Japan Coal Market Report by End User (Power Station (Thermal Coal), Coking Feedstock (Coking Coal), and Others), and Region 2026-2034

Japan Coal Market Size:

Japan coal market size reached 666.2 Thousand Tons in 2025. Looking forward, IMARC Group expects the market to reach 882.1 Thousand Tons by 2034, exhibiting a growth rate (CAGR) of 3.17% during 2026-2034. The market is primarily driven by the growing population, urbanization, the significant increase in energy demand, and technological advancements in clean coal technologies for reducing emissions while improving the energy efficiency of coal-fired plants in Japan.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

666.2 Thousand Tons |

|

Market Forecast in 2034

|

882.1 Thousand Tons |

| Market Growth Rate 2026-2034 | 3.17% |

Japan Coal Market Analysis:

- Major Market Drivers: Japan coal market is primarily driven by the country's heavy reliance on coal to produce energy, particularly due to the wake of the Fukushima nuclear accident which resulted in a decrease in the production of nuclear power. Moreover, the increasing market demand is also influenced by economic considerations, such as concerns about energy security and the accessibility of relatively inexpensive imported coal from nations like Australia and Indonesia.

- Key Market Trends: Japan is shifting toward cleaner coal technologies due to complying with more stringent environmental rules and lower emissions policies. Moreover, there has been a growing trend toward cleaner coal technology and efficiency improvements in coal-fired power plants.

- Competitive Landscape: Some of the major market players in the Japan coal industry include ITOCHU Corporation, Mitsubishi Chemical Group Corporation, among many others.

- Challenges and Opportunities: Challenges include environmental concerns, leading to regulatory pressure to lower coal's proportion in the energy mix. The Japan coal recent market opportunities include advanced coal technologies in Japan that ensure enhanced efficacy and help mitigate ecological consequences.

Japan Coal Market Trends:

Growing Population and Urbanization

There is significant internal migration-related growth in metropolitan regions. As cities require a constant and significant electrical supply to sustain residential, commercial, and industrial activity, urbanization increases the density of energy use. For instance, as per Statistics Bureau of Japan reports as of October 2023, 124,352 thousand people were living in Japan. 60,492 thousand males and 63,859 thousand females were counted among them. In terms of migration, there was a positive change in the Japanese population and a positive change in the foreign population for the second year in a row. Tokyo-to, Kanagawa-ken, Osaka-fu, Aichi-ken, and Saitama-ken were the five prefectures with the largest populations, accounting for 37.7% of the total population. Also, the increasing urbanization of society has led to the need for a consistent energy source to sustain building management systems and public transportation, individuals, and commercial activities. Hence, coal still plays an essential role in meeting these urban energy demands due to its capacity to provide electricity on a vast and consistent scale, contributing to Japan coal market growth.

Increasing Energy Needs

As per Low Carbon Power in 2023, more than half of Japan's power is produced from various sources, indicating that the country's electricity consumption is still heavily reliant on fossil fuels. In particular, coal makes up almost 30% of all energy produced. According to the Japan Electric Power Information Center, Inc. (JEPIC), Japan's overall producing capacity reached 314.7 Gigawatt (GW) at the end of fiscal year 2021, 49.4% of this was thermal power, of which 15.4% came from coal. Furthermore, plans are in place to add 20.6 Gigawatt (GW) of generating capacity by the fiscal year 2031. In addition, this expansion also involves new development to plan capacity adjustments for already-existing plants aside from those slated for decommissioning. Also, the ongoing reliance on coal is driven by the limited natural resources of Japan and the growing need for energy security. Hence, the efficiency of contemporary coal power technologies helps close the gap between present energy needs and long-term sustainability objectives, thus increasing the Japan coal market revenue.

