Japan Dairy Market Report by Product Type (Liquid Milk, Flavored Milk, Cream, Butter, Cheese, Yoghurt, Ice Cream, Anhydrous Milk Fat (AMF), Skimmed Milk Powder (SMP), Whole Milk Powder (WMP), Whey Protein, Lactose Powder, Curd, Paneer), and Region 2026-2034

Japan Dairy Market Report:

The Japan dairy market size reached USD 61,218.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 88,499.6 Million by 2034, exhibiting a growth rate (CAGR) of 4.18% during 2026-2034. The increasing health-consciousness among consumers, the significant expansion of the e-commerce and distribution channels, and the incorporation of dairy-based ingredients into Japanese cuisine, such as cheese and yogurt in sushi rolls and desserts, represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 61,218.4 Million |

| Market Forecast in 2034 | USD 88,499.6 Million |

| Market Growth Rate (2026-2034) | 4.18% |

Access the full market insights report Request Sample

Japan Dairy Market Report Analysis:

- Major Market Drivers: The increasing health consciousness among consumers and the rising demand for dairy products that offer essential nutrients, such as calcium and protein, contribute to bone health and overall well-being are primarily driving the growth of the market.

- Key Market Trends: The popularity of Western-style diets and the incorporation of dairy-based ingredients into Japanese cuisine, such as cheese and yogurt in sushi rolls and desserts, is propelling the Japan dairy market share.

- Challenges and Opportunities: The Japan dairy market faces challenges such as declining milk consumption due to changing dietary preferences and an aging population, prompting dairy producers to innovate and diversify product offerings. However, opportunities arise from increasing demand for dairy alternatives like plant-based milk and yogurt, as well as premium dairy products catering to health-conscious consumers and niche markets.

Japan Dairy Market Report Trends:

Growing Health Awareness Among Consumers

The growing health consciousness among consumers is primarily driving the growth of the Japan dairy market. Furthermore, the escalating preference for dairy products, like cheese and yogurt, as a source of essential nutrients like proteins, vitamins, and minerals is also creating a positive outlook for the market. For instance, in 2020, the production volume of cheese in Japan reached around 165 thousand metric tons. Processed cheese account for most cheese product sales in Japan, with a small share attributable to natural cheese. Similarly, in the Yogurt market, volume is expected to amount to 2.18 billion kg by 2028. The Yogurt market is expected to show a volume growth of 0.2% in 2025. The average volume per person in the Yogurt market is expected to amount to 17.6 kg in 2024. In addition to this, the inflating disposable incomes of consumers and the elevating levels of lifestyles are also augmenting the consumption of dairy products across the country, which is anticipated to augment the Japan dairy market demand in the coming years.

Increasing Number of Cafes and Restaurants

The growing utilization of dairy products like cheese, milk, yogurt, ice cream, butter, etc., in restaurants and cafes is further creating a positive outlook for the overall market. For instance, as of the end of March 2023, the number of restaurants in Japan amounted to roughly 935.35 thousand. Moreover, as of March 2022, the total number of authorized coffee shops in Japan amounted to approximately 100.57 thousand. Such an increasing number of cafes and eateries are significantly contributing to the market growth. In addition to this, ice cream is considered one of the most popular sweet treats among the Japanese population. The most sold ice cream type in Japan was family-sized multipacks, followed by ice cream served in paper cups, whereas vanilla ice cream was rated the most popular flavor in 2022. Moreover, on average, almost three-quarters of Japanese people drink coffee daily. The rise in consumption of ice creams and coffee, along with the escalating number of cafes, is anticipated to propel the Japan dairy market revenue in the coming years.

Rising Product Offerings

The dairy market is experiencing a surge in product offerings, driven by consumer demand for variety, convenience, and health-conscious options. This expansion includes innovations such as lactose-free milk, plant-based alternatives like almond and oat milk, artisanal cheese, probiotic yogurts, and flavored dairy beverages. As per the Japan dairy market forecast by IMARC, manufacturers are responding to evolving consumer preferences by diversifying their portfolios to cater to a wider range of tastes and dietary needs, fostering competition and driving growth in the dairy market. For instance, in September 2023, Kaneka Corporation launched a new individual-serving Organic Yogurt. The new product is sold through Kaneka Foods Corporation, a group company of Kaneka Corporation, at organic specialty stores, supermarkets, home-delivery services, and the Kaneka Online Shop. The new individual-serving type also includes a two-layered yogurt with blueberry confiture in addition to plain yogurt. Not only the yogurt but also the confiture is JAS-certified organic. Similarly, in March 2024, Japanese dairy giant Meiji launched a functional milk beverage that supports vision and sleep. The milk beverage, called Meiji Eye and Sleep W Support, contains 7.5mg of functional ingredient crocetin, a carotenoid derived from gardenia fruit and saffron. Due to its small molecular weight, it can be easily absorbed into the body. Such innovations in dairy products are positively impacting the Japan dairy market outlook.

Japan Dairy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type.

Breakup by Product Type:

To get detailed segment analysis of this market Request Sample

- Liquid Milk

- Flavored Milk

- Cream

- Butter

- Cheese

- Yoghurt

- Ice Cream

- Anhydrous Milk Fat (AMF)

- Skimmed Milk Powder (SMP)

- Whole Milk Powder (WMP)

- Whey Protein

- Lactose Powder

- Curd

- Paneer

The Japan dairy market report has provided a detailed breakup and analysis of the market based on the product type. This includes liquid milk, flavored milk, cream, butter, cheese, yoghurt, ice cream, anhydrous milk fat (AMF), skimmed milk powder (SMP), whole milk powder (WMP), whey protein, lactose powder, curd, and paneer.

