Japan Consumer Credit Market Report by Credit Type (Revolving Credits, Non-Revolving Credits), Service Type (Credit Services, Software and IT Support Services), Issuer (Banks and Finance Companies, Credit Unions, and Others), Payment Method (Direct Deposit, Debit Card, and Others), and Region 2026-2034

Market Overview:

Japan consumer credit market size reached USD 737.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,018.3 Million by 2034, exhibiting a growth rate (CAGR) of 3.66% during 2026-2034. The growing need for credit in emergency cases, increasing spending on travel and leisure activities, and advancements in digital banking and fintech providing easy access to credit represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 737.0 Million |

| Market Forecast in 2034 | USD 1,018.3 Million |

| Market Growth Rate (2026-2034) | 3.66% |

Access the full market insights report Request Sample

Consumer credit refers to financial services that allow individuals to borrow funds for personal expenses, such as purchasing consumer goods, covering medical bills, or financing education. It is typically available in various forms, including credit cards, personal loans, installment plans, auto loans, and student loans. It offers a convenient means to manage finances and make essential purchases without the need for substantial upfront payments. It allows individuals to make purchases and repay the borrowed amount over time in full by the due date or make partial payments, incurring interest on the remaining balance. It provides enhanced flexibility to people by allowing them to make purchases and pay off the balance over time. It serves as a safety net during emergencies and prevents financial crises. It enables individuals to maintain transparency in income and expenditure disparities. It assists in stimulating economic growth by encouraging consumer spending. It aids in simplifying budgeting and expense tracking and is helpful in financial planning. Besides this, it is beneficial in enhancing credit history for obtaining favorable terms on future loans, such as mortgages, and may result in lower interest rates. As it makes it easier for individuals to manage their finances, the demand for consumer credit is increasing in Japan.

Japan Consumer Credit Market Trends:

At present, the rising use of credit cards, as they offer rewards programs, cashback incentives, or travel perks to users, represents one of the major factors supporting the growth of the market in Japan. Besides this, the increasing utilization of consumer credit due to their lower interest rates in the country is strengthening the market growth. Additionally, there is a rise in the demand for credit in cases of emergencies among individuals. This, coupled with the increasing adoption of credit cards for everyday transactions, is bolstering the market growth in Japan. Apart from this, the growing demand for consumer credit on account of the rising spending on travel and leisure activities is positively influencing the market in the country. In addition, advancements in digital banking and fintech provide easy access of credit to individuals, which is contributing to the market growth. Moreover, the increasing need for consumer credit to start or expand a small business is offering lucrative growth opportunities to industry investors in the country. In line with this, the growing demand for credit cards, as they are easy to use, is offering a positive market outlook in Japan. Furthermore, the rising adoption of credit among students for educational purposes is impelling the market growth in the country.

Japan Consumer Credit Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on credit type, service type, issuer, and payment method.

Credit Type Insights:

To get detailed segment analysis of this market Request Sample

- Revolving Credits

- Non-Revolving Credits

The report has provided a detailed breakup and analysis of the market based on the credit type. This includes revolving credits and non-revolving credits.

Service Type Insights:

- Credit Services

- Software and IT Support Services

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes credit services and software and IT support services.

Issuer Insights:

- Banks and Finance Companies

- Credit Unions

- Others

The report has provided a detailed breakup and analysis of the market based on the issuer. This includes banks and finance companies, credit unions, and others.

Payment Method Insights:

- Direct Deposit

- Debit Card

- Others

A detailed breakup and analysis of the market based on the payment method have also been provided in the report. This includes direct deposit, debit card, and others.

