Italy Online Food Delivery Market Report by Platform Type (Mobile Applications, Website), Business Model (Order Focused Food Delivery System, Logistics Based Food Delivery System, Full-Service Food Delivery System), Payment Method (Online Payment, Cash on Delivery), and Region 2026-2034

Italy Online Food Delivery Market Overview:

The Italy online food delivery market size reached USD 7.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 11.5 Billion by 2034, exhibiting a growth rate (CAGR) of 5.59% during 2026-2034. The market is propelled by busy lifestyles and changing consumer preferences, the increasing smartphone penetration and internet accessibility, and the rising collaborations with restaurants, grocery stores, and other foodservice providers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.0 Billion |

| Market Forecast in 2034 | USD 11.5 Billion |

| Market Growth Rate (2026-2034) | 5.59% |

Access the full market insights report Request Sample

Italy Online Food Delivery Market Trends:

Enhanced Digital Infrastructure and Internet Penetration

Italy's digital infrastructure has improved dramatically due to the increasing use of high-speed internet and smartphone technology. As per Digital 2024: Italy report published by Datareportal, there were 51.56 million internet users in Italy at the start of 2024, when internet penetration stood at 87.7%. Italy was home to 42.80 million social media users in January 2024, equating to 72.8 % of the total population. Besides, a total of 81.55 million cellular mobile connections were active in Italy in early 2024, with this figure equivalent to 138.7 percent of the total population. Increased internet penetration has resulted in improved accessibility and convenience in online transactions. This digital readiness enables more Italian consumers to try out online meal delivery services. Apps and websites are user-friendly and effortlessly interact with digital payment methods, making ordering straightforward and appealing. These technology improvements have enabled a larger segment of the population to regularly use online meal delivery services, resulting in market growth as consumers value the convenience and efficiency provided by these platforms.

Urbanization and Busy Lifestyles

Italy's urban population is quickly increasing, resulting in busy lifestyles with less time for cooking or eating out. The 2023 population density in Italy is 200 people per Km2 (518 people per mi2), calculated on a total land area of 294,140 Km2 (113,568 sq. miles). Moreover, 71.9 % of the population of Italy is urban (42,343,688 people in 2023). Along with this Italy has a rich culinary heritage, and food is deeply ingrained in its culture. Italians appreciate good food and dining experiences. Online food delivery services meet the needs of city inhabitants by offering a simple solution for ordering meals with a few taps on their cellphones. This trend is supported by an increasing number of dual-income households and young professionals who value convenience and time-saving solutions, which is propelling the Italian online food delivery market forward.

Italy Online Food Delivery Market News:

- In October 2023, Deliveroo Italy and Uber Eats Italy were ordered to pay their riders social-security and pension contributions by the Labour Section of the Milan Court. The judge's decision concerns 2016-2020 in one case and 2020-21 in the other (ANSA).

- In February 2024, Just Eats, a leading food delivery company in Italy released its financial statements stating that in the Northern Europe segment, GTV increased gradually throughout 2023 which resulted in an increase of 3% to €7.7 Billion. Northern Europe continued to demonstrate strong profit generation with an adjusted EBITDA of €366 Million in 2023. The adjusted EBITDA margin in Northern Europe remained one of the industry's strongest and further improved to 4.8% of GTV in 2023 from 4.2% in 2022.

Italy Online Food Delivery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on platform type, business model, and payment method.

Platform Type Insights:

To get detailed segment analysis of this market Request Sample

- Mobile Applications

- Website

The report has provided a detailed breakup and analysis of the market based on the platform type. This includes mobile applications and website.

Business Model Insights:

- Order Focused Food Delivery System

- Logistics Based Food Delivery System

- Full-Service Food Delivery System

A detailed breakup and analysis of the market based on the business model have also been provided in the report. This includes order focused food delivery system, logistics based food delivery system, and full-service food delivery system.

Payment Method Insights:

- Online Payment

- Cash on Delivery

The report has provided a detailed breakup and analysis of the market based on the payment method. This includes online payment and cash on delivery.

