Japan Baby Care Products Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2026-2034

Japan Baby Care Products Market Overview:

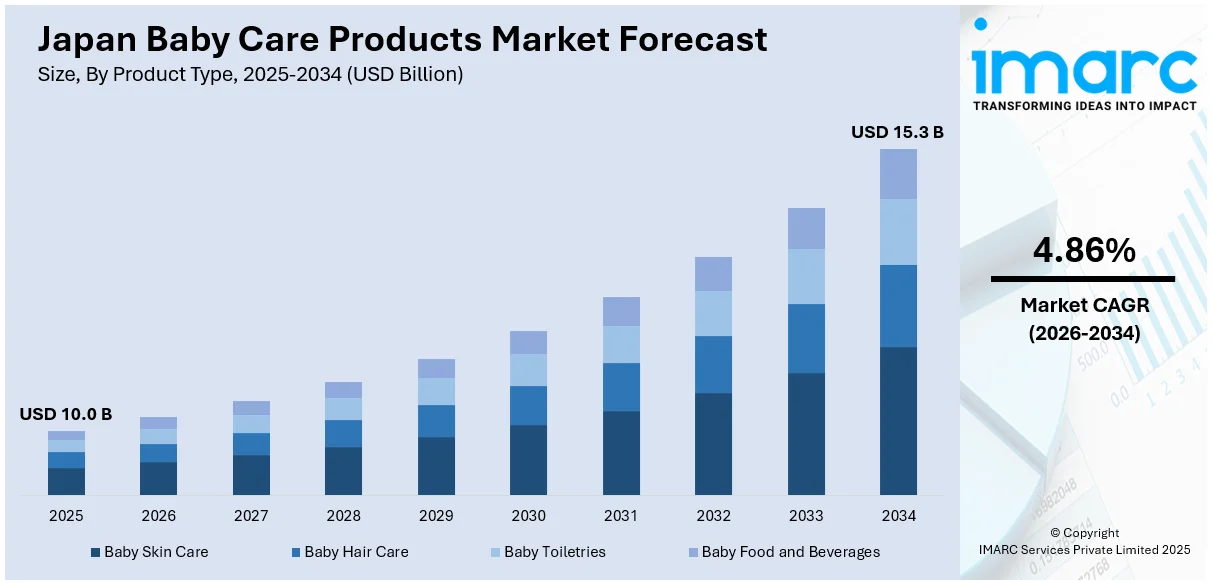

The Japan baby care products market size reached USD 10.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 15.3 Billion by 2034, exhibiting a growth rate (CAGR) of 4.86% during 2026-2034. The market is experiencing steady growth, driven by rising demand for organic goods, premium product preferences, and digital retail growth. Despite declining birth rates, increased per-child spending and innovation in sustainability and health-focused products support steady market development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10.0 Billion |

| Market Forecast in 2034 | USD 15.3 Billion |

| Market Growth Rate 2026-2034 | 4.86% |

Japan Baby Care Products Market Trends:

Rising Demand for Organic and Natural Products

Japanese parents are placing greater emphasis on product safety and skin-friendliness, leading to a growing preference for organic and natural baby care items. This shift is significantly contributing to Japan baby care products market growth, particularly in segments like lotions, shampoos, wipes, and diapers. For instance, on April 2024, Unicharm, a Japan-based company, launched the world's first horizontally recycled nappies in South Japan. These eco-friendly diapers address resource scarcity by reusing materials from used diapers. The process includes decontamination and sterilization, aiming to enhance sustainability in diaper production. Consumers are increasingly avoiding products that contain synthetic fragrances, dyes, alcohol, and parabens, favoring plant-based or dermatologist-tested alternatives. Brands that emphasize allergen-free, hypoallergenic, and chemical-free formulas are gaining trust and popularity. Many companies are also enhancing their labels to highlight transparency in ingredients and ethical sourcing. This growing preference for clean-label, eco-friendly baby products reflect a broader consumer consciousness around health, safety, and sustainability. As a result, the demand for natural baby care lines continues to grow across retail and e-commerce channels, helping shape Japan baby care products market share over the forecast period.

To get more information on this market Request Sample

Growth of Premium and Specialized Brands

In Japan, high-income and urban households are fueling demand for premium and specialized baby care products. Parents are increasingly prioritizing quality, safety, and performance over price, especially when it comes to skincare, nutrition, and hygiene items for infants. This has led to a surge in demand for dermatologist-tested skincare, organic baby food, high-absorbency diapers, and multifunctional baby gear from globally recognized and boutique premium brands. These products often feature advanced formulations, minimal additives, and sleek, user-friendly packaging. With fewer births and greater per-child spending, brands are focusing on value-added features, such as probiotic-rich formulas or hypoallergenic materials, to differentiate themselves. The trend is particularly strong in metropolitan areas like Tokyo and Osaka, where premium retail and e-commerce channels cater to this audience. This evolving consumer behavior is a key influence on the Japan baby care products market outlook.

