Japan Cyber Insurance Market Report by Component (Solution, Services), Insurance Type (Packaged, Stand-alone), Organization Size (Small and Medium Enterprises, Large Enterprises), End Use Industry (BFSI, Healthcare, IT and Telecom, Retail, and Others), and Region 2025-2033

Market Overview:

The Japan cyber insurance market size reached USD 839.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,252.6 Million by 2033, exhibiting a growth rate (CAGR) of 19.75% during 2025-2033. The growing concern regarding the potential risks and financial implications of cyber-attacks, the increased dependence on digital platforms and adoption of cloud-based solutions across various industries, and favorable government initiatives that promote adherence to cybersecurity measures represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 839.8 Million |

|

Market Forecast in 2033

|

USD 4,252.6 Million |

| Market Growth Rate 2025-2033 | 19.75% |

Cyber Insurance is an essential tool in modern business risk management that specifically addresses the vulnerabilities associated with digital operations. Designed to safeguard against the financial consequences stemming from cyber threats and data breaches, this insurance encompasses coverage for legal fees, notification costs, and other related expenses. It functions through a complex mechanism that evaluates the cyber risk profile of the insured, setting premiums accordingly, and delivers timely support and financial backing in the face of a cyber incident. It provides protection to organizations by offering assistance in both the prevention of digital threats and the handling of incidents when they occur. It is characterized by the provision of coverage for data loss recovery, network security liability, privacy liability, as well as regulatory compliance. Its properties extend to safeguarding various sectors, by adapting to the unique digital landscapes within each end-use industry.

Japan Cyber Insurance Market Trends:

The market in Japan is primarily driven by the growing concern among corporations and government bodies regarding the potential risks and financial implications of cyber-attacks. In line with this, the increased dependence on digital platforms and adoption of cloud-based solutions across various industries is providing an impetus to the market. Moreover, the incorporation of the Internet of Things (IoT) in diverse industrial applications and the rising number of connected devices are acting as a significant growth-inducing factor. In addition to this, favorable government initiatives that promote adherence to cybersecurity measures are resulting in higher investment in protective digital infrastructure. Besides this, the rising need to protect sensitive data in sectors such as healthcare and finance is creating lucrative opportunities in the market. Also, the rapid expansion of small and medium enterprises (SMEs) engaging in online business activities is impacting the market positively. The market is further driven by the widespread integration of e-commerce and the necessity to ensure transaction security. Apart from this, the substantial technological advancements within the country and the subsequent requirement for robust cyber risk management strategies are propelling the market. Furthermore, the increase in collaboration among universities, tech companies, and governmental bodies to create curriculum and training programs fostering a cybersecurity-conscious culture and creating skilled workforce are fueling the market. Some of the other factors contributing to the market include the shifting focus towards the safeguarding of intellectual property, active participation of Japan in international alliances and agreements that focus on shared cybersecurity standards and intelligence, and stringent regulations necessitating compliance with privacy laws.

Japan Cyber Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan cyber insurance market report, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, insurance type, organization size, and end use industry.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Insurance Type Insights:

- Packaged

- Stand-alone

A detailed breakup and analysis of the market based on the insurance type has also been provided in the report. This includes packaged and stand-alone.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

End Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

A detailed breakup and analysis of the market based on the end use industry has also been provided in the report. This includes BFSI, healthcare, IT and telecom, retail, and others.

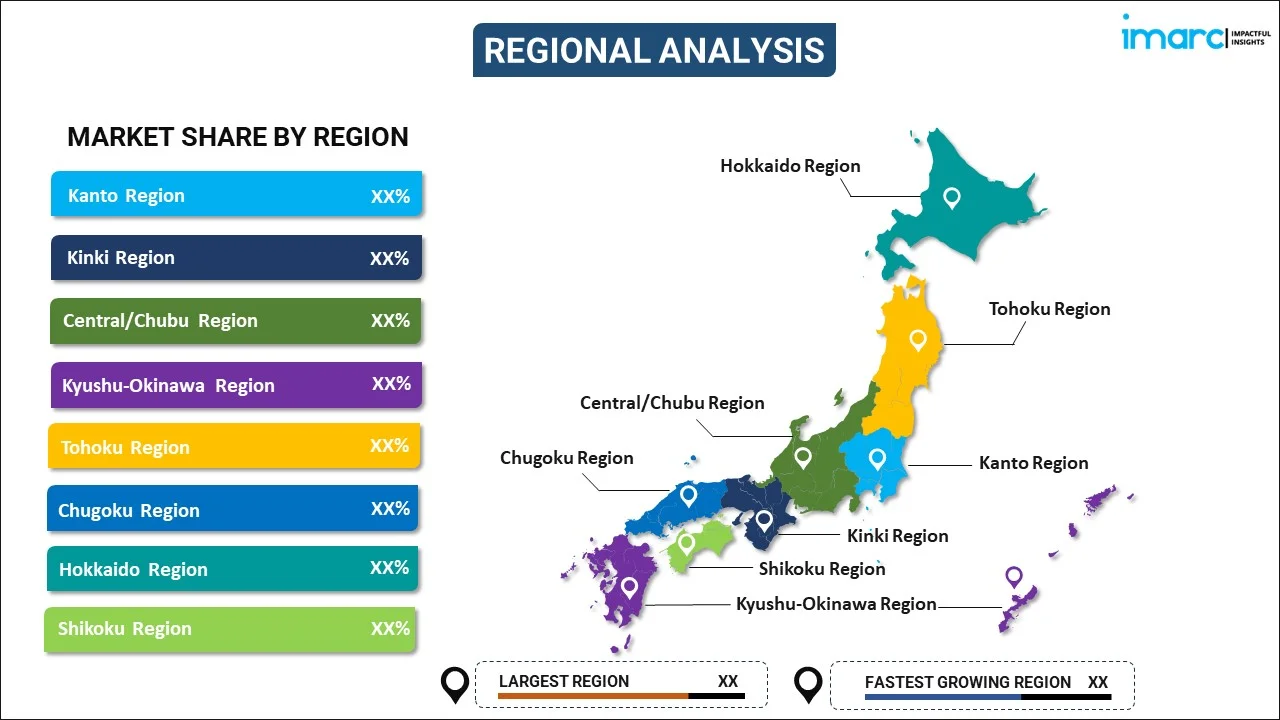

Regional Insights:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Cyber Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu/Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan cyber insurance market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan cyber insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan cyber insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cyber insurance market in Japan was valued at USD 839.8 Million in 2024.

The Japan cyber insurance market is projected to exhibit a CAGR of 19.75% during 2025-2033, reaching a value of USD 4,252.6 Million by 2033.

The Japan cyber insurance market is driven by increasing frequency of cyberattacks, growing digitalization of businesses, and rising awareness about data protection risks. Regulatory pressures, financial exposure from data breaches, and demand for risk management solutions further strengthen the adoption of cyber insurance coverage.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)