Japan Diabetes Devices Market Report by Type (Management Devices, Monitoring Devices), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Diabetes Clinics/Centers, Online Pharmacies, and Others), and Region 2026-2034

Market Overview:

Japan diabetes devices market size reached USD 1,990.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,520.6 Million by 2034, exhibiting a growth rate (CAGR) of 2.66% during 2026-2034. Significant innovations and technological advancements, focused on addressing the multifaceted demands of diabetic management, monitoring, and treatment are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,990.2 Million |

| Market Forecast in 2034 | USD 2,520.6 Million |

| Market Growth Rate (2026-2034) | 2.66% |

Diabetes devices refer to a category of medical equipment specifically designed to manage, monitor, and treat diabetes, a chronic condition characterized by elevated blood sugar levels. These devices play an essential role in assisting individuals with diabetes to maintain optimal blood glucose levels and prevent complications associated with uncontrolled diabetes. Diabetes devices include blood glucose monitors, insulin pumps, insulin pens, and continuous glucose monitoring (CGM) systems, amongst others. Blood glucose monitors are utilized for intermittent blood sugar testing, while the latter provide real-time glucose readings throughout the day. Insulin pumps and pens are crucial for the delivery of insulin, a hormone essential for the metabolism of carbohydrates, fats, and proteins. These devices, with their advancements in technology, are becoming more user-friendly, accurate, and minimally invasive, catering to the specific needs and preferences of diabetic patients. The incorporation of digital technologies such as apps and telemedicine platforms also helps in better diabetes management by offering personalized care and remote monitoring capabilities. In essence, diabetes devices are pivotal in empowering individuals with diabetes to lead a healthier and more manageable life, fostering advancements in medical technology and healthcare.

Japan Diabetes Devices Market Trends:

The Japan diabetes devices market is witnessing a period of substantial growth, driven by a confluence of trends and drivers, including an aging population and increasing prevalence of diabetes within the country. With Japan being home to a considerable elderly demographic, the necessity for innovative and efficient diabetes management devices is more paramount than ever, propelling advancements and investments in this sector. The surge in health consciousness and self-management of diabetes is leading to increased demand for user-friendly, accurate, and technologically advanced devices, such as continuous glucose monitoring systems and insulin delivery devices. Technological innovations and the integration of IoT and AI are significant trends in the market, enhancing the functionalities of diabetes devices, offering real-time monitoring, data analysis, and personalized recommendations, thus elevating the standard of diabetes care. The government’s supportive policies and initiatives aimed at healthcare innovation and chronic disease management also act as catalysts, bolstering the market’s trajectory. Moreover, the rise in partnerships between tech companies and medical device manufacturers is fostering the development of more sophisticated solutions. The growing acceptance and adoption of these advanced diabetes devices among healthcare providers and patients are anticipated to further augment the market growth. The emphasis on minimally invasive or non-invasive devices and the proliferation of telehealth and remote monitoring are reshaping the landscape of diabetes management in Japan, indicating a promising future for the diabetes devices market in the region.

Japan Diabetes Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Management Devices

- Insulin Pump

- Insulin Syringes

- Cartridges in Reusable Pens

- Insulin Disposable Pens

- Jet Injectors

- Monitoring Devices

- Self-monitoring Blood Glucose

-

- Continuous Glucose Monitoring

The report has provided a detailed breakup and analysis of the market based on the type. This includes management devices (insulin pump, insulin syringes, cartridges in reusable pens, insulin disposable pens, and jet injectors) and monitoring devices (self-monitoring blood glucose and continuous glucose monitoring).

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Diabetes Clinics/Centers

- Online Pharmacies

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacies, retail pharmacies, diabetes clinics/centers, online pharmacies, and others.

