Japan Data Center Networking Market Size, Share, Trends, and Forecast by Component, End-User, and Region, 2026-2034

Japan Data Center Networking Market Overview:

The Japan data center networking market size reached USD 2.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 6.3 Billion by 2034, exhibiting a growth rate (CAGR) of 10.83% during 2026-2034. Rising cloud adoption, AI-driven workloads, increasing demand for edge computing, regulatory compliance, introduction of hybrid cloud models requiring high-speed connectivity, and investments in 5G infrastructure are driving the market. Sustainability initiatives and energy-efficient networking solutions further accelerate market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.5 Billion |

| Market Forecast in 2034 | USD 6.3 Billion |

| Market Growth Rate (2026-2034) | 10.83% |

Japan Data Center Networking Market Trends:

AI-Powered Network Automation and Optimization

Japan’s data center networking market is experiencing rapid integration of AI-powered automation to enhance network efficiency and reduce operational complexity. AI-driven solutions optimize traffic flow, detect anomalies in real time, and ensure predictive maintenance, minimizing downtime. As enterprises adopt AI workloads, demand for intelligent network management solutions is increasing. For instance, in February 2025, Optage, a Japanese ISP owned by Kansai Electric Company (KEPCO), announced plans to deploy liquid-cooled containerized data centers in Mihama, Fukui Prefecture, by 2026. These AI-focused facilities will feature GPU-equipped servers and be powered by nuclear energy. Optage is also developing a 14-story data center in Osaka.

Expansion of Edge Data Centers for Low-Latency Connectivity

Japan is witnessing a surge in edge data center deployments to support applications requiring low-latency connectivity, such as autonomous vehicles, industrial IoT, and smart cities. The increasing adoption of 5G technology is accelerating this trend, necessitating robust edge networking infrastructure to handle decentralized data processing. Enterprises are investing in distributed networking architectures, leveraging SD-WAN and virtualized network functions (VNF) to optimize edge data transmission. Hyperscale cloud providers are expanding their regional edge nodes to enhance content delivery and support latency-sensitive applications. Japan’s regulatory focus on data sovereignty is also driving the localization of edge data centers, ensuring compliance with domestic data protection laws. These factors collectively contribute to the expansion of Japan’s edge computing ecosystem and advanced network solutions. For instance, in January 2025, Asia Pacific Land (APL) Group and Global Compute Infrastructure (GCI) partnered to develop two data center campuses in Japan. The first 120MW campus in Kitakyushu, Fukuoka Prefecture, will begin construction in 2026, with 60MW operational by September 2027. Additional land in Fukuoka Prefecture has been secured for 250MW of capacity by 2029. APL is also developing a six-facility data center campus in Itoshima, set for completion by 2034. The partnership aims to position Kyushu as a major data center hub, supporting Japan’s digital transformation.

Sustainability Initiatives Driving Green Networking Solutions

Sustainability is a growing priority in Japan’s data center networking sector, with enterprises focusing on energy-efficient networking solutions to reduce carbon footprints. Increasing electricity costs and stringent environmental regulations are compelling data center operators to adopt low-power networking hardware, including energy-efficient switches and routers. Liquid cooling and AI-driven power management systems are being integrated to optimize network energy consumption. Companies are also leveraging renewable energy sources and carbon-neutral initiatives to align with Japan’s long-term decarbonization goals. For instance, in January 2024, AWS planned to integrate low-carbon concrete in its Tokyo and Osaka data center expansions, partnering with Takenaka, Shimizu, and Obayashi corporations. The initiative is part of AWS’s ¥2.26 trillion (USD 15.24 Billion) investment in Japan through 2027. The company will use ECM concrete, biochar-infused concrete, and Cleancrete, reducing embodied carbon by up to 70%. AWS aims to enhance sustainability, improve energy efficiency, and support Japan’s digital transformation.

Japan Data Center Networking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on component and end-user.

Component Insights:

- Product

- Ethernet Switches

- Routers

- Storage Area Network (SAN)

- Application Delivery Controller (ADC)

- Others

- Services

- Installation and Integration

- Training and Consulting

- Support and Maintenance

The report has provided a detailed breakup and analysis of the market based on the component. This includes product (ethernet switches, routers, storage area network (SAN), application delivery controller (ADC), and others) and services (installation and integration, training and consulting, and support and maintenance).

End-User Insights:

- IT and Telecommunication

- BFSI

- Government

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes IT and telecommunication, BFSI, government, media and entertainment, and others.

