Japan 3PL Market Report by Transport (Railways, Roadways, Waterways, Airways), Service Type (Dedicated Contract Carriage, Domestic Transportation Management, International Transportation Management, Warehousing and Distribution, Value Added Logistics Services), End Use (Manufacturing, Retail, Healthcare, Automotive, and Others), and Region 2026-2034

Japan 3PL Market Size:

Japan 3PL market size reached USD 69.57 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 102.06 Billion by 2034, exhibiting a growth rate (CAGR) of 4.35% during 2026-2034. The growing integration of advanced technologies, such as the Internet of Things (IoT), in the logistics sector for efficient inventory management is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 69.57 Billion |

|

Market Forecast in 2034

|

USD 102.06 Billion |

| Market Growth Rate 2026-2034 | 4.35% |

Access the full market insights report Request Sample

3PL, also known as third-party logistics, represents the process of outsourcing supply chain management and logistics functions to specialized external agencies. It is employed by businesses to oversee tasks, such as transportation, warehousing, inventory management, order fulfillment, etc. This further enables companies to concentrate on their primary skills and objectives, enhancing efficiency, minimizing expenses, delivering superior service to their customers, etc. Third-party logistics providers possess the proficiency, technology, and assets to refine logistics operations, assuring smooth interaction among manufacturers, suppliers, and retailers. Engaging with a 3PL collaborator allows for adaptability, scalability, and swift adjustment to market variations. Consequently, this service is widely utilized across numerous sectors, signifying its crucial importance in contemporary business models.

Japan 3PL Market Trends:

E-commerce Growth Driving Demand

According to the Japan 3PL industry report, the market is witnessing robust expansion primarily due to the increasing growth of e-commerce sector. With customers rapidly shifting towards online platforms for shopping, logistics providers are playing a critical role in managing the delivery as well as fulfillment processes. Moreover, companies are currently depending on 3PL services for inventory management, warehousing handling, and last-mile delivery to facilitate timely shipments. In addition, the escalating demand for next-day as well as same-day delivery services has fueled the importance of effective logistics solutions, positioning 3PL providers as indispensable for aiding the e-commerce industry in Japan. As per industry reports, by 2025, it is projected that Japan's e-commerce market volume will reach $324 million, while the number of e-commerce users will surpass 100 million.

Technological Advancements in Logistics

The incorporation of innovative technologies such as IoT, automation, and artificial intelligence (AI), is significantly expanding the Japan 3PL market share by prompting notable transformation in 3PL services. Advancements, such as real-time tracking solutions, automated warehouses, and smart inventory management systems, are supporting logistics providers in enhancing operational efficacy and lowering costs. For instance, in February 2024, Skechers, a major footwear company, unveiled an automated warehouse in Japan to improve its operational efficacy, order accuracy, and speed of fulfilment process. Moreover, such innovations are substantially improving supply chain visibility, allowing various companies to upgrade routes and manage shipments more efficiently. In addition, as Japan continues to deploy digitalization across numerous sectors, the 3PL market is heavily profiting from these technological innovations, making logistics operations more refined and proactive to market needs.

Increase in Outsourcing by Manufacturers

Japan 3PL market analysis indicates that the manufacturers in Japan are currently outsourcing their logistics operations to third-party providers, significantly driving the expansion of the 3PL market. This trend enables manufacturers to emphasize on core business functions while profiting from the expertise of logistics providers for the management of sophisticated supply chains. In addition, outsourcing is prominently prevalent in industries, such as pharmaceuticals, automotive, and electronics, where supply chains are complex, and require fluctuates. For instance, in August 2024, Sumitomo Corporation announced investment in NEXT Logistics Japan to address the "2024 Logistics Problem," emphasizing on driver shortages and logistics complications in automotive sector by streamlining operations, improving manpower efficacy, and enhancing transportation through the utilization of double-trailer trucks. Moreover, by utilizing the adaptability and scalability of 3PL services, manufacturers can significantly enhance efficacy and cater to the consumer needs in an intensely competitive environment.

Japan 3PL Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on transport, service type, and end use.

Breakup by Transport:

To get detailed segment analysis of this market Request Sample

- Railways

- Roadways

- Waterways

- Airways

The report has provided a detailed breakup and analysis of the market by transport. This includes railways, roadways, waterways, and airways.

Breakup by Service Type:

- Dedicated Contract Carriage

- Domestic Transportation Management

- International Transportation Management

- Warehousing and Distribution

- Value Added Logistics Services

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes dedicated contract carriage, domestic transportation management, international transportation management, warehousing and distribution, and value added logistics services.

Breakup by End Use:

- Manufacturing

- Retail

- Healthcare

- Automotive

- Others

The report has provided a detailed breakup and analysis of market by end use. This includes manufacturing, retail, healthcare, automotive, and others.

