamwork, and minimize expenses associated with IT infrastructure. With enhanced security protocols and rapid implementation, cloud-based systems are widely adopted by organizations seeking agility and innovation. This mode supports remote work and digital-first strategies, aligning with the growing demand for sustainable and scalable solutions in Japan's evolving market landscape.

On-premises deployment remains essential for organizations in Japan that prioritize data control, compliance, and customizability. This mode allows businesses to maintain complete ownership of their IT infrastructure, ensuring alignment with strict regulatory requirements and internal policies. Although it requires higher initial investments and maintenance, on-premises solutions offer robust security and are often preferred by industries handling sensitive data. This deployment mode supports businesses that value long-term stability and tailored systems in their digital transformation journey.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises in the Japan digital transformation market are driving adoption with significant investments in advanced technologies to enhance efficiency and competitiveness. These organizations focus on leveraging AI, big data, and cloud solutions to streamline operations and improve decision-making. With vast resources and established infrastructure, large enterprises adopt comprehensive strategies to modernize processes and stay ahead in an evolving market. Their efforts often include partnerships with technology providers to scale innovation, meet global standards, and address complex operational challenges while maintaining compliance with regulatory requirements.

Small and medium-sized enterprises play a growing role in the Japan digital transformation market, driven by the need to remain competitive in a technology-first environment. SMEs are steadily embracing cost-effective cloud technologies and mobile solutions to enhance operational efficiency and strengthen interactions with their customers. Limited resources often lead these businesses to prioritize scalable, cost-effective technologies that deliver quick returns on investment. With government initiatives and digital adoption programs supporting SMEs, these enterprises are closing the digital gap, fostering innovation, and contributing to the Japan's digital transformation market growth in business ecosystem

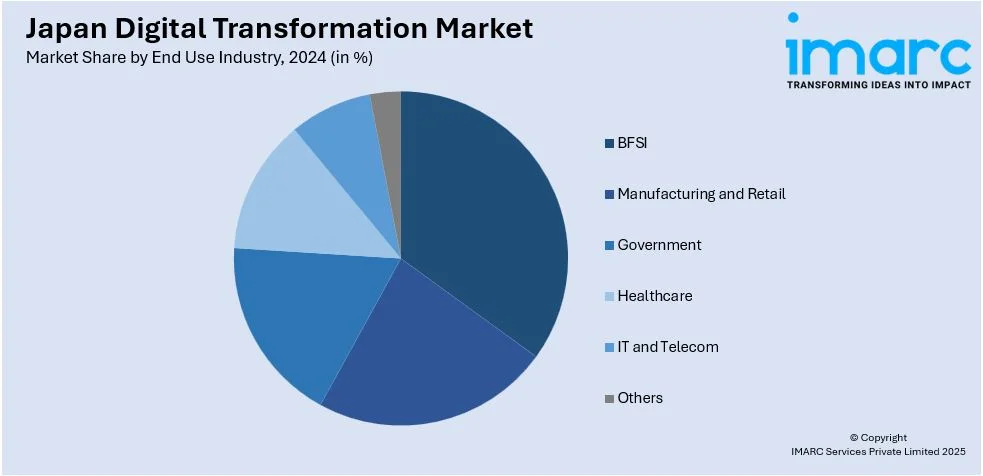

Analysis by End Use Industry:

- BFSI

- Manufacturing and Retail

- Government

- Healthcare

- IT and Telecom

- Others

The BFSI sector is a significant driver of the Japan digital transformation market, leveraging advanced technologies such as AI, blockchain, and data analytics to enhance customer experience, improve security, and streamline operations. Digital banking, mobile payment systems, and automation tools are widely adopted to meet evolving consumer expectations. Additionally, strong cybersecurity protocols are implemented to protect critical financial information, maintaining adherence to stringent regulatory requirements. The sector's focus on innovation and efficiency plays a pivotal role in transforming financial services across Japan.

Manufacturing and retail industries in Japan are embracing digital transformation to optimize supply chains, improve production efficiency, and enhance customer engagement. Smart manufacturing techniques, such as IoT and robotics, are reshaping production processes, while retail businesses leverage e-commerce platforms, data analytics, and AI-driven personalization to meet consumer demands. These industries focus on adopting agile, technology-first strategies to remain competitive in a rapidly evolving market. The integration of digital solutions helps businesses deliver better value and efficiency across the entire supply chain.

The government sector in Japan is actively adopting digital transformation to improve public services, enhance operational efficiency, and foster transparency. Smart city initiatives, cloud-based solutions, and advanced data analytics are central to modernizing governance and addressing citizen needs. Digital platforms streamline administrative processes, reduce paperwork, and provide seamless access to services. This adoption aligns with national policies aimed at creating a sustainable, tech-driven society while addressing challenges like aging infrastructure and workforce limitations.

The healthcare industry in Japan is undergoing a digital revolution, driven by the need for efficient, patient-centric solutions. Telemedicine, electronic health records, and AI-powered diagnostics are increasingly adopted to improve care delivery and resource management. Digital technologies help address the challenges of Japan’s aging population by streamlining workflows, enabling remote consultations, and enhancing medical research. These innovations improve healthcare accessibility and outcomes, making digital transformation an essential part of the sector's modernization efforts.

The IT and telecom sector is at the forefront of Japan’s digital transformation market, enabling technological advancements across industries. The industry fosters progress by advancing 5G networks, enhancing cloud technologies, and refining sophisticated data analysis methods. IT and telecom companies play a vital role in supporting digital adoption by providing scalable, secure, and efficient platforms for businesses. This segment’s focus on connectivity, automation, and integration ensures the continued growth of Japan’s digital ecosystem and its ability to compete on a global scale.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, encompassing Tokyo and other major cities, is a central hub for the Japan digital transformation market. As the country’s economic and technological center, it hosts numerous enterprises, government institutions, and research facilities driving innovation. The region's advanced infrastructure supports extensive adoption of AI, IoT, and cloud-based solutions. Businesses in Kanto utilize digital technologies to optimize workflows and improve client interactions, positioning the region as a significant contributor to the country’s digital evolution.

