Italy Pharmaceutical Market Size, Share, Trends and Forecast by Type, Nature, and Region, 2026-2034

Italy Pharmaceutical Market Size and Share:

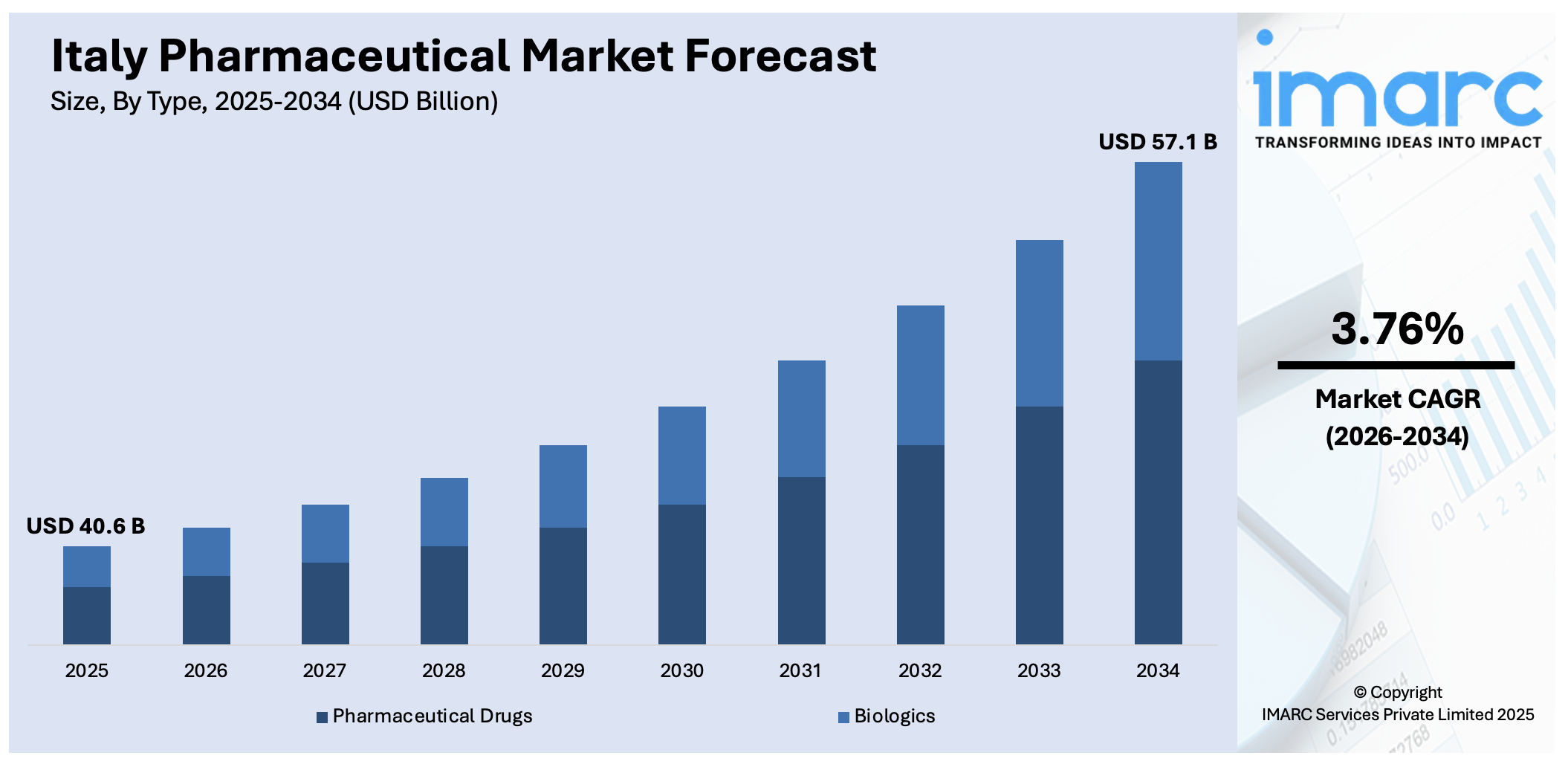

The Italy pharmaceutical market size was valued at USD 40.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 57.1 Billion by 2034, exhibiting a CAGR of 3.76% during 2026-2034. The market is driven by an aging population, rising chronic disease prevalence, and expanded healthcare access under the national health system. Moreover, increasing investments in research and development, adoption of advanced therapies including biologics and biosimilars, and strong government support for local manufacturing further support market growth. Additionally, digital health integration, e-prescriptions, and telemedicine adoption are some of the major factors augmenting Italy pharmaceutical market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 40.6 Billion |

