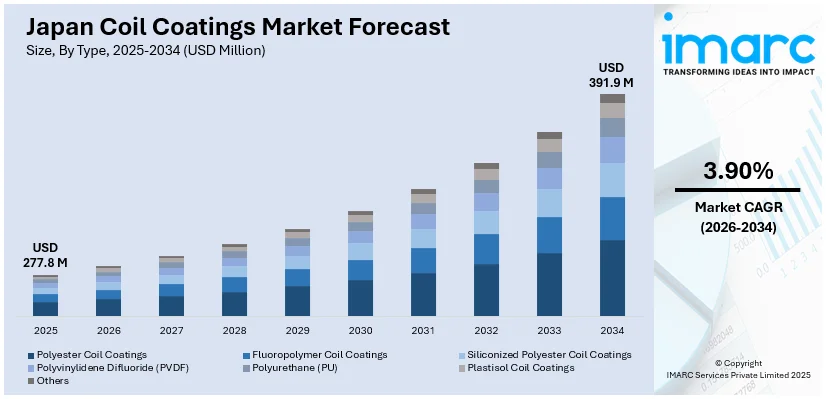

Japan Coil Coatings Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2026-2034

Japan Coil Coatings Market Size and Share:

The Japan coil coatings market size was valued at USD 277.8 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 391.9 Million by 2034, exhibiting a CAGR of 3.90% from 2026-2034. The market is driven by an increasing demand for pre-coated metal in the construction, automotive, and appliance industries. Growing emphasis on energy-efficient and sustainable building materials, advancements in coating technologies, and government initiatives promoting eco-friendly solutions further increase the Japan coil coating market share, alongside robust infrastructure development and industrialization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 277.8 Million |

|

Market Forecast in 2034

|

USD 391.9 Million |

| Market Growth Rate (2026-2034) | 3.90% |

The Japan coil coatings market is driven by several key factors, reflecting evolving industry demands and market trends. One primary driver is the expanding construction sector, fueled by urbanization and significant investments in infrastructure projects. For instance, Tokyo unveiled the Roppongi 5-chome West District Urban Redevelopment Project, set to commence construction in 2025. Dubbed the "Second Roppongi Hills," this initiative includes five blocks with diverse functions. Highlights include a 66-story office tower, a 70-story residential building with 800 units, and educational facilities. The project will also enhance infrastructure with pedestrian pathways and green spaces, aiming to create a "forest in the city center." Completion is anticipated by 2030, transforming the area's skyline and community dynamics.

To get more information on this market Request Sample

Coil coatings provide durability, corrosion resistance, and aesthetic appeal, making them indispensable for building materials such as roofing, wall panels, and cladding. One of the significant Japan coil coating market trends is the significant expansion of the automotive industry. As manufacturers increasingly use pre-coated metal components to enhance vehicle durability and reduce maintenance costs, this is contributing significantly to the market growth. The appliance sector also plays a crucial role in furthering the market expansion, with the demand for coated metals rising due to their application in durable, visually appealing, and corrosion-resistant home and industrial appliances.

Environmental sustainability is a critical factor influencing the Japan coil coatings market growth. With stringent regulations and rising consumer awareness, manufacturers are developing eco-friendly coatings, such as water-based and low-VOC products, to align with Japan’s environmental policies. Technological advancements, including improved application techniques and innovative formulations, boost the adoption of coil coatings. Increased focus on energy efficiency and lightweight materials in the construction and automotive sectors also supports market growth across the country.

