Japan Battery Market Report by Type (Primary Battery, Secondary Battery), Product (Lithium-Ion, Lead Acid, Nickel Metal Hydride, Nickel Cadmium, and Others), Application (Automotive Batteries, Industrial Batteries, Portable Batteries), and Region 2025-2033

Market Overview:

The Japan battery market size reached 79.2 GWh in 2024. Looking forward, IMARC Group expects the market to reach 229.9 GWh by 2033, exhibiting a growth rate (CAGR) of 12.6% during 2025-2033. The rising demand for electric vehicles (EVs) and energy storage solutions, significant technological advancements, the widespread adoption in consumer electronics and government support and regulations represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 79.2 GWh |

| Market Forecast in 2033 | 229.9 GWh |

| Market Growth Rate (2025-2033) | 12.6% |

A battery is a device that stores energy in chemical form and converts it into electrical energy when needed. This electrical energy is used to power various devices, ranging from small handheld gadgets to large industrial machinery. Characteristically, a battery consists of one or more cells, each containing two different types of electrodes separated by an electrolyte. The chemical reactions within the cells create a flow of electrons, providing a consistent and portable power source. Batteries come in various types and sizes, each designed to meet specific needs. Primary batteries are disposable and used once, while secondary batteries can be recharged and used multiple times. The capacity of a battery, measured in ampere-hours (Ah), signifies the amount of energy it can deliver, while its voltage (V) represents the force or pressure at which the energy is delivered. Furthermore, the choice of materials and design of a battery can significantly influence its performance, weight, lifespan, and environmental impact. Technological advancements have led to the development of batteries with higher energy densities, improved safety features, and reduced charging times. This makes batteries an indispensable component in modern life, powering everything from remote controls to electric vehicles, and playing a vital role in the transition toward cleaner and more sustainable energy solutions.

Japan Battery Market Trends:

Government Support and Strategic Policies

The Japanese government’s unwavering support and strategic policies are fundamental in propelling the market growth. In 2024, the Japanese government approved to fund a maximum of ¥347.9bn ($2.4bn) for electric vehicle (EV) battery investments in a bid to install 150 GWh/yr of domestic output capacity by 2030. A total of 12 projects are subsidized, according to the ministry of trade and industry (METI). This includes lithium-ion (Li-ion) battery cell production by a consortium of battery manufacturer Panasonic and auto manufacturer Subaru. This substantial funding aims to reduce Japan’s reliance on imported battery materials and foster domestic innovation. Additionally, the government is introducing favorable tax incentives and subsidies for companies investing in battery research and manufacturing facilities, thereby improving the Japan battery market share. Moreover, regulatory frameworks are streamlining the approval processes for new battery technologies, reducing time-to-market. In 2024, Toyota Motor Corporation (Toyota) announced that the development and production plans for its next generation batteries and all-solid-state batteries were certified by the METI as a part of the Japanese government’s “Supply Assurance Plan for Batteries.”

Technological Advancements and Innovation in Battery Technologies

Japan’s commitment to technological innovation is a major factor positively influencing the market. In 2024, Panasonic Holdings initiated the production of its next generation EV batteries after reopening a plant in Wakayama Perfecture. These batteries are lighter, more efficient, and cheaper to make compared to its predecessor, the 2170. Moreover, Panasonic Energy is investing ¥463 billion ($3.2 billion) with Subaru to build a new battery factory in Gunma Perfecture. These product launches reflect Japan’s leadership in advancing battery technologies. Furthermore, Japan is making significant strides in sustainable battery production, with various newly launched batteries incorporating recycled materials. These advancements not only meet the rising demands of the EV and renewable energy sectors but also reinforce Japan’s position as a global leader in battery technology. Continuous innovation ensures that Japanese battery manufacturers remain competitive and responsive to evolving market needs.