| Market Forecast in 2034 | USD 57.1 Billion |

| Market Growth Rate 2026-2034 | 3.76% |

The market is driven by the rise in lifestyle-related disorders such as diabetes and cardiovascular conditions, which is expanding the market demand. As per industry reports, one out of every five Europeans will be beyond the age of 65, with Italy's median age reaching 51 by 2025. The aging population and increased life expectancy lead to a sustained rise in demand for chronic disease treatments and long-term care medications. Moreover, the national healthcare system, which provides universal coverage, ensures consistent public spending on essential drugs, thereby supporting pharmaceutical demand across therapeutic categories. Also, the Italian government's emphasis on innovation and research, exemplified by tax incentives and funding for research and development (R&D) intensive activities, continues to attract pharmaceutical investments.

To get more information on this market Request Sample

Additionally, continual technological advancements in biologics and precision medicine are also playing a crucial role in reshaping treatment protocols and encouraging specialized drug development. Apart from this, strategic public-private partnerships have contributed to improving clinical trial activity, accelerating new drug approvals, and facilitating knowledge transfer. The country's high level of smartphone penetration, with 46.05 million users in 2023, represents 78.2% of the population. The widespread use of mobile devices facilitates seamless integration of telemedicine services, digital health monitoring, and remote prescription fulfillment. This allows patients to communicate with healthcare practitioners and makes the prescription procedure operate smoothly, which is providing an impetus to the market.

Italy Pharmaceutical Market Trends:

Increase in Innovations and Mergers

The rising trend of pursuing innovative therapies through biotechnology is significantly reshaping the market in Italy. Companies are increasingly leveraging mergers and acquisitions as a strategic tool to gain access to new research and development (R&D) capabilities and innovative biotechnological advancements. This approach allows pharmaceutical firms to enhance their product portfolios with cutting-edge treatments, which are often in advanced stages of development, thereby reducing the time and financial investment required to bring new drugs to the market. According to an industry report, in 2021, Cadila Healthcare entered a partnership with Italian firm CHEMI SpA to introduce a generic medication for the treatment of deep-vein thrombosis in the US market. As a part of the agreement, CHEMI will manufacture and supply the Enoxaparin Sodium Injection, which will be commercialized in the US by Zydus Pharmaceuticals Inc., a subsidiary of Cadila Healthcare. This collaboration aims to strengthen Zydus's injectable portfolio and underscores the company's commitment to enhancing the availability of critical care drugs for quality patient care. These activities not only bolster the company's competitive edge but also contribute to the Italy pharmaceutical market growth by accelerating the introduction of breakthrough therapies that can address unmet medical needs.

Rise in Digitalization and Technology Adoption

The rising adoption of telemedicine, e-health platforms, and AI-driven diagnostics characterizes the digitalization trend in the market. According to the IMARC Group, the Italy healthcare market size is expected to reach USD 294.45 billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. This shift responds to the rising demand for efficient healthcare delivery and aligns with broader health technology trends. Private companies nowadays are innovating with artificial intelligence (AI) to enhance drug development and patient management, while public sector initiatives are focusing on integrating digital health records and telehealth services to improve accessibility. For instance, Zeta Farmaceutici Group, an Italian pharmaceutical business, is undergoing digital transformation with NL42 Consulting. The company aims to improve quality processes, organizational efficiency, and cost visibility. Furthermore, the Italian government supports this digital transformation through regulatory frameworks and funding, aiming to make healthcare more proactive, personalized, and preventive, which is creating a positive Italy pharmaceutical market outlook.