Japan Coil Coatings Market Trends:

Growth in the Building and Construction Industry

The construction sector in Japan is projected to grow at 4.60% during 2024-2032, driven by urbanization, infrastructure development, and sustainability initiatives, in turn, significantly fueling the demand for coil coatings. These coatings enhance the durability and aesthetic appeal of construction materials such as roofing, siding, and cladding. With growing emphasis on energy-efficient and eco-friendly buildings, advanced coil coatings that offer weather resistance and thermal performance are increasingly preferred. The push for modern architectural designs further boosts the adoption of premium coatings, ensuring their widespread use in residential and commercial projects. For instance, in November 2023, Mori Building Co., Ltd. launched Azabudai Hills, a mixed-use complex in Tokyo, emphasizing a "Green & Wellness" urban lifestyle. Spanning 8.1 hectares, it features residential, commercial, cultural, and medical facilities, including Japan's tallest building at 330 meters. The project aims to integrate nature with urban living, supporting approximately 20,000 office workers and 3,500 residents. Azabudai Hills also promotes sustainability through renewable energy and innovative design, fostering a vibrant community and enhancing Tokyo's global competitiveness.

Advancements in Automotive Manufacturing

Japan's automotive industry, a global leader in innovation, contributes substantially to the coil coatings market. Coil coatings are used for vehicle components requiring durability, corrosion resistance, and enhanced aesthetics. As per the Motor Industry of Japan 2024 report by JAMA, motor vehicle production in Japan stood at 8.99 million units in 2023, up 14.8% from 2022, registering an increase for the first time in five years. Electric car new registrations also jumped 51% to a total of 88,512. The rising demand for electric vehicles and lightweight materials increases the need for high-performance coatings that withstand harsh conditions. Manufacturers also seek coatings that align with eco-friendly standards, spurring interest in low-VOC and sustainable coil coating solutions tailored to automotive applications. This is further propelling the demand for coil coatings in automotive manufacturing, thus creating a positive Japan coil coatings market outlook.

Demand for Durable and Sustainable Coating Solutions

With a growing emphasis on environmental regulations and sustainable practices, there is a heightened demand for coil coatings that offer superior performance and reduced environmental impact. Advanced coatings that resist corrosion, UV rays, and wear extend the lifespan of materials, reducing maintenance costs. This trend supports the adoption of eco-friendly coatings, meeting the requirements of Japan's environmentally conscious industries and regulatory frameworks. For instance, Nippon Paint has introduced a chromium (Cr) free primer for coil coatings in response to increasing regulations on VOCs and heavy metals in the construction industry. This eco-friendly primer meets safety standards by eliminating health risks associated with hexavalent chromium, a known carcinogen, while offering superior corrosion resistance and mechanical properties compared to traditional oil-based primers.

Japan Coil Coatings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan coil coatings market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, application, and end use industry.

Analysis by Type:

- Polyester Coil Coatings

- Fluoropolymer Coil Coatings

- Siliconized Polyester Coil Coatings

- Polyvinylidene Difluoride (PVDF)

- Polyurethane (PU)

- Plastisol Coil Coatings

- Others

Polyester coil coatings are expected to be the largest segment in the market because of their ability to accommodate several other options, value for money, and long-lasting. They are extensively used in constructions and appliances as well as have good weathering and ultraviolet ray resistance. They are versatile in adopting vibrant colors and finishes that match Japan’s architectural and designer inclinations, leading to their wide use in several construction sectors including roofing and cladding.

Fluoropolymer coatings are useful for their high density, chemical inertness, and resistance to aggressive conditions. Most popular in industrial, and high-performance architecture, they provide long-lasting shields against corrosion, fading, and ultraviolet exposure. Such characteristics make them suitable for Japan’s coasting and urban regions, with poor physical and chemical conditions.

Siliconized polyester coatings combine affordability with enhanced weather resistance, making them a preferred choice in roofing and siding. They offer better gloss retention and flexibility compared to standard polyester, suiting Japan's demand for durable and aesthetically appealing materials in construction, especially for residential and commercial buildings.

