Japan Cybersecurity Market Size, Share, Trends and Forecast by Component, Deployment Type, User Type, Industry Vertical, and Region, 2025-2033

Japan Cybersecurity Market Size and Share:

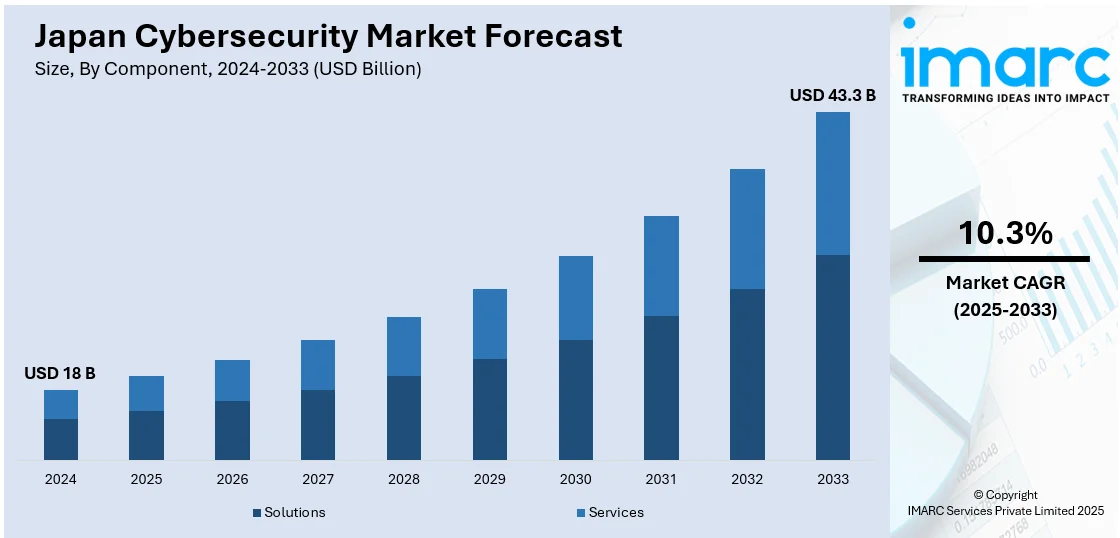

The Japan cybersecurity market size was valued at USD 18 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 43.3 Billion by 2033, exhibiting a CAGR of 10.3% from 2025-2033. The market is undergoing noteworthy growth, mainly impacted by the active focus on digital transformation across critical industries, burgeoning cyber threats, and increasing implementation of governmental policies addressing privacy concerns. As varied enterprises encounter transforming risks, need for leading-edge cybersecurity tools, such as AI-powered data protection and threat detection, is accelerating, positioning the market for a stable expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18 Billion |

| Market Forecast in 2033 | USD 43.3 Billion |

| Market Growth Rate (2025-2033) | 10.3% |

The increasing sophistication of cyber threats is a primary driver for Japan’s cybersecurity market. As cyberattacks become more advanced, businesses, government agencies, and critical infrastructure sectors are prioritizing the implementation of robust security measures. The rise of state-sponsored cyberattacks, ransomware, and data breaches targeting both private and public entities has heightened awareness about cybersecurity risks. For instance, as per industry reports, since the end of 2024, around 46 entities in Japan, including government and banks agencies, have been targeted by cyberattacks, likely leveraging the same malware. This growing threat landscape compels Japanese organizations to invest in advanced cybersecurity technologies and services, including threat intelligence, intrusion detection, and advanced encryption protocols, to safeguard sensitive data and ensure business continuity.

Government initiatives and regulatory frameworks are key factors shaping the cybersecurity market in Japan. The Japanese government has enacted several policies and frameworks to strengthen data security and privacy standards. Additionally, Japan is aligning with global cybersecurity norms, including the EU’s GDPR, which drives local businesses to adopt more stringent cybersecurity practices. These regulatory requirements, combined with the government’s push for digital transformation, encourage enterprises to invest in cybersecurity infrastructure and services to ensure compliance and protect against evolving cyber risks. For instance, in November 2024, Fujitsu and SAP Fioneer announced partnership to bolster the digital transformation across the insurance sector in Japan. This will encompass the development of cloud-based platform for insurance solutions. As a result, this development is anticipated to elevate the Japan cybersecurity market demand to safeguard cloud services.

