Japan Automotive Composites Market Size, Share, Trends and Forecast by Production Type, Material Type, and Application, Region, 2025-2033

Japan Automotive Composites Market Size and Share:

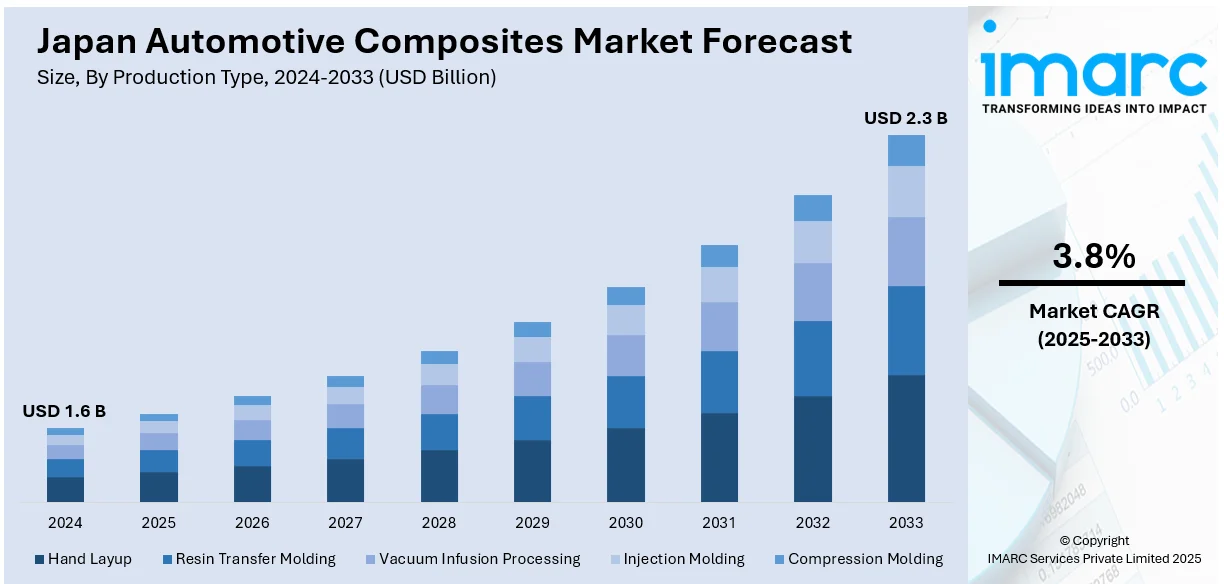

The Japan automotive composites market size was valued at USD 1.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.3 Billion by 2033, exhibiting a CAGR of 3.8% from 2025-2033. The Japan automotive market share is expanding steadily, fueled by the rising need for lightweight materials to improve fuel efficiency, the booming electric vehicle (EV) sector, significant progress in manufacturing technologies, stringent emission standards, and an increasing emphasis on sustainable practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Market Growth Rate (2025-2033) | 3.8% |

The need for vehicles with better fuel efficiency has significantly increased in recent years, primarily due to rising fuel prices and stricter emission regulations. For instance, the most recent standards on light duty vehicles aims to achieve a fuel efficiency target of 25.4 kilometers per liter, which is said to improve the fuel efficiency by 32% by the year 2030. Lighter vehicles consume less fuel, and automotive composites are a key enabler in reducing overall vehicle weight. Materials like carbon fiber-reinforced plastics (CFRP) and glass fiber-reinforced plastics (GFRP) offer a significantly lighter alternative to traditional options such as steel and aluminum, all while providing comparable or superior strength and durability.

