Japan Crop Insurance Market Size, Share, Trends and Forecast by Coverage, Distribution Channel, and Region, 2026-2034

Japan Crop Insurance Market Overview:

The Japan crop insurance market size reached USD 2.82 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.11 Billion by 2034, exhibiting a growth rate (CAGR) of 4.27% during 2026-2034. The market is gradually expanding due to climate-related risks, government subsidies, and rising awareness among farmers. Demand is also influenced by modern agricultural practices and the need for income protection during unpredictable weather and pest outbreaks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.82 Billion |

| Market Forecast in 2034 | USD 4.11 Billion |

| Market Growth Rate 2026-2034 | 4.27% |

Japan Crop Insurance Market Trends:

Shifting Weather Patterns Influence Coverage

The market is witnessing steady interest as weather variability becomes a constant concern for farmers. Erratic rainfall, typhoons, and rising temperatures have started to impact harvest cycles across major regions. This has led to an increasing reliance on insurance schemes to offset financial losses. In particular, farmers growing rice, fruits, and vegetables have become more cautious, opting for broader coverage that protects not just yield, but also quality and revenue. Changes in rainfall intensity and frequency have encouraged the expansion of insurance programs in both public and private sectors. Meanwhile, localized weather monitoring systems are being used to assess risks better. Developments in satellite imaging and crop data tracking are also supporting insurers in pricing and claim assessments. This has improved trust in the system and helped reduce fraudulent claims. Some regions have seen cooperative groups pooling risk to improve affordability and uptake. Over time, these small but steady improvements are shaping demand and are likely to strengthen the role of crop insurance in long-term farm sustainability strategies.

.webp)

To get more information on this market Request Sample

Government Support Strengthens Uptake

Government involvement continues to be a key driver of the Japan crop insurance sector. Subsidized premium rates and administrative support from the Ministry of Agriculture have helped make policies more affordable and accessible, especially for smallholders. Through cooperative frameworks and collaboration with local governments, outreach efforts have expanded into previously underserved areas. Programs designed to mitigate the economic effects of crop failure are gaining momentum. In recent years, targeted insurance awareness campaigns have been conducted in areas vulnerable to floods and droughts. Additionally, policy improvements now cover a broader variety of crops, moving beyond staple grains to include specialty produce. On the development side, simplified enrollment processes and digital claim-tracking tools are being introduced. These steps are aimed at improving adoption rates and reducing paperwork burdens on farmers. Insurers are also experimenting with index-based models to make payouts quicker and more transparent. These focused measures, supported by strong policy backing, continue to push the crop insurance market forward, especially as farmers become more risk-conscious and seek financial buffers against unexpected losses.

Japan Crop Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on coverage and distribution channel.

Coverage Insights:

- Multi-Peril Crop Insurance (MPCI)

- Crop-Hail Insurance

The report has provided a detailed breakup and analysis of the market based on the coverage. This includes multi-peril crop insurance (MPCI) and crop-hail insurance.

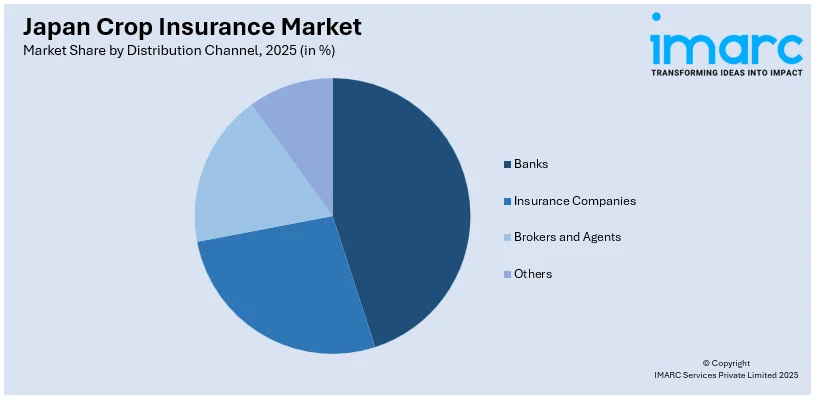

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Banks

- Insurance Companies

- Brokers and Agents

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes banks, insurance companies, brokers and agents, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Crop Insurance Market News:

- July 2024: Zenkyoren partnered with IFAD to issue a USD 50 Million nutrition bond supporting rural development and food security. As part of Japan’s cooperative insurance framework, this initiative strengthened crop insurance relevance by linking it to nutrition, resilience, and sustainable investments in small-scale farming communities.

Japan Crop Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Coverages Covered | Multi-Peril Crop Insurance (MPCI), Crop-Hail Insurance |

| Distribution Channels Covered | Banks, Insurance Companies, Brokers and Agents, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan crop insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan crop insurance market on the basis of coverage?

- What is the breakup of the Japan crop insurance market on the basis distribution channel?

- What is the breakup of the Japan crop insurance market on the basis of region?

- What are the various stages in the value chain of the Japan crop insurance market?

- What are the key driving factors and challenges in the Japan crop insurance?

- What is the structure of the Japan crop insurance market and who are the key players?

- What is the degree of competition in the Japan crop insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan crop insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan crop insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan crop insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)