Japan Automation Testing Market Report by Component (Testing Solutions, Services), Endpoint Interface (Web, Mobile, Desktop, Embedded Software), Enterprise Size (Small and Medium-Sized Enterprises, Large Enterprises), End User (IT and Telecommunication, BFSI, Healthcare, Retail, Transportation and Logistics, and Others), and Region 2026-2034

Market Overview:

Japan automation testing market size reached USD 1.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.1 Billion by 2034, exhibiting a growth rate (CAGR) of 12.92% during 2026-2034. The increasing demand for automation testing, which enables the identification of bugs and issues in the early stages of the development cycle, thereby ensuring the overall quality and reliability of the software products, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1.7 Billion |

|

Market Forecast in 2034

|

USD 5.1 Billion |

| Market Growth Rate 2026-2034 | 12.92% |

Access the full market insights report Request Sample

Automation testing is the practice of using specialized software tools to execute pre-scripted tests on a software application before it is released into the market. It involves the creation of scripts that can automatically test functionality, performance, and other critical aspects of the software, minimizing human intervention and expediting the testing process. This method allows for the swift and repetitive execution of tests, enabling the identification of bugs, errors, and performance issues early in the development cycle. Automation testing offers several benefits, such as increased test coverage, improved accuracy, faster feedback, and reduced testing time and costs. It is particularly useful for complex and large-scale projects where manual testing would be time-consuming and prone to human errors. While it requires initial investment and specialized expertise, its implementation can significantly enhance the overall quality and reliability of the software.

Japan Automation Testing Market Trends:

The automation testing market in Japan has experienced significant growth in recent years, primarily driven by several key factors. Firstly, the rising complexity of software applications, coupled with the need for faster time-to-market, has propelled the demand for automation testing tools. As a result, companies are increasingly adopting automated testing solutions to enhance the efficiency and accuracy of their software development processes. Moreover, the cost-effectiveness associated with automation testing has emerged as a crucial driver, enabling organizations to save time and resources while ensuring comprehensive test coverage. Furthermore, the growing emphasis on continuous integration and continuous delivery (CI/CD) practices has bolstered the adoption of automation testing, as it facilitates the seamless integration of testing within the development pipeline. Additionally, the escalating demand for robust quality assurance across various industry verticals, including healthcare, finance, and manufacturing, has spurred the deployment of automation testing to ensure reliable and consistent software performance. Lastly, the proliferation of agile and DevOps methodologies has further accelerated the demand for automation testing, enabling organizations to achieve higher levels of productivity and software quality through streamlined testing processes.

Japan Automation Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, endpoint interface, enterprise size, and end user.

Component Insights:

To get detailed segment analysis of this market Request Sample

- Testing Solutions

- Functional Testing

- API Testing

- Security Testing

- Compliance Testing

- Usability Testing

- Others

- Services

- Professional Services

- Managed Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes testing solutions, (functional testing, API testing, security testing, compliance testing, usability testing, and others) and services (professional services and managed service).

Endpoint Interface Insights:

- Web

- Mobile

- Desktop

- Embedded Software

A detailed breakup and analysis of the market based on the endpoint interface have also been provided in the report. This includes web, mobile, desktop, and embedded software.

Enterprise Size Insights:

- Small and Medium-Sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises.

End User Insights:

- IT and Telecommunication

- BFSI

- Healthcare

- Retail

- Transportation and Logistics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes IT and telecommunication, BFSI, healthcare, retail, transportation and logistics, and others.

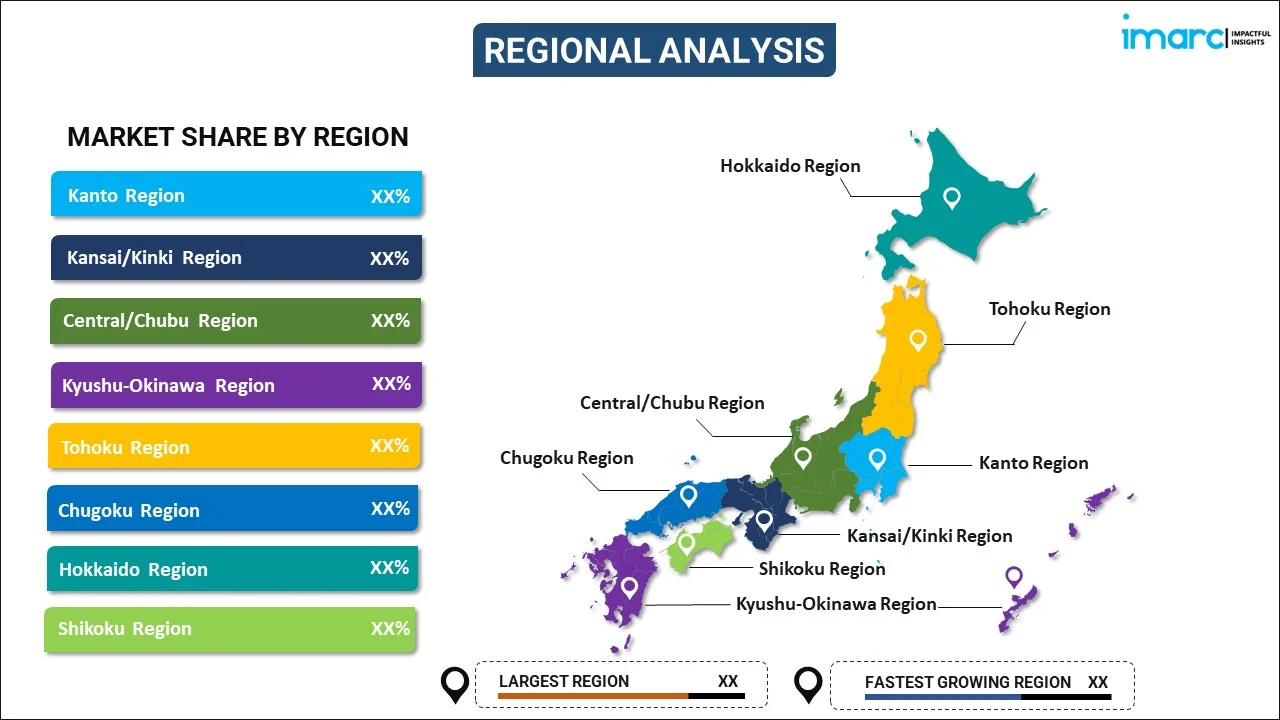

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Automation Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Endpoint Interfaces Covered | Web, Mobile, Desktop, Embedded Software |

| Enterprise Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| End Users Covered | IT and Telecommunication, BFSI, Healthcare, Retail, Transportation and Logistics, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan automation testing market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan automation testing market?

- What is the breakup of the Japan automation testing market on the basis of component?

- What is the breakup of the Japan automation testing market on the basis of endpoint interface?

- What is the breakup of the Japan automation testing market on the basis of enterprise size?

- What is the breakup of the Japan automation testing market on the basis of end user?

- What are the various stages in the value chain of the Japan automation testing market?

- What are the key driving factors and challenges in the Japan automation testing?

- What is the structure of the Japan automation testing market and who are the key players?

- What is the degree of competition in the Japan automation testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan automation testing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan automation testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan automation testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)