Japan’s push toward electric vehicles (EV) adoption is another strong driver of the automotive composites market growth. In 2023, the country sold 11.9 million electric cars along with 3.45 million new registrations. This marked a 7% increase of total vehicle registrations. The government has been actively promoting EVs to reduce greenhouse gas (GHG) emissions, offering subsidies and tax incentives to boost adoption. The national government has announced its intention to raise the share of EVs and PHEVs in passenger car sales to 20-30% by 2030. Composites play a vital role in EV manufacturing, as they are essential for reducing weight and enhancing battery efficiency. Lighter materials help EVs achieve longer driving ranges on a single charge, which is a key factor influencing consumer purchasing decisions. Furthermore, composites are increasingly used in EV components such as battery enclosures, structural reinforcements, and exterior panels. As Japanese automakers shift their production focus to EVs, the demand for automotive composites is expected to grow rapidly.

Japan Automotive Composites Market Trends:

Advancements in Composite Manufacturing Technologies

Advances in composite manufacturing technology are increasing the affordability and accessibility of these materials for use in automotive applications. Traditional composite production methods were often time-consuming and expensive, limiting their use in mass-market vehicles. However, innovations such as automated fiber placement (AFP), resin transfer molding (RTM), and three-dimensional (3D) printing have reduced production costs and increased scalability. Japanese companies are at the forefront of these technological developments, with collaborations between automakers and material suppliers to improve production efficiency. These advancements are enabling wider adoption of composites not just in high-end vehicles but also in mainstream models, thereby boosting Japan automotive composite market share.

Stringent Emission Regulations

Japan has some of the world’s strictest vehicle emission standards, driven by its commitment to reducing environmental impact. Japan's pledge to achieve net-zero emissions by 2050 and reduce emissions by 46% by 2030 has accelerated the adoption of EVs. To comply with these targets, automakers are increasingly using materials like composites to create lighter, more aerodynamic vehicles that minimize energy consumption. The automotive industry's efforts to align with these regulations are creating strong demand for composite materials, which are seen as a practical solution for achieving compliance without compromising vehicle performance or safety.

Increased Focus on Vehicle Safety

Safety has long been a key focus in the automotive industry, and the role of composites in improving safety features is gaining attention. With their exceptional strength-to-weight ratios and superior energy absorption capabilities, these materials are well-suited for crash structures and other vital safety components. The country saw a total 2,663 traffic accidents in 2024, which has increased the need for these effective safety features in automobiles. Road safety and consumer trust are paramount in Japan, hence the use of composites in vehicles aligns well with market expectations for high-quality and reliable products. The ability of composites to provide both structural integrity and weight reduction is driving their adoption in various safety applications, further fueling market growth.

Japan Automotive Composites Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan automotive composites market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on production type, material type, and application.

Analysis by Production Type:

- Hand Layup

- Resin Transfer Molding

- Vacuum Infusion Processing

- Injection Molding

- Compression Molding

As per the Japan automotive composite market outlook, hand layup is an old etching method of manufacturing composites. It is now most commonly employed in low-volume, made-to-order, automotive composite parts production. The hand layup process involves putting the strength in a mold with the application of hands upon the resin, thus being the perfect process for prototypes as well as for special components. Although it is flexible and has low initial setup costs, it is also labor-intensive and slow, limiting it to low-volume niche applications such as luxury or high-performance vehicles.

Resin transfer molding is an advanced semi-automated method of using resin injection, which fills the pre-placed reinforcement fibers inside the mold. This method is chiefly appreciated for producing better quality parts with high strength, intricate shapes, and superb surface finishes. Undergoing acceptance in parts such as hoods, doors, and structural reinforcements in the Japanese automotive industry, RTM boasts a balance between relatively low cost and high-quality output, especially to electric and lightweight vehicles.

Vacuum infusion processing, also known as vacuum-assisted resin transfer molding (VARTM), is a technique where resin is drawn into a mold under vacuum pressure. This method is valued for producing large, lightweight parts with uniform resin distribution, making it suitable for manufacturing aerodynamic components and body panels. Its capability to use minimal resin and produce high-performance composites aligns with Japan's focus on sustainable automotive solutions.

According to the latest Japan automotive composite market forecast, the most preferred method in terms of obtaining intricate mass-production components is injection molding. Composites are also utilized in interior panels, under-the-hood parts, and structural reinforcements. The automated process also saves materials and manufacturing time; hence, this process is more economical for mass production. Automation and material innovations have cemented injection molding as one of the dominant production methods in Japan.