Japan Cybersecurity Market Trends:

Increasing Focus on Cloud Security Solutions

In recent years, Japan’s cybersecurity landscape has seen a substantial inclination towards cloud security. As several enterprises are rapidly opting for cloud infrastructure, the requirement for leading-edge solutions to safeguard applications, data, and services hosted in the cloud has escalated. This trend is significantly propelled by the increase in digital transformation ventures and notable growth of remote work culture. For instance, according to industry reports, among Asian markets surveyed, Japan stands out with the highest proportion of fully remote workers. In local companies, 8.0% of employees work remotely, while in multinational firms, this figure rises to 16.0%. Furthermore, cybersecurity companies in Japan are improving their cloud security solutions to cater to the issues associated with the regulatory adherence data breaches, and unauthorized access. Moreover, hybrid cloud environments are emerging as prevalent and preferred options, necessitating resilient security measures that envelopes both cloud-based and on-premise systems.

Expansion of AI and Machine Learning in Threat Detection

Japan is witnessing a notable amplification in the deployment of machine learning (ML) and artificial intelligence (AI) for threat response and detection. AI-powered cybersecurity technologies are facilitating more precise, quicker identification of emerging threats, lowering the dependence on manual, conventional security operations. Furthermore, as cyberattacks become increasingly sophisticated, these technologies empower organizations to analyze vast datasets instantaneously, detecting trends and irregularities that could indicate a security breach. As cybercriminals develop more advanced techniques, Japan’s cybersecurity market is increasingly integrating AI/ML tools to enhance predictive capabilities and automate incident response. For instance, in January 2025, VicOne, a major Japan-based automotive cybersecurity firm, announced collaboration with NXP Semiconductors to offer leading-edge automotive cybersecurity through advanced AI-powered services.

Rising Importance of Data Privacy and Compliance

Japan is actively focusing on regulatory adherence and data privacy as a chief aspect of its cybersecurity tactic. With the implementation of stringent policies, including the Act on the Protection of Personal Information (APPI), several organizations are under intense pressure to safeguard critical consumer data and facilitate compliance to privacy rules. Furthermore, Japanese businesses are heavily investing in extensive data protection strategies, such as privacy-improving technologies, encryption, and guarded access controls. In addition, global data privacy networks are significantly impacting local adherence tactics, encouraging industries to align their cybersecurity standards with international policies to avoid penalties and alleviate risks. Moreover, the government of Japan acknowledge intense need for improving the country's cybersecurity abilities amidst accelerating threats from overseas. For instance, as per industry reports, over 200 cyberattacks targeting national security and high-tech data between 2019 and 2024 have been attributed to the Chinese group MirrorFace, highlighting the need for enhanced cybersecurity measures.

Japan Cybersecurity Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan cybersecurity market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, deployment type, user type, and industry vertical.

Analysis by Component:

- Solutions

- Identity and Access Management (IAM)

- Infrastructure Security

- Governance, Risk and Compliance

- Unified Vulnerability Management Service Offering

- Data Security and Privacy Service Offering

- Others

- Services

- Professional Services

- Managed Services

The Japan cybersecurity market's solutions segment encompasses a range of advanced offerings tailored to address diverse security challenges. Identity and access management (IAM) ensures secure and controlled user access, safeguarding systems against unauthorized intrusions, whereas Infrastructure security fortifies critical assets, protecting networks and endpoints from evolving cyber threats. Moreover, governance, risk, and compliance (GRC) solutions enable organizations to align with stringent regulatory requirements while mitigating operational risks. Furthermore, unified vulnerability management services proactively identify and remediate system vulnerabilities, enhancing overall security posture. Additionally, data security and privacy services provide robust protection for sensitive information, ensuring confidentiality and compliance with privacy regulations.

In the services segment, professional services and managed services hold notable market share in Japan's cybersecurity sector. Professional services provide expertise in deployed customized security tactics, launching risk assessments, and offering incident response strategy to fortify enterprises’ defenses. Managed services, on the other hand, offer response abilities, active monitoring, and threat detection via outsourced solutions. Such services facilitate companies to emphasize on critical operations while guaranteeing constant security coverage. Together, such offerings aid businesses in enhancing robustness, upgrading their cybersecurity frameworks, and catering to the magnifying sophistication of the threat environment in Japan.

Analysis by Deployment Type:

- Cloud-based

- On-premises

The cloud-based deployment segment holds a significant section in the Japan cybersecurity market share, driven by the growing adoption of cloud computing across industries. Organizations are steadily gravitating towards cloud-based solutions due to their flexibility, affordability, and capability to facilitate remote work. These platforms offer real-time monitoring and threat response, making them an ideal choice for addressing evolving cybersecurity challenges. The rise of hybrid work models and increasing investments in cloud infrastructure further bolster this segment's growth. Additionally, compliance with government-mandated security frameworks enhances trust in cloud-based cybersecurity solutions among Japanese enterprises.

On-premises deployment remains a key segment in the Japan cybersecurity market, particularly favored by industries requiring stringent control over sensitive data and systems. This deployment type is preferred for its ability to offer robust customization and enhanced data security, which are critical for sectors like banking, defense, and healthcare. Businesses operating with outdated systems or unique regulatory obligations frequently depend on on-premises solutions to ensure adherence to compliance standards. The segment continues to thrive due to its reliability in protecting critical infrastructure and the preference of businesses prioritizing localized security frameworks.