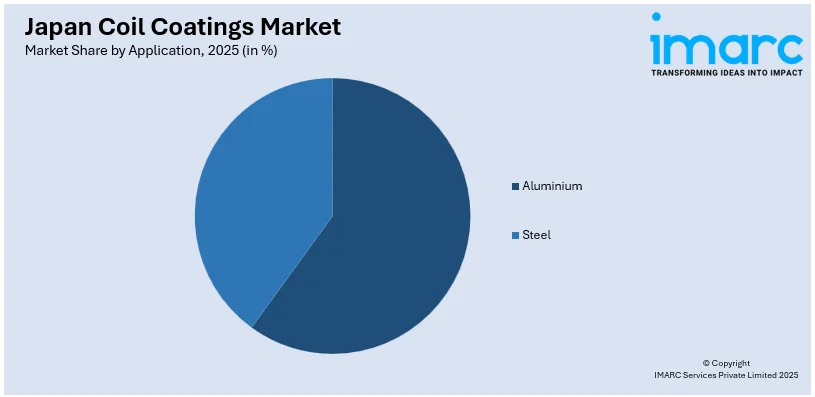

Analysis by Application:

Access the Comprehensive Market Breakdown Request Sample

- Aluminium

- Steel

The Japan coil coatings market is likely to be dominated by Aluminium because of its corrosion resistance, and lightweight, and recyclable characteristics. It is commonly used in the construction, transportation, and electronics industries. Due to its flexibility within architecture-related products, such as cladding or roofing, aluminium is favored more because of aspects like durability and consideration of the environment. The rising demand for environment-friendly and energy-efficient materials is further dominating the market growth.

Steel plays a crucial role in the Japan coil coatings market due to its strength, durability, and wide applicability in the construction and industrial sectors. The coated steel is used in infrastructural activities, roofing, and automotive parts because it has high tensile strength as well as offers the benefit of corrosion protection when given the right treatment. The Japanese preference for durability and longevity especially in infrastructure projects, and the accessibility and affordable nature of steel make it an unyielding factor that drives its use in the coil coatings market.

Analysis by End Use Industry:

- Building and Construction

- Appliances

- Automotive

- Others

The building and construction sector is expected to dominate the Japan coil coatings market due to the widespread use of coated materials like aluminum and steel in roofing, cladding, and structural components. Coil coatings provide durability, weather resistance, and aesthetic appeal, which are essential for Japan’s urban infrastructure. The focus on sustainable and earthquake-resilient buildings further boosts demand for coated materials, making the sector a significant driver of growth in the market.

The appliance sector drives the Japan coil coatings market due to the need for durable, corrosion-resistant, and visually appealing materials. The main applications of coated metals include refrigerators and washing machine outer bodies, along with other household appliances, these make the appliance durable and beautiful. The developed electronics, white goods, and other consumer appliances industries in Japan, and growing environmental consciousness and demand for such coils, promote a huge demand for this segment in the coil coatings market.

Major industries such as the automotive industry have a large demand for coil coatings to produce lightweight, anti-corrosion, and high-durability automotive parts. Coil coatings that improve the performance and visuals of vehicles to meet the requirements of the Japanese automobile industry. Due to environment conservation measures and fuel economy, vehicle manufacturers continue to use more coated material, thus securing the industry's significant share in the market.

Regional Analysis:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region drives the Japan coil coatings market due to its dense urbanization and significant demand from the construction and automotive sectors. The region's focus on modernizing infrastructure and residential developments increases the use of coated metals for roofing and cladding. Additionally, the strong presence of automotive manufacturers and appliance industries further fuels the demand for durable, corrosion-resistant coil coatings, solidifying the region’s importance in the market.

The Kansai region contributes to the coil coatings market through its robust industrial base and thriving construction activities. As a hub for manufacturing appliances and electronics, Kansai relies heavily on coated metals for both functional and aesthetic applications. Urban redevelopment projects and infrastructure expansion also demand high-quality, weather-resistant coatings for buildings, ensuring steady growth in the market for coil coatings in this region.

The Central/Chubu region’s role as an industrial powerhouse, particularly in automotive production, drives the coil coatings market. Lightweight and corrosion-resistant materials are essential for automotive components, increasing demand for coated metals. Additionally, the region’s infrastructure development projects and appliance manufacturing industry contribute to the need for high-performance coil coatings, increasing the Japan coil coatings market share.