Compression molding is a high-pressure technique commonly used for producing large, flat, or slightly curved composite parts. Known for its short cycle times and suitability for mass production, this method is extensively applied in creating components like bumper beams and battery covers. The durability and uniformity of parts produced through compression molding make it an attractive choice for both traditional and electric vehicles, particularly in high-volume production environments.

Analysis by Material Type:

- Thermoset Polymer

- Thermoplastic Polymer

- Carbon Fiber

- Glass Fiber

- Others

Thermoset polymers are widely favored for their exceptional heat resistance, strength, and lightweight characteristics. Commonly used materials like epoxy and polyester resins are widely employed in structural applications such as body panels, hoods, and chassis components. Thermoset composites offer exceptional durability and stability under high stress, making them suitable for traditional and electric vehicles. However, their non-recyclable nature presents challenges, especially as sustainability takes center stage in the industry.

As per the latest Japan automotive composite market trends, thermoplastic polymers are emerging as a popular alternative due to their recyclability, lightweight nature, and ease of manufacturing. Materials such as polypropylene and polyamide are commonly utilized in interior components, under-the-hood applications, and structural reinforcements. Their ability to be reshaped under heat provides flexibility and cost-efficiency, especially in high-volume production. Thermoplastics are increasingly preferred in Japan’s automotive market as manufacturers prioritize eco-friendly solutions and rapid prototyping capabilities.

Carbon fiber composites are the market's premium product, prized for their remarkable stiffness, corrosion resistance, and strength-to-weight ratio. These materials are frequently found in luxury and high-performance automobiles for structural reinforcements, roofs, and spoilers. Carbon fiber is also being used in battery enclosures and lightweight constructions to increase efficiency and range as electric vehicles become more popular.

Glass fiber composites are the most widely used materials in the market, offering a cost-effective alternative to carbon fiber with sufficient strength and durability. These materials are used for a range of automotive parts, including door panels, bumpers, and instrument panels, particularly in mid-range and mass-market vehicles. The affordability and versatility of glass fiber make it a popular choice for Japanese automakers seeking to balance performance with cost in lightweight vehicle design.