Technological Advancements

Japan has been implementing cutting-edge coal technologies that boost the effectiveness and lessen the environmental effects of coal-fired power production. Additionally, investments in Ultra-Supercritical (USC) and Integrated Gasification Combined Cycle (IGCC) facilities have increased the bar for coal efficiency. According to Mitsubishi Power, Integrated Coal Gasification Combined Cycle (IGCC) power plants represent an advanced thermal power system that integrates coal gasification with the Gas Turbine Combined Cycle (GTCC) system thus achieving significantly improving power generation efficiency and environmental performance. Along with this, compared to conventional coal-fired thermal power plants, large-scale IGCC systems lower CO2 emissions and improve power-generating efficiency by around 15%. Besides, USC plants run at extremely high pressures and temperatures, outperforming conventional coal-burning techniques in terms of efficiency and lowering carbon dioxide emissions per unit of power produced. These developments link coal with global efforts to minimize carbon footprints and satisfy domestic energy demands effectively, making coal a more attractive and less harmful alternative for the environment, thus creating a positive Japan coal market outlook.

Japan Coal Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on end user.

Breakup by End User:

- Power Station (Thermal Coal)

- Coking Feedstock (Coking Coal)

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes power station (thermal coal), coking feedstock (coking coal), and others.

Powe station (thermal coal) is the main fuel used in power plants in Japan and is essential to the country's energy output. Japan is committed to lowering its greenhouse gas (GHG) emissions and needs reliable, reasonably priced electricity, thus coal-fired power plants are influencing the market growth. Additionally, thermal coal is preferred for its steady power supply as it is dependable and affordable. Moreover, the international trade dynamics have an impact on this market sector due to Japan importing large amounts of thermal coal to fulfil its energy needs, and it modifies imports in response to changes in domestic policy and global market volatility. Hence, key players are introducing advanced product variants to meet these needs. As per the Japan coal market recent developments, Yokosuka Thermal Power Station Unit 2, began commercial operations in December 2023 and is managed by JERA Co., Inc. through its subsidiary JERA Power Yokosuka G.K. Additionally, Unit 2 is a highly efficient coal-fired power plant that generates power using an ultra-supercritical (USC) technology. With a 650 MW or more producing capacity, it is essential to maintain a steady supply of power. Moreover, JERA expedited the operating start of Unit 2 beyond its planned February 2024 date to increase supply capacity for the impending winter season. In addition, JERA is still dedicated to gradually swapping out outdated infrastructure with state-of-the-art power plants to improve electrical dependability and lower CO2 emissions across the region.

According to Japan coal market overview, coking feedstock (coking coal) is mostly utilized as a feedstock in the production of coke and is an essential part of Japan's steel manufacturing sector. Moreover, high-quality coking coal is required for manufacturing coke for the blast furnace steelmaking process. Furthermore, Japan is mostly dependent on imports from nations like Australia since it does not have large indigenous coal reserves. Additionally, the quality of coking coal for the manufacturing of steel is determined by its qualities, namely its carbon content and ash characteristics, which have an impact on the productivity and efficiency of Japanese steel makers.