Increasing Prevalence of Lifestyle Diseases

The rising burden of lifestyle-related diseases, such as type 2 diabetes, hypertension, cardiovascular conditions, and obesity, is significantly influencing the market. An industry survey assessed BMI levels and obesity/overweight prevalence in a representative sample of 1,433 Italians aged 35–74 across seven regions in 2023. The results indicate that obesity prevalence was 23% in men and 25% in women, while overweight prevalence was higher in men (47%) compared to women (30%). Sedentary behavior, urban dietary shifts, and increasing stress levels are contributing to a surge in chronic, non-communicable diseases. This is creating a sustained demand for long-term pharmaceutical therapies, including antihypertensives, lipid-lowering agents, and antidiabetic medications. Pharmaceutical companies are expanding their chronic care portfolios, with a growing emphasis on fixed-dose combinations and patient-friendly formulations that improve adherence. The market is also witnessing a shift toward personalized medicine, particularly in the treatment of metabolic syndromes, with therapies tailored based on genetic and phenotypic profiles. The focus on chronic disease management is expected to persist, placing long-term care drugs at the center of national health expenditure.

Italy Pharmaceutical Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Italy pharmaceutical market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type and nature.

Analysis by Type:

- Pharmaceutical Drugs

- Cardiovascular Drugs

- Dermatology Drugs

- Gastrointestinal Drugs

- Genito-Urinary Drugs

- Hematology Drugs

- Anti-Infective Drugs

- Metabolic Disorder Drugs

- Musculoskeletal Disorder Drugs

- Central Nervous System Drugs

- Oncology Drugs

- Ophthalmology Drugs

- Respiratory Diseases Drugs

- Biologics

- Monoclonal Antibodies (MAbS)

- Therapeutic Proteins

- Vaccines

Pharmaceutical medicines remain prevalent in the pharmaceutical industry in Italy. These are branded generics and prescription-based small-molecule medicines applied extensively to cardiovascular, metabolic, and central nervous system diseases. The healthcare system of the country provides extensive access to these drugs, with regional health authorities facilitating their purchase and supply. Italy also has robust domestic manufacturing capacities, which sustain the supply of essential drug categories. Pricing measures, reference pricing, and demand for cost-effective therapies also reinforce the dominance of this segment. Pharmaceutical medications continue to play a critical role in addressing widespread treatment demands among Italy's aging population.

Biologics are central to the market in Italy, particularly in oncology, immunology, and the treatment of rare diseases. These sophisticated, high-cost therapies are increasingly adopted for their efficacy in conditions where traditional drugs are not effective. Specialty care centers and hospitals nationwide have incorporated biologics into sophisticated treatment regimens. Moreover, encouragement from regulatory authorities such as AIFA (Italian Medicines Agency) for early approval and reimbursement coverage enables easy access. Biosimilars are also gaining momentum, reducing the cost of treatment and increasing patient reach. The biologics segment is expected to grow steadily as innovation and demand for precision therapies keep increasing.

Analysis by Nature:

