Japan Anime Market Size, Share, Trends and Forecast by Revenue Source, and Region, 2025-2033

Japan Anime Market Size and Share:

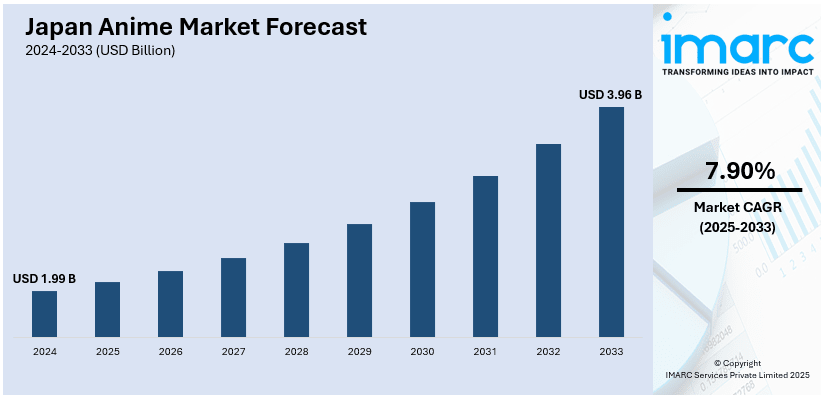

The Japan anime market size was valued at USD 1.99 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.96 Billion by 2033, exhibiting a CAGR of 7.90% from 2025-2033. The market is primarily driven by rapid global expansion through localization and streaming platforms enhancing cultural exchange and audience reach, a rise in original content production fostering innovative storytelling, and growth in merchandising-driven franchise development stimulating fan engagement and ensuring sustained profitability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.99 Billion |

| Market Forecast in 2033 | USD 3.96 Billion |

| Market Growth Rate (2025-2033) | 7.90% |

The regional market is majorly driven by the continual technological advancements in animation, producing visually stunning content that captivates global audiences. In line with this, the rapid integration of artificial intelligence (AI) and virtual reality is enhancing storytelling and creating immersive experiences. On December 14, 2024, Kaka Creation and Frontier Works unveiled Twins Hinahima, a Spring 2025 anime using 95% supportive AI. The series, inspired by a TikTok user, follows two high school girls navigating eerie events, highlighting AI's potential to reduce animators' workload while sparking debate about its role in anime. Moreover, global streaming platforms and localized content, with subtitles and dubbing, have expanded anime's reach, while strategic marketing positions it as a premium cultural export, bolstering its global significance.

The diversification of anime genres, ranging from action and fantasy to romance and slice-of-life, continues to drive the Japan anime market growth by catering to diverse audience preferences and broadening its appeal across age groups and cultural backgrounds. Collaborative ventures between Japanese studios and international entertainment giants have introduced anime to new markets, fostering expansion and funding high-quality productions. Furthermore, favorable government initiatives bolster the industry, offering subsidies, promotional support, and policies that enhance its global competitiveness. On June 21, 2024, Japan launched the Grand Design and Action Plan for a New Form of Capitalism to elevate its entertainment content industry, including anime, by supporting creators, improving production environments, and consolidating assistance programs. Initiatives like the Content Industry Public-Private Council and action4cinema promote fair labor practices, overseas expansion, and global cultural exchange, ensuring sustained market development.

Japan Anime Market Trends:

Global Expansion via Localization and Streaming

The global reach of Japanese anime is driven by the increasing localization of content and the expanding influence of streaming platforms. Localization efforts, such as multilingual subtitles, dubbing, and culturally adapted narratives, allow anime to resonate with diverse international audiences. For instance, on September 14, 2024, Visionary AI Cinema (VAC) partnered with Japanese streaming platforms and content producers to enhance localized entertainment experiences using AI-driven recommendations. VAC’s initiatives, including promoting Japanese anime and original content globally, support cultural exchange while increasing audience satisfaction and the international growth of Japan’s streaming and anime industries. Platforms like Netflix, Amazon Prime Video, and Crunchyroll are expanding their anime libraries and commissioning exclusive content, using simulcast releases and targeted promotions. These strategies broaden anime’s global appeal and establish it as a mainstream entertainment medium, fostering sustained growth and cultural exchange.

Growing Popularity of Original Anime Content

The Japan anime market share is witnessing a significant rise in original content production, reflecting a shift away from adaptations of manga, novels, or games. This trend allows creators greater creative freedom, resulting in unique storytelling and innovative narratives that resonate with global audiences. A prime example is Ninja Kamui, an original anime by acclaimed director Sunghoo Park, premiering February 10, 2024, on Adult Swim's Toonami. Featuring character designs by Takashi Okazaki and music by coldrain, the series reimagines ninjas in a near-future setting. A videogame adaptation, Ninja Kamui: Shinobi Origins, is set to release in spring 2024. The demand for high-quality, fresh content from global streaming platforms and diverse audiences is driving this trend, helping studios establish new intellectual properties and ensuring a steady stream of innovative anime content that sustains the industry’s global popularity and cultural influence.

