Japan Advertising Market Report by Type (Television, Print (Newspaper and Magazine), Radio, Outdoor, Internet (Search, Display, Classified, Video), Mobile, Cinema), and Region 2026-2034

Market Overview:

Japan advertising market size reached USD 60.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 83.1 Billion by 2034, exhibiting a growth rate (CAGR) of 3.70% during 2026-2034. The growing awareness about data privacy issues, incorporation of innovative technologies like augmented reality (AR) and virtual reality (VR) to create immersive and interactive experiences, and rising utilization of smartphones and tablets represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 60.0 Billion |

| Market Forecast in 2034 | USD 83.1 Billion |

| Market Growth Rate (2026-2034) | 3.70% |

Access the full market insights report Request Sample

Advertising is a strategic communication process used by organizations to promote their products, services, or ideas to a specific target audience. It involves the creation and dissemination of persuasive messages through various channels, such as television, print media, digital platforms, and outdoor advertising. It is cost-effective as compared to other marketing strategies, especially when reaching a large audience. It helps to inform, persuade, or influence individuals or groups to take a desired action, which can include purchasing a product. It serves as a means for companies to differentiate themselves and establish a strong market presence. It captures the attention of the audience and conveys key information about a product and its benefits. It helps in building and strengthening the identity and equity of a brand. It can create a positive perception of a brand, which assists in enhancing loyalty and trust among individuals. It increases the sales and profitability of a company by attracting new people and encouraging existing ones to make repeat purchases. It aids in providing valuable insights into the behavior and preferences of individuals. It is beneficial in targeting new markets, regions, or demographics, facilitating expansion of an organization. As it also allows companies in making data-driven adjustments for enhanced outcomes, the demand for advertising is rising in Japan.

Japan Advertising Market Trends:

Rising Digital Transformation and E-commerce Growth

Increased internet penetration and e-commerce expansion are shifting the focus of the advertising industry toward digital platforms, with high demand for online ads, social media marketing, and video content. In line with this, the survey titled “Advertising Expenditures in Japan,” published by Dentsu on in February, 2024, advertising expenditures in Japan totaled 7,316.7 Billion Yen (up 3.0% year on year) in 2023. The survey further highlights video advertisements grew 15.9% year on year to 686.0 Billion Yen, the highest growth rate among all ad categories. Instream advertising amounted to 383.7 Billion Yen, while outstream advertising totaled 302.2 Billion Yen. In 2024, video advertisements are forecast to maintain double-digit growth of 12.2% year on year, reaching 769.7 Billion Yen, as per the survey. The survey concludes that the growth of Japan's advertising market was spurred by Internet advertising expenditures, which have continued to rise amid the ongoing digital transformation of the Japanese society, and promotional media advertising expenditures, particularly in the category of events/exhibitions/screen displays, for which expenditures rose as the movement of people increased.

Significant Technological Advancements

The widespread adoption of artificial intelligence (AI), data analytics, and programmatic advertising helps brands target audiences more effectively, improving campaign personalization and reach. For instance, in October, MASTRUM, the impression based DOOH advertising platform launched by JR East Marketing & Communications Inc. (jeki) in partnership with Moving Walls Group earlier this year completed the integration of about 34,000 screens as part of its first phase. MASTRUM is a white-labeled, customized DSP/SSP platform tailored to the Japanese OOH advertising market. It is powered by Moving Walls, the global OOH enterprise software provider. With a focus on “visualization of advertising cost-effectiveness” and “automation of media transactions,” MASTRUM is set to be the largest OOH media platform in Japan. More than 400,000 OOH sites are planned to be on the platform in the future.

Growing Influencer Marketing and Content-Based Strategies

Japanese consumers tend to be highly receptive to trusted personalities, making influencers a key advertising medium. Many brands partner with influencers on social media platforms like Instagram, Twitter, and YouTube to reach their target demographics, which is expected to increase the overall Japan advertising market share. These influencers are not only celebrities but also niche creators who have loyal followings in categories like fashion, gaming, travel, and beauty. Authenticity is highly valued in the Japanese market, and influencer marketing enables brands to build trust and create organic connections with consumers. Additionally, content-based advertising, such as branded content and storytelling, resonates well with Japanese audiences, who prefer subtle, engaging ads over overtly promotional messages.

Japan Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Television

- Print (Newspaper and Magazine)

- Radio

- Outdoor

- Internet (Search, Display, Classified, Video)

- Mobile

- Cinema

The report has provided a detailed breakup and analysis of the market based on the type. This includes television, print (newspaper and magazine), radio, outdoor, internet (search, display, classified, video), mobile, and cinema.

