Japan Contactless Payment Market Report by Technology (Near Field Communication (NFC), Radio Frequency Identification (RFID), Infrared (IR), and Others), Device (Smartphones and Wearables, Point-of-Sale Terminals, Smart Cards), Solution (Payment Terminal Solution, Transaction Management, Security and Fraud Management, Hosted Point-of-Sales, Payment Analytics), Application (BFSI, Retail, Transportation, Healthcare, and Others), and Region 2025-2033

Market Overview:

Japan contactless payment market size reached USD 8.1 Trillion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.3 Trillion by 2033, exhibiting a growth rate (CAGR) of 14.60% during 2025-2033. The increasing usage of digital technologies for daily purposes, along with the inflating need for secure payment methods, is primarily driving the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.1 Trillion |

| Market Forecast in 2033 | USD 8.3 Trillion |

| Market Growth Rate (2025-2033) | 14.60% |

Contactless payment is a secure and user-friendly payment method that allows customers to conduct transactions with ease by simply tapping or waving their contactless-enabled cards, smartphones, or wearable devices near a payment terminal. This technology employs advanced features to facilitate rapid and smooth transactions. Furthermore, it offers an elevated level of convenience, enabling customers to swiftly complete purchases, especially for low-value transactions. It can streamline operations, reduce expenses associated with handling cash, and provide valuable data insights for analyzing customer behavior and preferences. Its global adoption is on the rise due to the manifold advantages it presents to businesses, including improved transaction speed, enhanced customer satisfaction, and heightened operational efficiency.

Japan Contactless Payment Market Trends:

In the context of the Japan market, the main driving force behind the growth of contactless payments is the growing preference for convenience among consumers in Japan. This is coupled with an increasing demand for secure payment methods that safeguard customer data and reduce the risk of fraud, providing a significant boost to the market. Additionally, Japanese consumers are embracing digital and mobile technologies for various daily activities, including making payments. The widespread use of smartphones and wearable devices, driven by rapid digitization efforts, has created a favorable environment for contactless payment solutions, further fueling demand within the country. Furthermore, governmental and regulatory bodies in Japan are actively promoting the adoption of contactless payments as part of broader financial inclusion initiatives. These efforts aim to reduce cash usage, enhance transaction transparency, and establish the necessary infrastructure and regulatory frameworks to support the growth of contactless payment systems. Continuous technological advancements play a vital role in the expansion of the contactless payment market in Japan. The availability of NFC-enabled devices, improvements in payment terminal infrastructure, and the integration of contactless capabilities into various forms such as cards, smartphones, and wearables have made contactless payments more accessible and appealing to both businesses and consumers. In light of these factors, the contactless payment market is poised for significant growth in Japan in the coming years.

Japan Contactless Payment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on technology, device, solution, and application.

Technology Insights:

- Near Field Communication (NFC)

- Radio Frequency Identification (RFID)

- Infrared (IR)

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes near field communication (NFC), radio frequency identification (RFID), infrared (IR), and others.

Device Insights:

- Smartphones and Wearables

- Point-of-Sale Terminals

- Smart Cards

A detailed breakup and analysis of the market based on the device have also been provided in the report. This includes smartphones and wearables, point-of-sale terminals, and smart cards.

Solution Insights:

- Payment Terminal Solution

- Transaction Management

- Security and Fraud Management

- Hosted Point-of-Sales

- Payment Analytics

The report has provided a detailed breakup and analysis of the market based on the solution. This includes payment terminal solution, transaction management, security and fraud management, hosted point-of-sales, and payment analytics.

Application Insights:

- BFSI

- Retail

- Transportation

- Healthcare

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes BFSI, retail, transportation, healthcare, and others.