Rising Demand from Automotive and Consumer Electronics Sectors

The increasing demand from the automotive and consumer electronics sectors is bolstering the market growth. As per a news article published by ET Auto in 2023, Japan raised support for the manufacturing of storage batteries to up to USD 2.2 billion, pledging nearly USD 1 billion in new subsidies for Toyota and other manufacturers to facilitate greater economic supply chain security. In the consumer electronics arena, Sharp Corporation announced the introduction of new AQUOS wish4 smartphone with enhanced battery life and shatter resistant display. The sales of this phone will begin in Japan, Taiwan, and Singapore. The large 5,00-mAh battery delivers extended battery life along with a nuisance call function that allows the user to block calls from suspicious phone numbers.

Japan Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan battery market report, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

To get more information on this market, Request Sample

- Primary Battery

- Secondary Battery

The report has provided a detailed breakup and analysis of the market based on the type. This includes primary battery and secondary battery.

Product Insights:

- Lithium-Ion

- Lead Acid

- Nickel Metal Hydride

- Nickel Cadmium

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes lithium-ion, lead acid, nickel metal hydride, nickel cadmium, and others.

Application Insights:

- Automotive Batteries

- Industrial Batteries

- Portable Batteries

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive batteries, industrial batteries, and portable batteries.

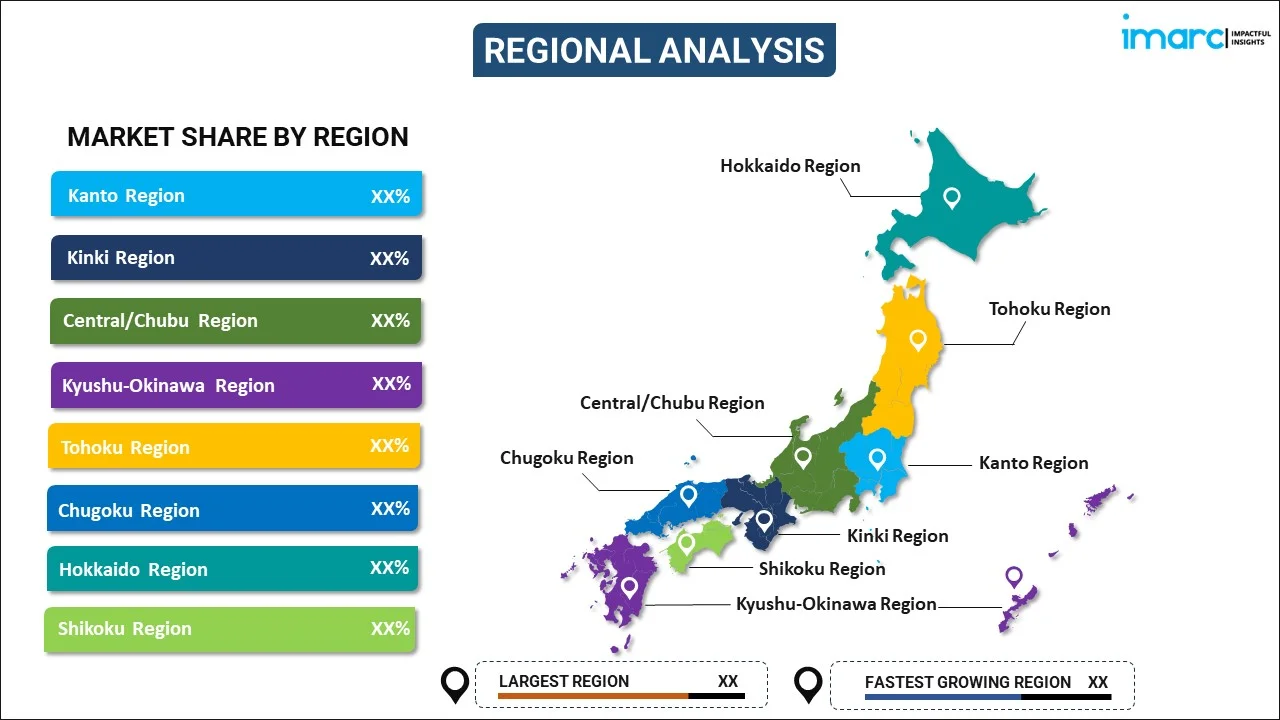

Regional Insights:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive Japan battery market analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- EEMB Japan

- GS Yuasa International Ltd.