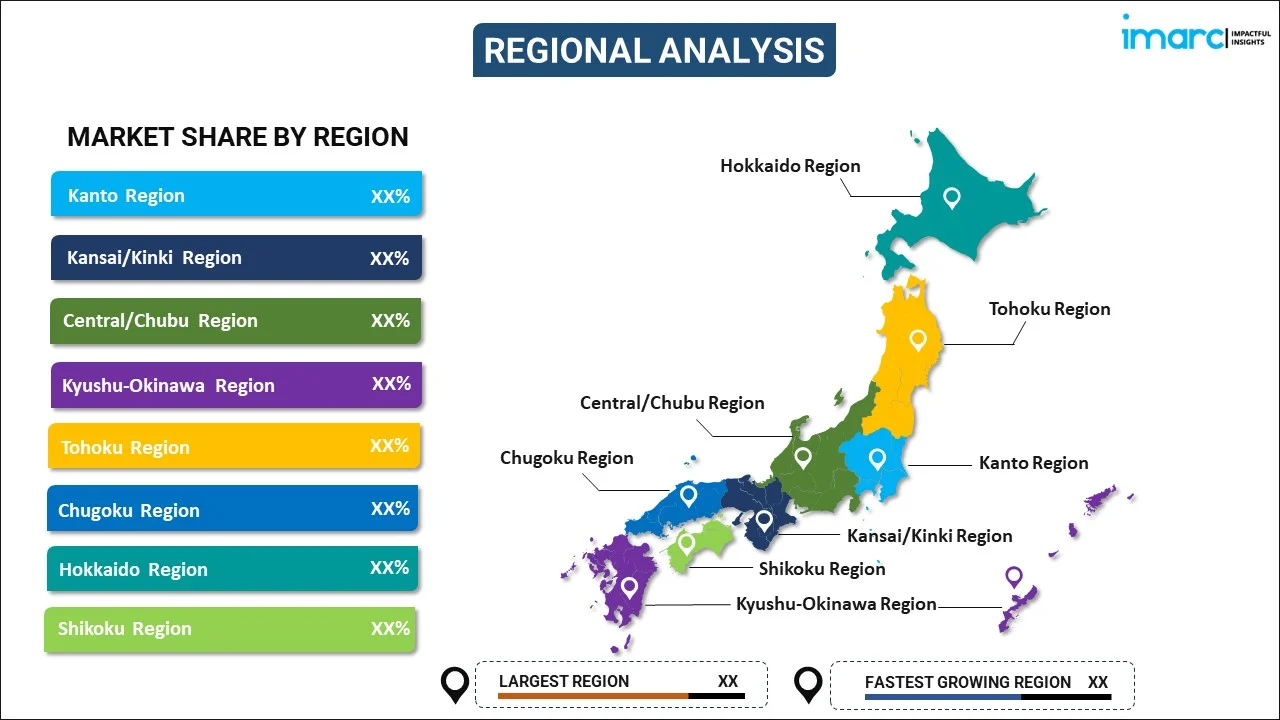

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- ACOM Co. Ltd. (Mitsubishi UFJ Financial Group Inc.)

- AIFUL Corporation

- Jaccs Co. Ltd.

- Orient Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Japan Consumer Credit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Credit Types Covered | Revolving Credits, Non-Revolving Credits |

| Service Types Covered | Credit Services, Software and IT Support Services |

| Issuers Covered | Banks and Finance Companies, Credit Unions, Others |

| Payment Methods Covered | Direct Deposit, Debit Card, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | ACOM Co. Ltd. (Mitsubishi UFJ Financial Group Inc.), AIFUL Corporation, Jaccs Co. Ltd., Orient Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan consumer credit market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan consumer credit market on the basis of credit type?

- What is the breakup of the Japan consumer credit market on the basis of service type?

- What is the breakup of the Japan consumer credit market on the basis of issuer?

- What is the breakup of the Japan consumer credit market on the basis of payment method?

- What are the various stages in the value chain of the Japan consumer credit market?

- What are the key driving factors and challenges in the Japan consumer credit?

- What is the structure of the Japan consumer credit market and who are the key players?

- What is the degree of competition in the Japan consumer credit market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan consumer credit market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan consumer credit market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan consumer credit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)