Japan Car Rental Market Report by Booking Type (Offline Booking, Online Booking), Rental Length (Short Term, Long Term), Vehicle Type (Luxury, Executive, Economy, SUVs, and Others), Application (Leisure/Tourism, Business), End-User (Self-Driven, Chauffeur-Driven), and Region 2025-2033

Japan Car Rental Market:

The Japan car rental market size reached USD 2.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5.7 Million by 2033, exhibiting a growth rate (CAGR) of 8.1% during 2025-2033. The significant expansion in the tourism sector, shifting consumer preferences toward shared mobility, the proliferation of mobile applications and online platforms and emerging technological innovations with enhanced accessibility and convenience represent some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.8 Million |

|

Market Forecast in 2033

|

USD 5.7 Million |

| Market Growth Rate 2025-2033 | 8.1% |

Japan Car Rental Market Analysis:

- Major Market Driver: The expanding tourism industry is primarily driving the growth of the Japan car rental market. In addition to this, the growing penetration of electric vehicles in the car rental fleet is also catalyzing the regional market.

- Key Market Trends: The rising inclination towards shared mobility solutions rather than owning a vehicle due to the growing environmental concerns, cost-effectiveness, and the convenience of not having to deal with parking and maintenance, is one of the significant key trends in the Japan car rental market.

- Challenges and Opportunities: Various car rental companies are facing difficulty in maintaining the vehicle fleet booking and price management. However, the usage of mobile technologies and other devices to meet consumers' personal transportation requirements more efficiently, along with increased initiatives by service operators, are anticipated to offer lucrative growth opportunities to the overall market.

Japan Car Rental Market Trends:

Increasing Demand for Online Car Rental Services

A significant rise in the number of people taking business and leisure trips across the country is driving the demand for car rental services in Japan. The number of Japanese outbound travelers increased by 50% in 2020. The number of inbound international tourists reached a record high of 33.1 million in 2023, and the number of Japanese domestic travelers reached 273 million in 2023. Moreover, increasing internet penetration in Japan is further helping companies in the market to capture a larger customer base with the help of dedicated mobile apps for the convenience of customers. Technology is considered to be a crucial factor driving the market growth. Various leading market players are integrating advanced technologies and mobile applications to enhance the customer experience and streamline the online car booking process. For instance, Toyota Motor Corporation (Toyota) started accepting applications for "Booking Car," a cloud service developed by Toyota Mobility Service Corporation for corporate customers nationwide who use company cars. Since the launch of this service, Toyota has received requests from all over the country to introduce and handle this service, which led to its nationwide expansion. The company has received inquiries from about 200 companies and has received high praise from customers who have already introduced the service.

Economic Environment Surrounding Traveling and Living Conditions

Additionally, a continuous shift in consumer preference from owning a car to renting car services in Japan on account of the rising environmental concerns is accelerating the growth of the market. The study by the Journal of Environment Management examined the quantity of newly registered and pre-owned vehicles in Japan and projected the overall count of privately owned and shared vehicles. This projection accounted for instances where vehicle owners opted for car-sharing services instead of purchasing a new private vehicle when disposing of their old cars. Moreover, in line with the sustainable development goals set by the United Nations (UN), Japan announced its aim to achieve a carbon-neutral and decarbonized society by 2050. As of 2020, the transportation sector in Japan was responsible for a large share of CO2 emissions, accounting for 18.6% of the total emissions, 45.9% of which were from passenger cars. Therefore, for Japan to achieve carbon neutrality by 2050, it is important for the country to reduce the CO2 emissions from passenger cars. This, in turn, is prompting the government authorities of Japan to promote the adoption of car rental services, which is expected to offer significant growth opportunities to the overall market.

Rise of Electric Vehicles in Rental Car Services

Various key market players are increasingly including electric vehicles in their rental car fleets on account of their cost-effectiveness and eco-friendly nature. Japan has seen a sharp increase in the demand for electric vehicles since 2016. In addition to this, numerous car manufacturing companies are developing and launching new products to expand the number of electric vehicles sold in the nation. For instance, in Japan, in May 2022, Toyota launched its all-new electric SUV Bz4x, which has a battery capacity of 71.4 kWh and can produce 201 horsepower. The vehicle also has cutting-edge ADAS security measures. Moreover, the government authorities of Japan are also offering incentives and subsidies to EV buyers to accelerate their adoption, due to which many car rental service operators are purchasing EVs instead of traditional IC engine cars. For instance, the government declared grants and incentives for buying electric automobiles. The incentives for battery electric vehicles increased from JPY 400000 to JPY 800000. Initiatives like these are projected to further augment the growth of the car rental market in Japan in the coming years.

Japan Car Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan car rental market report, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on booking type, rental length, vehicle type, application, and end user.

Booking Type Insights:

- Offline Booking

- Online Booking

The report has provided a detailed breakup and analysis of the market based on the booking type. This includes offline booking and online booking.