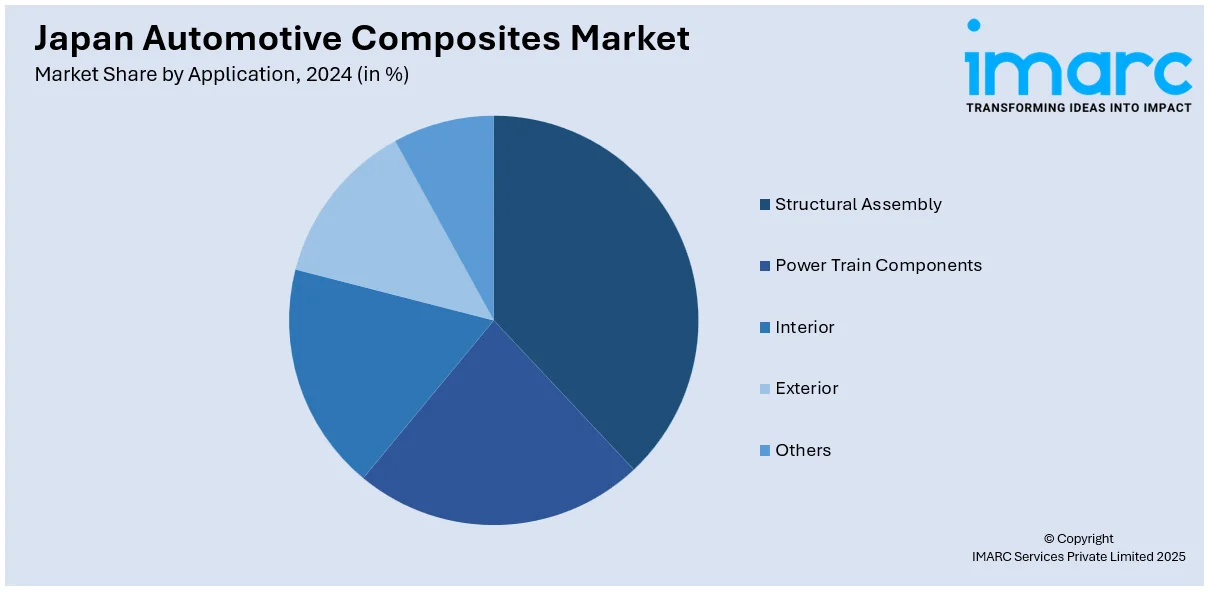

Analysis by Application:

- Structural Assembly

- Power Train Components

- Interior

- Exterior

- Others

Structural assembly is a critical application segment where composites are used to enhance vehicle strength while minimizing weight. Components like chassis, frames, and crash structures benefit from materials like carbon and glass fiber composites due to their high strength-to-weight ratio and energy absorption properties. In Japan, with increasing adoption of electric vehicles, composites are widely integrated into battery casings and structural reinforcements to meet safety and efficiency standards.

Composites are popular in powertrain components, given that they cleverly reduce weight and improve thermal stability, leading to better performance and fuel economy. Thermoset and thermoplastic polymers are used in some major parts such as transmission housings, engine covers, and even oil pans. The booming of this segment, largely prompted by the Japanese focus on energy-efficient vehicles, is quickly growing as manufacturers get their best internal combustion engines paired with the finest electric motor systems.

Composites are used widely for making vehicle interiors, including dashboards, door panels, seat frames, and trims. These materials are more preferred because they provide lightweight and durable solutions for aesthetics and allow greater design flexibility. The Japanese automotive segment puts major focus on quality and comfortable materials and is the strongest market to drive the use of composites, especially thermoplastics, in interiors for their recyclability and cost-effectiveness in mass production purposes.

The exterior segment relies heavily on composites for parts like bumpers, hoods, roofs, and aerodynamic components. Glass and carbon fiber composites are widely used due to their lightweight and weather-resistant properties, enhancing vehicle performance and aesthetics. In Japan, where the market for electric and hybrid vehicles is growing, composite materials are critical for achieving lightweight exteriors to improve overall energy efficiency and meet stringent emission standards.

Regional Analysis:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

In Japan, the Kanto region stands out as one of the leading markets for automotive composites. This area serves as a hub for research and development (R&D), nurturing numerous automakers and advanced material suppliers. With significant infrastructure and global proximity, Kanto demands innovative solutions for composite usage, especially front and rear end modules of electric vehicles and high-performance cars.

Kansai region houses an industrial base and advanced manufacturing with these capabilities. It produces a significant volume of composites, focusing on lightweight forms for traditional and electric vehicles. Of its strategic location and well-built automotive supply chain, Kansai is a great contributor to the composites market.

Home to Nagoya and major automotive giants like Toyota, the Chubu region is a powerhouse in Japan’s automotive sector. This area leads in adopting and implementing composite technologies, particularly in structural and exterior components. Its robust manufacturing infrastructure and focus on innovation ensure that Chubu remains a key player in the automotive composites market.

The Kyushu-Okinawa region has emerged as a growing market for automotive composites due to its strategic position as a gateway for exports to Asia. This region hosts several manufacturing facilities for both automakers and composite suppliers, with a focus on lightweight materials for improving vehicle efficiency. Kyushu's advancements in sustainable composites are also noteworthy.

The Tohoku region, with its expanding automotive manufacturing facilities, is increasingly contributing to the demand for composites. This area focuses on producing cost-effective materials and components for mid-range vehicles, with glass fiber composites being the primary choice. Tohoku's proximity to Kanto supports its role as a complementary market in the supply chain.

Further, Chugoku is a relatively smaller but important automotive composites market, aiming at the development of long-lasting materials for interior and exterior vehicle applications. It houses some key suppliers of thermoplastic and thermoset polymers, which can support a sustainable automotive industry.