Increased Online and Omnichannel Retailing

Japan's baby care products market is witnessing a significant shift toward online and omnichannel retailing, driven by changing consumer behavior and digital convenience. Busy parents, especially in urban areas, are turning to e-commerce platforms for quick access to a wide range of baby essentials, from diapers and wipes to skincare and nutritional products. Major online marketplaces, brand-owned websites, and subscription-based services offer flexibility, competitive pricing, and door-to-door delivery. At the same time, retailers are integrating offline and online touchpoints—such as in-store pickup, mobile apps, and loyalty programs—to create seamless shopping experiences. Personalized product recommendations, bundled offers, and digital parenting communities further strengthen brand engagement. This trend is enabling smaller and niche brands to reach targeted audiences, while also allowing consumers to explore premium and eco-friendly options with ease. As digital infrastructure expands, this channel will continue shaping purchasing patterns across Japan.

Japan Baby Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, category, and distribution channel.

Product Type Insights:

- Baby Skin Care

- Baby Hair Care

- Baby Toiletries

- Baby Bath Products and Fragrances

- Baby Diapers and Wipes

- Baby Food and Beverages

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby skin care, baby hair care, baby toiletries (baby bath products and fragrances and baby diapers and wipes), and baby food and beverages.

Category Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes premium and mass.

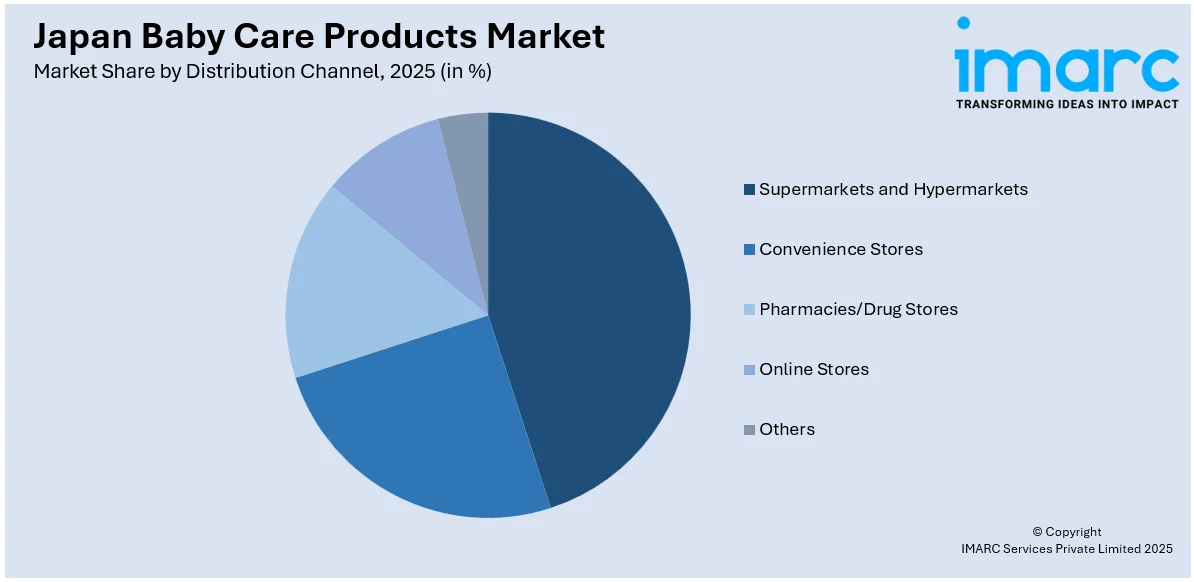

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies/Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmacies/drug stores, online stores, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Baby Care Products Market News:

- In February 2025, Japan's Unicharm announced its plans to open its third factory in Gujarat, India, with a $131 million investment aimed at increasing disposable diaper production by 30%. The facility, which will create approximately 1,000 jobs, will produce MamyPoko diapers and other hygiene products, reinforcing Unicharm's position as the market leader.

Japan Baby Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Baby Skin Care, Baby Hair Care, Baby Toiletries (Baby Bath Products and Fragrances and Baby Diapers and Wipes), Baby Food and Beverages |

| Categories Covered | Premium, Mass |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies/Drug Stores, Online Stores, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan baby care products market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan baby care products market on the basis of product type?

- What is the breakup of the Japan baby care products market on the basis of category?

- What is the breakup of the Japan baby care products market on the basis of distribution channel?

- What is the breakup of the Japan baby care products market on the basis of region?

- What are the various stages in the value chain of the Japan baby care products market?

- What are the key driving factors and challenges in the Japan baby care products market?

- What is the structure of the Japan baby care products market and who are the key players?

- What is the degree of competition in the Japan baby care products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan baby care products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan baby care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan baby care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)