The increasing consumption of liquid milk and flavored milk products, driven by factors such as increasing health awareness, convenience, and flavor innovation, is creating a positive outlook for the overall market. Liquid milk remains a staple due to its nutritional value and versatility, while flavored milk variants offer a flavorful alternative, appealing particularly to younger consumers. This trend reflects evolving consumer preferences towards dairy beverages that combine taste with health benefits, driving Japan dairy market’s recent price. Furthermore, ice cream is considered one of the most popular sweet treats among the Japanese population. The most sold ice cream type in Japan was family-sized multipacks, followed by ice cream served in paper cups, whereas vanilla ice cream was rated the most popular flavor in 2022. Additionally, the inflating spending capacities of consumers, along with the growing inclinations towards healthy food items, is positively impacting the market growth.

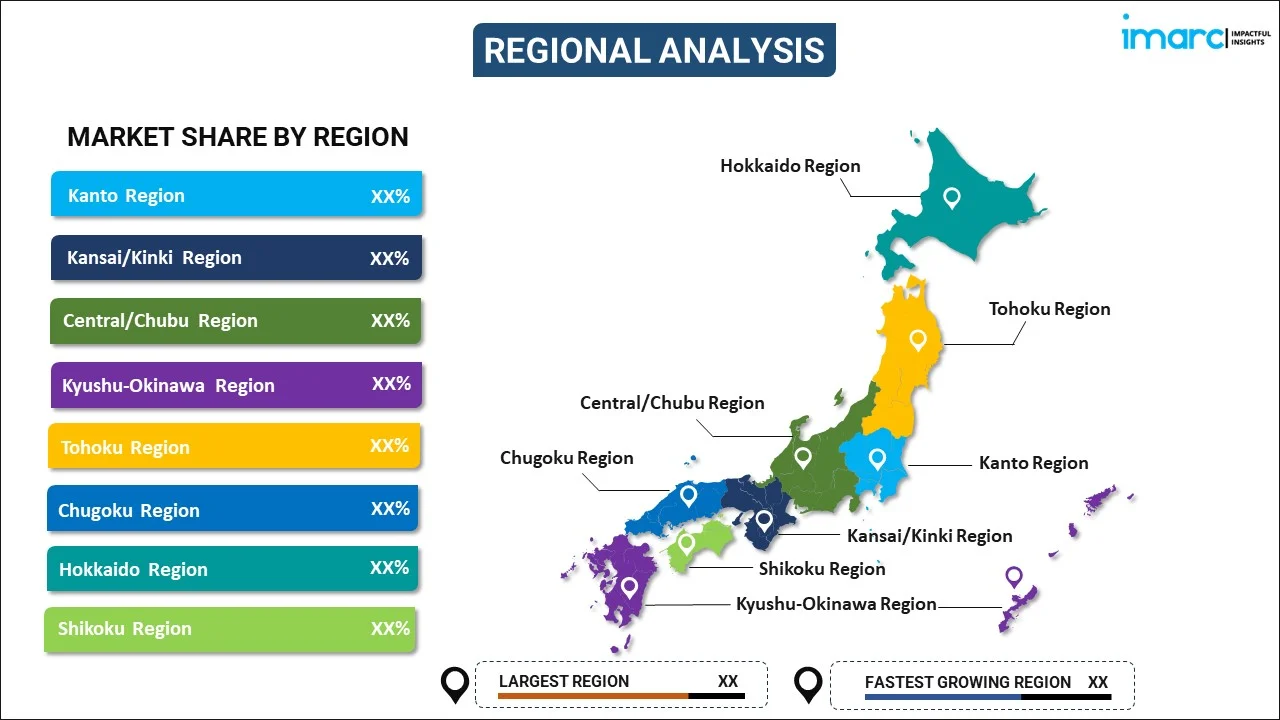

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

The demand for dairy products in Japan continues to grow, spurred by factors such as increasing health consciousness, dietary diversification, and the popularity of Western cuisines. Moreover, as per the Japan dairy market overview, there's a rising interest in dairy consumption, driven by the perception of dairy as a nutritious source of protein, calcium, and other essential nutrients. This trend is further fueled by the introduction of innovative dairy products catering to Japanese tastes, including yogurt drinks, cheese snacks, and premium ice creams.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the Japan dairy market companies. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Dairy Market Recent Developments:

- March 2024: Japanese dairy giant Meiji launched a functional milk beverage that supports vision and sleep. The milk beverage, called Meiji Eye and Sleep W Support, contains 7.5mg of functional ingredient crocetin, a carotenoid derived from gardenia fruit and saffron. Due to its small molecular weight, it can be easily absorbed into the body.

- September 2023: Kaneka Corporation launched a new individual-serving Organic Yogurt. The new product is sold through Kaneka Foods Corporation, a group company of Kaneka Corporation, at organic specialty stores, supermarkets, home-delivery services, and the Kaneka Online Shop. The new individual-serving type also includes a two-layered yogurt with blueberry confiture in addition to plain yogurt. Not only the yogurt but also the confiture is JAS-certified organic.

Japan Dairy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Liquid Milk, Flavored Milk, Cream, Butter, Cheese, Yoghurt, Ice Cream, Anhydrous Milk Fat (AMF), Skimmed Milk Powder (SMP), Whole Milk Powder (WMP), Whey Protein, Lactose Powder, Curd, Paneer |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan dairy market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan dairy market?

- What is the breakup of the Japan dairy market on the basis of product type?

- What are the various stages in the value chain of the Japan dairy market?

- What are the key driving factors and challenges in the Japan dairy?

- What is the structure of the Japan dairy market and who are the key players?

- What is the degree of competition in the Japan dairy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan dairy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan dairy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan dairy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)