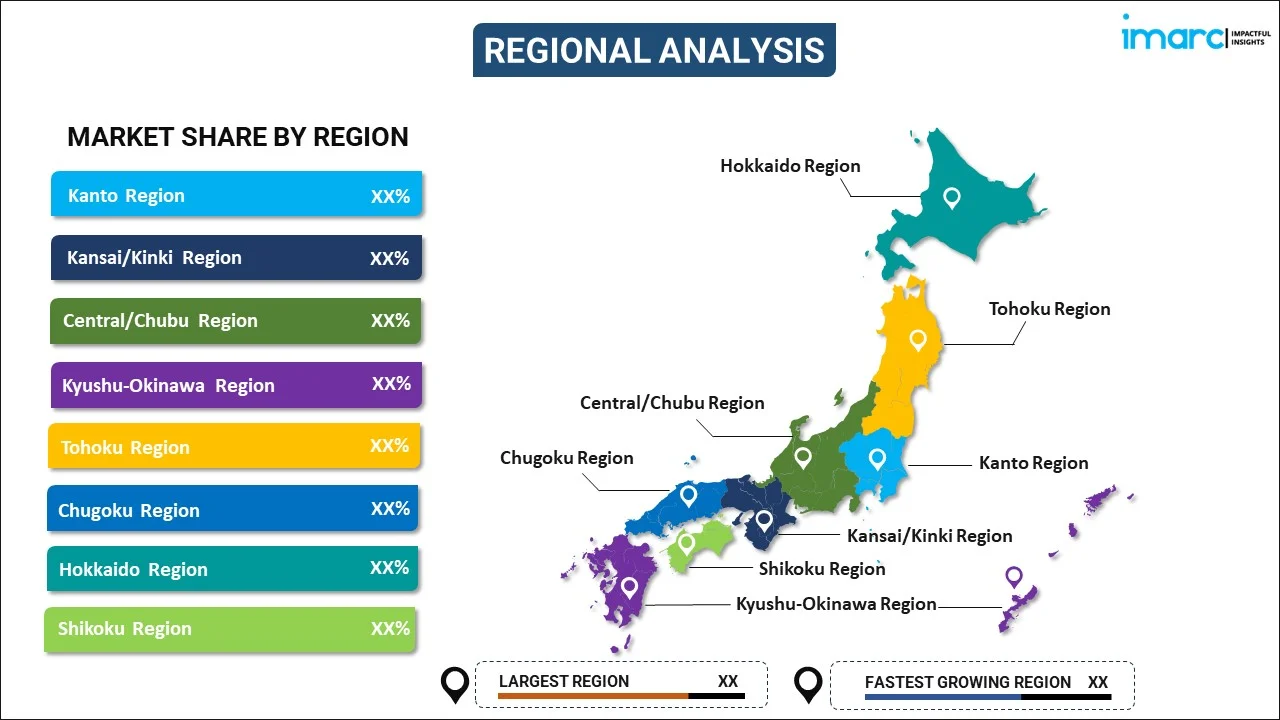

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- ARKRAY Inc.

- Ascensia Diabetes Care Holdings AG

- Dexcom Inc.

- Terumo Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Japan Diabetes Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | • Management Devices: Insulin Pump, Insulin Syringes, Cartridges in Reusable Pens, Insulin Disposable Pens, Jet Injectors • Monitoring Devices: Self-monitoring Blood Glucose, Continuous Glucose Monitoring |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Diabetes Clinics/Centers, Online Pharmacies, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | ARKRAY Inc., Ascensia Diabetes Care Holdings AG, Dexcom Inc., Terumo Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 9-11 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan diabetes devices market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan diabetes devices market?

- What is the breakup of the Japan diabetes devices market on the basis of type?

- What is the breakup of the Japan diabetes devices market on the basis of distribution channel?

- What are the various stages in the value chain of the Japan diabetes devices market?

- What are the key driving factors and challenges in the Japan diabetes devices?

- What is the structure of the Japan diabetes devices market and who are the key players?

- What is the degree of competition in the Japan diabetes devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan diabetes devices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan diabetes devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan diabetes devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)