Japan Abrasives Market Report by Product Type (Bonded Abrasives, Coated Abrasives, Super Abrasives, and Others), Material Type (Natural Abrasives, Synthetic Abrasives), End Use (Machinery, Metal Fabrication, Automotive, Electronics, Construction, and Others), and Region 2026-2034

Market Overview:

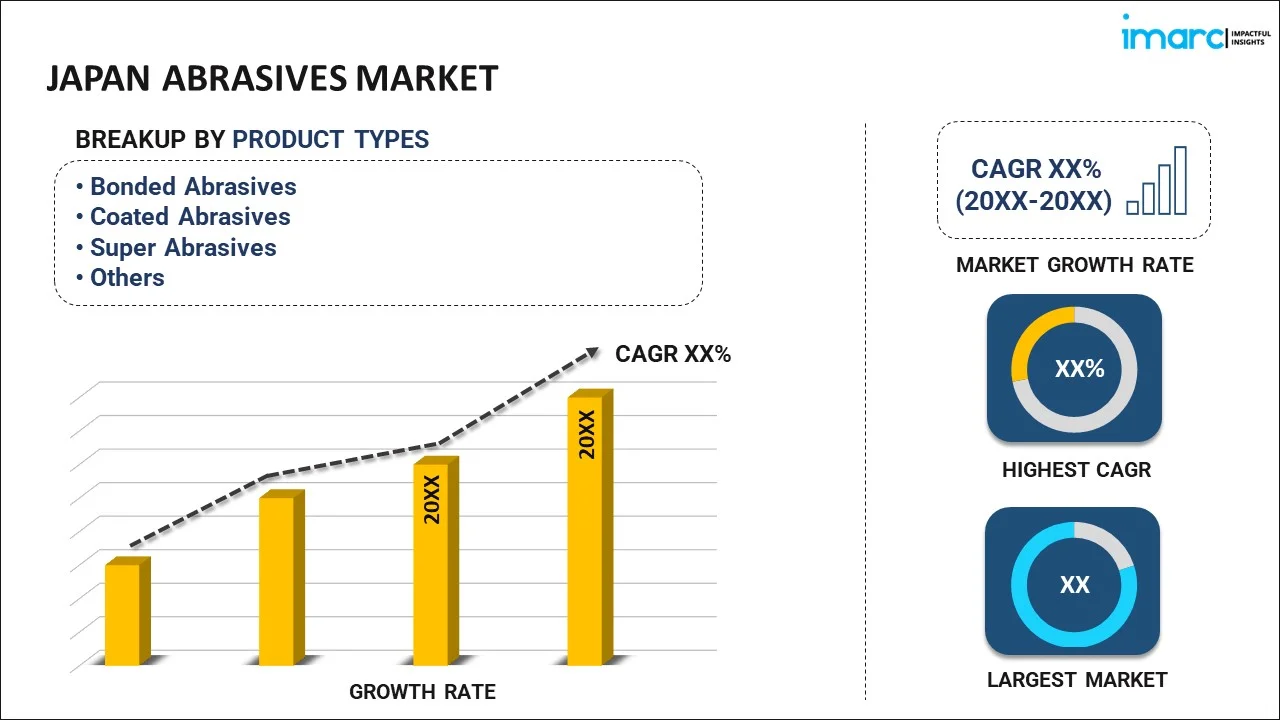

Japan abrasives market size reached USD 2.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.12% during 2026-2034. The market is being driven by several significant factors, including the shift towards electric vehicles, an increasing focus on sustainable energy solutions, and the growing adoption of digital technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.3 Million |

| Market Forecast in 2034 | USD 3.3 Million |

| Market Growth Rate 2026-2034 | 4.12% |

Abrasives are materials employed to eliminate surface layers from a variety of objects through friction. They assume a pivotal role in a multitude of industrial applications, including grinding, polishing, sanding, and cleaning. Typically characterized by their hardness and rough texture, these substances operate by either scratching or gradually wearing away surface materials when applied with force. They can be categorized into two main groups: natural and synthetic. Natural variants encompass minerals such as diamond, corundum, and emery, while synthetic options include silicon carbide and aluminum oxide. The choice of abrasive relies on the specific task at hand, taking into account factors such as material compatibility, hardness, and the desired surface finish. Abrasives find extensive use across diverse industries, including manufacturing, construction, and automotive, where they play a pivotal role in achieving the desired shapes, dimensions, and surface textures.