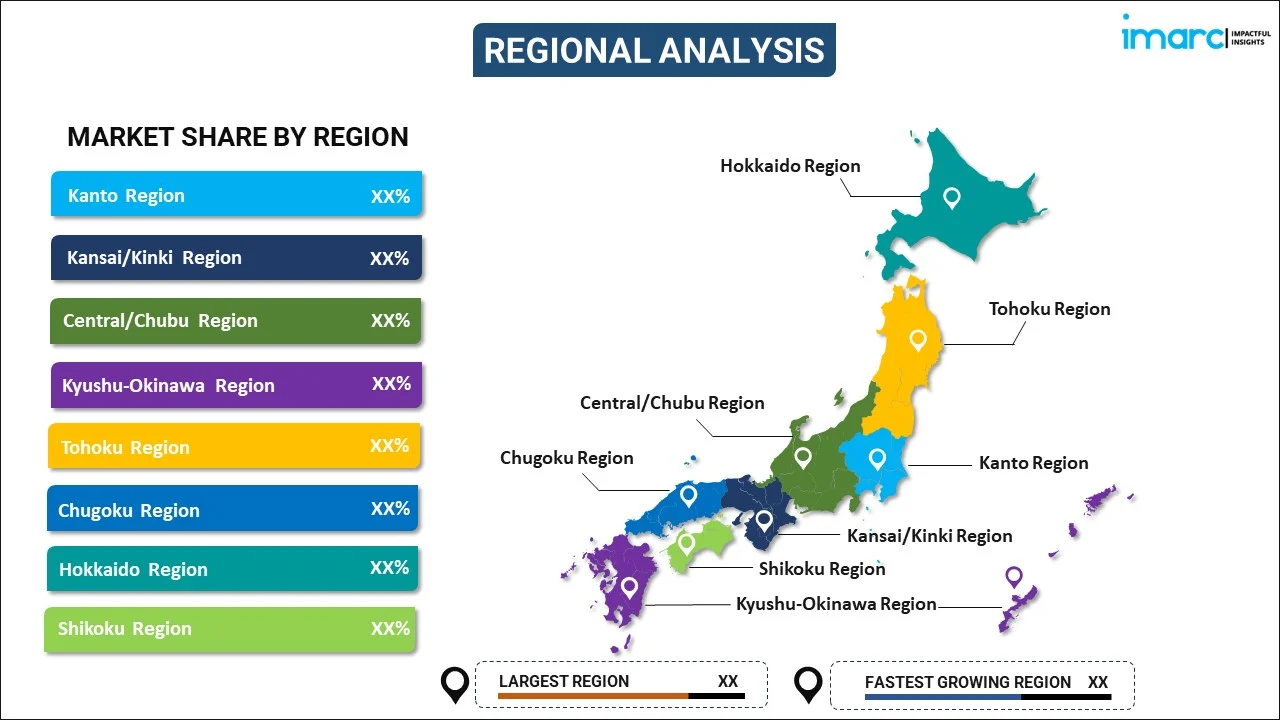

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of the Japan 3PL market by region, including Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Alps Logistics Co. Ltd.

- DHL

- Fukuyama Biagi Logistics Inc.

- Kintetsu World Express Inc.

- Kokusai Express Co. Ltd.

- LOGISTEED Ltd.

- Mitsui-Soko Holdings Co. Ltd.

- Nichirei Logistics Group Inc. (Nichirei Corporation)

- Nippon Express Co. Ltd.

- Sagawa Express Co. Ltd.

- Sankyu Inc.

- Yamato Holdings Co. Ltd.

- Yusen Logistics Co. Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Japan 3PL Market News:

- In July 2024, Sumitomo Corporation and Dexterity Inc. formed a joint venture called Dexterity-SC Japan to boost the deployment of robots utilizing AI for logistics, warehouse, supply chain management, and other labor-dependent industrial applications across the country.

- In February 2024, NYK Group, a Japan-based logistics and shipping company, announced strategic acquisition of Noel Topco, a UK-based logistics company, to expand its logistics operations. This tactical move complements NYK's strategy to invest in new sectors for sustained expansion and diversification.

Japan 3PL Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Transports Covered | Railways, Roadways, Waterways, Airways |

| Service Types Covered | Dedicated Contract Carriage, Domestic Transportation Management , International Transportation Management, Warehousing and Distribution, Value Added Logistics Services |

| End Uses Covered | Manufacturing, Retail, Healthcare, Automotive, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | Alps Logistics Co. Ltd., DHL, Fukuyama Biagi Logistics Inc., Kintetsu World Express Inc., Kokusai Express Co. Ltd, LOGISTEED Ltd., Mitsui-Soko Holdings Co. Ltd., Nichirei Logistics Group Inc. (Nichirei Corporation), Nippon Express Co. Ltd., Sagawa Express Co. Ltd., Sankyu Inc., Yamato Holdings Co. Ltd., Yusen Logistics Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan 3PL market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan 3PL market?

- What is the breakup of the Japan 3PL market on the basis of transport?

- What is the breakup of the Japan 3PL market on the basis of service type?

- What is the breakup of the Japan 3PL market on the basis of end use?

- What are the various stages in the value chain of the Japan 3PL market?

- What are the key driving factors and challenges in the Japan 3PL?

- What is the structure of the Japan 3PL market and who are the key players?

- What is the degree of competition in the Japan 3PL market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan 3PL market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan 3PL market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan 3PL industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)