Hokkaido’s contribution to the automotive composites market is limited but growing, with an emphasis on research into eco-friendly materials. This region benefits from academic partnerships and government support for developing innovative composite solutions. Hokkaido’s focus is primarily on lightweight, high-strength materials for structural components.

The Shikoku region is a niche market within the automotive composites industry, allocated to special applications such as small-scale manufacturing of composite parts for high-end luxury and performance vehicles. It is well known for being associated with craftsmanship and precision and thus has developed into a source of high-quality components, especially carbon fiber composites.

Competitive Landscape:

Driving forces in the market include innovation, sustainability, and efficiency to meet increasing demands for lightweight materials. Development of advanced composite materials including carbon fiber reinforced plastics and glass fiber reinforced plastics that offer improved vehicle performance and fuel economy is being prioritized by several companies. Emphasis is also placed on scaling up production and reducing costs through investments in state-of-the-art manufacturing processes including thermoplastic composites and resin transfer molding automation. Additionally, they participate in the development of sustainable and recyclable materials in line with environmental regulations and carbon neutrality goals. Alongside this, partnerships between material manufacturers and automakers are facilitating the introduction of composites into structural, interior, and exterior vehicle components. Out of improving material properties and reducing production costs will come the sustainability initiatives to position those players favorably against evolving needs as well as competition in a growing market in the automotive industry.

The report provides a comprehensive analysis of the competitive landscape in the Japan automotive composites market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, HKS Co., Ltd. and Nippon Seiki Co., Ltd. (Defi) announced the introduction of new collaborative products for the automotive aftermarket sector. This partnership leverages HKS's expertise in the automotive aftermarket and OEM sectors alongside Defi's renowned manufacturing and design proficiency in vehicle instrumentation to develop cutting-edge meter systems and precision instruments tailored for electric vehicles (EVs).

- In April 2024, Toray Industries, Inc., formed a strategic alliance with Hyundai Motor Group to advance material innovation for a new era of vehicles. This partnership plays a key role in the Hyundai’s future mobility strategy as they plan to adopt a comprehensive approach by pursuing fundamental advancements in material technology.

- In February 2024, The Mitsubishi Chemical Group announced the development of a high heat-resistant ceramic matrix composite (CMC) utilizing pitch-based carbon fibers. This innovative material is reported to withstand temperatures up to 1,500°C.

- In September 2023, Toray Industries, Inc. and Honda Motor Co., inked a deal to work together on developing a chemical recycling method for glass-fiber reinforced nylon 6 components recovered from cars approaching the end of their service life. The process that depolymerizes using subcritical water and regenerates the materials as caprolactam, a raw monomer, is being verified by the two businesses.

- In September 2023, Teijin Limited has decided to sell its entire stake in GH Craft Co., Ltd. to TIP Composite Co., Ltd., a subsidiary of Teijin’s composites business in Japan.

- In February 2023, Toray Industries Inc. announced that its carbon fiber product, Torayca, will be utilized in the motor case of the current H-IIA rocket. Additionally, Torayca remains in use for the motor case of the H3 Launch Vehicle, with Torayca prepreg now newly incorporated into the payload fairing section.

Japan Automotive Composites Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Production Types Covered | Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Injection Molding, Compression Molding |

| Material Types Covered | Thermoset Polymer, Thermoplastic Polymer, Carbon Fiber, Glass Fiber, Others |

| Applications Covered | Structural Assembly, Power Train Components, Interior, Exterior, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan automotive composites market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan automotive composites market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan automotive composites industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Japan automotive composites market was valued at USD 1.6 Billion in 2024.

The Japan automotive composites market is driven by increasing demand for lightweight materials to enhance fuel efficiency, the growing adoption of electric vehicles, advancements in manufacturing technologies, strict emission regulations, and a rising focus on sustainability, including recyclable and eco-friendly composite solutions.

IMARC estimates the Japan automotive composites market to exhibit a CAGR of 3.8% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)