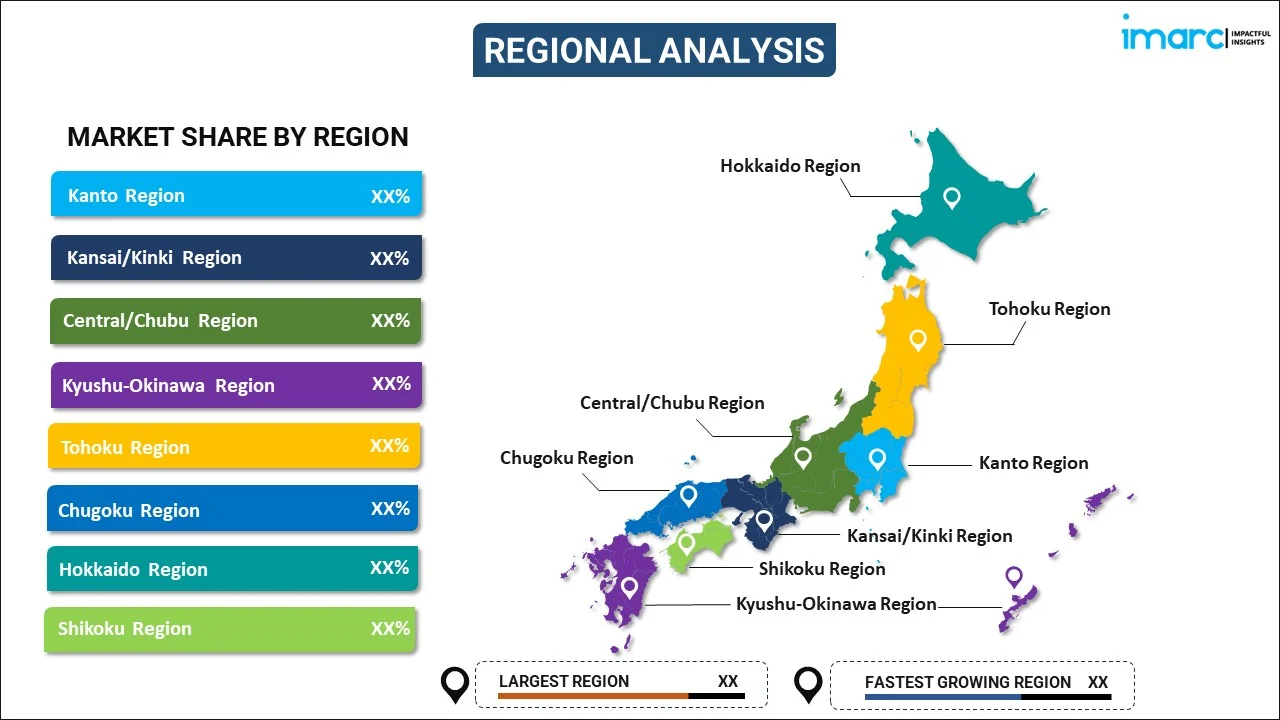

Breakup by Region:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major markets in the region, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

According to the Japan coal market forecast, the Kanto region, encompassing Tokyo and its surrounding prefectures, is a major hub for energy consumption in Japan. Additionally, coal usage in Kanto is primarily concentrated in thermal power generation. The region has seen a gradual shift toward renewable energy, coal-fired plants in Chiba and other areas remain significant for peak electricity demand periods. Furthermore, the region's proximity to major ports also facilitates the import of high-quality coal, making it a critical entry point in the coal supply chain across Japan.

The Kansai or Kinki region, with Osaka at its heart, traditionally relies on coal for a significant portion of its energy production, particularly in power plants and heavy industries like steel manufacturing. Additionally, the energy companies have been proactive in adopting cleaner coal technologies and exploring carbon capture solutions to reduce environmental impact. Furthermore, the strategic location of ports such as Kobe enhances its capacity for coal imports, ensuring a steady supply for its power stations and industrial plants contributing to Japan coal demand across the region.

The Central or Chubu region is known for its diverse industrial activities, including automobile manufacturing in Aichi and ceramic production in Gifu. Additionally, coal plays an essential role in energy production, particularly for industrial use. Moreover, power plants in this region have integrated advanced coal combustion technologies to enhance efficiency and minimize emissions. Hence, the presence of technology-driven companies in the region supports the development of innovative coal usage methods, aligning with Japan's energy policy for a sustainable and stable energy supply.

The Kyushu-Okinawa region, with its heavy industrial sectors, particularly in northern Kyushu, relies extensively on coal for energy. Coal-fired power plants in Fukuoka and Kagoshima are pivotal, especially given the region's lesser focus on nuclear power following nationwide safety concerns post-Fukushima. The region's ports facilitate coal imports, primarily from Australia and Indonesia, supporting local industries and electricity generation needs.

The Tohoku region, largely rural yet industrially significant in certain areas like Miyagi and Iwate, uses coal primarily for power generation. The region has increased its coal import capacity post the earthquake and tsunami, which caused a spike in demand for fossil fuel-based power to compensate for the damaged nuclear facilities. Moreover, the ongoing reconstruction efforts also drive the demand for coal-powered energy to support rebuilding and industrial activities.