Merchandising and Franchise Development

Merchandising and franchise development have become pivotal revenue drivers in the Japanese anime market. Successful anime series often expand into multifaceted franchises, including films, merchandise, video games, and theme park attractions. Collectibles such as action figures, apparel, and exclusive merchandise are highly coveted by fans, generating substantial profits. Notably, on May 22, 2024, McFarlane Toys partnered with VIZ Media to release detailed 7” action figures based on BLEACH: Thousand-Year Blood War, featuring ultra-articulation with 22 moving parts. Launching in late Summer 2024, these collectibles appeal to both long-time and new BLEACH fans, highlighting the growing anime-inspired merchandise market. Franchise-based projects like themed cafes and exhibitions boost fan engagement, while leveraging intellectual property across platforms cultivates long-term profitability, brand loyalty, and the industry’s resilience in a competitive global landscape.

Japan Anime Industry Segmentation:

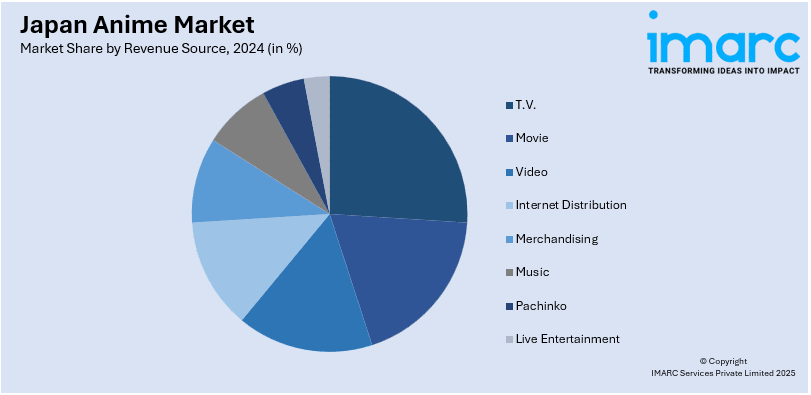

IMARC Group provides an analysis of the key trends in each segment of the Japan anime market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on revenue source.

Analysis by Revenue Source:

- T.V.

- Movie

- Video

- Internet Distribution

- Merchandising

- Music

- Pachinko

- Live Entertainment

The Japanese anime industry is seeing remarkable growth, driven by expanding global demand for television and movie content. Anime TV shows are a key revenue driver, with networks leveraging their immense popularity to secure high advertising revenues and licensing deals. Streaming platforms, both domestic and international, have further fueled this growth, making anime widely accessible. Increased investments in high-quality storytelling and innovative animation techniques have also captured global audiences, strengthening the industry's profitability. With expanding viewership, Japanese anime continues to dominate not only traditional broadcasting but also subscription-based video-on-demand platforms, ensuring steady and increasing revenue streams.

Anime movies represent another robust revenue stream, with theatrical releases achieving record-breaking box office sales in Japan and abroad. International distribution deals have introduced Japanese anime films to new markets, enhancing their profitability. Major studios are investing heavily in cinematic anime, blending rich narratives with visually stunning artistry to attract global audiences. Franchise-based movies, often building on popular TV series, are particularly lucrative. The rise of co-productions and collaborations with global studios is also amplifying opportunities, ensuring that anime films remain a cornerstone of the industry's economic growth.

The video segment, encompassing physical media and digital formats, continues to contribute significantly to the anime market's revenue. Blu-ray and DVD sales, although declining in some regions, remain popular among anime enthusiasts who value collectible editions. Simultaneously, the rise in digital purchases and rentals offset the decline in physical media. Video game adaptations and spin-offs of anime series have further bolstered the market. These cross-media ventures, supported by robust merchandising strategies, ensure that the video segment maintains its relevance, providing additional avenues for growth and reinforcing the Japanese anime industry's global dominance.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, encompassing Tokyo, is the epicenter of Japan's anime industry and a hub of innovation and growth. Home to numerous animation studios, production houses, and broadcasters, it drives the creation and distribution of anime content. The region benefits from its dense population and international connections, allowing anime events, conventions, and promotional campaigns to flourish. Tokyo's Akihabara district remains a cultural landmark, attracting domestic and global anime enthusiasts. The presence of major streaming platforms, publishers, and licensing firms in Kanto further fueled collaborations and investments, making the region a central force in the market.