- Maxell, Ltd

- NGK Insulators Ltd.

- Panasonic Corporation

- The Furukawa Battery Co., Ltd

- Toshiba Corporation

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Japan Battery Market News:

- May 2025: TDK Corp, Japan's electronic components producer, began the introduction of its next-gen silicon anode batteries to cater to the strong demand from smartphone manufacturers. Silicon anode batteries provided greater energy density compared to traditional batteries.

- May 2025: NTT Anode Energy initiated its energy storage operations by launching 3 high-voltage battery energy storage system (BESS) projects in Japan. Combined, these installations offered 15.3 megawatt-hours (MWh) of storage capacity. It assisted in integrating additional renewable energy sources, such as wind and solar, into the national grid. NTT's implementation of sodium-sulfur batteries could reduce the ecological damage from raw material harvesting.

- May 2025: Sumitomo Electric from Japan began constructing the nation's initial redox flow battery that received government subsidy approval. The 2 MW/8 MWh facility, being built on Kyushu Island, would receive funding through Japan’s FY2024 Renewable Energy Expansion and Grid-Scale Energy Storage System Support Program. The battery was set to be implemented for Shin-Idemitsu Co. Ltd. and was projected to be functional by October 2026.

- March 2025: Backed by a grant from the Tokyo Metropolitan Environmental Public Corporation, Ample, alongside Mitsubishi Fuso Truck and Bus Corporation and Mitsubishi Motors Corporation, implemented a system of battery swapping stations throughout Tokyo, providing effortless access for EV fleets across the city. This project would provide a scalable, zero-emission option to gas stations, assisting Tokyo in its aim to reduce greenhouse gas emissions by 50% by 2030.

- January 2025: Mazda Motor, a Japanese car manufacturer, intended to establish a lithium battery module pack factory in Japan with a yearly manufacturing capacity of 10GWh. Situated in Yamaguchi, Japan, the facility would manufacture packs and modules for automotive cylindrical lithium-ion battery cells obtained from Panasonic Energy of Japan.

- September 2024: Toyota Motor Corporation (Toyota) announced that the Ministry of Economy, Trade and Industry (METI) approved its development and production plans for next-generation batteries and all-solid-state batteries, under the Japanese government's ‘Supply Assurance Plan for Batteries.’ The policy sought to enhance the production infrastructure for batteries, encompassing battery cells, materials, and manufacturing equipment, which were identified as essential materials.

Japan Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | GWh |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Primary Battery, Secondary Battery |

| Products Covered | Lithium-Ion, Lead Acid, Nickel Metal Hydride, Nickel Cadmium, Others |

| Applications Covered | Automotive Batteries, Industrial Batteries, Portable Batteries |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | EEMB Japan, GS Yuasa International Ltd., Maxell, Ltd, NGK Insulators Ltd., Panasonic Corporation, The Furukawa Battery Co., Ltd, Toshiba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The battery market in Japan reached a volume of 79.2 GWh in 2024.

The Japan battery market is projected to exhibit a CAGR of 12.6% during 2025-2033, reaching a volume of 229.9 GWh by 2033.

Increasing adoption of electric vehicles (EVs) plays a major role, as Japan is shifting towards cleaner transportation. The growing investments in renewable energy projects are also creating the need for efficient energy storage systems, driving the demand for advanced batteries. Additionally, strategic partnerships and expansions by key domestic players are strengthening the market landscape.

Some of the major players in the Japan battery market include EEMB Japan, GS Yuasa International Ltd., Maxell, Ltd, NGK Insulators Ltd., Panasonic Corporation, The Furukawa Battery Co., Ltd, Toshiba Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)