Access the comprehensive market breakdown Request Sample

- Organic

- Conventional

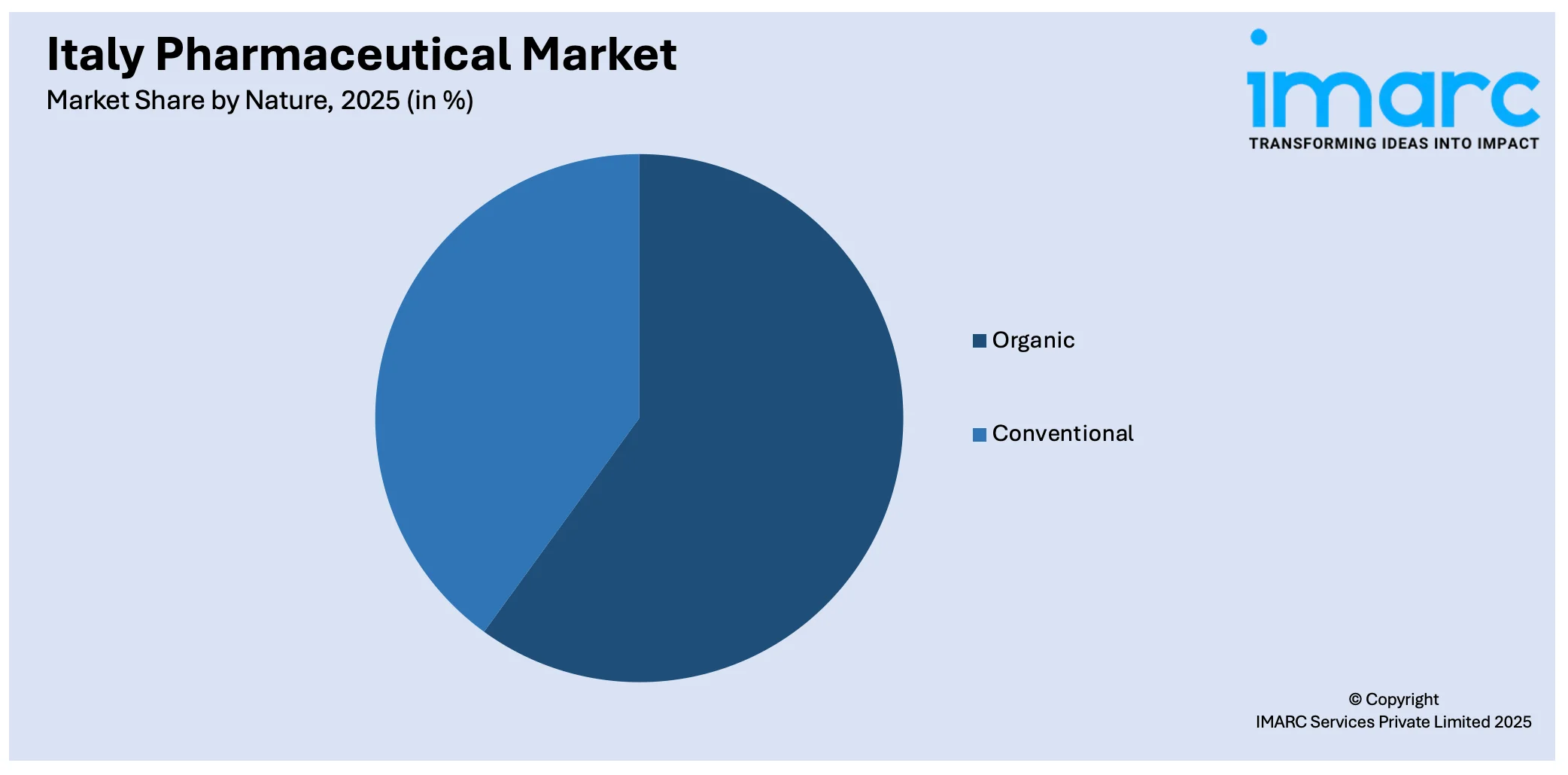

Organic pharmaceutical products are steadily gaining attention in Italy due to increasing consumer interest in natural and plant-based therapies. These include herbal medicines, nutraceuticals, and homeopathic remedies, often used as complementary treatments. The growing awareness regarding chemical-free and sustainable health solutions is influencing pharmacies and wellness stores to stock more organic options. Regulatory guidelines from the Ministry of Health ensure safety and efficacy standards, encouraging trust among consumers. The organic segment reflects Italy’s broader trend toward health-conscious lifestyles and is likely to see gradual expansion over time.

Conventional pharmaceutical products include a wide range of chemically synthesized drugs that treat acute and chronic health conditions. These include both branded and generic medicines used across hospitals, retail, and prescription channels. The healthcare system in Italy, backed by public funding and centralized procurement, relies heavily on conventional drugs for disease management. This category also benefits from robust clinical research, high production volumes, and established supply chains. As chronic conditions become more prevalent with an aging population, the demand for conventional pharmaceuticals remains strong, maintaining their dominant role in the market.

Regional Analysis:

- Northwest

- Northeast

- Central

- South

- Others

Northwest Italy, especially regions such as Lombardy and Piedmont, are significant regions in the market. Lombardy hosts a high density of pharmaceutical manufacturing units, research establishments, and biotech companies, and hence serves as an industrial output and innovation hub. Milan, being an important economic hub, has a presence of various multinational pharmaceutical headquarters as well as clinical research establishments. The area has a robust healthcare infrastructure, educational facilities, and public-private partnerships. These factors contribute to both the development and delivery of drugs. According to the Italy pharmaceutical market report, with high per capita healthcare expenditures, Northwest Italy makes a valuable contribution to domestic pharmaceutical sales and exports, thereby strengthening its strategic market position.

