Italy Real Estate Market Report by Property (Residential, Commercial, Industrial, Land), Business (Sales, Rental, Lease), Mode (Online, Offline), and Region 2025-2033

Italy Real Estate Market Outlook:

The Italy real estate market size reached USD 10.2 Trillion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.3 Trillion by 2033, exhibiting a growth rate (CAGR) of 1.1% during 2025-2033. Rapid urbanization, government expenditure on infrastructure development, rising interest by foreign investors, smart city projects, and sustainable development projects represents some of the key factors driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.2 Trillion |

| Market Forecast in 2033 | USD 11.3 Trillion |

| Market Growth Rate (2025-2033) | 1.1% |

Italy Real Estate Market Trends:

Urbanization and Infrastructure Development

The real estate market in Italy has been boosted mainly by the expansion of cities and improvement in infrastructure. 18.2% of real estate transactions in the second half of 2022 were made for investment, slightly higher than the 2021 percentage of around 16.5%. Genoa is the Italian city where renting a property yields the highest returns. In the capital of Liguria, the yield is 6.4%, followed by Palermo (6.3%) and Verona (6.2%). Large cities, such as Milan, Rome, and Turin, are facing population growth pressure, which has driven up demand for housing, office, and retail space. Government expenditure on infrastructural development like transportation and improvement of social amenities also makes the urban areas more desirable. Better connectivity and infrastructures not only boost the property value, but also lure businesses and inhabitants. Furthermore, smart city projects and sustainable development projects are changing the face of cities and providing real estate developers with a chance to meet the new demands of the society for urban, innovative, and green homes.

Foreign Investment and Economic Stability

Foreign investment and economic stability are the main factors that influence the development of the Italian real estate sector. In 2021, there was an increasing interest of foreign investors in the Italian real estate market, with a notable rise in transactions in Milan and Rome. These cities have seen significant foreign investments, particularly in commercial and luxury residential properties. Political stability with moderate rates of economic growth and sound fiscal policies creates a suitable atmosphere for property investment. Also, measures that have been taken to streamline the property purchase procedures and increase transparency have opened up the market to foreign investors. These factors, coupled with the attractiveness of Italy as a tourist and business hub, are also fueling the growth of the real estate market.

Italy Real Estate Market News:

- In May 2024, COIMA SGR, leader in the investment, development and management of real estate assets on behalf of institutional investors, acquired three prestigious properties in the historic center of Rome with the aim of optimizing their management through a plan of interventions aimed at reducing emissions and saving energy. The trophy assets constitute the portfolio of Sapphire, an alternative real estate investment fund reserved for qualified investors, of which COIMA becomes the manager and main investor.

- In March 2023, Generali Real Estate and ECE Real Estate partners acquired the Pep Shopping Centre in Munich Neuperlach, as part of a 50/50 joint venture. Generali Real Estate acquired a 50% stake on behalf of the specialized pan-European ‘Generali Shopping Center Fund’ (GSCF) managed by Generali Real Estate S.p.A. and reserved for professional investors. ECE Real Estate Partners has acquired the other 50% stake for the ‘ECE Progressive Income Growth Fund’. The vendor of the asset is Nuveen Real Estate, acting as Investment Advisor to the TIAA-CNP partnership, who owned the property in a joint venture.

Italy Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on property, business, and mode.

Property Insights:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

Business Insights:

- Sales

- Rental

- Lease

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales, rental, and lease.

Mode Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online and offline.

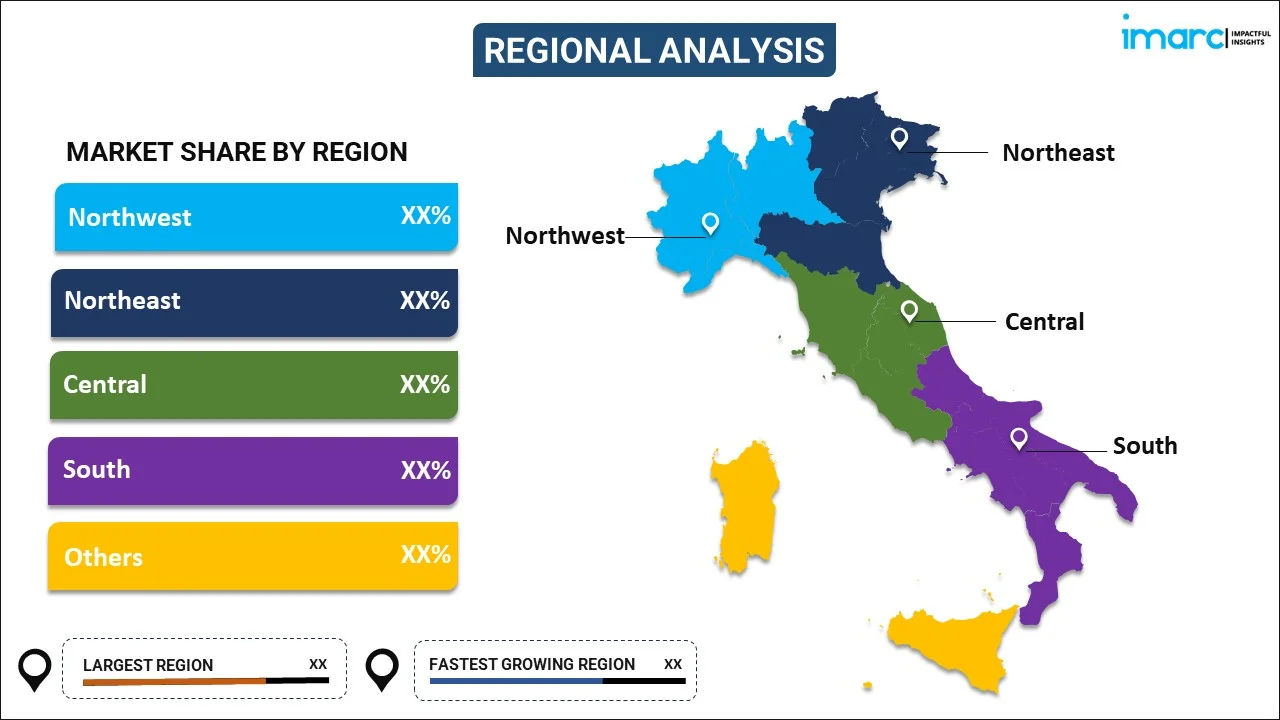

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Trillion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Business Covered | Sales, Rental, Lease |

| Modes Covered | Online, Offline |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy real estate market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Italy real estate market?

- What is the breakup of the Italy real estate market on the basis of property?

- What is the breakup of the Italy real estate market on the basis of business?

- What is the breakup of the Italy real estate market on the basis of mode?

- What are the various stages in the value chain of the Italy real estate market?

- What are the key driving factors and challenges in the Italy real estate?

- What is the structure of the Italy real estate market and who are the key players?

- What is the degree of competition in the Italy real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)