Japan Diabetes Drugs Market Report by Type (Insulins, Oral Anti-diabetic Drugs, Non-Insulin Injectable Drugs, Combination Drugs), Distribution Channel (Online Pharmacies, Hospital Pharmacies Retail Pharmacies), and Region 2026-2034

Market Overview:

Japan diabetes drugs market size reached USD 4.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 6.1 Billion by 2034, exhibiting a growth rate (CAGR) of 3.33% during 2026-2034. The rising number of established pharmaceutical companies engaged in the development, production, and distribution of a diverse range of diabetes medications, each aiming to control blood glucose levels effectively is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.6 Billion |

| Market Forecast in 2034 | USD 6.1 Billion |

| Market Growth Rate (2026-2034) | 3.33% |

Diabetes drugs play a pivotal role in managing and treating diabetes, a chronic condition characterized by elevated blood sugar levels due to the body's inability to produce sufficient insulin or utilize it effectively. These pharmaceutical agents are crucial in controlling the progression of the disease and mitigating the risk of complications, such as cardiovascular disease, kidney damage, and vision loss. There are various classes of diabetes drugs, each working differently to regulate blood glucose levels. Some are designed to boost insulin secretion, while others improve insulin sensitivity or decrease the amount of glucose absorbed by the intestines.

Japan Diabetes Drugs Market Trends:

The Japan diabetes drugs market is a rapidly evolving sector, responding to the escalating need stemming from the widespread prevalence of diabetes in the region, predominantly influenced by aging demographics and lifestyle alterations. The dynamics of this market are shaped by the infusion of innovative solutions and relentless research endeavors by prominent pharmaceutical entities, aimed at devising diverse medication strategies to meticulously regulate blood glucose levels. The market is experiencing substantial growth, fueled by a heightened awareness and understanding of diabetes and its associated complications. The propensity towards embracing novel and effective diabetes medications is prominent in Japan, with a significant inclination towards the integration of advanced drugs, such as GLP-1 receptor agonists, which are gaining traction due to their efficacy and multifunctionality in managing blood sugar levels and weight. A distinctive trend in the market is the burgeoning investment in R&D activities, fostering the development of groundbreaking drugs with enhanced capabilities and reduced side effects. The advent of personalized medicine is also playing a pivotal role in shaping the market landscape, enabling more tailored and patient-centric approaches to treatment. The heightened emphasis on healthcare and wellness, coupled with supportive regulatory frameworks and substantial healthcare expenditure, is anticipated to propel the regional market forward over the forecasted period.

Japan Diabetes Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Insulins

- Basal or Long Acting Insulins

- Lantus (Insulin Glargine)

- Levemir (Insulin Detemir)

- Toujeo (Insulin Glargine)

- Tresiba (Insulin Degludec)

- Basaglar (Insulin Glargine)

- Bolus or Fast Acting Insulins

- NovoRapid/Novolog (Insulin Aspart)

- Humalog (Insulin Lispro)

- Apidra (Insulin Glulisine)

- Traditional Human Insulins

- Novolin/Actrapid/Insulatard

- Humulin

- Insuman

- Biosimilar Insulins

- Insulin Glargine Biosimilars

- Human Insulin Biosimilars

- Basal or Long Acting Insulins

- Oral Anti-diabetic Drugs

- Biguanides

- Metformin

- Alpha-Glucosidase Inhibitors

- Dopamine D2 Receptor Agonist

- Bromocriptin

- SGLT-2 Inhibitor

- Invokana (Canagliflozin)

- Jardiance (Empagliflozin)

- Farxiga/Forxiga (Dapagliflozin)

- Suglat (Ipragliflozin)

- DPP-4 Inhibitors

- Onglyza (Saxagliptin)

- Tradjenta (Linagliptin)

- Vipidia/Nesina (Alogliptin)

- Galvus (Vildagliptin)

- Sulfonylureas

- Meglitinides

- Biguanides

- Non-Insulin Injectable Drugs

- GLP-1 Receptor Agonists

- Victoza (Liraglutide)

- Byetta (Exenatide)

- Bydureon (Exenatide)

- Trulicity (Dulaglutide)

- Lyxumia (Lixisenatide)

- Amylin Analogue

- Symlin (Pramlintide)

- GLP-1 Receptor Agonists

- Combination Drugs

- Insulin Combinations

- NovoMix (Biphasic Insulin Aspart)

- Ryzodeg (Insulin Degludec and Insulin Aspart)

- Xultophy (Insulin Degludec and Liraglutide)

- Oral Combination

- Janumet (Sitagliptin and Metformin)

- Janumet (Sitagliptin and Metformin)