Northeast Italy, including Veneto, Emilia-Romagna, and Friuli-Venezia Giulia, has a solid manufacturing and logistics base in the pharmaceutical industry. Veneto has developed production facilities and pharmaceutical companies focused on exports. Furthermore, proximity to Central and Eastern Europe enhances inter-border trade in the region. The universities and research centers based in Bologna and Padua facilitate clinical development and regulatory science. Emilia-Romagna also plays a major role in biotech growth and the development of specialty drugs. With effective infrastructure and robust industrial networks, Northeast Italy is an important contributor to both domestic drug supply and international pharmaceutical trade.

Central Italy, such as Lazio and Tuscany, has a well-established position in the pharmaceutical market fueled by its combination of academic research and public healthcare institutions. Rome, the capital, is home to Italy's national regulatory agency (AIFA) headquarters, which influences policy and market access. Lazio is home to a number of large pharmaceutical production facilities and logistics centers. Universities and life science clusters in Tuscany encourage research and development (R&D) collaborations and biotech innovation. Central Italy also provides a balanced mix of urban and rural healthcare needs, enabling firms to pilot and refine drug delivery models. Its industrial and regulatory presence grants it a strategic national role.

Southern Italy, including Campania, Puglia, Calabria, and Sicily, constitutes an emerging though less industrialized part of the pharmaceutical market. Public health care services are predominant here, and the demand is dominated by management of chronic disease as well as care for geriatrics. Campania and Sicily possess developing pharmaceutical manufacturing areas with backing from regional development initiatives and EU support. Nevertheless, disparities in access and infrastructure deficiencies have traditionally constrained market expansion. The implementation of initiatives to increase digital health uptake and decentralize care is enhancing pharmaceutical penetration. With increased investment in healthcare delivery, Southern Italy presents opportunities for market expansion, particularly in rural and underserved areas.

Competitive Landscape:

The market in Italy is characterized by intense competition across generics, patented drugs, and over-the-counter segments. Stringent regulatory policies, pricing controls, and strong government influence in reimbursement decisions shape market dynamics. Domestic manufacturers compete with global players, leveraging regional distribution networks and established healthcare relationships. According to the Italy pharmaceutical market forecast, the industry is expected to experience strong competition driven by advancements in biologics, increased healthcare spending, and rising demand for personalized medicine. Innovation in biotech and specialty therapies continues to expand market segments, while generics face downward pricing pressure due to frequent tenders and cost containment measures. Digital health and telemedicine adoption are increasing interest in e-pharmacy platforms, intensifying competition in distribution. In addition to this, regulatory approvals and pricing negotiations often determine market entry timing and competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the Italy pharmaceutical market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Chiesi Group acquired a new manufacturing site in Nerviano, Italy, where it planned to redevelop the former oncology center into a drug production hub. The facility is set to focus on carbon minimal inhalers, dry powder inhalers, and sterile biological products.

- March 2025: Oncopeptides AB received its first order for Pepaxti® (melflufen) in Italy, following its formal reimbursement approval. Pepaxti is recommended for adult patients with relapsed or refractory multiple myeloma who have had at least three prior treatments. Italy has a significant patient population for this indication, with an estimated 6,000 new cases annually.

- February 2025: DOC, an Italian pharmaceutical company specializing in generic drugs, rebranded to DOC Pharma to reflect its expanded business strategy. The company enhanced its portfolio by acquiring ophthalmic products from Medivis in 2022 and muscle relaxants through Muscoril®. Recently, DOC Pharma further diversified by acquiring Geopharma, an Italian developer of osteoarticular nutraceutical treatments.

- January 2025: Lupin and Avas Pharmaceuticals launched the orphan drug NaMuscla® (mexiletine) in Italy for adults with non-dystrophic myotonic (NDM) disorders. The drug, already approved in the EU since 2018, marks the first licensed treatment to alleviate myotonia symptoms in this patient group.

Italy Pharmaceutical Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Natures Covered | Organic, Conventional |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy pharmaceutical market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy pharmaceutical market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy pharmaceutical industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pharmaceutical market in Italy was valued at USD 40.6 Billion in 2025.

The growth of the Italy pharmaceutical market is driven by increased government spending on healthcare, rising prevalence of chronic diseases, expanding elderly population, growing demand for personalized medicine, favorable regulatory environment, and strong pharmaceutical exports. Advancements in biotechnology and digital health solutions, alongside strategic investments and innovation by domestic and multinational companies, are also contributing to market expansion.

The pharmaceutical market in Italy is projected to exhibit a CAGR of 3.76% during 2026-2034, reaching a value of USD 57.1 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)