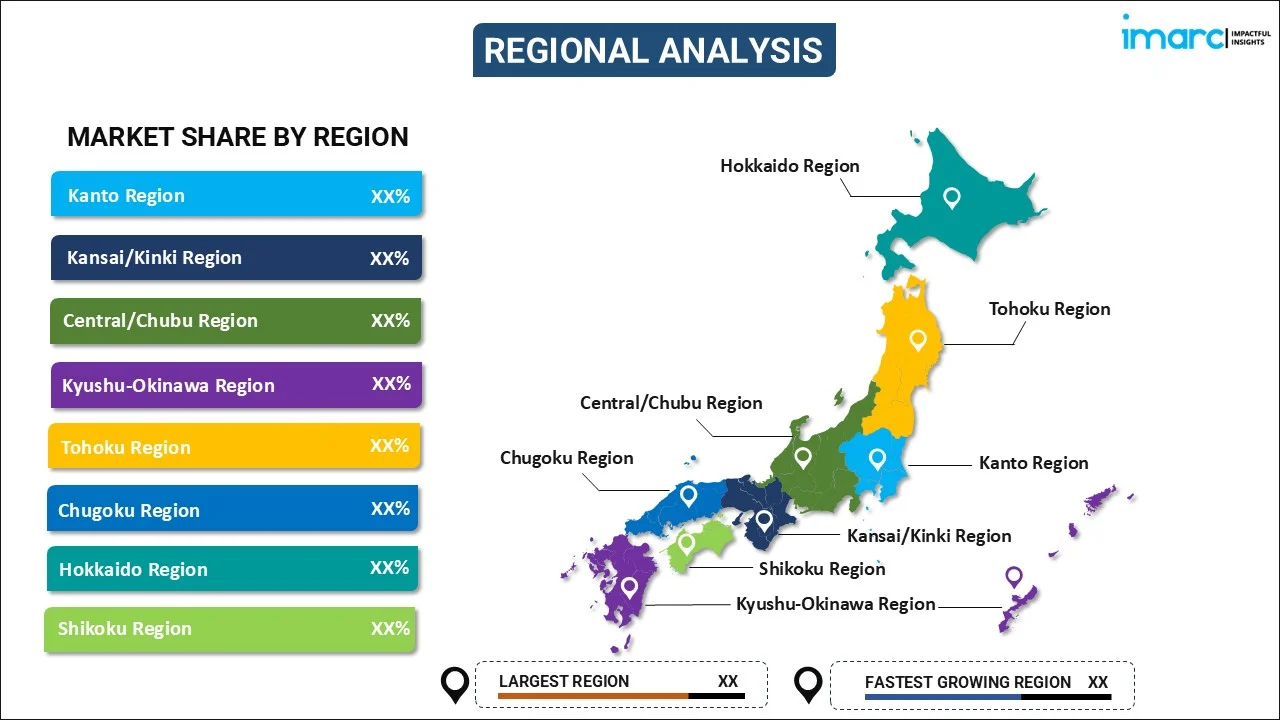

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Data Center Networking Market News:

- In August 2024, Singtel and Hitachi signed an MoU to collaborate on next-generation data centers and GPU Cloud in Japan and the Asia Pacific region. The partnership integrates Singtel’s data center expertise with Hitachi’s AI-driven solutions, including green power, cooling, and data management. Singtel’s Nxera plans to expand its 200MW AI-ready data center platform, while Hitachi will leverage Singtel’s GPU-as-a-Service (GPUaaS) to optimize AI applications. This initiative aims to accelerate AI adoption, enhance enterprise digital transformation, and promote sustainable, high-performance data centers to meet the region’s growing cloud and AI demands.

- In February 2025, CapitaLand Investment Limited (CLI) announced the development of a 50MW data center in Osaka, Japan, marking its first facility in the country. The company has acquired a freehold land parcel and plans to invest $700 million in the project.

- In February 2025, Seraya Partners launched AQX, a Tokyo-based investment platform focused on Japan’s digital infrastructure market. AQX aims to invest in shared telecom infrastructure and AI-enabling digital assets across the APAC region. Japan, the world’s third-largest digital infrastructure market, presents lucrative opportunities. Seraya previously established Empyrion DC, which is developing data centers in Tokyo, Seoul, and Taipei. The firm raised a USD 800 Million fund in 2023 for digital infrastructure and energy transition investments, reinforcing its commitment to sustainable, AI-driven connectivity solutions in Japan and beyond.

- In January 2025, EdgeConneX announced its expansion into Japan with the development of a 140MW data center in the Osaka-Kyoto region, in collaboration with Kagoya Asset Management. The facility is set to be operational by 2027, marking EdgeConneX’s first venture into the Japanese market to address the rising demand for cloud and AI services.

- In November 2024, Preferred Networks, Inc. (PFN), a leading AI company in Japan, has selected Digital Realty’s NRT12 data center in Tokyo to host its AI computing platform. NRT12 offers scalable rack power up to 150kW and direct liquid cooling, supporting PFN’s high-performance AI workloads. The facility, part of PlatformDIGITAL, provides global connectivity across 300+ data centers. PFN has begun deployment and plans full-scale operations by January 2026 to support AI-driven innovation.

Japan Data Center Networking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| End-Users Covered | IT And Telecommunication, BFSI, Government, Media And Entertainment, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan data center networking market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan data center networking market on the basis of component?

- What is the breakup of the Japan data center networking market on the basis of end-user?

- What are the various stages in the value chain of the Japan data center networking market?

- What are the key driving factors and challenges in the Japan data center networking market?

- What is the structure of the Japan data center networking market and who are the key players?

- What is the degree of competition in the Japan data center networking market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan data center networking market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan data center networking market.

- Porter's F

ive Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan data center networking industry and its attractiveness. - Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)