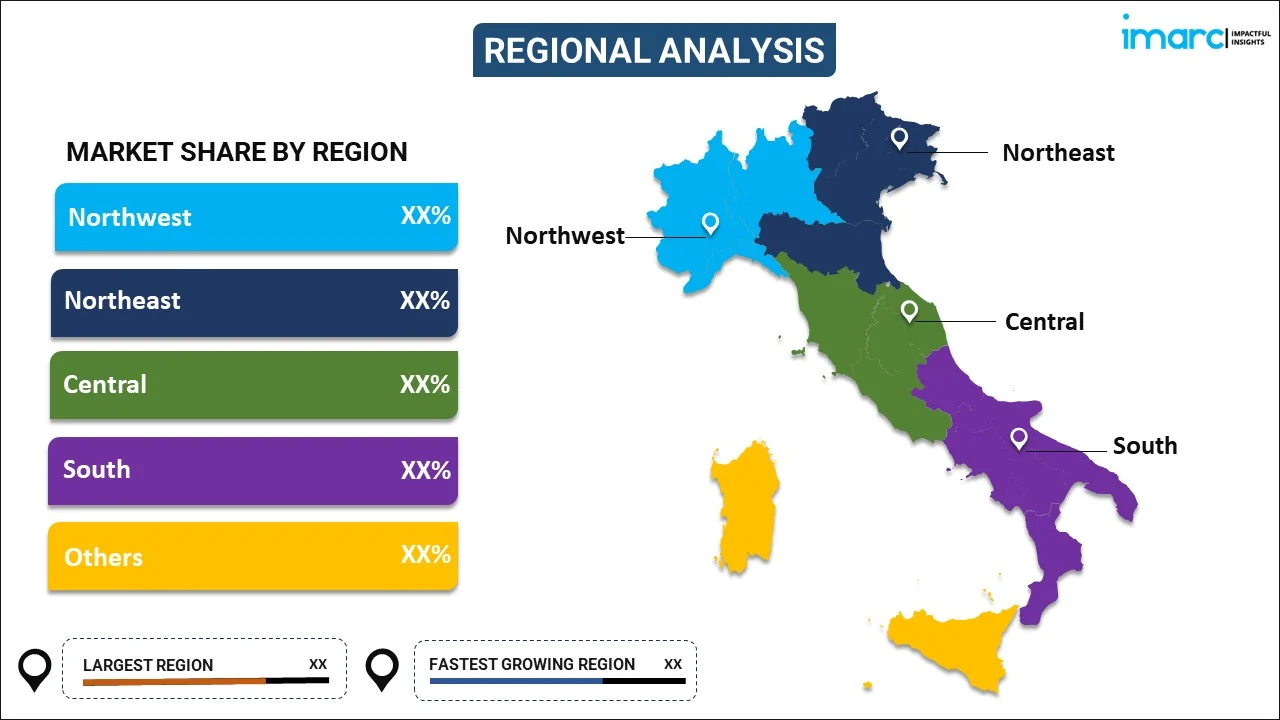

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players in the market include

- Deliveroo

- Foodracers

- Glovo

- Just Eat

- Uber Eats

Italy Online Food Delivery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platform Types Covered | Mobile Applications, Website |

| Business Models Covered | Order Focused Food Delivery System, Logistics Based Food Delivery System, Full-Service Food Delivery System |

| Payment Methods Covered | Online Payment, Cash on Delivery |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Companies Covered | Deliveroo, Foodracers, Glovo, Just Eat, Uber Eats |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy online food delivery market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Italy online food delivery market?

- What is the breakup of the Italy online food delivery market on the basis of platform type?

- What is the breakup of the Italy online food delivery market on the basis of business model?

- What is the breakup of the Italy online food delivery market on the basis of payment method?

- What are the various stages in the value chain of the Italy online food delivery market?

- What are the key driving factors and challenges in the Italy online food delivery?

- What is the structure of the Italy online food delivery market and who are the key players?

- What is the degree of competition in the Italy online food delivery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy online food delivery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy online food delivery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy online food delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)