Rental Length Insights:

- Short Term

- Long Term

A detailed breakup and analysis of the market based on the rental length has also been provided in the report. This includes short term, and long term.

Vehicle Type Insights:

- Luxury

- Executive

- Economy

- SUVs

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes luxury, executive, economy, SUVs, and others.

Application Insights:

- Leisure/Tourism

- Business

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes leisure/tourism, and business.

End-User Insights:

- Self-Driven

- Chauffeur-Driven

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes self-driven, and chauffeur-driven.

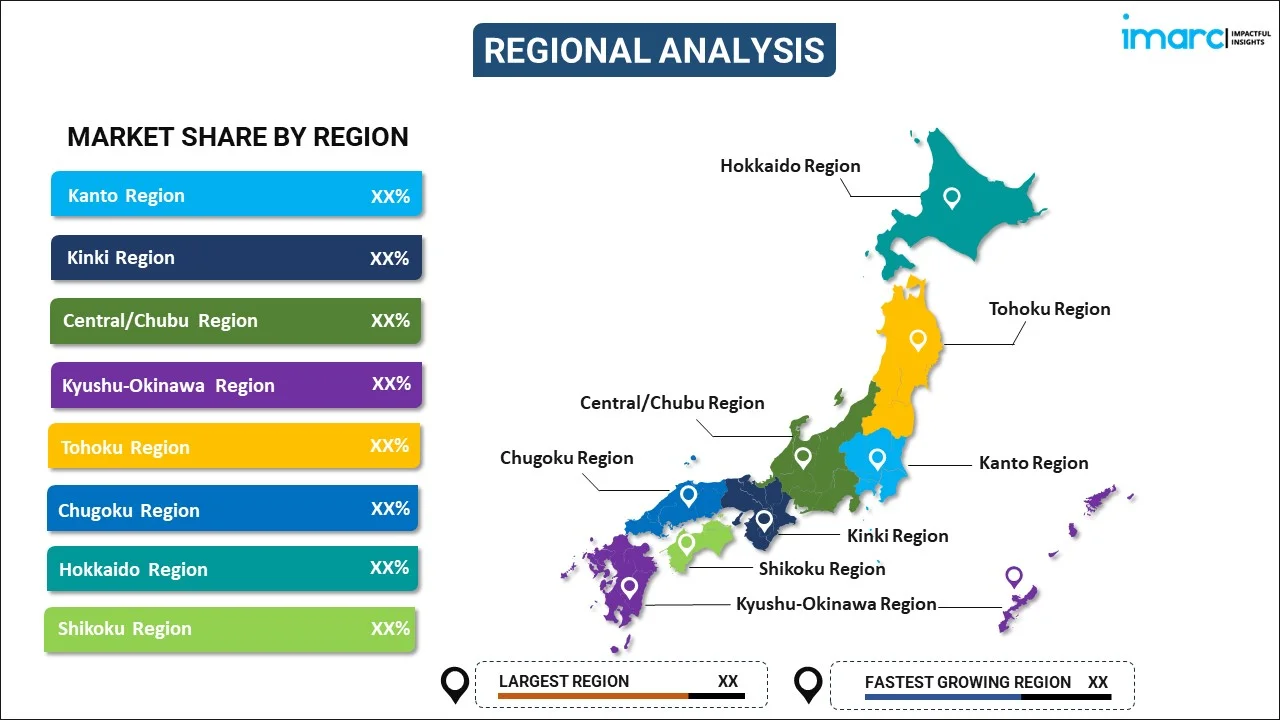

Regional Insights:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Car Rental Market News:

- January 2024: Car rental giant Hertz announced that it would sell its fleet of approximately 20,000 EVs and reinvest in gasoline-powered vehicles. The company said the move was about improving profitability by listening to customers' preferences.

- January 2024: A car-sharing organization set up in Ishinomaki City announced a program to offer free rental car services to people affected by the Noto Peninsula earthquake. Rentals began on January 15. A total of 25 cars, including light trucks, mini cars, and vans for up to 10 passengers, are available to those who need a vehicle as a result of the quake. Relief organizations are also eligible.

Japan Car Rental Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Booking Types Covered | Offline Booking, Online Booking |

| Rental Lengths Covered | Short Term, Long Term |

| Vehicle Types Covered | Luxury, Executive, Economy, SUVs, Others |

| Applications Covered | Leisure/Tourism, Business |

| End-Users Covered | Self-Driven, Chauffeur-Driven |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan car rental market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan car rental market?

- What is the breakup of the Japan car rental market on the basis of booking type?

- What is the breakup of the Japan car rental market on the basis of rental length?

- What is the breakup of the Japan car rental market on the basis of vehicle type?

- What is the breakup of the Japan car rental market on the basis of application?

- What is the breakup of the Japan car rental market on the basis of end-user?

- What are the various stages in the value chain of the Japan car rental market?

- What are the key driving factors and challenges in the Japan car rental market?

- What is the structure of the Japan car rental market and who are the key players?

- What is the degree of competition in the Japan car rental market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan car rental market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan car rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan car rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)