Italy Natural Gas & Renewable Energy Market Report by Natural Gas and Renewable Energy (Natural Gas, Renewable Energy), and Region 2026-2034

Italy Natural Gas & Renewable Energy Market Overview:

The Italy natural gas & renewable energy market size reached USD 52.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 103.0 Billion by 2034, exhibiting a growth rate (CAGR) of 7.48% during 2026-2034. Favorable government incentives, the European Union’s (EU) aspiring climate targets, ongoing technological advancements, energy diversification needs, declining costs of renewables, increased private investment, escalating environmental concerns, improved infrastructure, and rising consumer demand for sustainable energy solutions are some of the key factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 52.4 Billion |

|

Market Forecast in 2034

|

USD 103.0 Billion |

| Market Growth Rate 2026-2034 | 7.48% |

Access the full market insights report Request Sample

Italy Natural Gas & Renewable Energy Market Trends:

Government policies and EU climate targets

Government policies and EU climate targets are pivotal in driving Italy's natural gas and renewable energy market. Italy's commitment to the EU's carbon neutrality goals by 2050 has spurred the implementation of subsidies, tax incentives, and feed-in tariffs to bolster renewable energy investments. Regulatory measures like carbon pricing and emissions trading schemes further incentivize the transition from fossil fuels to cleaner energy sources. In 2020, Italy aimed for a 30% share of renewable energy in total energy consumption by 2030. However, in 2023, the Ministry of Energy proposed more ambitious goals: a 40% share of renewable energy in total energy consumption and a revised target of 65% for renewables in electricity production by 2030, compared to the previous 55%. Negotiations with the European Commission hope to have a legally binding version of the plan completed by June 2024. These policies and goals attract stakeholders and drive growth in Italy's natural gas and renewable energy sectors.

Technological advancements

Innovations in renewable energy technologies, such as more efficient solar panels, advanced wind turbines, and improved energy storage solutions, have greatly enhanced the viability and competitiveness of renewable energy sources. For example, the cost of solar photovoltaic (PV) technology has decreased dramatically due to advancements in manufacturing and economies of scale, making solar power more accessible and affordable. Similarly, improvements in wind turbine design and offshore wind technologies have increased the capacity and reliability of wind energy. Rapid advancements in energy storage technologies, particularly battery storage, are resolving the intermittent nature of renewable energy and facilitating more stable and dependable grid integration. These technological advancements reduce the overall cost of renewable energy projects and increase their efficiency and performance, thus impelling the market demand.

The trend towards energy diversification and security

Italy aims to reduce its reliance on imported fossil fuels and enhance energy security by diversifying its energy mix. Natural gas, seen as a transitional fuel with a lower carbon footprint than coal and oil, plays a key role. The development of liquified natural gas (LNG) infrastructure and the expansion of domestic natural gas production ensure a stable energy supply. Integrating renewable energy into the national grid further contributes to a resilient, sustainable system. Italy remains an attractive market for natural gas and renewable technologies. Despite consuming 4.5% less energy in 2022 than in 2021, the energy mix still relied on fossil fuels. According to the Ministry of Environment and Energy Security (MASE), 2022 energy sources were natural gas (37.6%), oil (35.7%), renewables (18.5%), coal (5%), imported electricity (2.5%), and non-renewable waste (0.8%). This balanced approach reduces environmental impact and enhances energy security, boosting the market growth.

Italy Natural Gas & Renewable Energy Market News:

- In December 2023, Italy enacted a new Energy Decree to strengthen energy security and promote renewable sources. The energy decree aims to support renewable energy and enhance Italy's energy resilience.

Italy Natural Gas & Renewable Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on natural gas and renewable energy.

Natural Gas and Renewable Energy Insights:

To get detailed segment analysis of this market Request Sample

- Natural Gas

- Breakup by Type

- Ethane

- Propane

- Methane

- Others

- Breakup by Type

-

- Breakup by Source

- Conventional Gas

- Unconventional Gas

- Breakup by Source

-

- Breakup by Application

- Automotive

- Power Generation

- Household

- Industrial Fuel

- Others

- Breakup by Application

- Renewable Energy

- Breakup by Type

- Solar

- Wind

- Hydro

- Others

- Breakup by Type

-

- Breakup by Application

- Industrial

- Residential

- Commercial

- Breakup by Application

The report has provided a detailed breakup and analysis of the market based on the natural gas and renewable energy. This includes natural gas [breakup by type (ethane, propane, methane, and others), breakup by source (conventional gas and unconventional gas), and breakup by application (automotive, power generation, household, industrial fuel, and others)] and renewable energy [breakup by type (solar, wind, hydro, and others) and breakup by application (industrial, residential, and commercial)].