The Kinki region, home to cities like Osaka, Kyoto, and Kobe, is a significant player in Japan's digital transformation market. Renowned for its manufacturing sector, the area prioritizes advanced production techniques and the adoption of IoT technologies within industrial operations. Its rich cultural heritage also promotes digital adoption in tourism and retail, creating enhanced visitor experiences through digital platforms. Kinki’s blend of traditional industries and modern technology underscores its vital role in advancing digital transformation.

The Chubu region, with cities like Nagoya, is a key industrial area, particularly in automotive and manufacturing. This region's digital transformation focuses on smart manufacturing, robotics, and supply chain optimization. Companies adopt advanced analytics and automation to increase efficiency and reduce costs. The region’s strategic location and strong industrial base position it as a critical contributor to Japan’s digital growth, especially in precision engineering and industrial innovation.

The Kyushu-Okinawa region emphasizes digital transformation in agriculture, tourism, and renewable energy. Its adoption of smart farming technologies and e-commerce platforms enhances agricultural productivity and market reach. In tourism, digital platforms are transforming visitor experiences, while renewable energy projects use advanced monitoring and data analytics for efficiency. The region's commitment to leveraging technology for sustainability and economic development makes it a growing contributor to Japan’s digital transformation.

The Tohoku region is focusing on digital transformation to revitalize its economy and improve infrastructure. Investments in smart agriculture, renewable energy, and disaster resilience technologies are central to its strategy. Digital tools help optimize resource management and enhance community services, addressing challenges posed by its rural nature and aging population. Tohoku’s efforts align with national initiatives to bridge regional disparities in digital adoption.

The Chugoku region leverages digital transformation to modernize its manufacturing and logistics sectors. Ports in this region adopt advanced technologies to streamline shipping and trade operations. Regional enterprises prioritize leveraging cloud technologies and utilizing data-driven strategies to enhance efficiency and lower operational expenditures. Chugoku's growing emphasis on digital solutions is fostering economic growth and sustainability across its industries.

Hokkaido is embracing digital transformation to address its unique challenges, such as its vast geography and harsh climate. The region is focusing on smart agriculture, leveraging IoT and data analytics to boost productivity and sustainability. Tourism, a major economic driver, benefits from digital platforms and AI-driven personalization, significantly enhancing the Japan digital transformation market demand. Hokkaido’s integration of technology into key sectors supports economic development and enhances regional competitiveness.

The Shikoku region adopts digital transformation to support its small and medium-sized enterprises and boost local industries like agriculture, fishing, and tourism. Cloud solutions and mobile technologies help improve operational efficiency and market access. Shikoku’s initiatives to integrate digital tools into traditional industries underscore its efforts to balance modernization with cultural preservation, driving regional economic growth.

Competitive Landscape:

The competitive landscape of the Japan digital transformation market is marked by intense innovation and strong collaboration among domestic and global technology providers. Companies are investing heavily in AI, IoT, cloud computing, and 5G technologies to meet rising demand across industries. Moreover, strategic partnerships and mergers are common as businesses seek to enhance capabilities and expand market presence. For instance, in November 2024, Fujitsu and SAP Fioneer partnered to accelerate digital transformation in Japan’s insurance industry by developing the Japan Edition of SAP Fioneer Cloud for Insurance, enabling streamlined operations, innovation, and enhanced governance across core insurance services. Besides this, the focus on data-driven solutions, automation, and cybersecurity is fueling competition, positioning Japan as a hub for digital transformation advancements.

The report provides a comprehensive analysis of the competitive landscape in the Japan digital transformation market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, global IT corporation FPT, Chugoku Electric Power, and technology innovator Enecom have partnered to advance Chugoku Electric Power’s digital transformation objectives, focusing on improving operational efficiency and service delivery in Japan's energy sector.

- In December 2024, NEC and Japan Airlines collaborated to utilize artificial intelligence for monitoring carry-on luggage at Tokyo's Haneda airport. This system aims to streamline the boarding process and enhance punctuality, reflecting the application of digital solutions in the aviation sector.

- In March 2024, Itochu and Boston Consulting Group launched a new digital transformation consultancy, with Itochu holding a majority stake and BCG providing expertise, focusing on IT strategies and technology implementation.

- In April 2024, Accenture acquired CLIMB, a technology services provider in Gunma Prefecture, to enhance its capabilities in system integration, IT infrastructure modernization, and supporting digital transformation for financial and government sectors.

- In April 2024, Microsoft revealed a $2.9 billion investment to enhance its AI and cloud infrastructure in Japan, aiming to strengthen the country’s digital capabilities and assist businesses in their digital transformation efforts.

Japan Digital Transformation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Deployment Modes Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Use Industries Covered | BFSI, Manufacturing and Retail, Government, Healthcare, IT and Telecom, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan digital transformation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan digital transformation market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan digital transformation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Japan digital transformation market was valued at USD 57.9 Billion in 2024.

The market is driven by the need for enhanced efficiency, rising adoption of advanced technologies like AI, IoT, and cloud computing, and increasing demand for personalized customer experiences. Government initiatives, workforce automation, and the growing focus on sustainable solutions further accelerate digital adoption across industries and regions.

IMARC estimates the Japan digital transformation market to reach USD 304.8 Billion in 2033, exhibiting a CAGR of 20.3% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)