Analysis by User Type:

- Large Enterprises

- Small and Medium Enterprises

Japan cybersecurity market outlook reflects that large enterprises are actively exhibiting a crucial role in steering the market, driven by their extensive IT infrastructure and the increasing complexity of cyber threats. These organizations prioritize advanced security measures to protect sensitive data, intellectual property, and critical systems from sophisticated attacks. With stringent regulatory compliance requirements, large enterprises invest heavily in robust cybersecurity solutions, including endpoint protection, network security, and threat intelligence. Their adoption of emerging technologies such as AI-powered analytics and zero-trust frameworks further enhances their market position, reflecting their capacity to implement comprehensive and scalable cybersecurity strategies.

Small and medium enterprises represent a growing segment in the Japan cybersecurity market, fueled by the increasing frequency of cyberattacks targeting smaller organizations. SMEs are adopting cost-effective, scalable security solutions to safeguard business-critical data and maintain operational continuity. Furthermore, with digital transformation initiatives, including cloud adoption and remote work infrastructure, SMEs face heightened vulnerabilities, prompting investment in firewall solutions, intrusion detection systems, and managed security services. In addition, government support through subsidies and awareness programs has also encouraged cybersecurity adoption among SMEs, positioning them as an emerging contributor to the overall Japan cybersecurity market growth.

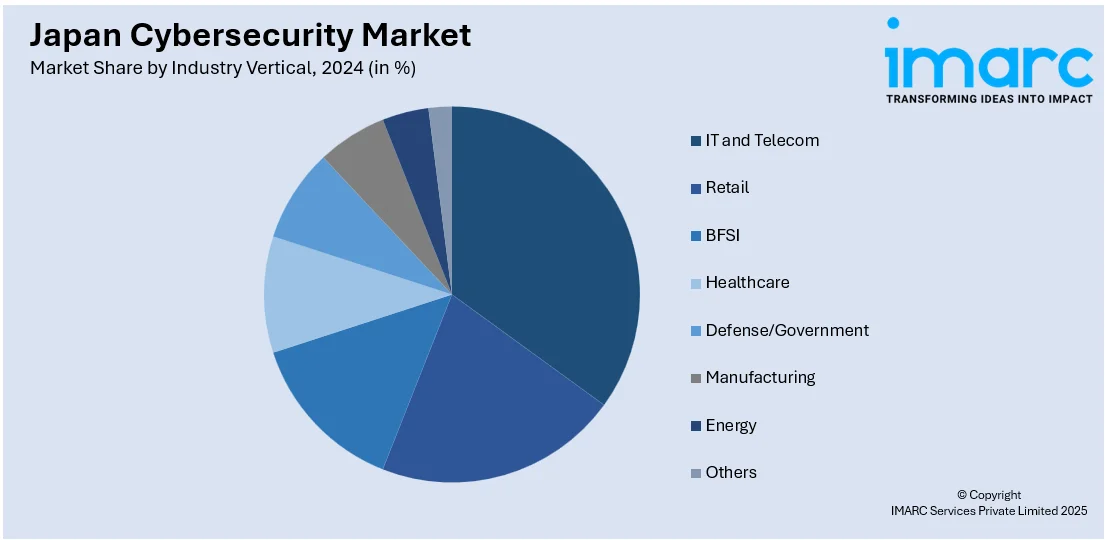

Analysis by Industry Vertical:

- IT and Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others

The IT and telecom sector holds a significant share in Japan's cybersecurity market due to its reliance on vast networks and data-intensive operations. Increasing adoption of cloud computing, IoT, and 5G technologies has heightened vulnerability to cyberattacks, driving investments in advanced cybersecurity solutions. Moreover, telecom operators prioritize securing networks to prevent data breaches and service disruptions. The sector’s regulatory requirements further compel companies to adopt robust security frameworks. Rising digitalization in Japan's IT and telecom industries underscores the critical need for proactive measures to safeguard sensitive information and maintain service integrity.

The retail sector in Japan is rapidly becoming dependent on digital platforms, encompassing point-of-sale systems and e-commerce applications, positioning it as a crucial contributor to the cybersecurity market expansion. The rapid emergence of user data storage and online transactions has fueled the incidences of cyberattacks, typically including phishing and such as data breaches. As a result, retailers are actively opting for cybersecurity services to secure user information and safeguard their payment platforms. Adherence with data protection policies, including the Act on the Protection of Personal Information (APPI), further boosts heavy investments in security solutions, facilitating business continuity and sustaining user trust in a competitive ecosystem of the market.