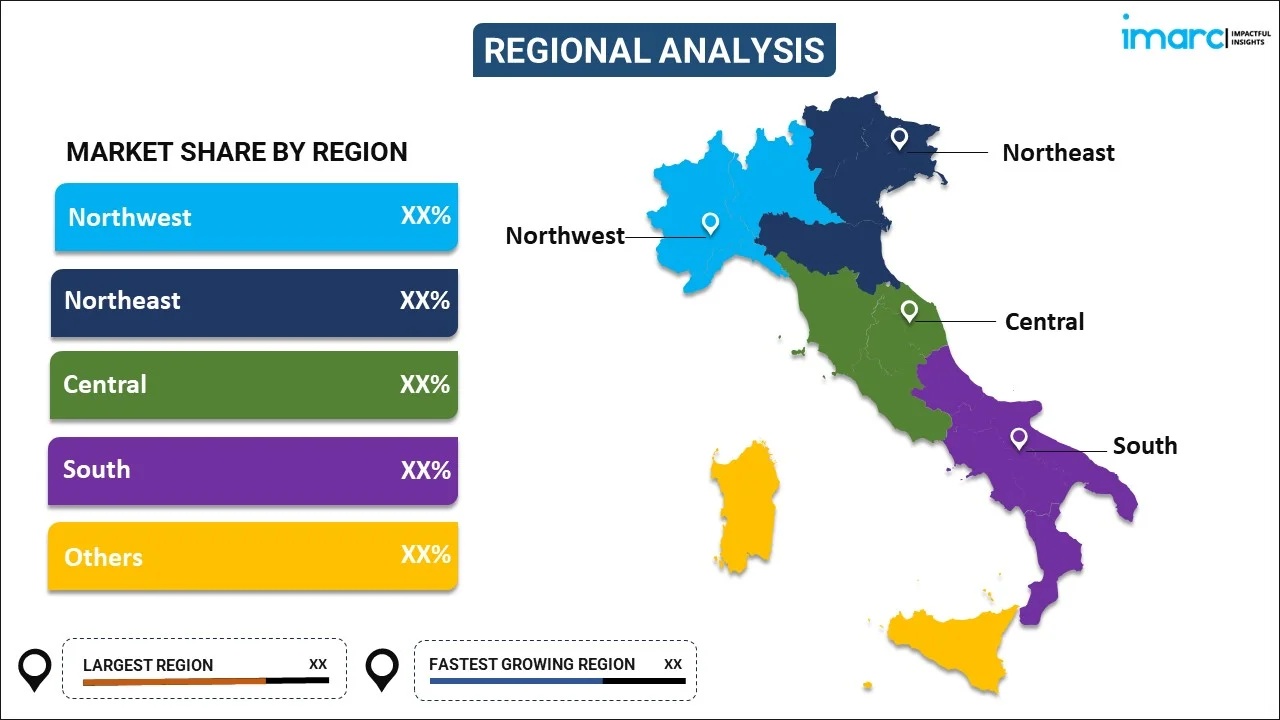

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Natural Gas & Renewable Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natural Gas and Renewable Energy Covered |

|

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy natural gas & renewable energy market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Italy natural gas & renewable energy market?

- What is the breakup of the Italy natural gas & renewable energy market on the basis of natural gas and renewable energy?

- What are the various stages in the value chain of the Italy natural gas & renewable energy market?

- What are the key driving factors and challenges in the Italy natural gas & renewable energy?

- What is the structure of the Italy natural gas & renewable energy market and who are the key players?

- What is the degree of competition in the Italy natural gas & renewable energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy natural gas & renewable energy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy natural gas & renewable energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy natural gas & renewable energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)