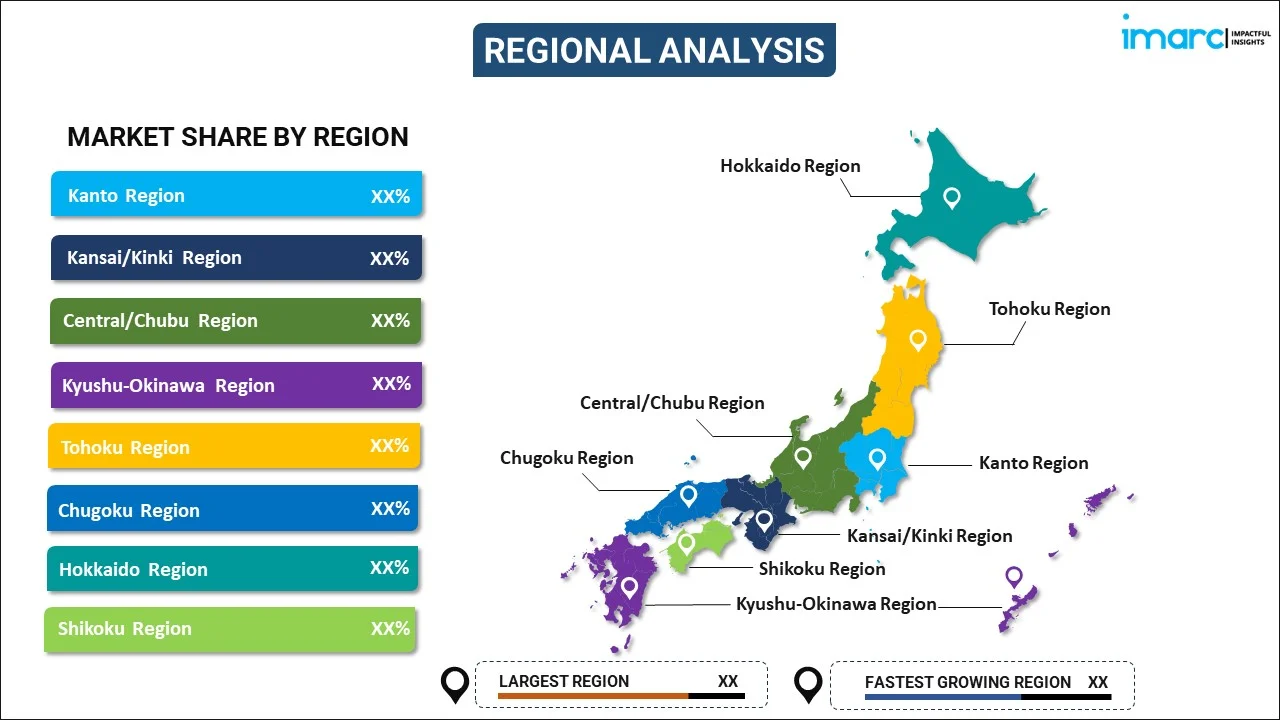

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Contactless Payment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Trillion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Near Field Communication (NFC), Radio Frequency Identification (RFID), Infrared (IR), Others |

| Devices Covered | Smartphones and Wearables, Point-of-Sale Terminals, Smart Cards |

| Solutions Covered | Payment Terminal Solution, Transaction Management, Security and Fraud Management, Hosted Point-of-Sales, Payment Analytics |

| Applications Covered | BFSI, Retail, Transportation, Healthcare, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan contactless payment market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan contactless payment market?

- What is the breakup of the Japan contactless payment market on the basis of technology?

- What is the breakup of the Japan contactless payment market on the basis of device?

- What is the breakup of the Japan contactless payment market on the basis of solution?

- What is the breakup of the Japan contactless payment market on the basis of application?

- What are the various stages in the value chain of the Japan contactless payment market?

- What are the key driving factors and challenges in the Japan contactless payment?

- What is the structure of the Japan contactless payment market and who are the key players?

- What is the degree of competition in the Japan contactless payment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan contactless payment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan contactless payment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan contactless payment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)