The Kyushu-Okinawa region’s growing construction activities and focus on infrastructure development contribute significantly to the coil coatings market. Coastal conditions in the region necessitate corrosion-resistant materials for buildings and appliances. Moreover, the region's expanding automotive and manufacturing industries create a consistent demand for durable and eco-friendly coatings, further supporting market growth.

In the Tohoku region, reconstruction and redevelopment projects post-natural disasters are key drivers of the coil coatings market. The demand for resilient and weatherproof materials in building and infrastructure projects boosts the use of coated metals. Additionally, the region's emerging manufacturing activities contribute to the need for durable and efficient coatings, ensuring market growth.

The Chugoku region’s industrial base, particularly in steel production, plays a vital role in driving the coil coatings market. The region also benefits from ongoing construction and infrastructure upgrades that require corrosion-resistant and durable materials. With a focus on expanding industrial and residential areas, the demand for high-quality coil coatings remains strong in Chugoku.

Hokkaido’s harsh climatic conditions and focus on infrastructure resilience drive demand for coil coatings. Coated metals are essential for weatherproofing buildings and appliances, ensuring durability in extreme environments. The region's growing industrial activities and investment in construction projects further contribute to the need for high-performance coil coatings, supporting steady market expansion.

The Shikoku region supports the coil coatings market through its focus on residential and commercial building projects. The region’s mild coastal conditions necessitate weather-resistant and aesthetically appealing coatings for construction materials. Additionally, the presence of small-scale manufacturing industries drives demand for coated metals in appliances and industrial applications, ensuring market stability.

Competitive Landscape:

The Japan coil coatings market is marked by intense competition among domestic and international players, driven by advancements in technology and product innovation. Key companies focus on developing eco-friendly, durable, and high-performance coatings to cater to growing demand from the construction, automotive, and appliance sectors. Prominent firms leverage partnerships, R&D investments, and regional expertise to expand their market presence. Rising infrastructure projects, stringent environmental regulations, and the shift toward sustainable materials further intensify competition. Established manufacturers dominate through extensive distribution networks, while emerging players emphasize niche offerings and customization, fostering a dynamic and evolving competitive landscape.

Latest News and Developments:

- In October 2024, Nippon Paint Holdings declared its plans to pay US$2.3 billion to acquire global chemicals formulator AOC. Lone Star Fund will sell its entire ownership stake in AOC's parent company LSF11 A5 TopCo and its subsidiaries to the Japanese corporation. The Tennessee-based company manufactures composite resins, colorants, and coatings.

- In May 2023, Kansai Paint Co., Ltd. successfully acquired the global railway coatings business assets from Beckers Group's Becker Industrie SAS. This acquisition enhances Kansai HELIOS's market position in Europe, particularly in France, where it opened a new subsidiary. The company aims to expand its industrial coatings expertise and strengthen its competitiveness through strategic investments and mergers.

Japan Coil Coatings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyester Coil Coatings, Fluoropolymer Coil Coatings, Siliconized Polyester Coil Coatings, Polyvinylidene Difluoride (PVDF), Polyurethane (PU), Plastisol Coil Coatings, Others |

| Applications Covered | Aluminium, Steel |

| End Use Industries Covered | Building and Construction, Appliances, Automotive, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan coil coatings market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan coil coatings market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan coil coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Japan coil coatings market was valued at USD 277.8 Million in 2025.

The growth of Japan's coil coatings market is driven by rising construction activities, an increasing demand for durable and eco-friendly materials, advancements in coating technologies, and the expanding automotive and electronics sectors. Additionally, a focus on energy-efficient buildings and the adoption of nanotechnology coatings further fuel market expansion.

The Japan coil coatings market is projected to exhibit a CAGR of 3.90% during 2026-2034, reaching a value of USD 391.9 Million by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)