Japan Beer Market Report by Product Type (Standard Lager, Premium Lager, Specialty Beer, and Others), Packaging (Glass, PET Bottle, Metal Can, and Others), Production (Macro-Brewery, Micro-Brewery, and Others), Alcohol Content (High, Low, Alcohol-Free), Flavor (Flavored, Unflavored), Distribution Channel (Supermarkets and Hypermarkets, On-Trades, Specialty Stores, Convenience Stores, and Others), and Region 2025-2033

Market Overview:

The Japan beer market size reached USD 20.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 29.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.3% during 2025-2033. Standard lager, known for its crisp and refreshing taste, has captured a significant Japan beer market share due to its widespread appeal and adaptability catering to numerous individuals seeking a light and easy-drinking option, which is influencing the market growth.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 20.0 Billion |

| Market Forecast in 2033 | USD 29.0 Billion |

| Market Growth Rate 2025-2033 | 4.3% |

Beer is a carbonated and fermented alcoholic beverage produced by mixing yeast, hops, water and cereal grains, such as wheat, rye, corn, barley and rice. Stout, lager, ale, malt and porter are some of the commonly available beer variants. Beer is also infused with various additional flavorings of fruits and herbs to enhance taste and fragrance. It is usually stored and packaged in metal cans and glass bottles and manufactured in macro-, micro-and craft breweries. It is a rich source of essential minerals, fibers, vitamins, polyphenols and antioxidants. Moderate consumption of beer can aid in reducing stress, strengthening muscles and improving cognitive functioning. It also maintains blood pressure levels, prevents kidney stones and minimizes the risks of developing cardiovascular and circulatory ailments.

The growth in the Japan beer market can be attributed to the rising product demand among the millennials. There is also an increasing consumer preference for beer and other alcoholic beverages during celebrations and social and cultural gatherings. Moreover, the escalating demand for premium craft beer among the masses is favoring the market growth. Various product innovations, such as the introduction of beers with less sugar content suitable for health-conscious consumers, are providing a thrust to the market growth. Product manufacturers are also launching variants manufactured and brewed using natural and sustainably sourced ingredients, thereby increasing the product demand. Other factors, including the development of exotic and tropical flavored beer variants, along with convenient product availability through e-commerce websites, are driving the market growth across the country.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Japan beer market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, packaging, production, alcohol content, flavor and distribution channel.

Breakup by Product Type:

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

Breakup by Packaging:

- Glass

- PET Bottle

- Metal Can

- Others

Breakup by Production:

- Macro-Brewery

- Micro-Brewery

- Others

Breakup by Alcohol Content:

- High

- Low

- Alcohol-Free

Breakup by Flavor:

- Flavored

- Unflavored

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

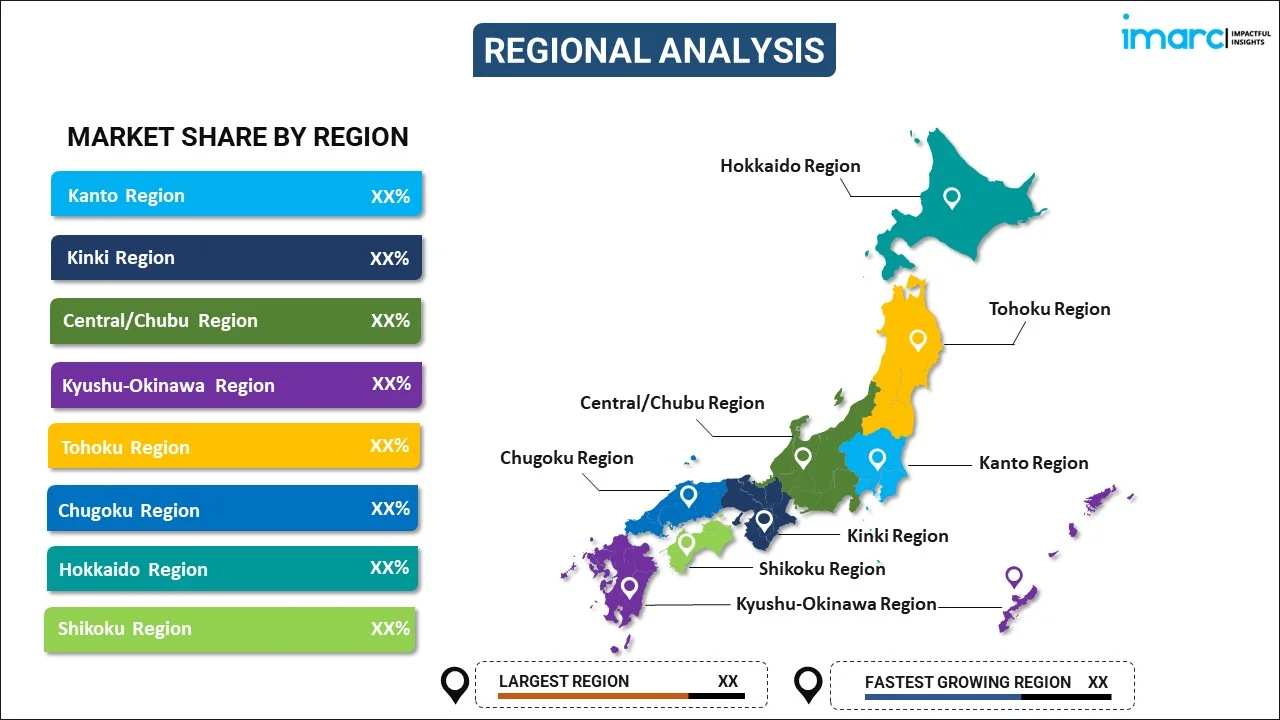

Breakup by Region:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product Type, Packaging, Production, Alcohol Content, Flavor, Distribution Channel, Region |

| Region Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan beer market was valued at USD 20.0 Billion in 2024.

We expect the Japan beer market to exhibit a CAGR of 4.3% during 2025-2033.

The rising demand for premium craft beer, along with the introduction of beer variants in exotic and tropical flavors, is primarily driving the Japan beer market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of beer across the nation.

Based on the product type, the Japan beer market has been segmented into standard lager, premium lager, specialty beer, and others, where standard lager currently holds the majority of the total market share.

Based on the packaging, the Japan beer market can be divided into glass, PET bottle, metal can, and others. Currently, glass exhibits a clear dominance in the market.

Based on the production, the Japan beer market has been categorized into macro-brewery, micro-brewery, and others. Among these, macro-brewery currently accounts for the largest market share.

Based on the alcohol content, the Japan beer market can be segregated into high, low, and alcohol-free. Currently, high exhibits a clear dominance in the market.

Based on the flavor, the Japan beer market has been divided into flavored and unflavored, where unflavored currently holds the majority of the total market share.

Based on the distribution channel, the Japan beer market can be bifurcated into supermarkets and hypermarkets, on-trades, specialty stores, convenience stores, and others. Currently, supermarkets and hypermarkets exhibit a clear dominance in the market.

On a regional level, the market has been classified into Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region, where Kanto Region currently dominates the Japan beer market.

A growing shift towards craft beers, with smaller, independent breweries is gaining popularity among consumers. This trend is driven by an increasing need for authenticity and an exit from the mass-produced products traditionally dominant in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)