Japan Abrasives Market Trends:

As industrialization gains momentum in emerging economies, there has been a substantial increase in the demand for abrasives in various manufacturing processes, including grinding, cutting, and finishing. Modern manufacturing places a significant emphasis on precision engineering, where even the slightest imperfections can impact product quality and functionality. Abrasives play a pivotal role in enabling precise shaping and finishing of materials, meeting the stringent quality standards required in today's competitive landscape. Moreover, the shift toward automated and computer-controlled manufacturing systems has driven the need for specialized abrasives capable of consistent performance over extended periods. The lean manufacturing trend, which prioritizes efficiency and waste reduction, further encourages the adoption of high-performance abrasives, contributing to faster production cycles and reduced material wastage. With a growing number of vehicles being manufactured annually, there is a noticeable surge in demand for abrasives in automotive manufacturing processes such as grinding, polishing, and surface preparation. The pursuit of high-quality finishes, whether for engine components or exterior bodywork, necessitates the use of specialized abrasive products capable of achieving precision and consistency. Furthermore, the emergence of electric vehicles (EVs) has had a significant impact on the demand for abrasives. Additionally, the shift toward lightweight vehicles to enhance fuel efficiency and reduce emissions is promoting the use of new materials like carbon fiber composites. This, in turn, is expected to bolster the regional market over the forecasted period.

Japan Abrasives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, material type, and end use.

Product Type Insights:

- Bonded Abrasives

- Coated Abrasives

- Super Abrasives

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes bonded abrasives, coated abrasives, super-abrasives, and others.

Material Type Insights:

- Natural Abrasives

- Synthetic Abrasives

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes natural abrasives and synthetic abrasives.

End Use Insights:

- Machinery

- Metal Fabrication

- Automotive

- Electronics

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes machinery, metal fabrication, automotive, electronics, construction, and others.

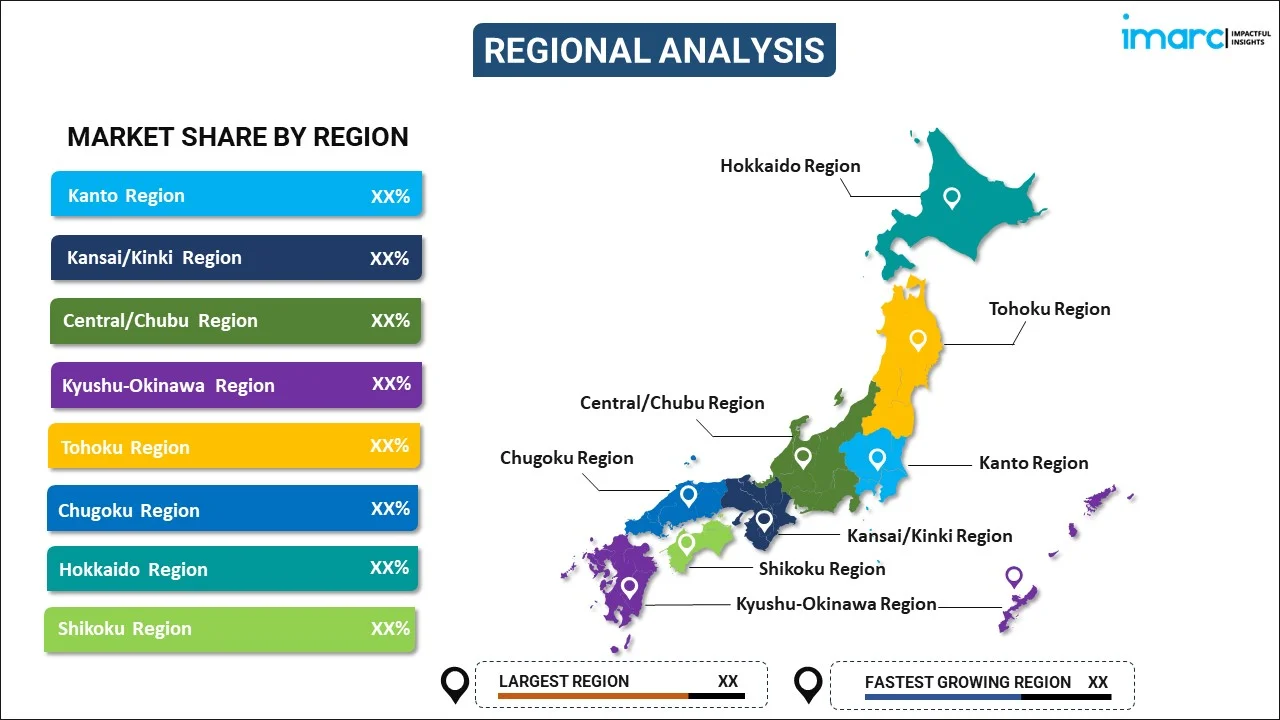

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Abrasives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Bonded Abrasives, Coated Abrasives, Super Abrasives, Others |

| Material Types Covered | Natural Abrasives, Synthetic Abrasives |

| End Uses Covered | Machinery, Metal Fabrication, Automotive, Electronics, Construction, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan abrasives market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan abrasives market?

- What is the breakup of the Japan abrasives market on the basis of product type?

- What is the breakup of the Japan abrasives market on the basis of material type?

- What is the breakup of the Japan abrasives market on the basis of end use?

- What are the various stages in the value chain of the Japan abrasives market?

- What are the key driving factors and challenges in the Japan abrasives?

- What is the structure of the Japan abrasives market and who are the key players?

- What is the degree of competition in the Japan abrasives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan abrasives market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan abrasives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan abrasives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)