The Kinki region, including Osaka and Kyoto, plays a vital role in the market with its rich cultural heritage and vibrant fan base. Osaka’s reputation as a commercial hub fosters strong connections between creators and investors, driving regional productions. Kyoto’s traditional artistry influences anime, adding depth and uniqueness to the storytelling. The region hosts popular anime-related events, augmenting tourism, and consumer engagement. With local governments supporting creative industries and animation-focused educational programs, the Kinki region continues to grow as a center for talent development, innovative productions, and audience engagement, strengthening its position in the anime market.

The Central or Chubu region, including Nagoya, emerged as a growing player in the industry. The region benefits from a rising number of studios and partnerships with national broadcasters, producing anime that resonates with both local and international audiences. Chubu’s accessibility and strategic location render it a convenient hub for anime conventions, attracting enthusiasts and fostering community expansion. Local governments’ initiatives to promote creative industries have encouraged new talent and investments. The region’s blend of modernity and tradition provides unique settings for storytelling, enabling Chubu to contribute distinctively to the positive momentum of the industry.

Competitive Landscape:

The Japanese anime market's competitive landscape features a mix of established studios, emerging creators, and global players. Major studios dominate with high-quality productions and global franchises, while smaller studios gain ground with niche storytelling and innovative techniques. Streaming platforms like Netflix and Crunchyroll are expanding the market by commissioning exclusive anime, intensifying competition. Furthermore, strategic collaborations between Japanese creators and global studios are intensifying, thereby impelling the market. On December 12, 2024, Warner Music Japan (WMJ) and NBCUniversal Entertainment Japan (NBCUJ) announced a partnership to leverage anime's global popularity. The collaboration involves music tie-ins, such as WMJ artists creating theme songs, and expanding NBCUJ's anime catalog internationally through ADA's network. Moreover, rising demand, technological advancements, and government support ensure sustained growth and innovation in the market.

The report provides a comprehensive analysis of the competitive landscape in the Japan anime market with detailed profiles of all major companies.

Latest News and Developments:

- January 15, 2024: Toei Animation’s ONN'ON STUDIOS announced that they will host "Virtual Anime Fes" on January 27, 2024 (JST), in VRChat's ImaginaryPark2070 and live stream it on YouTube. Highlights include a virtual reading stage, a new MR game from KAIJU DECODE, and a new film announcement by the Expelled from Paradise team. SATELLITE, a time-limited virtual unit, will also debut with two original songs.

- February 26, 2024: Toyota, in collaboration with Intertrend Communications, launched its first anime series, GRIP. The five-episode campaign showcases Toyota’s Gazoo Racing (GR) cars in a high-energy anime adventure that blends human spirit and tech-driven challenges. Created to captivate young audiences, the series highlights driving thrills while celebrating anime’s global popularity and Toyota’s innovative, performance-oriented image.

- April 20, 2024: Studio Ghibli, in collaboration with Premium Bandai, released new action figures from Nausicaä of the Valley of the Wind. The sets include Tolmekian Armoured Soldiers and Imperial Princess Kushana, featuring detailed designs, removable headgear, and 20 movable parts for dynamic posing. Priced between 10,450–11,000 yen, the figures are available for pre-order in limited quantities, with shipping scheduled for October, offering fans a chance to recreate iconic scenes from the 1984 classic.

- May 23, 2024: Tech Mahindra and Fuji TV announced a strategic partnership to co-develop content for the global entertainment industry. Combining Fuji TV’s original programming with Tech Mahindra’s localization and animation expertise, the collaboration will introduce Japanese content, including anime, to Indian audiences while licensing Indian content to Japan. The partnership aims to create unique, globally appealing content by leveraging Tech Mahindra's animation studios and market insights.

- January 6, 2025: Sony's Crunchyroll announced an anime adaptation of Ghost of Tsushima, based on the acclaimed Sucker Punch video game, premiering in 2027. Produced with Aniplex, directed by Takanobu Mizuno, and featuring Gen Urobuchi's storytelling, the series will combine samurai aesthetics and cinematic visuals. This marks Sony's first anime adaptation, highlighting the synergy of PlayStation Productions, Sucker Punch, and Aniplex.

Japan Anime Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Revenue Sources Covered | T.V., Movie, Video, Internet Distribution, Merchandising, Music, Pachinko, Live Entertainment |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan anime market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan anime market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan anime industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Anime refers to a Japanese style of animated entertainment characterized by vibrant visuals, imaginative storytelling, and diverse genres. It spans TV shows, movies, and web series, appealing to audiences of all ages. Renowned for its artistic creativity, anime often incorporates cultural elements, making it a global phenomenon in contemporary pop culture.

The Japan anime market was valued at USD 1.99 Billion in 2024.

IMARC estimates the Japan anime market to exhibit a CAGR of 7.90% during 2025-2033.

The Japan market is propelled by growth through localized content and streaming platforms, innovative original content production attracting diverse audiences, significant advancements in animation techniques, the increasing adoption of AI and VR for engaging experiences, and merchandising expansion improving fan interaction and long-term revenue opportunities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)