- Insulin Combinations

The report has provided a detailed breakup and analysis of the market based on the type. This includes insulins [basal or long acting insulins (lantus (insulin glargine), levemir (insulin detemir), toujeo (insulin glargine), tresiba (insulin degludec), and basaglar (insulin glargine)), bolus or fast acting insulins (novorapid/novolog (insulin aspart), humalog (insulin lispro), and apidra (insulin glulisine)), traditional human insulins (novolin/actrapid/insulatard, humulin, insuman), biosimilar insulins (insulin glargine biosimilars and human insulin biosimilars)], oral anti-diabetic drugs, [biguanides (metformin), alpha-glucosidase inhibitors, dopamine d2 receptor agonist( bromocriptin), sglt-2 inhibitor (invokana (canagliflozin), jardiance (empagliflozin, farxiga/forxiga (dapagliflozin), suglat (ipragliflozin), dpp-4 inhibitors (onglyza (saxagliptin), tradjenta (linagliptin), vipidia/nesina (alogliptin), galvus (vildagliptin)), sulfonylureas, and meglitinides], non-insulin injectable drugs [glp-1 receptor agonists( victoza (liraglutide), byetta (exenatide), bydureon (exenatide), trulicity (dulaglutide), lyxumia (lixisenatide)), amylin analogue (symlin (pramlintide))], and combination drugs [insulin combinations (novomix (biphasic insulin aspart), ryzodeg (insulin degludec and insulin aspart), and xultophy (insulin degludec and liraglutide), and oral combination (janumet (sitagliptin and metformin))].

Distribution Channel Insights:

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online pharmacies, hospital pharmacies, and retail pharmacies.

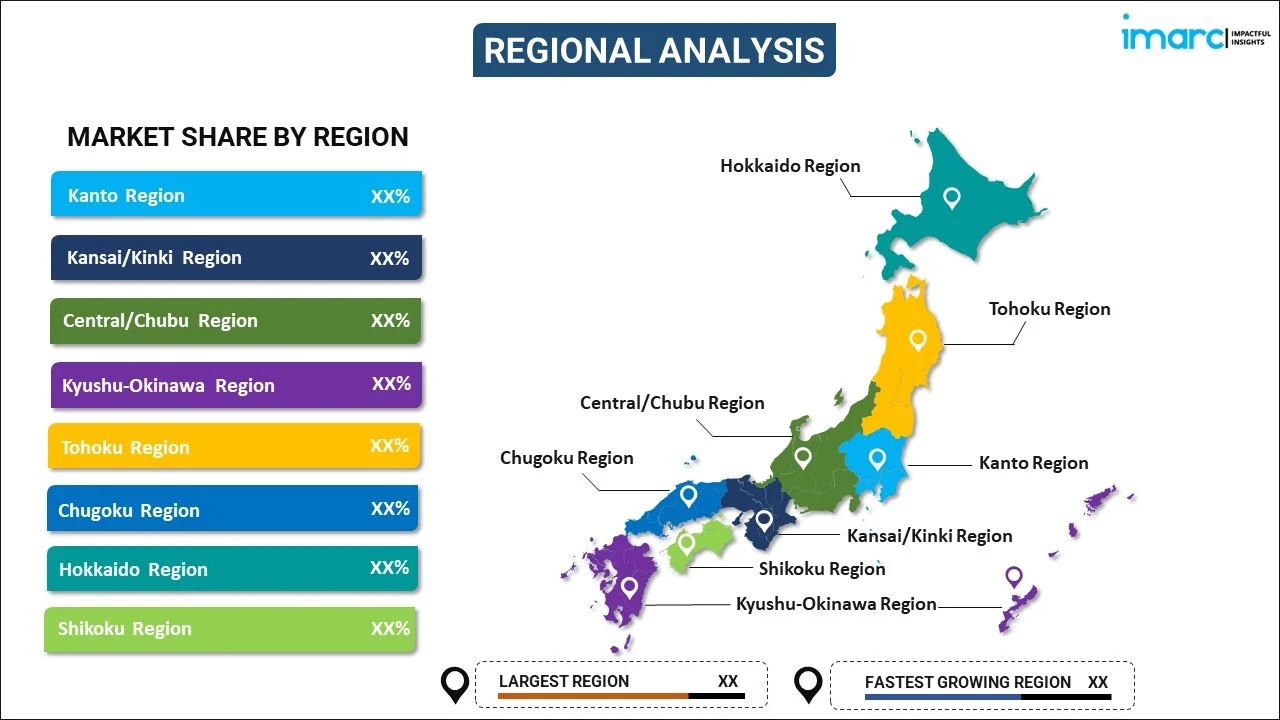

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Diabetes Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Distribution Channels Covered | Online Pharmacies, Hospital Pharmacies, Retail Pharmacies |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan diabetes drugs market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan diabetes drugs market?

- What is the breakup of the Japan diabetes drugs market on the basis of type?

- What is the breakup of the Japan diabetes drugs market on the basis of distribution channel?

- What are the various stages in the value chain of the Japan diabetes drugs market?

- What are the key driving factors and challenges in the Japan diabetes drugs?

- What is the structure of the Japan diabetes drugs market and who are the key players?

- What is the degree of competition in the Japan diabetes drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan diabetes drugs market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan diabetes drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan diabetes drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)