In the Chugoku region, coal is a cornerstone for energy production, particularly in Hiroshima and Okayama, where several large coal-fired power plants operate. Additionally, the dependency on coal is driven by its industrial base, including shipbuilding and chemical manufacturing across the region. Furthermore, recent initiatives aim to enhance the efficiency of existing coal-fired plants and reduce their environmental footprint, in line with national goals for energy sustainability.

Hokkaido, characterized by its cold climate and vast agricultural sectors, utilizes coal mainly for heating and power generation. Additionally, the extensive coal mines supported local energy needs across the region. Furthermore, modern times see imported coal becoming more predominant, with power plants in cities like Tomakomai utilizing coal to ensure a stable energy supply during harsh winters.

Shikoku region, with a less dense industrial landscape compared to other regions, still holds strategic coal-fired power plants in Ehime and Kagawa. These plants are essential for regional energy security, providing a reliable power supply to support local industries and residential needs. Furthermore, the ongoing efforts to integrate renewable energy sources are necessitating continued investment in cleaner coal technologies across the region.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided. Some of the major market players in the Japan coal companies include ITOCHU Corporation, and Mitsubishi Chemical Group Corporation, among many others.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- At present, key players in the market are actively engaged in various strategies to expand Japan coal market share. Additionally, companies like J-Power and Nippon Steel are investing in advanced coal utilization technologies such as Integrated Gasification Combined Cycle (IGCC) and carbon capture, utilization, and storage (CCUS) to enhance efficiency and reduce emissions. These efforts align with Japan's broader energy goals of ensuring stability and reducing environmental impact. Additionally, collaborations with international coal suppliers aim to secure stable and cost-effective coal imports. Furthermore, corporate strategies also emphasize sustainability by gradually integrating renewable energy sources, indicating a shift toward a more balanced energy mix while maintaining coal as a critical component in the short to medium term among several Japan coal companies. For instance, on 6 July 2023, J-POWER, IINO LINES, and Norsepower have announced a collaboration to equip the world's first dedicated coal carrier with a rotor sail, a wind propulsion auxiliary device. Electric Power Development Co., Ltd. (J-POWER) and IINO Kaiun Kaisha, Ltd. (IINO LINES) will install the rotor sail manufactured by Norsepower Oy Ltd. on the YODOHIME, a dedicated coal carrier completed in February. It is scheduled for installation in Q3 2024, this marks the first application of Norsepower's Rotor SailsTM on a dedicated coal carrier worldwide.

Japan Coal Market News:

- 1 December 2023, Prime Minister Kishida participated in the World Climate Action Summit held during the 28th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP28) in Dubai. He attended the opening session and delivered remarks during the high-level segment attended by heads of state and government. Each country needs to tackle unabated coal power plants according to their unique path toward achieving net-zero emissions, considering national circumstances. Japan, in alignment with its net-zero goals, plans to cease the construction of new unabated coal power plants domestically while ensuring a steady energy supply.

- 1April 2024, JERA Co., Inc. (JERA) and IHI Corporation (IHI) commenced the first demonstration testing of substituting a large volume of fuel ammonia (20% of heating value) at JERA’s Hekinan Thermal Power Station in Hekinan City, Aichi Prefecture. This initiative is part of the development of technologies for carbon recycling and next-generation thermal power generation/research, development, and demonstration of technologies for ammonia co-firing thermal power generation projects. The project aims to develop technology for substituting ammonia as fuel in a large-scale commercial coal-fired power plant. It will assess factors such as boiler heat absorption and environmental impacts, including exhaust gases. The Project is expected to span approximately four years, from July 2021 to March 2025.

Japan Coal Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Users Covered | Power Station (Thermal Coal), Coking Feedstock (Coking Coal), Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | ITOCHU Corporation, Mitsubishi Chemical Group Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan coal market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan coal market?

- What is the breakup of the Japan coal market on the basis of end user?

- What are the various stages in the value chain of the Japan coal market?

- What are the key driving factors and challenges in the Japan coal market?

- What is the structure of the Japan coal market, and who are the key players?

- What is the degree of competition in the Japan coal market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan coal market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan coal market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan coal industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)