The BFSI sector accounts for an integral segment of Japan's cybersecurity market, pertaining to its intense demand for securing crucial financial data and guaranteeing safe transactions. Elevating utilization of blockchain technologies, digital banking, and mobile payment applications has amplified the chances of cyberattacks. In addition, regulatory policies, enveloping financial security policies from the Financial Services Agency (FSA), necessitate stringent cybersecurity practices. Furthermore, financial institutions actively invest in cutting-edge solutions, like threat monitoring systems, encryption, and fraud detection to protect against cyber threats, sustain consumer trust, and cater to the strict adherence needs.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region is prominent in the Japan cybersecurity market due to its status as the country’s economic and technological hub. Hosting major cities like Tokyo and Yokohama, the region is home to numerous global corporations, financial institutions, and technology companies. The high concentration of digital infrastructure and critical data assets necessitates advanced cybersecurity solutions. Increasing adoption of cloud computing and IoT technologies further drives demand for robust security frameworks. Additionally, government initiatives supporting digital transformation and stringent regulatory compliance requirements contribute significantly to the region's market share in the cybersecurity sector.

The Kinki region, anchored by Osaka and Kyoto, is a significant player in Japan’s cybersecurity market. Its diverse industrial base, including manufacturing, technology, and services, underscores the need for strong cybersecurity measures to protect sensitive data and intellectual property. The region’s extensive use of digital technologies in production and logistics amplifies the demand for network security and data protection solutions. Furthermore, the presence of numerous educational and research institutions fosters innovation in cybersecurity tools and strategies, reinforcing the region’s market growth and contribution to the national cybersecurity landscape.

The Chubu region, known for its industrial prowess, plays a vital role in Japan’s cybersecurity market. With key industries such as automotive manufacturing and heavy machinery, the region prioritizes cybersecurity to safeguard critical systems and proprietary technologies. The increasing integration of IoT and smart manufacturing systems further drives demand for advanced security solutions. Chubu’s growing base of small and medium-sized enterprises adopting digital platforms also contributes to market expansion. Moreover, regional initiatives supporting cybersecurity training and awareness ensure enhanced resilience against cyber threats, bolstering the region’s market presence.

Competitive Landscape:

The market exhibits an intense competitive landscape, with major players encompassing global cybersecurity providers and domestic companies. Key firms actively emphasize on providing innovative services, mainly including endpoint protection, threat detection, and cloud security to address the transforming market demands. Moreover, collaborations with companies and governmental bodies are intensely prevalent to cater to the magnifying issue of cyber threats. For instance, in February 2024, ASEAN Japan Cybersecurity Community Alliance (AJCCA) signed an MoU with Asian-Oceanian Computing Industry Organization (ASOCIO). The agreement seeks to enhance cooperation between a cybersecurity-focused ASEAN association alliance and an ICT service federation operating across 24 Asia-Pacific markets. In addition, advancements in machine learning (ML) and artificial intelligence (AI) for proactive security purposes are bolstering competition. Furthermore, the market experiences substantial investment in research and development initiatives to sustain a competitive edge and improve service offerings.

The report provides a comprehensive analysis of the competitive landscape in the Japan cybersecurity market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Japan announced a partnership with the United States to launch a collaborative research program for AI-based cyberattacks. This venture is anticipated to initiate in April.

- In April 2024, Microsoft announced significant investment of USD 2.9 billion in cloud infrastructure as well as AI in Japan while fueling the country's expertise, cybersecurity, and research abilities through plans to partner with the government for cybersecurity services.

- In May 2024, Japan announced plans establishing a consultative body to implement an active cyber defense system aimed at strengthening its response to cyberattacks on critical infrastructure. The government will collaborate with experts from sectors such as railways, electricity, and telecommunications. This partnership will focus on sharing information regarding cyber risks and potential countermeasures, including analyzing global cyberattacks. The system is designed to serve as a centralized hub for intelligence gathering and coordinating defensive actions, modeled after the US Cybersecurity and Infrastructure Security Agency’s Joint Cyber Defense Collaborative (JCDC).

- In February 2024, Heimdal announced a tactical partnership with Jupiter Technology Corporation to supply its cybersecurity products in Japan. Jupiter will distribute Heimdal's XDR Unified Security Platform.

Japan Cybersecurity Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | Cloud-based, On-premises |

| User Types Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan cybersecurity market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan cybersecurity market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan cybersecurity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cybersecurity market was valued at USD 18 Billion in 2024.

The market is driven by increasing cyber threats, rising adoption of digital technologies, stringent government regulations, and growing investments in advanced security solutions. Factors such as the expansion of cloud computing, IoT integration, and the need to protect critical infrastructure further accelerate market growth.

IMARC estimates the Japan cybersecurity market to reach USD 43.3 Billion in 2033, exhibiting a CAGR of 10.3% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)