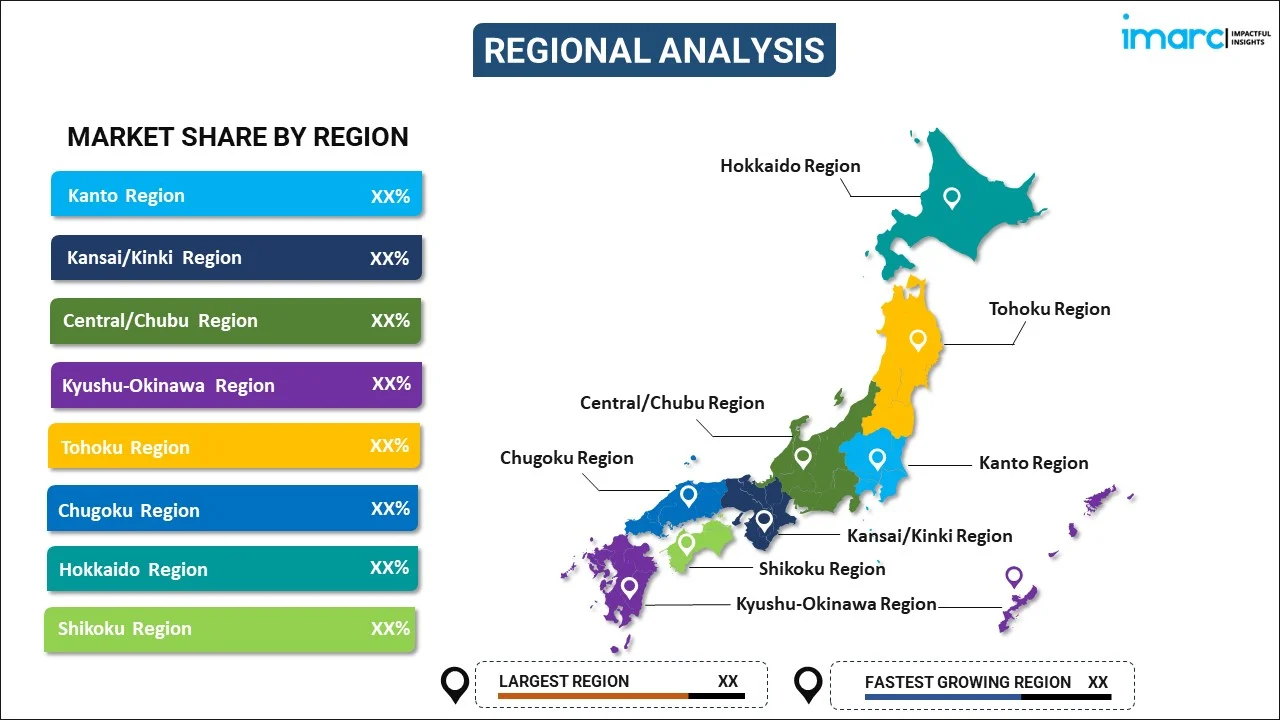

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the Japan advertising market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include:

- ADK Holdings Inc

- CyberAgent, Inc.

- Daiko Advertising Inc.

- Dentsu Inc.

- Hakuhodo Inc

- Kesion Co., Ltd

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Japan Advertising Market News:

- In July 2024, Acast, the world’s largest podcast company, announced its partnership with Japan's premier digital audio advertising agency, Otonal Inc. This strategic alliance will further amplify Acast’s global footprint, meeting the surging demands from advertisers and creators in Japan by providing innovative and far-reaching podcast advertising solutions.

- In April 2023, Hakuhodo, the Japanese advertising and marketing behemoth, announced an acquisition in India. The agency’s majority stake in independent brand agency group MA&TH Entertainment Network was a significant play revealing an ambition to not only expand its presence in India but also its footprint within the content and production space.

Japan Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Television, Print (Newspaper and Magazine), Radio, Outdoor, Internet (Search, Display, Classified, Video), Mobile, Cinema |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | ADK Holdings Inc, CyberAgent, Inc., Daiko Advertising Inc., Dentsu Inc., Hakuhodo Inc, Kesion Co., Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan advertising market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan advertising market?

- What is the breakup of the Japan advertising market on the basis of type?

- What are the various stages in the value chain of the Japan advertising market?

- What are the key driving factors and challenges in the Japan advertising s?

- What is the structure of the Japan advertising market and who are the key players?

- What is the degree of competition in the Japan advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan advertising market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)